May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural…

May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural…

May 6: NMB Bank has invested in Hotel Marriott, a five star deluxe hotel, under construction at Nagpokhari. Prabhu Bank and Nepal Bangladesh Bank have already invested in the venture. According to NMB Bank, out of Rs 4 billion of the total investment, the banks will invest Rs 3.20…

May 6: Kumari Bank and YES Remit have signed remittance agreement on May 5. Rajiv Giri, Acting Chief Executive Officer of Kumari Bank and Munal Jung Karki, Chief Executive Officer of YES Remit signed the agreement on behalf of their respective companies. After the agreement, money send through Yes Remit from all around the world can be received from all the branches of Kumari Bank and its remit…

May 6: Sunrise Bank has started operation of branchless banking services in Laxminiya-7, Mahottari. Mukunda Raj Mahato, Chief of Kanti Bazar National Campus, Rajendra Singh Kushwaha, Local Social Worker and Aasha Rana, Deputy General Manager of the bank inaugurated the banking service amid a program on Thursday. The bank informs that the service aims of providing banking services to local public. Local public can get facilities of saving and payment through the branchless banking…

May 6: CEDB hydro fund is issuing 1,761,000 units of general shares at Rs 100 per unit worth Rs 176.1 million. The fund has appointed NCM Merchant Banking as its Issue Manager. Binay Kumar Bhandari, CEO of CEDB and Bijay Lal Shrestha, Operational manager of NCM Merchant signed the agreement paper amid a program organised on…

May 5: Red carpet launch of Apex Short Film Festival 2016 was held on May 2 at Apex College. The theme of the festival was ‘Freedom’.Out of 24 registered short films, selected 8 were screened in the premiere show. Top three movies were awarded after the screening. “Desire” bagged the first prize in the contest, “Two Souls” and “The Feels” were the first and second runners-up respectively. The winners were awarded with Samsung Galaxy smartphone, cash prize, trophy, and certificate. According to the press statement, around 1000 Apexians are expected to participate in the event sponsored by Samsung Galaxy, Silhoutte Media, and QFX…

May 5: Securities Board of Nepal (SEBON) has issued a new directive regarding announcement of right share issuance and auction bidding of shares. SEBON releasing a circular on Tuesday, has directed companies to broadcast right share issuance notice in seven various medias while for auction bidding sale of shares, the number of medias should be six. SEBON concluded that a day notice as per the current…

May 5: Everest Bank has launched instant money transfer (remittance) in collaboration with Xoom Corporation, USA. In the press statement, the bank informs that the bank have partnered with Xoom to expand modern banking services from…

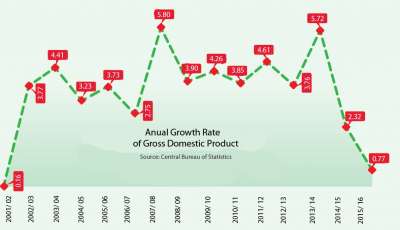

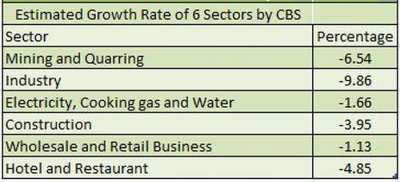

May 4: The government has made an initial projection of the economic growth at 0.77 percent for the fiscal year 2015/16. The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate which has narrowly avoided entering into a negative territory in the current FY. As per the CBS, the growth projection is lowest in the last 14 years. The nation had witnessed economic growth of 0.16 percent during the FY 2001-02 due to the spiralling arm conflict along with Royal Massacre and unfavourable…

May 4: The Central Bureau of Statistics (CBS) has projected negative growth rate for six sectors in the current fiscal year 2015/16. The six sectors include mining and quarring, industry, electricity, gas and water, construction sector, wholesale and retail business sector, and hotel and restaurant sectors. These sectors have faced negative growth rate for the first time since last seven years. According to the statistics of CBS, these sectors have continuously logged increasing annual growth rates in the last seven years. Besides having fluctuating growth rate between FY 2009/10 to 2014/15, the sectors have not logged negative growth…

May 4: Nepal General Marketing (NGM), the authorized distributor of Hero two-wheelers in Nepal, has conducted Hero Mileage Test program at Dhangadi on Tuesday. The program was organised jointly by NGM and Bishesh Automobiles, the authorised distributor of Hero two-wheelers for Dhangadi. “With the slogan ‘Every Drop of Fuel is Useful’, the program was held to inform people about the condition of mileage and the ways to attain high mileage levels for their two-wheelers ,” said Pushkar Sharma, General Manager of Bishesh…

May 4: The establishment of industries in Bhairahawa Special Economic Zone (SEZ) will start from mid-July. After the essential amendment of the work procedure of Special Economic Zone Development Committee by the Cabinet, inviting the investors for the establishment of industries, the necessary procedure was moved forward for the operation of Bhairahawa…

May 4: Global IME Bank has collaborated with the Saudi Arabian National Commercial Bank’s (NCB) quickpay service in order to facilitate remittance service from Saudi Arabia. “Nepalese migrant workers can now send money through 150 quickpay service locations from Saudi Arabia,” the bank said in a press statement. According to the bank, recipients can instantly receive payment from all Global IME branches, any IMEs and remit…

May 4: The merger proposal of Vibor Bikas Bank and Society Development Bank has been approved. The special general meeting held on Tuesday also endorsed the proposals of renaming the merged entity as Vibor Society Development Bank and valuation of the shares of both banks in the proportion of 1:1. The paid-up capital of the bank after merger will exceed to Rs 1.80 billion. The Bank has planned to merge with another organisation for insufficient paid up…

