Warning (2): getimagesize(/var/www/html/newbusinessage.com/app/webroot/img/news/thumbnails/20161114101214_mum\'s.jpg): failed to open stream: No such file or directory [APP/View/Articles/index.ctp, line 35]Code Context

<?php

list($width, $height) = getimagesize(WWW_ROOT.'img'.DS.'news'.DS.'thumbnails'.DS.$article['Article']['image']);

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/index.ctp'

$dataForView = array(

'articles' => array(

(int) 0 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 1 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 2 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 3 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 4 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 5 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 6 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 7 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 8 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 9 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 10 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 11 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 12 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 13 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 14 => array(

'Article' => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$articles = array(

(int) 0 => array(

'Article' => array(

'id' => '4732',

'article_category_id' => '1',

'title' => '200 Plastic Industries Closed, 4000 employments lost',

'sub_title' => '',

'summary' => 'November 14: The government's move of banning plastic production citing environmental issues has become the prime reason for the closure of nearly 200 plastic industries. Using the section 7 of Environment protection Act, 2053, the government had banned the production, import, storage and sales of plastic since April 14, 2015. According to Sarad Sharma, President of Nepal Plastic Manufacturers' Association, only 150 plastic industries are being operated after the closure of 200 industries.',

'content' => '<p style="text-align: justify;">November 14: The government's move of banning plastic production citing environmental issues has become the prime reason for the closure of nearly 200 plastic industries. Using the section 7 of Environment protection Act, 2053, the government had banned the production, import, storage and sales of plastic since April 14, 2015. According to Sarad Sharma, President of Nepal Plastic Manufacturers' Association, only 150 plastic industries are being operated after the closure of 200 industries.</p>

<p style="text-align: justify;">The plastic manufacturers claim that the government is trying to close the industries instead of stressing execution of the directive that has set standard of plastic. "The government's move has caused heavy losses to the entrepreneurs," said Sharma. The government's move has caused deterioration of domestic investment, however, raised import of foreign plastic product in the Nepali market. As per Sharma, more than 4000 workers lost direct employment due to the closure of plastic industries.</p>

<p style="text-align: justify;">However, department of environment said that although the government has banned the production of below standard plastic bags, most of the plastic industries in and around the valley are still into operation. According to the department, it had restricted production, sales and distribution of plastic bags below 30 microns. </p>

<p style="text-align: justify;">Recently, the government started inspection of the plastic industries that are producing plastic product below standard. It has also taken action against those industries who failed to recuperate as per the government's directive. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4562',

'image' => '20161114021744_plst.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 1 => array(

'Article' => array(

'id' => '4731',

'article_category_id' => '1',

'title' => 'Construction 36 MW Balephi 'A' Hydropower Project Starts',

'sub_title' => '',

'summary' => 'November 14: The construction of 36 MW Balephi 'A' hydropower project has started with a target to complete the construction by December 2018.The project is being developed by Huwaning Development. The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed ',

'content' => '<p style="text-align: justify;">November 14: The construction of 36 MW Balephi 'A' hydropower project has started with a target to complete the construction by December 2018.</p>

<p style="text-align: justify;">The project is being developed by Huwaning Development. The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed through a consortium loan of five banks including Global IME, Sanima, Everest, SBI and NIDC Development Bank. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche.</p>

<p> </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4561',

'image' => '20161114125523_balephi_khola.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 2 => array(

'Article' => array(

'id' => '4730',

'article_category_id' => '1',

'title' => 'IPO to Float under Free Pricing Mechanism',

'sub_title' => '',

'summary' => 'November 14: The companies preparing to float initial public offering to the public may now price the share under the free pricing mechanism. The possibility of the free pricing increased with the approval of new regulation 'Nepal Securities Registration and Issue Regulations, 2073' by Securities Board of Nepal (SEBON).',

