December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter.…

December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter.…

December 18: Advance Automobiles, the authorised distributor of Renault products for Nepal has launched a new sales scheme 'Renault Winter Super Celebration Offer'. Issuing a press statement, the company informed that the scheme is applicable to the Duster and Kwid model of Renault cars.…

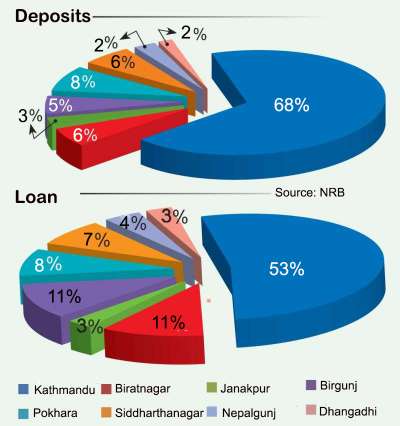

December 18: According to a study conducted by Nepal Rastra Bank (NRB), the loan deposit ratio in the current FY has reached 81.2 per cent resulted by a raise in loan extensions compare to deposits of BFIs. As the ratio is above 80 per cent, the market may face liquidity problem in the near future.…

December 18: Womi Microfinance is distributing 21 per cent bonus share to its shareholders. The 5th annual general meeting of the microfinance held on December 16 endorsed the proposal of distributing 20 per cent bonus share and 1.108 per cent cash dividend to its shareholders. After distribution of the bonus share, the paid-up capital will raise to Rs 64.8…

December 18: Nepal Bangladesh (NB) Bank has started a branch in Galchi of Dhading. Gyanendra Prasad Dhungana, CEO of the bank inaugurated the branch amid a program of December 15. The bank is providing its services through the network of 36 branches, 2 extension counters, 7 branchless banking services and 35 ATMs.…

December 18: Global IME Bank has won 'Best Internet Bank 2016' award. An 'International Finance Magazine' published from London honoured the bank with the award. Chandra Prasad Dhakal, Chairman of the bank and Anil Gyawali, CEO of the bank received the award amid a program organised in Singapore. Global IME Bank was provided with the award due to its advanced internet banking services to its customers, said the bank in a press statement. Global IME is the first bank in Nepal to provide internet banking services in national language. The bank is providing advance technology based secure Global Online Internet Banking and Global Smart Mobile Banking services to its customers.…

December 16: The government has announced various measures aimed at removing policy obstructions to facilitate development of hydropower projects in the country. Speaking at the Power Summit ‘16 organised by the Independent Power Producers’ Association, Nepal (IPPAN), Prime Minister…

December 16: Shareholders of Ace Development Bank have accused the bank's promoters of forwarding the merger process with Nepal Investment Bank (NIBL) in low swap ratio due to the old private and business relation with the Chairman of NIBL, Prithwi Bahadur Pandey. According to them, the promoters of Ace being the promoters of NIBL as well are acting for their own benefits only overlooking the general investors' interest.…

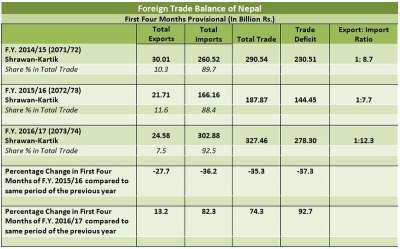

December 16: in the first four months of the current FY 2073/74, Nepal has imported Rs 12 worth of merchandise on Rs 1 exported merchandise. According to the foreign trade statistics of Trade and Export Promotion Centre published on Thursday, December 15, the ratio of export-import which was rested on 1:7.7 during the review period of the last FY has increased to 1:12.3 in the first four months of the current…

December 16: International experts and Nepali banking leaders have stressed on enhancing cyber security in the Nepali BFI sector. In an interaction programme titled 'Cyber Security and Trust in Technology' organised by US software giant Microsoft in association with the Nepal Bankers'…

December 16: The grand finale of Prostyle Manhunt International is being conducted in the valley on December 17. The program, sponsored by Prostyle oil, a product of Dabur Nepal, will announce the winner of Manhunt International Nepal 2016, said the company in a press statement. The company added that the winner among the 15 participants of the program being held at Hyatt will win the title 'Prostyle Manhunt International Nepal 2016' and compete in the competition'Manhunt International' on 2017 representing Nepal.…

December 16: National Life Insurance is providing 31.5 per cent dividend to its shareholders. The 28th annual general meeting of the company held on December 14 approved the proposal of distributing 30 per cent bonus share and 1.58 per cent cash dividend to its shareholders. In the AGM, Prema Singh, Chairman of the company presented the annual report of the FY 2071/72.…

December 16" Chandragiri Cable Car, constructed by Chandragiri Hills was officially launched on December 15. The cable car that was in test-operation since August 8 was officially inaugurated by the Prime Minister Pushpa Kamal Dahal. Chandragiri Hills has also build infrastructure in Chandragiri…

December 16: Ncell has launched two attractive services - ‘Weekly Roaming Data Packs’ and ‘Transit Pass’ - for the customers who need data connectivity while traveling out of the…