May 4: Mega Bank has appointed Global IME Capital as issue manager for issuance of 25 percent right shares endorsed by its 5th annual general meeting. Anupama Khunjeli, Chief Operating Officer of Mega Bank and Nalina Shrestha, Chief Merchant Banking Officer of Global IME Capital signed the agreement amid a program organised on…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '3478', 'article_category_id' => '1', 'title' => 'Swap Ratio of BOK and Lumbini Bank Decided', 'sub_title' => '', 'summary' => 'May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural meeting.', 'content' => '<p style="text-align: justify;"><span style="font-size:13pt">May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural meeting. </span></p> <p style="text-align: justify;"><span style="font-size:13pt">The share swap ratio of BOK and Lumbini Bank has been fixed at 100:82. The banks have fixed swap ratio after six months of merger agreement.</span></p> <p style="text-align: justify;"><span style="font-size:13pt">After the merger, the bank will have 69 branches and 62 ATMs. At present, BOK has 51 branches and 57 ATMs while Lumbini Bank has 18 branches and 5 ATMs. </span></p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3314', 'image' => '20160506012113_bok&LUMBINI.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '3477', 'article_category_id' => '1', 'title' => 'NMB Invests in Hotel Marriott', 'sub_title' => '', 'summary' => 'May 6: NMB Bank has invested in Hotel Marriott, a five star deluxe hotel, under construction at Nagpokhari. Prabhu Bank and Nepal Bangladesh Bank have already invested in the venture. According to NMB Bank, out of Rs 4 billion of the total investment, the banks will invest Rs 3.20 billion.', 'content' => '<p>May 6: NMB Bank has invested in Hotel Marriott, a five star deluxe hotel, under construction at Nagpokhari. Prabhu Bank and Nepal Bangladesh Bank have already invested in the venture. According to NMB Bank, out of Rs 4 billion of the total investment, the banks will invest Rs 3.20 billion.</p> <p>Hotel Marriott will have 230 rooms along with facilities of swimming pool, casino, mini gulf, conference hall, banquet hall, health club and spa. The hotel that is also a chain of Marriott International, a leading hotel chain based in Maryland, USA, is expected to come into operation in 2018.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3313', 'image' => '20160506123853_hotel.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '3476', 'article_category_id' => '1', 'title' => 'Remit Agreement between Kumari and YES Remit', 'sub_title' => '', 'summary' => 'May 6: Kumari Bank and YES Remit have signed remittance agreement on May 5. Rajiv Giri, Acting Chief Executive Officer of Kumari Bank and Munal Jung Karki, Chief Executive Officer of YES Remit signed the agreement on behalf of their respective companies. After the agreement, money send through Yes Remit from all around the world can be received from all the branches of Kumari Bank and its remit agents.', 'content' => '<p style="text-align:justify">May 6: Kumari Bank and YES Remit have signed remittance agreement on May 5. Rajiv Giri, Acting Chief Executive Officer of Kumari Bank and Munal Jung Karki, Chief Executive Officer of YES Remit signed the agreement on behalf of their respective companies. After the agreement, money send through Yes Remit from all around the world can be received from all the branches of Kumari Bank and its remit agents.</p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3312', 'image' => '20160506114146_yes.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '3475', 'article_category_id' => '1', 'title' => 'Sunrise Bank Starts Branchless Banking in Mahottari', 'sub_title' => '', 'summary' => 'May 6: Sunrise Bank has started operation of branchless banking services in Laxminiya-7, Mahottari. Mukunda Raj Mahato, Chief of Kanti Bazar National Campus, Rajendra Singh Kushwaha, Local Social Worker and Aasha Rana, Deputy General Manager of the bank inaugurated the banking service amid a program on Thursday. The bank informs that the service aims of providing banking services to local public. Local public can get facilities of saving and payment through the branchless banking services.', 'content' => '<p>May 6: Sunrise Bank has started operation of branchless banking services in Laxminiya-7, Mahottari. Mukunda Raj Mahato, Chief of Kanti Bazar National Campus, Rajendra Singh Kushwaha, Local Social Worker and Aasha Rana, Deputy General Manager of the bank inaugurated the banking service amid a program on Thursday. The bank informs that the service aims of providing banking services to local public. Local public can get facilities of saving and payment through the branchless banking services.</p> <p>At present, the bank is providing modern banking services through 53 branches and 67 ATMs. It is a third branchless banking service opening of the bank. Previously, Sunrise Bank has started branchless banking services in Mangaltal of Kavre and Bahundangi of Jhapa. </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-08', 'keywords' => '', 'description' => '', 'sortorder' => '3311', 'image' => '20160506112148_sunrise.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '3474', 'article_category_id' => '1', 'title' => 'NCM Merchant Issue Manager of CEDB Hydro Fund', 'sub_title' => '', 'summary' => 'May 6: CEDB hydro fund is issuing 1,761,000 units of general shares at Rs 100 per unit worth Rs 176.1 million. The fund has appointed NCM Merchant Banking as its Issue Manager. Binay Kumar Bhandari, CEO of CEDB and Bijay Lal Shrestha, Operational manager of NCM Merchant signed the agreement paper amid a program organised on Thursday.', 'content' => '<p style="text-align: justify;">May 6: CEDB hydro fund is issuing 1,761,000 units of general shares at Rs 100 per unit worth Rs 176.1 million. The fund has appointed NCM Merchant Banking as its Issue Manager.</p> <p style="text-align: justify;">Binay Kumar Bhandari, CEO of CEDB and Bijay Lal Shrestha, Operational manager of NCM Merchant signed the agreement paper amid a program organised on Thursday.</p> <p style="text-align: justify;">CEDB hydro fund has been founded in 2009 by Clean Energy Development Bank in order to promote and develop Hydro Power Projects in Nepal. Presently, Radhi Hydropower Project (4.4MW), Sange Hydropower Project (183KW) and Khudi Hydropower Project (4MW) are operating under the company. </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3310', 'image' => '20160506110440_ncm.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '3473', 'article_category_id' => '1', 'title' => 'Apex Short Film Festival 2016 begins', 'sub_title' => '', 'summary' => 'May 5: Red carpet launch of Apex Short Film Festival 2016 was held on May 2 at Apex College. The theme of the festival was ‘Freedom’.Out of 24 registered short films, selected 8 were screened in the premiere show. Top three movies were awarded after the screening. “Desire” bagged the first prize in the contest, “Two Souls” and “The Feels” were the first and second runners-up respectively. The winners were awarded with Samsung Galaxy smartphone, cash prize, trophy, and certificate. According to the press statement, around 1000 Apexians are expected to participate in the event sponsored by Samsung Galaxy, Silhoutte Media, and QFX Cinemas.', 'content' => '<p>May 5: Red carpet launch of Apex Short Film Festival 2016 was held on May 2 at Apex College. The theme of the festival was ‘Freedom’.Out of 24 registered short films, selected 8 were screened in the premiere show. Top three movies were awarded after the screening. “Desire” bagged the first prize in the contest, “Two Souls” and “The Feels” were the first and second runners-up respectively. The winners were awarded with Samsung Galaxy smartphone, cash prize, trophy, and certificate.