'content' => '<p style="text-align: justify;">November 14: The companies preparing to float initial public offering to the public may now price the share under the free pricing mechanism. The possibility of the free pricing increased with the approval of new regulation 'Nepal Securities Registration and Issue Regulations, 2073' by Securities Board of Nepal (SEBON).</p>

<p style="text-align: justify;">Issuing a press statement on November 13, SEBON informed of scrapping the 'Securities Registration and Issue Regulations, 2065'. The new regulation particularly mentions of forming a mechanism under which international financial institution will be able to issue bond/debentures in local currency. Similarly, real organised sectors will be given opportunity to go public with minimum of 10 percent public offering. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4560',

'image' => '20161114124130_ipo.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 3 => array(

'Article' => array(

'id' => '4729',

'article_category_id' => '1',

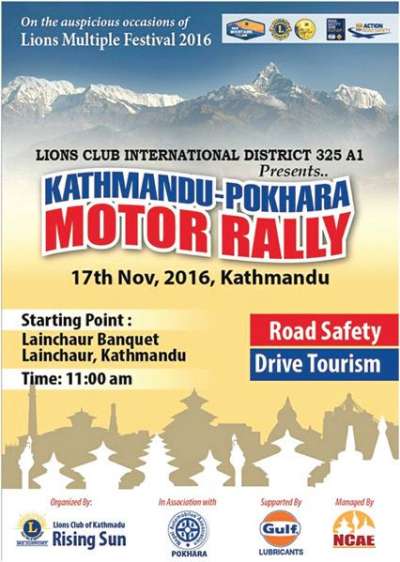

'title' => 'Lions Motor Rally on November 17',

'sub_title' => '',

'summary' => 'November 14: Lions Club International District 325 A1 is organising 'Lions Motor Rally' from Kathmandu to Pokhara on November 17. The Lions Club is organising the motor rally with the technical support of Nepal Automobiles Sport Association (NASA).',

'content' => '<p style="text-align: justify;">November 14: Lions Club International District 325 A1 is organising 'Lions Motor Rally' from Kathmandu to Pokhara on November 17. The Lions Club is organising the motor rally with the technical support of Nepal Automobiles Sport Association (NASA).</p>

<p style="text-align: justify;">The motor rally that is scheduled to start from Lainchaur Banquet at 11.00 hours, will reach Pokhara through touching various locations. The club is also organising Lions Multiple Festival 2016 at the same time in Pokhara. The club informs that the motor rally of this year is special, also due to the festival. The overall management of the rally is being done by Lion club of Kathmandu Rising sun affiliated with Lions Club International District 325 A1. The motor rally is officially sponsored by Gulf Lubricants. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4559',

'image' => '20161114111914_lions.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 4 => array(

'Article' => array(

'id' => '4728',

'article_category_id' => '1',

'title' => 'Net Profit of Nepal Gramin Bikash Bank Increases Two Folds',

'sub_title' => '',

'summary' => 'November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.',

'content' => '<p style="text-align: justify;">November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.</p>

<p style="text-align: justify;">Similarly, the operating profit of the bank has increased by 3 times to Rs 45.5 million in the first quarter of the current FY in compare to the same period of the last FY. Moreover, the loan extension of the bank has increased by 21.31 percent to Rs 6.85 billion. However, the reserve fund of the bank has decreased by 80.21 percent to Rs 45.8 million during the review period in compare to the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4558',

'image' => '20161114104810_profit.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 5 => array(

'Article' => array(

'id' => '4727',

'article_category_id' => '1',

'title' => 'Pokhara Finance's 100 days Fixed Deposit Scheme',

'sub_title' => '',

'summary' => 'November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. ',

'content' => '<p style="text-align: justify;">November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4557',

'image' => '20161114103421_pokhara.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 6 => array(

'Article' => array(

'id' => '4726',

'article_category_id' => '1',

'title' => 'Kakrebihar to distribute Bonus share',

'sub_title' => '',

'summary' => 'November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.',

'content' => '<p style="text-align: justify;">November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.</p>