December 16: Standard Chartered Bank Nepal is distributing 33.33 per cent bonus share and 1.75 per cent cash dividend to its shareholders. The annual general meeting of the bank held on December 15 has approved the proposal of the bonus share forwarded by its board of…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4958', 'article_category_id' => '1', 'title' => 'Exclusive SsangYong Showroom at Naxal', 'sub_title' => '', 'summary' => 'December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter. ', 'content' => '<p>December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter. South Korean Ambassador to Nepal Choe Young Jin along with IMS Group Chairman Deepak Malhotra and the company's President and CEO Dikesh Malhotra inaugurated the showroom.</p> <p>"To celebrate the grand opening and the upcoming Christmas and New Year's IMS Motors is offering its valued customers a discount of upto Rs 500,000 on purchase of Ssangyong vechicles through IMS Motors. The offer is valid from 18th December to 6th January 2017," said IMS Motors in a press statement. According to the statement, the company is expanding its wings with dealer's expansion in all major cities of Nepal. Adding to that the company is also in the verge of opening an exclusive Ssangyong service center.</p> <p>The new SsangYong showroom houses a variety of luxurious SUVs and pickups, which includes XLV, Korando, Rexton and Actyon Sports. According to the company, the features of each model makes the car exclusive. Some of the features available are ABS and EBD system, body frame made out of ultra high strength steel, large boot capacity in XLV, dual automatic a/c, active AWD with lock mode, Attractive day time running lights, bluetooth connectivity in Korand, seven seating arrangement, premium leather interior, three driver seat memory , impressive HID headlamps in Rexton and new sport design with luxurious interior, durable bed liner for better protection in Actyon Sports.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-19', 'keywords' => '', 'description' => '', 'sortorder' => '4780', 'image' => '20161219101741_sang showroom.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4957', 'article_category_id' => '1', 'title' => 'Renault Winter Super Celebration Scheme', 'sub_title' => '', 'summary' => 'December 18: Advance Automobiles, the authorised distributor of Renault products for Nepal has launched a new sales scheme 'Renault Winter Super Celebration Offer'. Issuing a press statement, the company informed that the scheme is applicable to the Duster and Kwid model of Renault cars. ', 'content' => '<p style="text-align: justify;">December 18: Advance Automobiles, the authorised distributor of Renault products for Nepal has launched a new sales scheme 'Renault Winter Super Celebration Offer'. Issuing a press statement, the company informed that the scheme is applicable to the Duster and Kwid model of Renault cars. </p> <p style="text-align: justify;">According to the company, customers can purchase Duster in Rs 27,999 and Kwid in Rs 12,999 monthly instalment on 6.99 per cent interest rate. The scheme will come into effect from December 15. Under the scheme, customers are entitled to free road tax and two years of free servicing. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4779', 'image' => '20161218013725_reno.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4953', 'article_category_id' => '1', 'title' => 'Loan-Deposit Ratio above 80%', 'sub_title' => '', 'summary' => 'December 18: According to a study conducted by Nepal Rastra Bank (NRB), the loan deposit ratio in the current FY has reached 81.2 per cent resulted by a raise in loan extensions compare to deposits of BFIs. As the ratio is above 80 per cent, the market may face liquidity problem in the near future. T', 'content' => '<p style="text-align:justify">December 18: According to a study conducted by Nepal Rastra Bank (NRB), the loan deposit ratio in the current FY has reached 81.2 per cent resulted by a raise in loan extensions compare to deposits of BFIs. As the ratio is above 80 per cent, the market may face liquidity problem in the near future. The ratio was of 77.8 per cent during the last FY. As per the study, areas other than Kathmandu have above 80 per cent such ratio, among which, Birgunj topped the list with 164.48 per cent loan deposit ratio.</p> <p style="text-align:justify">In the review period, deposits of BFIs have increased by 20.2 per cent to Rs 1962.27 billion compare to 23 per cent growth in the last FY. Expansion of banking services providing easy and better accessibility to the general public and raise in remittance flow has caused the BFIs' deposit to escalate during the review period. Meanwhile, the loan extensions of the BFIs have increased by 25.4 per cent amounting to Rs 1593.57 billion during the period. In the last FY, such loan extensions had increased by 23.7 per cent.</p> <p style="text-align:justify">Kathmandu, being the capital of the country has the best accessibility to BFIs. During the period, a total of 3,721 branches of BFIs are under operation. Among them, Kathmandu has the most number of branches of 1,051. As per the study, Dhangadhi has the least number of BFIs' branches with only 190 branches operating.</p> <p style="text-align:justify">In the total deposit, Kathmandu contributes 68.1 per cent of the total deposits. Similarly, outside the valley, Pokhara topped the list with 7.6 per cent deposits collection. Likewise, Dhangadhi, being the least financial accessible area contributes only 1.6 per cent in the total deposits.</p> <p style="text-align:justify">Moreover, BFIs have extended the highest loan amount to Kathmandu. In the total amount of loan, Kathmandu utilises 52.6 per cent of BFIs loans. Outside the capital, the BFIs have extended the highest loans to Birgunj of 11.6 per cent and the least loans to Dhangadhi of 2.7 per cent. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4778', 'image' => '20161218120149_loan.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4956', 'article_category_id' => '1', 'title' => 'Womi Microfinance to distribute 21% Bonus', 'sub_title' => '', 'summary' => 'December 18: Womi Microfinance is distributing 21 per cent bonus share to its shareholders. The 5th annual general meeting of the microfinance held on December 16 endorsed the proposal of distributing 20 per cent bonus share and 1.108 per cent cash dividend to its shareholders. After distribution of the bonus share, the paid-up capital will raise to Rs 64.8 million.', 'content' => '<p style="text-align: justify;">December 18: Womi Microfinance is distributing 21 per cent bonus share to its shareholders. The 5<sup>th</sup> annual general meeting of the microfinance held on December 16 endorsed the proposal of distributing 20 per cent bonus share and 1.108 per cent cash dividend to its shareholders. After distribution of the bonus share, the paid-up capital will raise to Rs 64.8 million.</p> <p style="text-align: justify;">The AGM held in the central office of the microfinance at Dhading elected Bindiya Pradhan, Bimala Upadhya Ghimire and Kishori Thapa in the board of directors from promoter shareholders. Moreover, the BOD meeting held after the AGM selected Bindiya Pradhan as its chairman. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4778', 'image' => '20161218125110_womi.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4955', 'article_category_id' => '1', 'title' => 'NB Bank Starts Branch at Galchi', 'sub_title' => '', 'summary' => 'December 18: Nepal Bangladesh (NB) Bank has started a branch in Galchi of Dhading. Gyanendra Prasad Dhungana, CEO of the bank inaugurated the branch amid a program of December 15. The bank is providing its services through the network of 36 branches, 2 extension counters, 7 branchless banking services and 35 ATMs. ', 'content' => '<p style="text-align: justify;">December 18: Nepal Bangladesh (NB) Bank has started a branch in Galchi of Dhading. Gyanendra Prasad Dhungana, CEO of the bank inaugurated the branch amid a program of December 15. The bank is providing its services through the network of 36 branches, 2 extension counters, 7 branchless banking services and 35 ATMs. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4777', 'image' => '20161218123759_nb bank.