</p> <p>According to the press statement, around 1000 Apexians are expected to participate in the event sponsored by Samsung Galaxy, Silhoutte Media, and QFX Cinemas.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3309', 'image' => null, 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '3472', 'article_category_id' => '1', 'title' => 'SEBON’s New Directive on Right Share and Auction Bidding Sale', 'sub_title' => '', 'summary' => 'May 5: Securities Board of Nepal (SEBON) has issued a new directive regarding announcement of right share issuance and auction bidding of shares. SEBON releasing a circular on Tuesday, has directed companies to broadcast right share issuance notice in seven various medias while for auction bidding sale of shares, the number of medias should be six. SEBON concluded that a day notice as per the current a', 'content' => '<p style="text-align: justify;">May 5: Securities Board of Nepal (SEBON) has issued a new directive regarding announcement of right share issuance and auction bidding of shares. SEBON releasing a circular on Tuesday, has directed companies to broadcast right share issuance notice in seven various medias while for auction bidding sale of shares, the number of medias should be six.</p> <p style="text-align: justify;">SEBON concluded that a day notice as per the current arrangement is not sufficient for flow of information during share issuance due to which shareholders miss out from applying for the shares. Therefore, SEBON has formulated new arrangement in order to make information system more effective for the benefits of shareholders. The board expects that the new arrangement will develop the share market, making it healthy, transparent and controlled. According to the new arrangement, while issuing the right shares, companies will have to publish notices in at least two national newspapers in the first week. Similarly, in the second week, share notification should be broadcasted in one national newspaper. Likewise, in the third and fourth week, at least two online newspapers and two FM stations should flow the information consecutively. </p> <p style="text-align: justify;">Similarly, in the case of auction bidding sale of shares, companies need to broadcast the information in at least two online newspapers, seven days prior to opening of sales. Likewise, five days prior to the sales, information should be broadcasted from two major FM stations and three days before the sales, information should be broadcasted from two major national economic newspapers. Additionally, companies need to provide softcopy of the notice to the board two days before the issuance of the notice. SEBON believes that the kind of information broadcasting will reach investors to a greater extent.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3308', 'image' => '20160505120425_sebn.JPG', 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '3471', 'article_category_id' => '1', 'title' => 'Remittance Agreement between Everest Bank and Xoom Corporation', 'sub_title' => '', 'summary' => 'May 5: Everest Bank has launched instant money transfer (remittance) in collaboration with Xoom Corporation, USA. In the press statement, the bank informs that the bank have partnered with Xoom to expand modern banking services from USA.', 'content' => '<p style="text-align: justify;">May 5: Everest Bank has launched instant money transfer (remittance) in collaboration with Xoom Corporation, USA. In the press statement, the bank informs that the bank have partnered with Xoom to expand modern banking services from USA.</p> <p style="text-align: justify;"> “Nepal receives a significant sum of remittances in proportion to the country’s Gross Domestic Product. The presence of Xoom will further contribute to the easy, secure and convenient transfer of remittances into the country,” said A. K Ahluwalia, Chief Executive Officer of Everest Bank in the press statement. It has been informed that customers can transfer up to $1,000 for a flat fee of $4.99 through Xoom corporation. Similarly, for transactions beyond $1,000, the fee will be waived when paying with a U.S. bank account.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;">Xoom, a PayPal service, is a leading digital money transfer provider that enables consumers to send money, pay bills and send prepaid mobile phone reloads for family and friends around the world in a secure, fast and cost-effective way, using their mobile phone, tablet or computer.</p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3307', 'image' => '20160505105915_Everest bank.jpg', 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '3470', 'article_category_id' => '1', 'title' => 'Economic Growth at 14-Year Low', 'sub_title' => '', 'summary' => 'May 4: The government has made an initial projection of the economic growth at 0.77 percent for the fiscal year 2015/16. The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate which has narrowly avoided entering into a negative territory in the current FY. As per the CBS, the growth projection is lowest in the last 14 years. The nation had witnessed economic growth of 0.16 percent during the FY 2001-02 due to the spiralling arm conflict along with Royal Massacre and unfavourable weather.', 'content' => '<p style="text-align:justify">May 4: The government has made an initial projection of the economic growth at 0.77 percent for the fiscal year 2015/16. The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate which has narrowly avoided entering into a negative territory in the current FY. As per the CBS, the growth projection is lowest in the last 14 years. The nation had witnessed economic growth of 0.16 percent during the FY 2001-02 due to the spiralling arm conflict along with Royal Massacre and unfavourable weather.</p> <p style="text-align:justify">The Bureau made the depressed growth projection due to the last year’s devastating earthquake, six months long Tarai unrest and decrease in production of rice, wheat and barley due to unfavourable weather. Earlier, the government had estimated economic growth of 6 percent in the budget presentation of the current FY. Meanwhile the Finance Ministry, in its White Paper forecasted the growth rate at 2 percent while the strikes in Terai and the Indian blockade were at full swing. CBS has presented the projection based on various indicators including consumption, savings and investments.</p> <p style="text-align:justify">The bureau has estimated 32.28 percent contribution from primary sector that includes agriculture and forest, fishery and mining and quarrying to the country’s Gross Domestic Product (GDP). Although the contribution of agriculture and forestry is estimated to be 31.19 percent, CBS has estimated its annual growth rate at 1.14 percent. Similarly, the fishery sector is expected to grow by 11.76 percent annually while its contribution to GDP has been logged at o.5 percent. Meanwhile, CBD has estimated increase in annual growth rates of transportation, communication and storage, financial intermediation, real estate and commercial services along with education and health sector.</p> <p style="text-align:justify">Similarly, the annual growth rate of mining and quarrying and industries in GDP is forecasted to decrease by 6.54 percent and 9.86 percent respectively. Likewise, the annual growth of electricity, cooking gas and water, construction sector, wholesale and retail, hotel and restaurants has decreased as well. Meanwhile, the contribution of secondary sectors such as construction, industries and electricity, cooking gas and water has been projected to be 13.43 percent. At the same time, the bureau has estimated 59.29 percent contribution of the third sector comprising service and retail business, hotel and restaurant, transportation, communication and storage and commercial services.