<p style="text-align: justify;">"The BOD proposal has been sent to Nepal Rastra Bank (NRB) for approval," said Jagat Bahadur Thapa, Chief Manager of the bank. The bank informed of extending Rs 474.7 loan while collecting Rs 798.1 deposit during the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4556',

'image' => '20161114102340_kakrebihar.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 7 => array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 8 => array(

'Article' => array(

'id' => '4724',

'article_category_id' => '1',

'title' => 'Financial Market Losing Excess Liquidity',

'sub_title' => '',

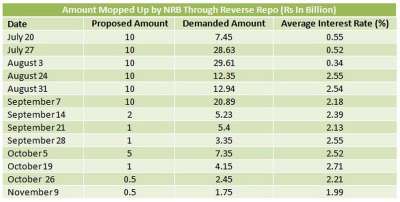

'summary' => 'November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.',

'content' => '<p style="text-align: justify;">November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.</p>

<p style="text-align: justify;">NRB that was regularly mopping up Rs 10 billion regularly in 1 or 2 weeks time lag through reverse repo has reduced the amount to Rs 500 million. The bank issued the reverse repo of Rs 3.20 billion only once since September. "The bank which was issuing reverse repo of Rs 10billion has decreased the amount to Rs 500 million which clearly indicates the declining liquidity in the market," said a former banker.</p>

<p style="text-align: justify;">The bank was issuing reverse repo of Rs 10 billion weekly till September 7 which it decreased to Rs 4 billion on September 14 indicating the lack of excess liquidity. After that, the bank mopped up Rs 1 billion each time except for October 5, in which the bank issued reverse repo of Rs 5 billion. However, as the banks demanded high interest rate, the bank moped up Rs 3.20 billion from the market. The incident proved that the excess liquidity that was prevailed in the financial market has ended, as per the banker.</p>

<p style="text-align: justify;"> "After October 26, the NRB has issued reverse repo of Rs 500 million only. Moreover, the BFIs are also attracting deposit on an increased interest rate. Thus, the market is surely losing the excess liquidity," he said. Narayan Prasad Poudel, Spokesperson of NRB also accepts the decline in excess liquidity. "Bankers have started to mention the liquidity problem. On early September also, the market had no significantly higher liquidity when the NRB issued Rs 10 billion worth of reverse repo. However, demand of loan might have been decreased," he said. He opined that the NRB reduces the reverse repo amount as mopping up of higher amount increased the interbank interest rate. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4554',

'image' => '20161113015213_reverse repo.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 9 => array(

'Article' => array(

'id' => '4723',

'article_category_id' => '1',

'title' => 'Net Profit of Commercial Banks Increases in the 1st Quarter',

'sub_title' => '',

'summary' => 'November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.',

'content' => '<p style="text-align: justify;">November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.</p>

<p style="text-align: justify;">Among the first quarter report publisher commercial banks, NMB bank has been able to obtain the highest net profit. In the first three months of the current FY, the net profit of the bank increased by 147.58 percent to Rs 353.6 million. The bank earned Rs 140 million in the corresponding period of the last FY. In the review period, the bank increased its investment by 111 percent, loan extension by 102 percent, net interest income by 159 percent and operational profit by 102 percent. The bank was also able to recover 160 million non-performing loan of the last FY.</p>

<p style="text-align: justify;">Similarly, Citizens Bank International has been able to increase its net profit by 141.74 percent to Rs 345.1 million from Rs 140 million of the corresponding period of the last FY.</p>

<p style="text-align: justify;">Likewise, Sunrise Bank has earned Rs 253.1 million net profit in the first three months of the current FY which is 114 percent growth than the corresponding period of the last FY. Meanwhile, Siddhartha Bank increased its net profit by 109.07 percent to Rs 359.3 million.</p>

<p style="text-align: justify;">On the basis of total amount, Nabil Bank has topped the list. Nabil Bank has been able to earn Rs 798.3 million net profit in the first quarter of the current FY. The amount is 22.17 percent more than the corresponding period of the last FY. Similarly, Nepal Investment Bank earned Rs 740.8 million net profit during the first three months of the current FY which is 74 percent growth from the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4553',