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4954', 'article_category_id' => '1', 'title' => 'Global IME Bags 'Best Internet Bank 2016' Award', 'sub_title' => '', 'summary' => 'December 18: Global IME Bank has won 'Best Internet Bank 2016' award. An 'International Finance Magazine' published from London honoured the bank with the award. Chandra Prasad Dhakal, Chairman of the bank and Anil Gyawali, CEO of the bank received the award amid a program organised in Singapore. Global IME Bank was provided with the award due to its advanced internet banking services to its customers, said the bank in a press statement. Global IME is the first bank in Nepal to provide internet banking services in national language. The bank is providing advance technology based secure Global Online Internet Banking and Global Smart Mobile Banking services to its customers. ', 'content' => '<p style="text-align: justify;">December 18: Global IME Bank has won 'Best Internet Bank 2016' award. An 'International Finance Magazine' published from London honoured the bank with the award. Chandra Prasad Dhakal, Chairman of the bank and Anil Gyawali, CEO of the bank received the award amid a program organised in Singapore. Global IME Bank was provided with the award due to its advanced internet banking services to its customers, said the bank in a press statement. Global IME is the first bank in Nepal to provide internet banking services in national language. The bank is providing advance technology based secure Global Online Internet Banking and Global Smart Mobile Banking services to its customers. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4776', 'image' => '20161218123311_glbal.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4952', 'article_category_id' => '1', 'title' => 'Govt to Remove Policy Hurdles in Hydro Electricity Production', 'sub_title' => '', 'summary' => 'December 16: The government has announced various measures aimed at removing policy obstructions to facilitate development of hydropower projects in the country. Speaking at the Power Summit ‘16 organised by the Independent Power Producers’ Association, Nepal (IPPAN), Prime Minister Pushp', 'content' => '<p style="text-align: justify;">December 16: The government has announced various measures aimed at removing policy obstructions to facilitate development of hydropower projects in the country. Speaking at the Power Summit ‘16 organised by the Independent Power Producers’ Association, Nepal (IPPAN), Prime Minister Pushpakamal Dahal said that the policy changes would secure and guarantee investments of private power producers. The two-day event began in the capital on December 15 with the main theme of “10,000MW in 10 Years”. The policy changes will come as value added tax (VAT) rebate of Rs 5 million per megawatt produced by the private producers. Similarly, the government has announced that it will not engaged in development of hydropower projects lesser than 100MW capacity. Similarly, it also plans to replace the existing ‘Take and Pay’ provision with ‘Take or Pay’. Under this the government will purchase all the electricity produced by private producers. Likewise, minister Sharma also informed that the policy allowing the private producers to participate as institutional investors in government projects will also be introduced.</p> <p style="text-align: justify;">“The government formed under my leadership after the declaring Nepal a Federal Democratic Republic announced to produce 10,000MW in 10 years,” PM Dahal mentioned. “Now the government is active to achieve that aim by addressing issues related to policy, legal, and technical aspects of power production.” Stating that the government cannot alone produce the targeted amount of power, Dahal said that it is possible to produce power exceeding the target with the participation of the private sector. He also mentioned that the government will talk to the India regarding the ‘Guidelines on Cross Border Trade of Electricity’ recently issued by Indian power ministry. The new directive has made it difficult for Nepali and foreign power producers except those from India to develop export-oriented hydroelectric projects in Nepal. As per the directive, India will only import power produced from hydroelectric projects of neighbouring countries with at least 51 per cent equity of Indian companies or those with 100 equity of the neighbouring governments.</p> <p style="text-align: justify;">Speaking at the inaugural event, energy minister Janardan Sharma cited the lack of willingness as the main factor obstructing the production of electricity in sufficient quantity. “If we have the will to do so, the problems will solve eventually,” he expressed. He informed that various changes in policy will take place in order to spur the HEP development.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4774', 'image' => '20161216044751_power.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4941', 'article_category_id' => '1', 'title' => 'Merger between Ace and NIBL: Ace's General Investors in Woe', 'sub_title' => '', 'summary' => 'December 16: Shareholders of Ace Development Bank have accused the bank's promoters of forwarding the merger process with Nepal Investment Bank (NIBL) in low swap ratio due to the old private and business relation with the Chairman of NIBL, Prithwi Bahadur Pandey. According to them, the promoters of Ace being the promoters of NIBL as well are acting for their own benefits only overlooking the general investors' interest. ', 'content' => '<p style="text-align:justify">December 16: Shareholders of Ace Development Bank have accused the bank's promoters of forwarding the merger process with Nepal Investment Bank (NIBL) in low swap ratio due to the old private and business relation with the Chairman of NIBL, Prithwi Bahadur Pandey. According to them, the promoters of Ace being the promoters of NIBL as well are acting for their own benefits only overlooking the general investors' interest. </p> <p style="text-align:justify">The general investors are anxious that the NIBL Chairman Pandey might obtain the merger approval against the law from NRB by creating political pressure through his in-laws who is also a former finance minister and by influencing the related department of NRB.</p> <p style="text-align:justify">The promoter and general shareholders' proportion in Ace Development Bank is of 51:49. In the general meeting of Ace, investors had voiced against the 41 per cent valuation of the bank for the merger with NIBL which will provide annulled monetary gain to the promoters and tumble the general shareholders.</p> <p style="text-align:justify">Previously, when the merger of Sunrise Bank and Narayani National Development Bank was undertaken, Narayani was valued 78 per cent. Similarly, when ILFC Finance merged with Civil Bank, ILFC was valued 80 per cent. Likewise, Clean Energy Development Bank was valued 75 per cent while merging with NMB Bank, Kasthamandap Development Bank was valued 80 per cent while merging with Kumari Bank and Tribeni Development Bank was valued 100 per cent while merging with Janata Bank.</p> <p style="text-align:justify">Keeping the objections from general investors apart, when the annual general meeting of Ace decided about the merger, the investors went to Commission for the Investigation of Abuse of Authority (CIAA). In the AGM, Chairman of Ace, Yogendra Shakya was absent citing ill health. The general investors have submitted complaints against the decision to NRB and CIAA. After receiving the complain from general investors, CIAA wrote to NRB on November 25. General investors doubt that the NRB might approved the 41 per cent swap ratio besides the CIAA intervention in the influence of NIBl Chairman.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216111234_investment.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4943', 'article_category_id' => '1', 'title' => 'Nepal Records Highest Gap in Export-Import', 'sub_title' => '', 'summary' => 'December 16: in the first four months of the current FY 2073/74, Nepal has imported Rs 12 worth of merchandise on Rs 1 exported merchandise. According to the foreign trade statistics of Trade and Export Promotion Centre published on Thursday, December 15, the ratio of export-import which was rested on 1:7.7 during the review period of the last FY has increased to 1:12.3 in the first four months of the current FY.', 'content' => '<p style="text-align:justify">December 16: in the first four months of the current FY 2073/74, Nepal has imported Rs 12 worth of merchandise on Rs 1 exported merchandise. According to the foreign trade statistics of Trade and Export Promotion Centre published on Thursday, December 15, the ratio of export-import which was rested on 1:7.7 during the review period of the last FY has increased to 1:12.3 in the first four months of the current FY.</p> <p style="text-align:justify">'In the current FY, total import compare to export has nearly expanded by 5 folds resulting highest export-import ratio till date. The ratio was low during the initial period of last FY due to the affect of border blockade in import, said experts. However, the ratio has surpassed the ratio of FY 2071/72 as well which was 1:8.7. It indicates that the growth rate of export compare to import during the normal period is also minimal.