</p> <p style="text-align:justify">Similarly, the bureau informed that the revised the economic growth for FY 2014/15 at 2.32 percent.</p> <p style="text-align:justify"><strong>Per Capita Income of Nepali Rs 80,900</strong></p> <p style="text-align:justify">The per capita income of Nepali has increased to Rs 80,921 from last year’s 77,079. The per capita income has increased by Rs 3,842 in current FY in compare to last FY. In US Dollar terms, per capita income has declined by USD 9 to USD 766. Meanwhile, it has revised the per capita income AT 775 USD for the last FY.</p> <p style="text-align:justify"><strong>Size of GDP Rs 2.24 trillion</strong></p> <p style="text-align:justify">CBS has predicted the size of the country’s GDP at Rs 2.24 trillion in current FY. The bureau has revised the size at Rs 2.12 trillion during the last FY. “Nepali economy has been hit hard by the last year’s devastating earthquake followed by border blockade. Therefore, the size of the economy structure will not significantly change in the current FY,” says Suman Aryal Director General of CBS.</p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3306', 'image' => '20160504034922_annual growth.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '3469', 'article_category_id' => '1', 'title' => ' 6 Sectors to Face Negative Growth Rate in Last 7 Years', 'sub_title' => '', 'summary' => 'May 4: The Central Bureau of Statistics (CBS) has projected negative growth rate for six sectors in the current fiscal year 2015/16. The six sectors include mining and quarring, industry, electricity, gas and water, construction sector, wholesale and retail business sector, and hotel and restaurant sectors. These sectors have faced negative growth rate for the first time since last seven years. According to the statistics of CBS, these sectors have continuously logged increasing annual growth rates in the last seven years. Besides having fluctuating growth rate between FY 2009/10 to 2014/15, the sectors have not logged negative growth rate.', 'content' => '<p>May 4: The Central Bureau of Statistics (CBS) has projected negative growth rate for six sectors in the current fiscal year 2015/16. The six sectors include mining and quarring, industry, electricity, gas and water, construction sector, wholesale and retail business sector, and hotel and restaurant sectors. These sectors have faced negative growth rate for the first time since last seven years. According to the statistics of CBS, these sectors have continuously logged increasing annual growth rates in the last seven years. Besides having fluctuating growth rate between FY 2009/10 to 2014/15, the sectors have not logged negative growth rate.</p> <p>The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate</p> <p> Similarly, as per the National Account Estimate Report published on Tuesday the growth rate of other nine sectors are estimated to be positive. CBS has categories total of 15 sectors as economic activities sectors.</p> <p> According to CBS, the devastating earthquake of last year, political instability after declaration of constitution and Indian blockade has simultaneously lead to negative growth rate.</p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3305', 'image' => '20160504024759_DATA.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '3468', 'article_category_id' => '1', 'title' => 'Hero’s Mileage Test in Dhangadi', 'sub_title' => '', 'summary' => 'May 4: Nepal General Marketing (NGM), the authorized distributor of Hero two-wheelers in Nepal, has conducted Hero Mileage Test program at Dhangadi on Tuesday. The program was organised jointly by NGM and Bishesh Automobiles, the authorised distributor of Hero two-wheelers for Dhangadi. “With the slogan ‘Every Drop of Fuel is Useful’, the program was held to inform people about the condition of mileage and the ways to attain high mileage levels for their two-wheelers ,” said Pushkar Sharma, General Manager of Bishesh Automobiles.', 'content' => '<p style="text-align: justify;">May 4: Nepal General Marketing (NGM), the authorized distributor of Hero two-wheelers in Nepal, has conducted Hero Mileage Test program at Dhangadi on Tuesday. The program was organised jointly by NGM and Bishesh Automobiles, the authorised distributor of Hero two-wheelers for Dhangadi.</p> <p style="text-align: justify;">“With the slogan ‘Every Drop of Fuel is Useful’, the program was held to inform people about the condition of mileage and the ways to attain high mileage levels for their two-wheelers ,” said Pushkar Sharma, General Manager of Bishesh Automobiles.</p> <p style="text-align: justify;">Suruchi Jyoti, Vice Chairman of Nepal General Marketing and Sundara Rajan , Service Asia Head of Hero Motors were present in the event. Sixty hero motor customers participated in the test drive event.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3304', 'image' => '20160504015712_hero.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '3467', 'article_category_id' => '1', 'title' => 'Establishment of Industries at Bhairahawa SEZ from Mid-July', 'sub_title' => '', 'summary' => 'May 4: The establishment of industries in Bhairahawa Special Economic Zone (SEZ) will start from mid-July. After the essential amendment of the work procedure of Special Economic Zone Development Committee by the Cabinet, inviting the investors for the establishment of industries, the necessary procedure was moved forward for the operation of Bhairahawa Sez.', 'content' => '<p style="text-align: justify;">May 4: The establishment of industries in Bhairahawa Special Economic Zone (SEZ) will start from mid-July. After the essential amendment of the work procedure of Special Economic Zone Development Committee by the Cabinet, inviting the investors for the establishment of industries, the necessary procedure was moved forward for the operation of Bhairahawa Sez.</p> <p style="text-align: justify;">According to the Committee, the interested investors can submit their proposals with detail information of technical and financial capacity, experience of operating industry including others. “In the upcoming three months, the analysis of received proposals, preparation of list, providing license to establish industries including other works will be concluded,” informs Executive Director of the Committee, Chandi Prasad Bhatta.</p> <p style="text-align: justify;">Bhatta added, “Completing all process, the establishment of industries at Bhairahawa SEZ will get started from the mid-August.” According to the new system stated in work procedure, within a year of agreement, the industry should be established and should start the production.</p> <p style="text-align: justify;">Likewise the foreign investment will not be allowed on the industries producing food items and agro products, herbal products, leather goods, carpets and woolen goods, pashmina and silk, hand-made papers, handicrafts and ornaments, sportswear, jewelry and precious stone, plastic production, hosiery, assembled electronics and production of electrical parts, information technology and beverages. “We are planning to provide license to the foreign investors investing in other sectors besides above mentioned sectors,” Bhatta says, adding, “Investors from Taiwan, Korea and China are showing interest to invest in the industries in SEZ.”</p> <p style="text-align: justify;">Likewise, multinational company Coca-Cola has also expressed its willingness to come to SEZ. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3303', 'image' => '20160504015343_bhairaha sez.