'image' => '20161113122514_net profit.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 10 => array(

'Article' => array(

'id' => '4722',

'article_category_id' => '1',

'title' => 'Innovative Undertakes Social Work on the Occasion of 7th Anniversary',

'sub_title' => '',

'summary' => 'November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7th anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.',

'content' => '<p style="text-align: justify;">November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7<sup>th</sup> anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.</p>

<p style="text-align: justify;">On the occasion, the bank distributed essential supplies to vision impaired children of Birendra Secondary School, Chappiya. The program was organised on the chairmanship of Parshu Ram Parajuli, Director of the bank.</p>

<p style="text-align: justify;">Similarly, the bank organised town cleaning program in which the Chief of the City, Gopal Prasad Regmi was the Chief Guest. The program was participated by the bank employees, local people, social workers and municipality employees.</p>

<p style="text-align: justify;">Likewise, the bank also organised blood donation program on the occasion. The program organised under the chairmanship of Dr Rishi Ram Sharma in the premises of central offices was participated by the bank's employees, employees of various BFIs and wellwishers. A total of 25 units of blood were collected from the program. Prabin Kumar Dahal, CEO of the bank informed that the programs were organised under the corporate social responsibility of the bank. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4552',

'image' => '20161113112305_innovative.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 11 => array(

'Article' => array(

'id' => '4721',

'article_category_id' => '1',

'title' => 'Kamana Bikash Bank in 10th Year',

'sub_title' => '',

'summary' => 'November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. ',

'content' => '<p style="text-align: justify;">November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4551',

'image' => '20161113104321_KAMANA.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 12 => array(

'Article' => array(

'id' => '4720',

'article_category_id' => '1',

'title' => 'Sidhu Bikash Bank to distribute 16.8% Bonus Share',

'sub_title' => '',

'summary' => 'November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. ',

'content' => '<p style="text-align: justify;">November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4550',

'image' => '20161113103626_sidhu.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 13 => array(

'Article' => array(

'id' => '4719',

'article_category_id' => '1',

'title' => '5 Banks to Provide Consortium Loan to Upper Balephi 'A'',

'sub_title' => '',

'summary' => 'November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.',

'content' => '<p style="text-align: justify;">November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.</p>

<p style="text-align: justify;">The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed by the banks. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche. The company has targeted to conclude the project within December 2018. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4549',

'image' => '20161113102556_global.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 14 => array(

'Article' => array(

'id' => '4718',

'article_category_id' => '1',

'title' => 'APRACA Nominates NRB as President',

'sub_title' => '',

'summary' => 'November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.',

'content' => '<p style="text-align: justify;">November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.</p>

<p style="text-align: justify;">Similarly, the association organized a workshop ‘Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region' which was inaugurated by Dr Chiranjivi Nepal, Governor of NRB. Speaking at the workshop, Governor Nepal said that lack of reach in economic sources and financial illiteracy are the global challenges for the economic prosperity. “Everyone should practice for inclusive financial growth utilizing the digital payment system for maximum,” he pointed.</p>

<p style="text-align: justify;"> Likewise, S.K. Sur Chowdhury, Governor of Bangladesh Bank opined that poverty has created social discrimination and economic inclusion is necessary to end the discrimination.</p>

<p style="text-align: justify;">According to the NRB, more than 120 member organization from 21 different countries took participations in workshop.</p>

<p style="text-align: justify;">Established in 1977, APRACA is regional organization that motivates rural economics and agriculture for its member countries. NRB is a founding member of the Association where other five Nepali organizations working on rural finance are also members of it. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4548',

'image' => '20161111022951_apraca.JPG',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

)

$current_user = null

$logged_in = false

$cat_id = '1'

$categoryTitle = array(

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

)

)