</p> <p style="text-align:justify">Although the growth of export was below expectation, the total foreign trade of the country has significantly increased during the review period. The total trade has increased by 74.3 per cent to Rs 327.46 billion in the review period compare to the same period of the last FY. In the total foreign trade, the export and import contributes 7.5 per cent and 92.5 per cent respectively.</p> <p style="text-align:justify">In the review period, the total export has increased by 13.2 per cent to Rs 24.58 billion while the import has increased by 82.3 per cent to Rs 302.88 billion, as per the statistics of the Centre. The major products that were exported from the country were woollen carpets, readymade garments, lentils polyester and other yarns. In the review period, export of woollen carpets and readymade garments were declined by 4.1 per cent and 13 per cent respectively. As usual, India and USA remains the country's major export partners.</p> <p style="text-align:justify">In the review period, iron and steel and products thereof, petroleum products, transportation vehicles and parts thereof has increased significantly. In the review period, import of iron and steel and products thereof has increased by 91 per cent while petroleum and transportation has increased by 93.3 per cent and 232.1 per cent respectively. As a result, the total import has risen by 80 per cent. As per the statistics, India and China covers a huge section of Nepal's import.</p> <p style="text-align:justify">The extravagant growth in import compare to export has led the country's trade deficit outgrown by nearly 93 per cent to Rs 278.3 billion in the review period. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216010413_foreign trade.JPG', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4948', 'article_category_id' => '1', 'title' => 'Call for Strengthening Cyber Security in BFI Sector', 'sub_title' => '', 'summary' => 'December 16: International experts and Nepali banking leaders have stressed on enhancing cyber security in the Nepali BFI sector. In an interaction programme titled 'Cyber Security and Trust in Technology' organised by US software giant Microsoft in association with the Nepal Bankers' ', 'content' => '<p style="text-align:justify">December 16:<strong> </strong>International experts and Nepali banking leaders have stressed on enhancing cyber security in the Nepali BFI sector. In an interaction programme titled 'Cyber Security and Trust in Technology' organised by US software giant Microsoft in association with the Nepal Bankers' Associatyion (NBA) in the capital on December 15, they highlighted the need of new cyber security approach to minimise the risks of cyber attacks in the networks of banks and financial institutions. Chief Guest for the event Chiranjivi Nepal, Governor of Nepal Rastra Bank mentioned the importance of security in technology and practical cyber security in all the small and big financial institutions.</p> <p style="text-align:justify">The main speaker of the programme Astrid Tuminez, Senior Director- Corporate Affairs, Microsoft South East Asia shared the benefits and opportunities of cloud computing in the age of fourth industrial revolution. Speaking on the cybercrime in the digitized world, she added that the firms need to understand cyber security and resilience through trusted technology. "The Microsoft Trusted Cloud helps you focus on your core business. You can achieve the benefits of cloud while knowing that your security, privacy and compliance needs are being met. It is highly secure and compliant online services around the globe," she said.</p> <p style="text-align:justify">Meanwhile, Anil Keshary Shah, President of Nepal Bankers' Association spoke about the threats and attacks of cyber-securities in banking systems and discussed the measures to solve the problems of cyber threats. "News of security breaches continues to dominate headlines and the scale and scope of intrusions are growing, he said, adding, " In 2014 alone, data breaches were up by 78 per cent over the previous year, and cyber criminals comprised more than a billion data records in more than 1500 breaches." </p> <p style="text-align:justify">The programme also included a panel discussion on the issues of cyber security. DIGP Nawaraj Silwal, Chief of Central Investigation Bureau (CIB) Nepal, Ajit Regmi, Deputy Director (IT) of Nepal Rastra Bank, Bijendra Suwal, Chief Information Officer (CIO) of Nepal Investment Bank, Sudesh Khaling, CEO of Laxmi Bank including Shah and Tuminez were the panelist for the event. The discussion was moderated by Bin Ru Tan, Regional Sales Director of Southeast Asia new markets of Microsoft.</p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-20', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216023009_cyber security.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4949', 'article_category_id' => '1', 'title' => 'Prostyle Manhunt International Grand Finale on Dec 17', 'sub_title' => '', 'summary' => 'December 16: The grand finale of Prostyle Manhunt International is being conducted in the valley on December 17. The program, sponsored by Prostyle oil, a product of Dabur Nepal, will announce the winner of Manhunt International Nepal 2016, said the company in a press statement. The company added that the winner among the 15 participants of the program being held at Hyatt will win the title 'Prostyle Manhunt International Nepal 2016' and compete in the competition'Manhunt International' on 2017 representing Nepal. ', 'content' => '<p style="text-align:justify">December 16: The grand finale of Prostyle Manhunt International is being conducted in the valley on December 17. The program, sponsored by Prostyle oil, a product of Dabur Nepal, will announce the winner of Manhunt International Nepal 2016, said the company in a press statement. The company added that the winner among the 15 participants of the program being held at Hyatt will win the title 'Prostyle Manhunt International Nepal 2016' and compete in the competition'Manhunt International' on 2017 representing Nepal. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216024918_prostyle.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4950', 'article_category_id' => '1', 'title' => 'National Life to Provide 31.5% Bonus Share', 'sub_title' => '', 'summary' => 'December 16: National Life Insurance is providing 31.5 per cent dividend to its shareholders. The 28th annual general meeting of the company held on December 14 approved the proposal of distributing 30 per cent bonus share and 1.58 per cent cash dividend to its shareholders. In the AGM, Prema Singh, Chairman of the company presented the annual report of the FY 2071/72. ', 'content' => '<p style="text-align:justify">December 16: National Life Insurance is providing 31.5 per cent dividend to its shareholders. The 28<sup>th</sup> annual general meeting of the company held on December 14 approved the proposal of distributing 30 per cent bonus share and 1.58 per cent cash dividend to its shareholders. In the AGM, Prema Singh, Chairman of the company presented the annual report of the FY 2071/72. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216030239_national life.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4951', 'article_category_id' => '1', 'title' => 'Chandragiri Cable Car Officially Launched', 'sub_title' => '', 'summary' => 'December 16" Chandragiri Cable Car, constructed by Chandragiri Hills was officially launched on December 15. The cable car that was in test-operation since August 8 was officially inaugurated by the Prime Minister Pushpa Kamal Dahal. Chandragiri Hills has also build infrastructure in Chandragiri ', 'content' => '<p style="text-align:justify">December 16" Chandragiri Cable Car, constructed by Chandragiri Hills was officially launched on December 15. The cable car that was in test-operation since August 8 was officially inaugurated by the Prime Minister Pushpa Kamal Dahal. Chandragiri Hills has also build infrastructure in Chandragiri Hills including Bhaleshwor Mahadev's Temple, view tower and resort. The cable car way starts from Thankot station to end at 2KM away Chandragiri hill. As per the company, Rs 6 billion capital has been invested in the construction of the cable car.</p> <p style="text-align:justify">In the program, PM Dahal said given that the population has willpower, science-technology and investment, Nepal can achieve a splendid development in short period. He stressed that many projects can be developed on private and public sector's co-operation.</p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216033720_chandagiri.