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '3466', 'article_category_id' => '1', 'title' => 'Remit Agreement between Global IME and NCB', 'sub_title' => '', 'summary' => 'May 4: Global IME Bank has collaborated with the Saudi Arabian National Commercial Bank’s (NCB) quickpay service in order to facilitate remittance service from Saudi Arabia. “Nepalese migrant workers can now send money through 150 quickpay service locations from Saudi Arabia,” the bank said in a press statement. According to the bank, recipients can instantly receive payment from all Global IME branches, any IMEs and remit agents.', 'content' => '<p style="text-align: justify;">May 4: Global IME Bank has collaborated with the Saudi Arabian National Commercial Bank’s (NCB) quickpay service in order to facilitate remittance service from Saudi Arabia. “Nepalese migrant workers can now send money through 150 quickpay service locations from Saudi Arabia,” the bank said in a press statement. According to the bank, recipients can instantly receive payment from all Global IME branches, any IMEs and remit agents.</p> <p style="text-align: justify;">Global IME Bank has already established remittance business in UAE, Qatar, Bahrain, Malaysia, India, UK and South Korea. This is the first time Global IME Bank has collaborated with National Commercial Bank to boost remittance service from Saudi to Nepal. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3302', 'image' => '20160504013904_glo.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '3465', 'article_category_id' => '1', 'title' => 'Proposal of Vibor-Society Merger Approved', 'sub_title' => '', 'summary' => 'May 4: The merger proposal of Vibor Bikas Bank and Society Development Bank has been approved. The special general meeting held on Tuesday also endorsed the proposals of renaming the merged entity as Vibor Society Development Bank and valuation of the shares of both banks in the proportion of 1:1. The paid-up capital of the bank after merger will exceed to Rs 1.80 billion. The Bank has planned to merge with another organisation for insufficient paid up capital.', 'content' => '<p style="text-align: justify;">May 4: The merger proposal of Vibor Bikas Bank and Society Development Bank has been approved. The special general meeting held on Tuesday also endorsed the proposals of renaming the merged entity as Vibor Society Development Bank and valuation of the shares of both banks in the proportion of 1:1. The paid-up capital of the bank after merger will exceed to Rs 1.80 billion. The Bank has planned to merge with another organisation for insufficient paid up capital.</p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3301', 'image' => '20160504013525_vibor.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '3464', 'article_category_id' => '1', 'title' => 'Mega Bank Appoints Global IME Capital as Issue Manager', 'sub_title' => '', 'summary' => 'May 4: Mega Bank has appointed Global IME Capital as issue manager for issuance of 25 percent right shares endorsed by its 5th annual general meeting. Anupama Khunjeli, Chief Operating Officer of Mega Bank and Nalina Shrestha, Chief Merchant Banking Officer of Global IME Capital signed the agreement amid a program organised on Monday.', 'content' => '<p style="text-align: justify;">May 4: Mega Bank has appointed Global IME Capital as issue manager for issuance of 25 percent right shares endorsed by its 5<sup>th</sup> annual general meeting. Anupama Khunjeli, Chief Operating Officer of Mega Bank and Nalina Shrestha, Chief Merchant Banking Officer of Global IME Capital signed the agreement amid a program organised on Monday.</p> <p style="text-align: justify;">After issuance of 25 percent right shares, the total paid-up capital of Mega bank will reach Rs 4.05 billion. The bank has collected Rs 29 billion deposit and flowed Rs 26 billion loans, as per the press statement. At present, the bank is serving its customer through 44 branches, 45 ATMs, 53 advanced branchless banking services, 1400 Mega Remit network and 1 extension counters. </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3300', 'image' => '20160504105339_global.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '3478', 'article_category_id' => '1', 'title' => 'Swap Ratio of BOK and Lumbini Bank Decided', 'sub_title' => '', 'summary' => 'May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural meeting.', 'content' => '<p style="text-align: justify;"><span style="font-size:13pt">May 6: The merger process between Bank of Kathmandu and Lumbini Bank is about to get concluded with the banks deciding swap ratio for merger after a long procedural meeting. </span></p> <p style="text-align: justify;"><span style="font-size:13pt">The share swap ratio of BOK and Lumbini Bank has been fixed at 100:82. The banks have fixed swap ratio after six months of merger agreement.</span></p> <p style="text-align: justify;"><span style="font-size:13pt">After the merger, the bank will have 69 branches and 62 ATMs. At present, BOK has 51 branches and 57 ATMs while Lumbini Bank has 18 branches and 5 ATMs. </span></p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3314', 'image' => '20160506012113_bok&LUMBINI.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '3477', 'article_category_id' => '1', 'title' => 'NMB Invests in Hotel Marriott', 'sub_title' => '', 'summary' => 'May 6: NMB Bank has invested in Hotel Marriott, a five star deluxe hotel, under construction at Nagpokhari. Prabhu Bank and Nepal Bangladesh Bank have already invested in the venture. According to NMB Bank, out of Rs 4 billion of the total investment, the banks will invest Rs 3.20 billion.', 'content' => '<p>May 6: NMB Bank has invested in Hotel Marriott, a five star deluxe hotel, under construction at Nagpokhari. Prabhu Bank and Nepal Bangladesh Bank have already invested in the venture. According to NMB Bank, out of Rs 4 billion of the total investment, the banks will invest Rs 3.20 billion.</p> <p>Hotel Marriott will have 230 rooms along with facilities of swimming pool, casino, mini gulf, conference hall, banquet hall, health club and spa. The hotel that is also a chain of Marriott International, a leading hotel chain based in Maryland, USA, is expected to come into operation in 2018.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3313', 'image' => '20160506123853_hotel.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '3476', 'article_category_id' => '1', 'title' => 'Remit Agreement between Kumari and YES Remit', 'sub_title' => '', 'summary' => 'May 6: Kumari Bank and YES Remit have signed remittance agreement on May 5. Rajiv Giri, Acting Chief Executive Officer of Kumari Bank and Munal Jung Karki, Chief Executive Officer of YES Remit signed the agreement on behalf of their respective companies. After the agreement, money send through Yes Remit from all around the world can be received from all the branches of Kumari Bank and its remit agents.', 'content' => '<p style="text-align:justify">May 6: Kumari Bank and YES Remit have signed remittance agreement on May 5. Rajiv Giri, Acting Chief Executive Officer of Kumari Bank and Munal Jung Karki, Chief Executive Officer of YES Remit signed the agreement on behalf of their respective companies. After the agreement, money send through Yes Remit from all around the world can be received from all the branches of Kumari Bank and its remit agents.</p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3312', 'image' => '20160506114146_yes.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '3475', 'article_category_id' => '1', 'title' => 'Sunrise Bank Starts Branchless Banking in Mahottari', 'sub_title' => '', 'summary' => 'May 6: Sunrise Bank has started operation of branchless banking services in Laxminiya-7, Mahottari. Mukunda Raj Mahato, Chief of Kanti Bazar National Campus, Rajendra Singh Kushwaha, Local Social Worker and Aasha Rana, Deputy General Manager of the bank inaugurated the banking service amid a program on Thursday. The bank informs that the service aims of providing banking services to local public. Local public can get facilities of saving and payment through the branchless banking services.', 'content' => '<p>May 6: Sunrise Bank has started operation of branchless banking services in Laxminiya-7, Mahottari. Mukunda Raj Mahato, Chief of Kanti Bazar National Campus, Rajendra Singh Kushwaha, Local Social Worker and Aasha Rana, Deputy General Manager of the bank inaugurated the banking service amid a program on Thursday. The bank informs that the service aims of providing banking services to local public. Local public can get facilities of saving and payment through the branchless banking services.