$article = array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

$width = (int) 400

$height = (int) 396

$ratio = (float) 1.010101010101

$img_width = (int) 280

$img_height = (float) 277.2

$date = '2016-11-14 00:00:00'

$dateFromDatabase = (int) 1479060900

$dateTwentyforHoursAgo = (int) 1755166133

$today = '2025-08-15 03:53:53pm'

$today2 = (int) 1755252533

$newDate = 'Nov 14, 2016'

$commentCount = (int) 0

$word_count = (int) 79

$time_to_read = (float) 0.4

$time_to_read_min = (float) 0

$time_to_read_second = (float) 24

getimagesize - [internal], line ??

include - APP/View/Articles/index.ctp, line 35

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Warning (2): Division by zero [APP/View/Articles/index.ctp, line 36]Code Context <?php

list($width, $height) = getimagesize(WWW_ROOT.'img'.DS.'news'.DS.'thumbnails'.DS.$article['Article']['image']);

$ratio = $width / $height;

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/index.ctp'

$dataForView = array(

'articles' => array(

(int) 0 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 1 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 2 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 3 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 4 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 5 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 6 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 7 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 8 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 9 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 10 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 11 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 12 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 13 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 14 => array(

'Article' => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$articles = array(

(int) 0 => array(

'Article' => array(

'id' => '4732',

'article_category_id' => '1',

'title' => '200 Plastic Industries Closed, 4000 employments lost',

'sub_title' => '',

'summary' => 'November 14: The government's move of banning plastic production citing environmental issues has become the prime reason for the closure of nearly 200 plastic industries. Using the section 7 of Environment protection Act, 2053, the government had banned the production, import, storage and sales of plastic since April 14, 2015. According to Sarad Sharma, President of Nepal Plastic Manufacturers' Association, only 150 plastic industries are being operated after the closure of 200 industries.',

'content' => '<p style="text-align: justify;">November 14: The government's move of banning plastic production citing environmental issues has become the prime reason for the closure of nearly 200 plastic industries. Using the section 7 of Environment protection Act, 2053, the government had banned the production, import, storage and sales of plastic since April 14, 2015. According to Sarad Sharma, President of Nepal Plastic Manufacturers' Association, only 150 plastic industries are being operated after the closure of 200 industries.</p>

<p style="text-align: justify;">The plastic manufacturers claim that the government is trying to close the industries instead of stressing execution of the directive that has set standard of plastic. "The government's move has caused heavy losses to the entrepreneurs," said Sharma. The government's move has caused deterioration of domestic investment, however, raised import of foreign plastic product in the Nepali market. As per Sharma, more than 4000 workers lost direct employment due to the closure of plastic industries.</p>

<p style="text-align: justify;">However, department of environment said that although the government has banned the production of below standard plastic bags, most of the plastic industries in and around the valley are still into operation. According to the department, it had restricted production, sales and distribution of plastic bags below 30 microns. </p>

<p style="text-align: justify;">Recently, the government started inspection of the plastic industries that are producing plastic product below standard. It has also taken action against those industries who failed to recuperate as per the government's directive. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4562',

'image' => '20161114021744_plst.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 1 => array(

'Article' => array(

'id' => '4731',

'article_category_id' => '1',

'title' => 'Construction 36 MW Balephi 'A' Hydropower Project Starts',

'sub_title' => '',

'summary' => 'November 14: The construction of 36 MW Balephi 'A' hydropower project has started with a target to complete the construction by December 2018.The project is being developed by Huwaning Development. The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed ',

'content' => '<p style="text-align: justify;">November 14: The construction of 36 MW Balephi 'A' hydropower project has started with a target to complete the construction by December 2018.</p>

<p style="text-align: justify;">The project is being developed by Huwaning Development. The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed through a consortium loan of five banks including Global IME, Sanima, Everest, SBI and NIDC Development Bank. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche.</p>

<p> </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4561',

'image' => '20161114125523_balephi_khola.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 2 => array(