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4942', 'article_category_id' => '1', 'title' => 'Ncell Launches ‘Weekly Roaming Data Packs’ and ‘Transit Pass’', 'sub_title' => '', 'summary' => 'December 16: Ncell has launched two attractive services - ‘Weekly Roaming Data Packs’ and ‘Transit Pass’ - for the customers who need data connectivity while traveling out of the country.', 'content' => '<p style="text-align: justify;">December 16: Ncell has launched two attractive services - ‘Weekly Roaming Data Packs’ and ‘Transit Pass’ - for the customers who need data connectivity while traveling out of the country. Issuing a press statement, the mobile service providers said that Weekly Roaming Data Packs enable the customers to enjoy data service at as low as Rs 5 per MB, while Roaming Transit Pass ensures unlimited data service in major transit destinations. </p> <p style="text-align: justify;"><br /> According to the press statement, both the services will come to the effect from Friday, December 16. Under Weekly Roaming Data Packs, customers can buy 250 MB roaming data pack at Rs 1,500 or 1GB roaming data pack at Rs 5,000. Similarly, the customers who activate the roaming transit pass will require paying Rs 500 to enjoy unlimited data service during transit period. The prices include applicable government taxes. The Weekly Data Roaming Packs are available for over fifty countries including India, China, USA, UK, Hong Kong, Singapore, Australia, Malaysia, France, Germany, New Zealand, Qatar and Turkey, among others. As for the Roaming Transit Pass, the service will be applicable in 10 countries, including India, China, Bangladesh, Hong Kong, Malaysia, Oman, Qatar, Singapore, Thailand and Turkey. </p> <p style="text-align: justify;"><br /> "Ncell prepaid and post-paid customers can activate the Weekly Roaming Data Packs by dialling *17129# and following the instruction. To activate roaming, prepaid customers can type A and send SMS to 900228, while post-paid customers need to visit the nearest Ncell Centre or by contacting respective account manager. The Weekly Roaming Data Packs will be valid for 7 days from the date of activation. Under the service of Roaming Transit Pass, the customers will get validity of 8 hours. To activate it, customers first need to activate roaming service by dialing *12127#, and activate the transit pass by dialing *17129# and following the instruction. Once the validity expires, customers will be charged at Pay As You Go rate as defined for respective countries," reads the statement.<br /> <br /> “The new services are designed for the customers who need data connectivity while on the move. We believe the service will add value to our customers, enabling them to stay connected with their family, friends and business even when they travel abroad,” said Milan Sharma, corporate communication expert of Ncell. </p> <p style="text-align: justify;"><br /> The customers can subscribe the Weekly Roaming Data Packs multiple times as they require. There is no provision of auto renewal. Customers can dial *101# and check their remaining data volume, informed the company.</p> <p> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4772', 'image' => '20161216114027_ncell.JPG', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4944', 'article_category_id' => '1', 'title' => 'Standard Chartered to Distribute 35% Bonus Share', 'sub_title' => '', 'summary' => 'December 16: Standard Chartered Bank Nepal is distributing 33.33 per cent bonus share and 1.75 per cent cash dividend to its shareholders. The annual general meeting of the bank held on December 15 has approved the proposal of the bonus share forwarded by its board of directors.', 'content' => '<p style="text-align:justify">December 16: Standard Chartered Bank Nepal is distributing 33.33 per cent bonus share and 1.75 per cent cash dividend to its shareholders. The annual general meeting of the bank held on December 15 has approved the proposal of the bonus share forwarded by its board of directors.</p> <p style="text-align:justify">On the occasion, the bank informed of issuing further public offering (FPO) of Rs 3.30 billion so that to reach the Rs 8 billion minimum paid-up capital cap as per the directive of NRB. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4772', 'image' => '20161216011830_sc-logo.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4958', 'article_category_id' => '1', 'title' => 'Exclusive SsangYong Showroom at Naxal', 'sub_title' => '', 'summary' => 'December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter. ', 'content' => '<p>December 18: IMS Motors, a subsidiary of IMS Group has opened an exclusive SsangYong showroom at Naxal. The new outlet of the Korean luxury four-wheeler brand is located opposite to the Nepal Police Headquarter. South Korean Ambassador to Nepal Choe Young Jin along with IMS Group Chairman Deepak Malhotra and the company's President and CEO Dikesh Malhotra inaugurated the showroom.</p> <p>"To celebrate the grand opening and the upcoming Christmas and New Year's IMS Motors is offering its valued customers a discount of upto Rs 500,000 on purchase of Ssangyong vechicles through IMS Motors. The offer is valid from 18th December to 6th January 2017," said IMS Motors in a press statement. According to the statement, the company is expanding its wings with dealer's expansion in all major cities of Nepal. Adding to that the company is also in the verge of opening an exclusive Ssangyong service center.</p> <p>The new SsangYong showroom houses a variety of luxurious SUVs and pickups, which includes XLV, Korando, Rexton and Actyon Sports. According to the company, the features of each model makes the car exclusive. Some of the features available are ABS and EBD system, body frame made out of ultra high strength steel, large boot capacity in XLV, dual automatic a/c, active AWD with lock mode, Attractive day time running lights, bluetooth connectivity in Korand, seven seating arrangement, premium leather interior, three driver seat memory , impressive HID headlamps in Rexton and new sport design with luxurious interior, durable bed liner for better protection in Actyon Sports.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-19', 'keywords' => '', 'description' => '', 'sortorder' => '4780', 'image' => '20161219101741_sang showroom.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4957', 'article_category_id' => '1', 'title' => 'Renault Winter Super Celebration Scheme', 'sub_title' => '', 'summary' => 'December 18: Advance Automobiles, the authorised distributor of Renault products for Nepal has launched a new sales scheme 'Renault Winter Super Celebration Offer'. Issuing a press statement, the company informed that the scheme is applicable to the Duster and Kwid model of Renault cars. ', 'content' => '<p style="text-align: justify;">December 18: Advance Automobiles, the authorised distributor of Renault products for Nepal has launched a new sales scheme 'Renault Winter Super Celebration Offer'. Issuing a press statement, the company informed that the scheme is applicable to the Duster and Kwid model of Renault cars. </p> <p style="text-align: justify;">According to the company, customers can purchase Duster in Rs 27,999 and Kwid in Rs 12,999 monthly instalment on 6.99 per cent interest rate. The scheme will come into effect from December 15. Under the scheme, customers are entitled to free road tax and two years of free servicing. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4779', 'image' => '20161218013725_reno.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4953', 'article_category_id' => '1', 'title' => 'Loan-Deposit Ratio above 80%', 'sub_title' => '', 'summary' => 'December 18: According to a study conducted by Nepal Rastra Bank (NRB), the loan deposit ratio in the current FY has reached 81.2 per cent resulted by a raise in loan extensions compare to deposits of BFIs. As the ratio is above 80 per cent, the market may face liquidity problem in the near future. T', 'content' => '<p style="text-align:justify">December 18: According to a study conducted by Nepal Rastra Bank (NRB), the loan deposit ratio in the current FY has reached 81.2 per cent resulted by a raise in loan extensions compare to deposits of BFIs. As the ratio is above 80 per cent, the market may face liquidity problem in the near future. The ratio was of 77.8 per cent during the last FY. As per the study, areas other than Kathmandu have above 80 per cent such ratio, among which, Birgunj topped the list with 164.48 per cent loan deposit ratio.