</p> <p>At present, the bank is providing modern banking services through 53 branches and 67 ATMs. It is a third branchless banking service opening of the bank. Previously, Sunrise Bank has started branchless banking services in Mangaltal of Kavre and Bahundangi of Jhapa. </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-08', 'keywords' => '', 'description' => '', 'sortorder' => '3311', 'image' => '20160506112148_sunrise.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '3474', 'article_category_id' => '1', 'title' => 'NCM Merchant Issue Manager of CEDB Hydro Fund', 'sub_title' => '', 'summary' => 'May 6: CEDB hydro fund is issuing 1,761,000 units of general shares at Rs 100 per unit worth Rs 176.1 million. The fund has appointed NCM Merchant Banking as its Issue Manager. Binay Kumar Bhandari, CEO of CEDB and Bijay Lal Shrestha, Operational manager of NCM Merchant signed the agreement paper amid a program organised on Thursday.', 'content' => '<p style="text-align: justify;">May 6: CEDB hydro fund is issuing 1,761,000 units of general shares at Rs 100 per unit worth Rs 176.1 million. The fund has appointed NCM Merchant Banking as its Issue Manager.</p> <p style="text-align: justify;">Binay Kumar Bhandari, CEO of CEDB and Bijay Lal Shrestha, Operational manager of NCM Merchant signed the agreement paper amid a program organised on Thursday.</p> <p style="text-align: justify;">CEDB hydro fund has been founded in 2009 by Clean Energy Development Bank in order to promote and develop Hydro Power Projects in Nepal. Presently, Radhi Hydropower Project (4.4MW), Sange Hydropower Project (183KW) and Khudi Hydropower Project (4MW) are operating under the company. </p> ', 'published' => true, 'created' => '2016-05-06', 'modified' => '2016-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '3310', 'image' => '20160506110440_ncm.jpg', 'article_date' => '2016-05-06 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '3473', 'article_category_id' => '1', 'title' => 'Apex Short Film Festival 2016 begins', 'sub_title' => '', 'summary' => 'May 5: Red carpet launch of Apex Short Film Festival 2016 was held on May 2 at Apex College. The theme of the festival was ‘Freedom’.Out of 24 registered short films, selected 8 were screened in the premiere show. Top three movies were awarded after the screening. “Desire” bagged the first prize in the contest, “Two Souls” and “The Feels” were the first and second runners-up respectively. The winners were awarded with Samsung Galaxy smartphone, cash prize, trophy, and certificate. According to the press statement, around 1000 Apexians are expected to participate in the event sponsored by Samsung Galaxy, Silhoutte Media, and QFX Cinemas.', 'content' => '<p>May 5: Red carpet launch of Apex Short Film Festival 2016 was held on May 2 at Apex College. The theme of the festival was ‘Freedom’.Out of 24 registered short films, selected 8 were screened in the premiere show. Top three movies were awarded after the screening. “Desire” bagged the first prize in the contest, “Two Souls” and “The Feels” were the first and second runners-up respectively. The winners were awarded with Samsung Galaxy smartphone, cash prize, trophy, and certificate.</p> <p>According to the press statement, around 1000 Apexians are expected to participate in the event sponsored by Samsung Galaxy, Silhoutte Media, and QFX Cinemas.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3309', 'image' => null, 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '3472', 'article_category_id' => '1', 'title' => 'SEBON’s New Directive on Right Share and Auction Bidding Sale', 'sub_title' => '', 'summary' => 'May 5: Securities Board of Nepal (SEBON) has issued a new directive regarding announcement of right share issuance and auction bidding of shares. SEBON releasing a circular on Tuesday, has directed companies to broadcast right share issuance notice in seven various medias while for auction bidding sale of shares, the number of medias should be six. SEBON concluded that a day notice as per the current a', 'content' => '<p style="text-align: justify;">May 5: Securities Board of Nepal (SEBON) has issued a new directive regarding announcement of right share issuance and auction bidding of shares. SEBON releasing a circular on Tuesday, has directed companies to broadcast right share issuance notice in seven various medias while for auction bidding sale of shares, the number of medias should be six.</p> <p style="text-align: justify;">SEBON concluded that a day notice as per the current arrangement is not sufficient for flow of information during share issuance due to which shareholders miss out from applying for the shares. Therefore, SEBON has formulated new arrangement in order to make information system more effective for the benefits of shareholders. The board expects that the new arrangement will develop the share market, making it healthy, transparent and controlled. According to the new arrangement, while issuing the right shares, companies will have to publish notices in at least two national newspapers in the first week. Similarly, in the second week, share notification should be broadcasted in one national newspaper. Likewise, in the third and fourth week, at least two online newspapers and two FM stations should flow the information consecutively. </p> <p style="text-align: justify;">Similarly, in the case of auction bidding sale of shares, companies need to broadcast the information in at least two online newspapers, seven days prior to opening of sales. Likewise, five days prior to the sales, information should be broadcasted from two major FM stations and three days before the sales, information should be broadcasted from two major national economic newspapers. Additionally, companies need to provide softcopy of the notice to the board two days before the issuance of the notice. SEBON believes that the kind of information broadcasting will reach investors to a greater extent.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3308', 'image' => '20160505120425_sebn.JPG', 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '3471', 'article_category_id' => '1', 'title' => 'Remittance Agreement between Everest Bank and Xoom Corporation', 'sub_title' => '', 'summary' => 'May 5: Everest Bank has launched instant money transfer (remittance) in collaboration with Xoom Corporation, USA. In the press statement, the bank informs that the bank have partnered with Xoom to expand modern banking services from USA.', 'content' => '<p style="text-align: justify;">May 5: Everest Bank has launched instant money transfer (remittance) in collaboration with Xoom Corporation, USA. In the press statement, the bank informs that the bank have partnered with Xoom to expand modern banking services from USA.</p> <p style="text-align: justify;"> “Nepal receives a significant sum of remittances in proportion to the country’s Gross Domestic Product. The presence of Xoom will further contribute to the easy, secure and convenient transfer of remittances into the country,” said A. K Ahluwalia, Chief Executive Officer of Everest Bank in the press statement. It has been informed that customers can transfer up to $1,000 for a flat fee of $4.99 through Xoom corporation. Similarly, for transactions beyond $1,000, the fee will be waived when paying with a U.S. bank account.