'Article' => array(

'id' => '4730',

'article_category_id' => '1',

'title' => 'IPO to Float under Free Pricing Mechanism',

'sub_title' => '',

'summary' => 'November 14: The companies preparing to float initial public offering to the public may now price the share under the free pricing mechanism. The possibility of the free pricing increased with the approval of new regulation 'Nepal Securities Registration and Issue Regulations, 2073' by Securities Board of Nepal (SEBON).',

'content' => '<p style="text-align: justify;">November 14: The companies preparing to float initial public offering to the public may now price the share under the free pricing mechanism. The possibility of the free pricing increased with the approval of new regulation 'Nepal Securities Registration and Issue Regulations, 2073' by Securities Board of Nepal (SEBON).</p>

<p style="text-align: justify;">Issuing a press statement on November 13, SEBON informed of scrapping the 'Securities Registration and Issue Regulations, 2065'. The new regulation particularly mentions of forming a mechanism under which international financial institution will be able to issue bond/debentures in local currency. Similarly, real organised sectors will be given opportunity to go public with minimum of 10 percent public offering. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4560',

'image' => '20161114124130_ipo.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 3 => array(

'Article' => array(

'id' => '4729',

'article_category_id' => '1',

'title' => 'Lions Motor Rally on November 17',

'sub_title' => '',

'summary' => 'November 14: Lions Club International District 325 A1 is organising 'Lions Motor Rally' from Kathmandu to Pokhara on November 17. The Lions Club is organising the motor rally with the technical support of Nepal Automobiles Sport Association (NASA).',

'content' => '<p style="text-align: justify;">November 14: Lions Club International District 325 A1 is organising 'Lions Motor Rally' from Kathmandu to Pokhara on November 17. The Lions Club is organising the motor rally with the technical support of Nepal Automobiles Sport Association (NASA).</p>

<p style="text-align: justify;">The motor rally that is scheduled to start from Lainchaur Banquet at 11.00 hours, will reach Pokhara through touching various locations. The club is also organising Lions Multiple Festival 2016 at the same time in Pokhara. The club informs that the motor rally of this year is special, also due to the festival. The overall management of the rally is being done by Lion club of Kathmandu Rising sun affiliated with Lions Club International District 325 A1. The motor rally is officially sponsored by Gulf Lubricants. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4559',

'image' => '20161114111914_lions.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 4 => array(

'Article' => array(

'id' => '4728',

'article_category_id' => '1',

'title' => 'Net Profit of Nepal Gramin Bikash Bank Increases Two Folds',

'sub_title' => '',

'summary' => 'November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.',

'content' => '<p style="text-align: justify;">November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.</p>

<p style="text-align: justify;">Similarly, the operating profit of the bank has increased by 3 times to Rs 45.5 million in the first quarter of the current FY in compare to the same period of the last FY. Moreover, the loan extension of the bank has increased by 21.31 percent to Rs 6.85 billion. However, the reserve fund of the bank has decreased by 80.21 percent to Rs 45.8 million during the review period in compare to the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4558',

'image' => '20161114104810_profit.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 5 => array(

'Article' => array(

'id' => '4727',

'article_category_id' => '1',

'title' => 'Pokhara Finance's 100 days Fixed Deposit Scheme',

'sub_title' => '',

'summary' => 'November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. ',

'content' => '<p style="text-align: justify;">November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4557',

'image' => '20161114103421_pokhara.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 6 => array(

'Article' => array(

'id' => '4726',

'article_category_id' => '1',

'title' => 'Kakrebihar to distribute Bonus share',

'sub_title' => '',

'summary' => 'November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.',

'content' => '<p style="text-align: justify;">November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.</p>

<p style="text-align: justify;">"The BOD proposal has been sent to Nepal Rastra Bank (NRB) for approval," said Jagat Bahadur Thapa, Chief Manager of the bank. The bank informed of extending Rs 474.7 loan while collecting Rs 798.1 deposit during the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4556',

'image' => '20161114102340_kakrebihar.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 7 => array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 8 => array(