</p> <p style="text-align:justify">In the review period, deposits of BFIs have increased by 20.2 per cent to Rs 1962.27 billion compare to 23 per cent growth in the last FY. Expansion of banking services providing easy and better accessibility to the general public and raise in remittance flow has caused the BFIs' deposit to escalate during the review period. Meanwhile, the loan extensions of the BFIs have increased by 25.4 per cent amounting to Rs 1593.57 billion during the period. In the last FY, such loan extensions had increased by 23.7 per cent.</p> <p style="text-align:justify">Kathmandu, being the capital of the country has the best accessibility to BFIs. During the period, a total of 3,721 branches of BFIs are under operation. Among them, Kathmandu has the most number of branches of 1,051. As per the study, Dhangadhi has the least number of BFIs' branches with only 190 branches operating.</p> <p style="text-align:justify">In the total deposit, Kathmandu contributes 68.1 per cent of the total deposits. Similarly, outside the valley, Pokhara topped the list with 7.6 per cent deposits collection. Likewise, Dhangadhi, being the least financial accessible area contributes only 1.6 per cent in the total deposits.</p> <p style="text-align:justify">Moreover, BFIs have extended the highest loan amount to Kathmandu. In the total amount of loan, Kathmandu utilises 52.6 per cent of BFIs loans. Outside the capital, the BFIs have extended the highest loans to Birgunj of 11.6 per cent and the least loans to Dhangadhi of 2.7 per cent. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4778', 'image' => '20161218120149_loan.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4956', 'article_category_id' => '1', 'title' => 'Womi Microfinance to distribute 21% Bonus', 'sub_title' => '', 'summary' => 'December 18: Womi Microfinance is distributing 21 per cent bonus share to its shareholders. The 5th annual general meeting of the microfinance held on December 16 endorsed the proposal of distributing 20 per cent bonus share and 1.108 per cent cash dividend to its shareholders. After distribution of the bonus share, the paid-up capital will raise to Rs 64.8 million.', 'content' => '<p style="text-align: justify;">December 18: Womi Microfinance is distributing 21 per cent bonus share to its shareholders. The 5<sup>th</sup> annual general meeting of the microfinance held on December 16 endorsed the proposal of distributing 20 per cent bonus share and 1.108 per cent cash dividend to its shareholders. After distribution of the bonus share, the paid-up capital will raise to Rs 64.8 million.</p> <p style="text-align: justify;">The AGM held in the central office of the microfinance at Dhading elected Bindiya Pradhan, Bimala Upadhya Ghimire and Kishori Thapa in the board of directors from promoter shareholders. Moreover, the BOD meeting held after the AGM selected Bindiya Pradhan as its chairman. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4778', 'image' => '20161218125110_womi.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4955', 'article_category_id' => '1', 'title' => 'NB Bank Starts Branch at Galchi', 'sub_title' => '', 'summary' => 'December 18: Nepal Bangladesh (NB) Bank has started a branch in Galchi of Dhading. Gyanendra Prasad Dhungana, CEO of the bank inaugurated the branch amid a program of December 15. The bank is providing its services through the network of 36 branches, 2 extension counters, 7 branchless banking services and 35 ATMs. ', 'content' => '<p style="text-align: justify;">December 18: Nepal Bangladesh (NB) Bank has started a branch in Galchi of Dhading. Gyanendra Prasad Dhungana, CEO of the bank inaugurated the branch amid a program of December 15. The bank is providing its services through the network of 36 branches, 2 extension counters, 7 branchless banking services and 35 ATMs. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4777', 'image' => '20161218123759_nb bank.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4954', 'article_category_id' => '1', 'title' => 'Global IME Bags 'Best Internet Bank 2016' Award', 'sub_title' => '', 'summary' => 'December 18: Global IME Bank has won 'Best Internet Bank 2016' award. An 'International Finance Magazine' published from London honoured the bank with the award. Chandra Prasad Dhakal, Chairman of the bank and Anil Gyawali, CEO of the bank received the award amid a program organised in Singapore. Global IME Bank was provided with the award due to its advanced internet banking services to its customers, said the bank in a press statement. Global IME is the first bank in Nepal to provide internet banking services in national language. The bank is providing advance technology based secure Global Online Internet Banking and Global Smart Mobile Banking services to its customers. ', 'content' => '<p style="text-align: justify;">December 18: Global IME Bank has won 'Best Internet Bank 2016' award. An 'International Finance Magazine' published from London honoured the bank with the award. Chandra Prasad Dhakal, Chairman of the bank and Anil Gyawali, CEO of the bank received the award amid a program organised in Singapore. Global IME Bank was provided with the award due to its advanced internet banking services to its customers, said the bank in a press statement. Global IME is the first bank in Nepal to provide internet banking services in national language. The bank is providing advance technology based secure Global Online Internet Banking and Global Smart Mobile Banking services to its customers. </p> ', 'published' => true, 'created' => '2016-12-18', 'modified' => '2016-12-18', 'keywords' => '', 'description' => '', 'sortorder' => '4776', 'image' => '20161218123311_glbal.jpg', 'article_date' => '2016-12-18 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4952', 'article_category_id' => '1', 'title' => 'Govt to Remove Policy Hurdles in Hydro Electricity Production', 'sub_title' => '', 'summary' => 'December 16: The government has announced various measures aimed at removing policy obstructions to facilitate development of hydropower projects in the country. Speaking at the Power Summit ‘16 organised by the Independent Power Producers’ Association, Nepal (IPPAN), Prime Minister Pushp', 'content' => '<p style="text-align: justify;">December 16: The government has announced various measures aimed at removing policy obstructions to facilitate development of hydropower projects in the country. Speaking at the Power Summit ‘16 organised by the Independent Power Producers’ Association, Nepal (IPPAN), Prime Minister Pushpakamal Dahal said that the policy changes would secure and guarantee investments of private power producers. The two-day event began in the capital on December 15 with the main theme of “10,000MW in 10 Years”. The policy changes will come as value added tax (VAT) rebate of Rs 5 million per megawatt produced by the private producers. Similarly, the government has announced that it will not engaged in development of hydropower projects lesser than 100MW capacity. Similarly, it also plans to replace the existing ‘Take and Pay’ provision with ‘Take or Pay’. Under this the government will purchase all the electricity produced by private producers. Likewise, minister Sharma also informed that the policy allowing the private producers to participate as institutional investors in government projects will also be introduced.</p> <p style="text-align: justify;">“The government formed under my leadership after the declaring Nepal a Federal Democratic Republic announced to produce 10,000MW in 10 years,” PM Dahal mentioned. “Now the government is active to achieve that aim by addressing issues related to policy, legal, and technical aspects of power production.” Stating that the government cannot alone produce the targeted amount of power, Dahal said that it is possible to produce power exceeding the target with the participation of the private sector. He also mentioned that the government will talk to the India regarding the ‘Guidelines on Cross Border Trade of Electricity’ recently issued by Indian power ministry. The new directive has made it difficult for Nepali and foreign power producers except those from India to develop export-oriented hydroelectric projects in Nepal. As per the directive, India will only import power produced from hydroelectric projects of neighbouring countries with at least 51 per cent equity of Indian companies or those with 100 equity of the neighbouring governments.</p> <p style="text-align: justify;">Speaking at the inaugural event, energy minister Janardan Sharma cited the lack of willingness as the main factor obstructing the production of electricity in sufficient quantity. “If we have the will to do so, the problems will solve eventually,” he expressed. He informed that various changes in policy will take place in order to spur the HEP development.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4774', 'image' => '20161216044751_power.