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;">Xoom, a PayPal service, is a leading digital money transfer provider that enables consumers to send money, pay bills and send prepaid mobile phone reloads for family and friends around the world in a secure, fast and cost-effective way, using their mobile phone, tablet or computer.</p> ', 'published' => true, 'created' => '2016-05-05', 'modified' => '2016-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '3307', 'image' => '20160505105915_Everest bank.jpg', 'article_date' => '2016-05-05 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '3470', 'article_category_id' => '1', 'title' => 'Economic Growth at 14-Year Low', 'sub_title' => '', 'summary' => 'May 4: The government has made an initial projection of the economic growth at 0.77 percent for the fiscal year 2015/16. The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate which has narrowly avoided entering into a negative territory in the current FY. As per the CBS, the growth projection is lowest in the last 14 years. The nation had witnessed economic growth of 0.16 percent during the FY 2001-02 due to the spiralling arm conflict along with Royal Massacre and unfavourable weather.', 'content' => '<p style="text-align:justify">May 4: The government has made an initial projection of the economic growth at 0.77 percent for the fiscal year 2015/16. The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate which has narrowly avoided entering into a negative territory in the current FY. As per the CBS, the growth projection is lowest in the last 14 years. The nation had witnessed economic growth of 0.16 percent during the FY 2001-02 due to the spiralling arm conflict along with Royal Massacre and unfavourable weather.</p> <p style="text-align:justify">The Bureau made the depressed growth projection due to the last year’s devastating earthquake, six months long Tarai unrest and decrease in production of rice, wheat and barley due to unfavourable weather. Earlier, the government had estimated economic growth of 6 percent in the budget presentation of the current FY. Meanwhile the Finance Ministry, in its White Paper forecasted the growth rate at 2 percent while the strikes in Terai and the Indian blockade were at full swing. CBS has presented the projection based on various indicators including consumption, savings and investments.</p> <p style="text-align:justify">The bureau has estimated 32.28 percent contribution from primary sector that includes agriculture and forest, fishery and mining and quarrying to the country’s Gross Domestic Product (GDP). Although the contribution of agriculture and forestry is estimated to be 31.19 percent, CBS has estimated its annual growth rate at 1.14 percent. Similarly, the fishery sector is expected to grow by 11.76 percent annually while its contribution to GDP has been logged at o.5 percent. Meanwhile, CBD has estimated increase in annual growth rates of transportation, communication and storage, financial intermediation, real estate and commercial services along with education and health sector.</p> <p style="text-align:justify">Similarly, the annual growth rate of mining and quarrying and industries in GDP is forecasted to decrease by 6.54 percent and 9.86 percent respectively. Likewise, the annual growth of electricity, cooking gas and water, construction sector, wholesale and retail, hotel and restaurants has decreased as well. Meanwhile, the contribution of secondary sectors such as construction, industries and electricity, cooking gas and water has been projected to be 13.43 percent. At the same time, the bureau has estimated 59.29 percent contribution of the third sector comprising service and retail business, hotel and restaurant, transportation, communication and storage and commercial services.</p> <p style="text-align:justify">Similarly, the bureau informed that the revised the economic growth for FY 2014/15 at 2.32 percent.</p> <p style="text-align:justify"><strong>Per Capita Income of Nepali Rs 80,900</strong></p> <p style="text-align:justify">The per capita income of Nepali has increased to Rs 80,921 from last year’s 77,079. The per capita income has increased by Rs 3,842 in current FY in compare to last FY. In US Dollar terms, per capita income has declined by USD 9 to USD 766. Meanwhile, it has revised the per capita income AT 775 USD for the last FY.</p> <p style="text-align:justify"><strong>Size of GDP Rs 2.24 trillion</strong></p> <p style="text-align:justify">CBS has predicted the size of the country’s GDP at Rs 2.24 trillion in current FY. The bureau has revised the size at Rs 2.12 trillion during the last FY. “Nepali economy has been hit hard by the last year’s devastating earthquake followed by border blockade. Therefore, the size of the economy structure will not significantly change in the current FY,” says Suman Aryal Director General of CBS.</p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3306', 'image' => '20160504034922_annual growth.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '3469', 'article_category_id' => '1', 'title' => ' 6 Sectors to Face Negative Growth Rate in Last 7 Years', 'sub_title' => '', 'summary' => 'May 4: The Central Bureau of Statistics (CBS) has projected negative growth rate for six sectors in the current fiscal year 2015/16. The six sectors include mining and quarring, industry, electricity, gas and water, construction sector, wholesale and retail business sector, and hotel and restaurant sectors. These sectors have faced negative growth rate for the first time since last seven years. According to the statistics of CBS, these sectors have continuously logged increasing annual growth rates in the last seven years. Besides having fluctuating growth rate between FY 2009/10 to 2014/15, the sectors have not logged negative growth rate.', 'content' => '<p>May 4: The Central Bureau of Statistics (CBS) has projected negative growth rate for six sectors in the current fiscal year 2015/16. The six sectors include mining and quarring, industry, electricity, gas and water, construction sector, wholesale and retail business sector, and hotel and restaurant sectors. These sectors have faced negative growth rate for the first time since last seven years. According to the statistics of CBS, these sectors have continuously logged increasing annual growth rates in the last seven years. Besides having fluctuating growth rate between FY 2009/10 to 2014/15, the sectors have not logged negative growth rate.</p> <p>The Central Bureau of Statistics (CBS) in its National Account Estimate Report published on Tuesday estimated the growth rate</p> <p> Similarly, as per the National Account Estimate Report published on Tuesday the growth rate of other nine sectors are estimated to be positive. CBS has categories total of 15 sectors as economic activities sectors.</p> <p> According to CBS, the devastating earthquake of last year, political instability after declaration of constitution and Indian blockade has simultaneously lead to negative growth rate.</p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3305', 'image' => '20160504024759_DATA.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '3468', 'article_category_id' => '1', 'title' => 'Hero’s Mileage Test in Dhangadi', 'sub_title' => '', 'summary' => 'May 4: Nepal General Marketing (NGM), the authorized distributor of Hero two-wheelers in Nepal, has conducted Hero Mileage Test program at Dhangadi on Tuesday. The program was organised jointly by NGM and Bishesh Automobiles, the authorised distributor of Hero two-wheelers for Dhangadi. “With the slogan ‘Every Drop of Fuel is Useful’, the program was held to inform people about the condition of mileage and the ways to attain high mileage levels for their two-wheelers ,” said Pushkar Sharma, General Manager of Bishesh Automobiles.', 'content' => '<p style="text-align: justify;">May 4: Nepal General Marketing (NGM), the authorized distributor of Hero two-wheelers in Nepal, has conducted Hero Mileage Test program at Dhangadi on Tuesday. The program was organised jointly by NGM and Bishesh Automobiles, the authorised distributor of Hero two-wheelers for Dhangadi.