'Article' => array(

'id' => '4724',

'article_category_id' => '1',

'title' => 'Financial Market Losing Excess Liquidity',

'sub_title' => '',

'summary' => 'November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.',

'content' => '<p style="text-align: justify;">November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.</p>

<p style="text-align: justify;">NRB that was regularly mopping up Rs 10 billion regularly in 1 or 2 weeks time lag through reverse repo has reduced the amount to Rs 500 million. The bank issued the reverse repo of Rs 3.20 billion only once since September. "The bank which was issuing reverse repo of Rs 10billion has decreased the amount to Rs 500 million which clearly indicates the declining liquidity in the market," said a former banker.</p>

<p style="text-align: justify;">The bank was issuing reverse repo of Rs 10 billion weekly till September 7 which it decreased to Rs 4 billion on September 14 indicating the lack of excess liquidity. After that, the bank mopped up Rs 1 billion each time except for October 5, in which the bank issued reverse repo of Rs 5 billion. However, as the banks demanded high interest rate, the bank moped up Rs 3.20 billion from the market. The incident proved that the excess liquidity that was prevailed in the financial market has ended, as per the banker.</p>

<p style="text-align: justify;"> "After October 26, the NRB has issued reverse repo of Rs 500 million only. Moreover, the BFIs are also attracting deposit on an increased interest rate. Thus, the market is surely losing the excess liquidity," he said. Narayan Prasad Poudel, Spokesperson of NRB also accepts the decline in excess liquidity. "Bankers have started to mention the liquidity problem. On early September also, the market had no significantly higher liquidity when the NRB issued Rs 10 billion worth of reverse repo. However, demand of loan might have been decreased," he said. He opined that the NRB reduces the reverse repo amount as mopping up of higher amount increased the interbank interest rate. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4554',

'image' => '20161113015213_reverse repo.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 9 => array(

'Article' => array(

'id' => '4723',

'article_category_id' => '1',

'title' => 'Net Profit of Commercial Banks Increases in the 1st Quarter',

'sub_title' => '',

'summary' => 'November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.',

'content' => '<p style="text-align: justify;">November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.</p>

<p style="text-align: justify;">Among the first quarter report publisher commercial banks, NMB bank has been able to obtain the highest net profit. In the first three months of the current FY, the net profit of the bank increased by 147.58 percent to Rs 353.6 million. The bank earned Rs 140 million in the corresponding period of the last FY. In the review period, the bank increased its investment by 111 percent, loan extension by 102 percent, net interest income by 159 percent and operational profit by 102 percent. The bank was also able to recover 160 million non-performing loan of the last FY.</p>

<p style="text-align: justify;">Similarly, Citizens Bank International has been able to increase its net profit by 141.74 percent to Rs 345.1 million from Rs 140 million of the corresponding period of the last FY.</p>

<p style="text-align: justify;">Likewise, Sunrise Bank has earned Rs 253.1 million net profit in the first three months of the current FY which is 114 percent growth than the corresponding period of the last FY. Meanwhile, Siddhartha Bank increased its net profit by 109.07 percent to Rs 359.3 million.</p>

<p style="text-align: justify;">On the basis of total amount, Nabil Bank has topped the list. Nabil Bank has been able to earn Rs 798.3 million net profit in the first quarter of the current FY. The amount is 22.17 percent more than the corresponding period of the last FY. Similarly, Nepal Investment Bank earned Rs 740.8 million net profit during the first three months of the current FY which is 74 percent growth from the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4553',

'image' => '20161113122514_net profit.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 10 => array(

'Article' => array(

'id' => '4722',

'article_category_id' => '1',

'title' => 'Innovative Undertakes Social Work on the Occasion of 7th Anniversary',

'sub_title' => '',

'summary' => 'November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7th anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.',

'content' => '<p style="text-align: justify;">November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7<sup>th</sup> anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.</p>