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4941', 'article_category_id' => '1', 'title' => 'Merger between Ace and NIBL: Ace's General Investors in Woe', 'sub_title' => '', 'summary' => 'December 16: Shareholders of Ace Development Bank have accused the bank's promoters of forwarding the merger process with Nepal Investment Bank (NIBL) in low swap ratio due to the old private and business relation with the Chairman of NIBL, Prithwi Bahadur Pandey. According to them, the promoters of Ace being the promoters of NIBL as well are acting for their own benefits only overlooking the general investors' interest. ', 'content' => '<p style="text-align:justify">December 16: Shareholders of Ace Development Bank have accused the bank's promoters of forwarding the merger process with Nepal Investment Bank (NIBL) in low swap ratio due to the old private and business relation with the Chairman of NIBL, Prithwi Bahadur Pandey. According to them, the promoters of Ace being the promoters of NIBL as well are acting for their own benefits only overlooking the general investors' interest. </p> <p style="text-align:justify">The general investors are anxious that the NIBL Chairman Pandey might obtain the merger approval against the law from NRB by creating political pressure through his in-laws who is also a former finance minister and by influencing the related department of NRB.</p> <p style="text-align:justify">The promoter and general shareholders' proportion in Ace Development Bank is of 51:49. In the general meeting of Ace, investors had voiced against the 41 per cent valuation of the bank for the merger with NIBL which will provide annulled monetary gain to the promoters and tumble the general shareholders.</p> <p style="text-align:justify">Previously, when the merger of Sunrise Bank and Narayani National Development Bank was undertaken, Narayani was valued 78 per cent. Similarly, when ILFC Finance merged with Civil Bank, ILFC was valued 80 per cent. Likewise, Clean Energy Development Bank was valued 75 per cent while merging with NMB Bank, Kasthamandap Development Bank was valued 80 per cent while merging with Kumari Bank and Tribeni Development Bank was valued 100 per cent while merging with Janata Bank.</p> <p style="text-align:justify">Keeping the objections from general investors apart, when the annual general meeting of Ace decided about the merger, the investors went to Commission for the Investigation of Abuse of Authority (CIAA). In the AGM, Chairman of Ace, Yogendra Shakya was absent citing ill health. The general investors have submitted complaints against the decision to NRB and CIAA. After receiving the complain from general investors, CIAA wrote to NRB on November 25. General investors doubt that the NRB might approved the 41 per cent swap ratio besides the CIAA intervention in the influence of NIBl Chairman.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216111234_investment.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4943', 'article_category_id' => '1', 'title' => 'Nepal Records Highest Gap in Export-Import', 'sub_title' => '', 'summary' => 'December 16: in the first four months of the current FY 2073/74, Nepal has imported Rs 12 worth of merchandise on Rs 1 exported merchandise. According to the foreign trade statistics of Trade and Export Promotion Centre published on Thursday, December 15, the ratio of export-import which was rested on 1:7.7 during the review period of the last FY has increased to 1:12.3 in the first four months of the current FY.', 'content' => '<p style="text-align:justify">December 16: in the first four months of the current FY 2073/74, Nepal has imported Rs 12 worth of merchandise on Rs 1 exported merchandise. According to the foreign trade statistics of Trade and Export Promotion Centre published on Thursday, December 15, the ratio of export-import which was rested on 1:7.7 during the review period of the last FY has increased to 1:12.3 in the first four months of the current FY.</p> <p style="text-align:justify">'In the current FY, total import compare to export has nearly expanded by 5 folds resulting highest export-import ratio till date. The ratio was low during the initial period of last FY due to the affect of border blockade in import, said experts. However, the ratio has surpassed the ratio of FY 2071/72 as well which was 1:8.7. It indicates that the growth rate of export compare to import during the normal period is also minimal.</p> <p style="text-align:justify">Although the growth of export was below expectation, the total foreign trade of the country has significantly increased during the review period. The total trade has increased by 74.3 per cent to Rs 327.46 billion in the review period compare to the same period of the last FY. In the total foreign trade, the export and import contributes 7.5 per cent and 92.5 per cent respectively.</p> <p style="text-align:justify">In the review period, the total export has increased by 13.2 per cent to Rs 24.58 billion while the import has increased by 82.3 per cent to Rs 302.88 billion, as per the statistics of the Centre. The major products that were exported from the country were woollen carpets, readymade garments, lentils polyester and other yarns. In the review period, export of woollen carpets and readymade garments were declined by 4.1 per cent and 13 per cent respectively. As usual, India and USA remains the country's major export partners.</p> <p style="text-align:justify">In the review period, iron and steel and products thereof, petroleum products, transportation vehicles and parts thereof has increased significantly. In the review period, import of iron and steel and products thereof has increased by 91 per cent while petroleum and transportation has increased by 93.3 per cent and 232.1 per cent respectively. As a result, the total import has risen by 80 per cent. As per the statistics, India and China covers a huge section of Nepal's import.</p> <p style="text-align:justify">The extravagant growth in import compare to export has led the country's trade deficit outgrown by nearly 93 per cent to Rs 278.3 billion in the review period. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216010413_foreign trade.JPG', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4948', 'article_category_id' => '1', 'title' => 'Call for Strengthening Cyber Security in BFI Sector', 'sub_title' => '', 'summary' => 'December 16: International experts and Nepali banking leaders have stressed on enhancing cyber security in the Nepali BFI sector. In an interaction programme titled 'Cyber Security and Trust in Technology' organised by US software giant Microsoft in association with the Nepal Bankers' ', 'content' => '<p style="text-align:justify">December 16:<strong> </strong>International experts and Nepali banking leaders have stressed on enhancing cyber security in the Nepali BFI sector. In an interaction programme titled 'Cyber Security and Trust in Technology' organised by US software giant Microsoft in association with the Nepal Bankers' Associatyion (NBA) in the capital on December 15, they highlighted the need of new cyber security approach to minimise the risks of cyber attacks in the networks of banks and financial institutions. Chief Guest for the event Chiranjivi Nepal, Governor of Nepal Rastra Bank mentioned the importance of security in technology and practical cyber security in all the small and big financial institutions.</p> <p style="text-align:justify">The main speaker of the programme Astrid Tuminez, Senior Director- Corporate Affairs, Microsoft South East Asia shared the benefits and opportunities of cloud computing in the age of fourth industrial revolution. Speaking on the cybercrime in the digitized world, she added that the firms need to understand cyber security and resilience through trusted technology. "The Microsoft Trusted Cloud helps you focus on your core business. You can achieve the benefits of cloud while knowing that your security, privacy and compliance needs are being met. It is highly secure and compliant online services around the globe," she said.</p> <p style="text-align:justify">Meanwhile, Anil Keshary Shah, President of Nepal Bankers' Association spoke about the threats and attacks of cyber-securities in banking systems and discussed the measures to solve the problems of cyber threats. "News of security breaches continues to dominate headlines and the scale and scope of intrusions are growing, he said, adding, " In 2014 alone, data breaches were up by 78 per cent over the previous year, and cyber criminals comprised more than a billion data records in more than 1500 breaches." </p> <p style="text-align:justify">The programme also included a panel discussion on the issues of cyber security. DIGP Nawaraj Silwal, Chief of Central Investigation Bureau (CIB) Nepal, Ajit Regmi, Deputy Director (IT) of Nepal Rastra Bank, Bijendra Suwal, Chief Information Officer (CIO) of Nepal Investment Bank, Sudesh Khaling, CEO of Laxmi Bank including Shah and Tuminez were the panelist for the event. The discussion was moderated by Bin Ru Tan, Regional Sales Director of Southeast Asia new markets of Microsoft.