</p> <p style="text-align: justify;">“With the slogan ‘Every Drop of Fuel is Useful’, the program was held to inform people about the condition of mileage and the ways to attain high mileage levels for their two-wheelers ,” said Pushkar Sharma, General Manager of Bishesh Automobiles.</p> <p style="text-align: justify;">Suruchi Jyoti, Vice Chairman of Nepal General Marketing and Sundara Rajan , Service Asia Head of Hero Motors were present in the event. Sixty hero motor customers participated in the test drive event.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3304', 'image' => '20160504015712_hero.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '3467', 'article_category_id' => '1', 'title' => 'Establishment of Industries at Bhairahawa SEZ from Mid-July', 'sub_title' => '', 'summary' => 'May 4: The establishment of industries in Bhairahawa Special Economic Zone (SEZ) will start from mid-July. After the essential amendment of the work procedure of Special Economic Zone Development Committee by the Cabinet, inviting the investors for the establishment of industries, the necessary procedure was moved forward for the operation of Bhairahawa Sez.', 'content' => '<p style="text-align: justify;">May 4: The establishment of industries in Bhairahawa Special Economic Zone (SEZ) will start from mid-July. After the essential amendment of the work procedure of Special Economic Zone Development Committee by the Cabinet, inviting the investors for the establishment of industries, the necessary procedure was moved forward for the operation of Bhairahawa Sez.</p> <p style="text-align: justify;">According to the Committee, the interested investors can submit their proposals with detail information of technical and financial capacity, experience of operating industry including others. “In the upcoming three months, the analysis of received proposals, preparation of list, providing license to establish industries including other works will be concluded,” informs Executive Director of the Committee, Chandi Prasad Bhatta.</p> <p style="text-align: justify;">Bhatta added, “Completing all process, the establishment of industries at Bhairahawa SEZ will get started from the mid-August.” According to the new system stated in work procedure, within a year of agreement, the industry should be established and should start the production.</p> <p style="text-align: justify;">Likewise the foreign investment will not be allowed on the industries producing food items and agro products, herbal products, leather goods, carpets and woolen goods, pashmina and silk, hand-made papers, handicrafts and ornaments, sportswear, jewelry and precious stone, plastic production, hosiery, assembled electronics and production of electrical parts, information technology and beverages. “We are planning to provide license to the foreign investors investing in other sectors besides above mentioned sectors,” Bhatta says, adding, “Investors from Taiwan, Korea and China are showing interest to invest in the industries in SEZ.”</p> <p style="text-align: justify;">Likewise, multinational company Coca-Cola has also expressed its willingness to come to SEZ. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3303', 'image' => '20160504015343_bhairaha sez.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '3466', 'article_category_id' => '1', 'title' => 'Remit Agreement between Global IME and NCB', 'sub_title' => '', 'summary' => 'May 4: Global IME Bank has collaborated with the Saudi Arabian National Commercial Bank’s (NCB) quickpay service in order to facilitate remittance service from Saudi Arabia. “Nepalese migrant workers can now send money through 150 quickpay service locations from Saudi Arabia,” the bank said in a press statement. According to the bank, recipients can instantly receive payment from all Global IME branches, any IMEs and remit agents.', 'content' => '<p style="text-align: justify;">May 4: Global IME Bank has collaborated with the Saudi Arabian National Commercial Bank’s (NCB) quickpay service in order to facilitate remittance service from Saudi Arabia. “Nepalese migrant workers can now send money through 150 quickpay service locations from Saudi Arabia,” the bank said in a press statement. According to the bank, recipients can instantly receive payment from all Global IME branches, any IMEs and remit agents.</p> <p style="text-align: justify;">Global IME Bank has already established remittance business in UAE, Qatar, Bahrain, Malaysia, India, UK and South Korea. This is the first time Global IME Bank has collaborated with National Commercial Bank to boost remittance service from Saudi to Nepal. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3302', 'image' => '20160504013904_glo.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '3465', 'article_category_id' => '1', 'title' => 'Proposal of Vibor-Society Merger Approved', 'sub_title' => '', 'summary' => 'May 4: The merger proposal of Vibor Bikas Bank and Society Development Bank has been approved. The special general meeting held on Tuesday also endorsed the proposals of renaming the merged entity as Vibor Society Development Bank and valuation of the shares of both banks in the proportion of 1:1. The paid-up capital of the bank after merger will exceed to Rs 1.80 billion. The Bank has planned to merge with another organisation for insufficient paid up capital.', 'content' => '<p style="text-align: justify;">May 4: The merger proposal of Vibor Bikas Bank and Society Development Bank has been approved. The special general meeting held on Tuesday also endorsed the proposals of renaming the merged entity as Vibor Society Development Bank and valuation of the shares of both banks in the proportion of 1:1. The paid-up capital of the bank after merger will exceed to Rs 1.80 billion. The Bank has planned to merge with another organisation for insufficient paid up capital.</p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3301', 'image' => '20160504013525_vibor.JPG', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '3464', 'article_category_id' => '1', 'title' => 'Mega Bank Appoints Global IME Capital as Issue Manager', 'sub_title' => '', 'summary' => 'May 4: Mega Bank has appointed Global IME Capital as issue manager for issuance of 25 percent right shares endorsed by its 5th annual general meeting. Anupama Khunjeli, Chief Operating Officer of Mega Bank and Nalina Shrestha, Chief Merchant Banking Officer of Global IME Capital signed the agreement amid a program organised on Monday.', 'content' => '<p style="text-align: justify;">May 4: Mega Bank has appointed Global IME Capital as issue manager for issuance of 25 percent right shares endorsed by its 5<sup>th</sup> annual general meeting. Anupama Khunjeli, Chief Operating Officer of Mega Bank and Nalina Shrestha, Chief Merchant Banking Officer of Global IME Capital signed the agreement amid a program organised on Monday.</p> <p style="text-align: justify;">After issuance of 25 percent right shares, the total paid-up capital of Mega bank will reach Rs 4.05 billion. The bank has collected Rs 29 billion deposit and flowed Rs 26 billion loans, as per the press statement. At present, the bank is serving its customer through 44 branches, 45 ATMs, 53 advanced branchless banking services, 1400 Mega Remit network and 1 extension counters. </p> ', 'published' => true, 'created' => '2016-05-04', 'modified' => '2016-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '3300', 'image' => '20160504105339_global.jpg', 'article_date' => '2016-05-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117