<p style="text-align: justify;">On the occasion, the bank distributed essential supplies to vision impaired children of Birendra Secondary School, Chappiya. The program was organised on the chairmanship of Parshu Ram Parajuli, Director of the bank.</p>

<p style="text-align: justify;">Similarly, the bank organised town cleaning program in which the Chief of the City, Gopal Prasad Regmi was the Chief Guest. The program was participated by the bank employees, local people, social workers and municipality employees.</p>

<p style="text-align: justify;">Likewise, the bank also organised blood donation program on the occasion. The program organised under the chairmanship of Dr Rishi Ram Sharma in the premises of central offices was participated by the bank's employees, employees of various BFIs and wellwishers. A total of 25 units of blood were collected from the program. Prabin Kumar Dahal, CEO of the bank informed that the programs were organised under the corporate social responsibility of the bank. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4552',

'image' => '20161113112305_innovative.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 11 => array(

'Article' => array(

'id' => '4721',

'article_category_id' => '1',

'title' => 'Kamana Bikash Bank in 10th Year',

'sub_title' => '',

'summary' => 'November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. ',

'content' => '<p style="text-align: justify;">November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4551',

'image' => '20161113104321_KAMANA.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 12 => array(

'Article' => array(

'id' => '4720',

'article_category_id' => '1',

'title' => 'Sidhu Bikash Bank to distribute 16.8% Bonus Share',

'sub_title' => '',

'summary' => 'November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. ',

'content' => '<p style="text-align: justify;">November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4550',

'image' => '20161113103626_sidhu.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 13 => array(

'Article' => array(

'id' => '4719',

'article_category_id' => '1',

'title' => '5 Banks to Provide Consortium Loan to Upper Balephi 'A'',

'sub_title' => '',

'summary' => 'November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.',

'content' => '<p style="text-align: justify;">November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.</p>

<p style="text-align: justify;">The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed by the banks. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche. The company has targeted to conclude the project within December 2018. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4549',

'image' => '20161113102556_global.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 14 => array(

'Article' => array(

'id' => '4718',

'article_category_id' => '1',

'title' => 'APRACA Nominates NRB as President',

'sub_title' => '',

'summary' => 'November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.',

'content' => '<p style="text-align: justify;">November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.</p>

<p style="text-align: justify;">Similarly, the association organized a workshop ‘Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region' which was inaugurated by Dr Chiranjivi Nepal, Governor of NRB. Speaking at the workshop, Governor Nepal said that lack of reach in economic sources and financial illiteracy are the global challenges for the economic prosperity. “Everyone should practice for inclusive financial growth utilizing the digital payment system for maximum,” he pointed.</p>

<p style="text-align: justify;"> Likewise, S.K. Sur Chowdhury, Governor of Bangladesh Bank opined that poverty has created social discrimination and economic inclusion is necessary to end the discrimination.</p>

<p style="text-align: justify;">According to the NRB, more than 120 member organization from 21 different countries took participations in workshop.</p>

<p style="text-align: justify;">Established in 1977, APRACA is regional organization that motivates rural economics and agriculture for its member countries. NRB is a founding member of the Association where other five Nepali organizations working on rural finance are also members of it. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4548',

'image' => '20161111022951_apraca.JPG',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

)

$current_user = null

$logged_in = false

$cat_id = '1'

$categoryTitle = array(

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

)

)

$article = array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

$width = null

$height = null

$ratio = (float) 1.010101010101

$img_width = (int) 280

$img_height = (float) 277.2

$date = '2016-11-14 00:00:00'

$dateFromDatabase = (int) 1479060900

$dateTwentyforHoursAgo = (int) 1755166133

$today = '2025-08-15 03:53:53pm'

$today2 = (int) 1755252533

$newDate = 'Nov 14, 2016'

$commentCount = (int) 0

$word_count = (int) 79

$time_to_read = (float) 0.4

$time_to_read_min = (float) 0

$time_to_read_second = (float) 24

include - APP/View/Articles/index.ctp, line 36

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117