</p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-20', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216023009_cyber security.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4949', 'article_category_id' => '1', 'title' => 'Prostyle Manhunt International Grand Finale on Dec 17', 'sub_title' => '', 'summary' => 'December 16: The grand finale of Prostyle Manhunt International is being conducted in the valley on December 17. The program, sponsored by Prostyle oil, a product of Dabur Nepal, will announce the winner of Manhunt International Nepal 2016, said the company in a press statement. The company added that the winner among the 15 participants of the program being held at Hyatt will win the title 'Prostyle Manhunt International Nepal 2016' and compete in the competition'Manhunt International' on 2017 representing Nepal. ', 'content' => '<p style="text-align:justify">December 16: The grand finale of Prostyle Manhunt International is being conducted in the valley on December 17. The program, sponsored by Prostyle oil, a product of Dabur Nepal, will announce the winner of Manhunt International Nepal 2016, said the company in a press statement. The company added that the winner among the 15 participants of the program being held at Hyatt will win the title 'Prostyle Manhunt International Nepal 2016' and compete in the competition'Manhunt International' on 2017 representing Nepal. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216024918_prostyle.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4950', 'article_category_id' => '1', 'title' => 'National Life to Provide 31.5% Bonus Share', 'sub_title' => '', 'summary' => 'December 16: National Life Insurance is providing 31.5 per cent dividend to its shareholders. The 28th annual general meeting of the company held on December 14 approved the proposal of distributing 30 per cent bonus share and 1.58 per cent cash dividend to its shareholders. In the AGM, Prema Singh, Chairman of the company presented the annual report of the FY 2071/72. ', 'content' => '<p style="text-align:justify">December 16: National Life Insurance is providing 31.5 per cent dividend to its shareholders. The 28<sup>th</sup> annual general meeting of the company held on December 14 approved the proposal of distributing 30 per cent bonus share and 1.58 per cent cash dividend to its shareholders. In the AGM, Prema Singh, Chairman of the company presented the annual report of the FY 2071/72. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216030239_national life.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4951', 'article_category_id' => '1', 'title' => 'Chandragiri Cable Car Officially Launched', 'sub_title' => '', 'summary' => 'December 16" Chandragiri Cable Car, constructed by Chandragiri Hills was officially launched on December 15. The cable car that was in test-operation since August 8 was officially inaugurated by the Prime Minister Pushpa Kamal Dahal. Chandragiri Hills has also build infrastructure in Chandragiri ', 'content' => '<p style="text-align:justify">December 16" Chandragiri Cable Car, constructed by Chandragiri Hills was officially launched on December 15. The cable car that was in test-operation since August 8 was officially inaugurated by the Prime Minister Pushpa Kamal Dahal. Chandragiri Hills has also build infrastructure in Chandragiri Hills including Bhaleshwor Mahadev's Temple, view tower and resort. The cable car way starts from Thankot station to end at 2KM away Chandragiri hill. As per the company, Rs 6 billion capital has been invested in the construction of the cable car.</p> <p style="text-align:justify">In the program, PM Dahal said given that the population has willpower, science-technology and investment, Nepal can achieve a splendid development in short period. He stressed that many projects can be developed on private and public sector's co-operation.</p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4773', 'image' => '20161216033720_chandagiri.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4942', 'article_category_id' => '1', 'title' => 'Ncell Launches ‘Weekly Roaming Data Packs’ and ‘Transit Pass’', 'sub_title' => '', 'summary' => 'December 16: Ncell has launched two attractive services - ‘Weekly Roaming Data Packs’ and ‘Transit Pass’ - for the customers who need data connectivity while traveling out of the country.', 'content' => '<p style="text-align: justify;">December 16: Ncell has launched two attractive services - ‘Weekly Roaming Data Packs’ and ‘Transit Pass’ - for the customers who need data connectivity while traveling out of the country. Issuing a press statement, the mobile service providers said that Weekly Roaming Data Packs enable the customers to enjoy data service at as low as Rs 5 per MB, while Roaming Transit Pass ensures unlimited data service in major transit destinations. </p> <p style="text-align: justify;"><br /> According to the press statement, both the services will come to the effect from Friday, December 16. Under Weekly Roaming Data Packs, customers can buy 250 MB roaming data pack at Rs 1,500 or 1GB roaming data pack at Rs 5,000. Similarly, the customers who activate the roaming transit pass will require paying Rs 500 to enjoy unlimited data service during transit period. The prices include applicable government taxes. The Weekly Data Roaming Packs are available for over fifty countries including India, China, USA, UK, Hong Kong, Singapore, Australia, Malaysia, France, Germany, New Zealand, Qatar and Turkey, among others. As for the Roaming Transit Pass, the service will be applicable in 10 countries, including India, China, Bangladesh, Hong Kong, Malaysia, Oman, Qatar, Singapore, Thailand and Turkey. </p> <p style="text-align: justify;"><br /> "Ncell prepaid and post-paid customers can activate the Weekly Roaming Data Packs by dialling *17129# and following the instruction. To activate roaming, prepaid customers can type A and send SMS to 900228, while post-paid customers need to visit the nearest Ncell Centre or by contacting respective account manager. The Weekly Roaming Data Packs will be valid for 7 days from the date of activation. Under the service of Roaming Transit Pass, the customers will get validity of 8 hours. To activate it, customers first need to activate roaming service by dialing *12127#, and activate the transit pass by dialing *17129# and following the instruction. Once the validity expires, customers will be charged at Pay As You Go rate as defined for respective countries," reads the statement.<br /> <br /> “The new services are designed for the customers who need data connectivity while on the move. We believe the service will add value to our customers, enabling them to stay connected with their family, friends and business even when they travel abroad,” said Milan Sharma, corporate communication expert of Ncell. </p> <p style="text-align: justify;"><br /> The customers can subscribe the Weekly Roaming Data Packs multiple times as they require. There is no provision of auto renewal. Customers can dial *101# and check their remaining data volume, informed the company.</p> <p> </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4772', 'image' => '20161216114027_ncell.JPG', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4944', 'article_category_id' => '1', 'title' => 'Standard Chartered to Distribute 35% Bonus Share', 'sub_title' => '', 'summary' => 'December 16: Standard Chartered Bank Nepal is distributing 33.33 per cent bonus share and 1.75 per cent cash dividend to its shareholders. The annual general meeting of the bank held on December 15 has approved the proposal of the bonus share forwarded by its board of directors.', 'content' => '<p style="text-align:justify">December 16: Standard Chartered Bank Nepal is distributing 33.33 per cent bonus share and 1.75 per cent cash dividend to its shareholders. The annual general meeting of the bank held on December 15 has approved the proposal of the bonus share forwarded by its board of directors.</p> <p style="text-align:justify">On the occasion, the bank informed of issuing further public offering (FPO) of Rs 3.30 billion so that to reach the Rs 8 billion minimum paid-up capital cap as per the directive of NRB. </p> ', 'published' => true, 'created' => '2016-12-16', 'modified' => '2016-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '4772', 'image' => '20161216011830_sc-logo.jpg', 'article_date' => '2016-12-16 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117