May 15: Machhapuchchhre Bank has started its 72th ATM service in Hile, Dhankuta on May 13. “The bank aims to provide quick and reliable service to the customers of Hile through the ATM booth,” informs the bank in a press…

May 15: Machhapuchchhre Bank has started its 72th ATM service in Hile, Dhankuta on May 13. “The bank aims to provide quick and reliable service to the customers of Hile through the ATM booth,” informs the bank in a press…

VG Automobiles, the authorised distributor of Suzuki two- wheelers in Nepal have opened a showroom at Tikapur, Kailali. The company has partnered with Bhandari and Sons regarding the operation of the showroom. Suman Dhital, Head of Regional Administrative Office, Adhir Kumar Shrestha, General Manager VG Automobiles and Amit Bhandari, Proprietor of Bhandari and Sons were present during the inauguration of the outlet. According to the Bhandari, Suzuki motorcycles and scooters ranging from Rs 164,900 – 279,900 are available in the showroom.…

May 13: Prabhu Money Transfer and National Microfinance Bittiya Sanstha Limited have signed a remittance agreement. Rameshwor Sapkota, Deputy General Manager of Prabhu Money Transfer and Ram Bahadur Yadav, CEO of National Microfinance signed the agreement on behalf of their respective organisations amid a program held at the head office of the microfinance in Dhading Besi. The Sanstha which has received nationwide transaction permit has 24 branches in districts including Dhading, Bhaktapur, Parsa, Sindhupalchowk, Morang, Siraha, Kailali, Banke,…

May 13: Despite the adverse investment scenario, profit of commercial banks has increased by 36 percent due to the rise in spread rate (difference in deposit and loan interest rates). Among the total 29 banks in operation, 26 have published third quarter financial reports of the current fiscal year. Based on the reports, their profit has increased compared to same period of last FY. Profit of the banks which had totalled Rs 15.51 billion by mid-April of last FY jumped to Rs 21 billion in the same period of the current FY. The banks have increased spread rate by 0.01-1.11 percent by mid-April compared to last month of the FY…

May 13: Ford, a multinational motor company, has started exchange and test drive fair on Pokhara from May 12. The fair will end on May 14. According to Chabi Gautam, Sales Manager of Ford in Nepal, the fair has been organised keeping the customers’ benefits in mind. The fair was organised by Auto Venture, the authorised distributer of Ford in Pokhara. According to the company, customers bringing old cars during the fair will receive maximum price for their vehicles. The company is also offering special discount in exchange of…

May 13: AIDS Health Care Foundation (AHF) Nepal has organised the ‘fund the fund’ campaign. "The campaign helps in gaining the commitment of the donor agency countries to increase their contribution in global fund," informs Deepak Dhungel, Country Director of AHF Nepal. AHF and HIV Association along with various other joint venture organizations, through fund the fund campaign are requesting economically strong countries like Germany, China and Japan for collecting the 5th round global fund of Rs 13 billion. "Global fund is not able to meet its targeted fund since 2010 due to decreasing commitment of donor agencies," mentions Dhungel. AHF has submitted memorandum to the respective embassies on May 12, 2016 regarding the…

May 13: The European Union and Transparency International Nepal in Kathmandu launched a support program to foster integrity in the post-earthquake reconstruction and rehabilitation process on May 12. Head of the Delegation of the European Union to Nepal, Ambassador Rensje Teerink and President of Transparency International (TI) Nepal, Bharat Bahadur Thapa signed the project documents on behalf of their organizations. “The 1 million Euros project, which is a part of a broader package of 105 million euro, will run for a period of 5 years to complement the rebuilding campaign with various accountability and transparency activities,” informs the joint press statement of two…

May 13: Janata Bank has signed Interbank Payment System (NCHL-IPS) with Nepal Clearing House Limited (NCHL). As per the agreement, NCHL will provide NCHL-IPS service for electronic payment system to Janata Bank. Neelesh Man Singh Pradhan, CEO of NCHL and Kumar LAmsal, CEO of Janata bank signed the agreement to this effect on May…

May 12: United Traders Syndicate, the authorised distributor of Toyota in Nepal has opened a separate outlet, Galaxy Automobiles for its Toyota Certified Used Car Division. The Lalitpur-based outlet located at Bakhundol, will allow the customers to sell any brand of cars and also to exchange new models of Toyota…

May 12: A modern shopping complex has opened in Gongabu of Kathmandu. BG Mall located at New Bus Park area has started its operation officially from May 11. Former finance minister Dr Ramsharan Mahat and Pashupati Murarka, President of Federation of Nepalese Commerce and Industry (FNCCI) jointly inaugurated the shopping mall amid a function on Wednesday. Speaking at the program, Mahat urged the government to remove policy hurdles in order to foster entrepreneurship in the…

May 12: Sujal food has launched ‘Crave Candy’ in new packaging in the market. “The candy has been launched in round shape with new packaging in the market,” informs the company. The company stated that company has drawn new wrapper in a bid to attract children with its impressive new design. The company has planned of starting advertisement campaign across the country with a new theme “Kwappai Khau Swad Ma…

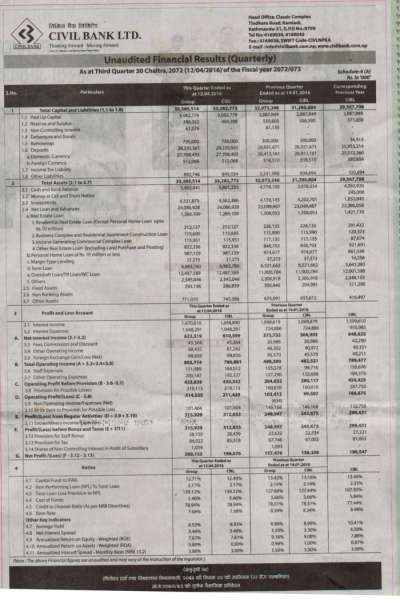

May 12: Net Profit of Civil Bank has increased by 4 percent to Rs 199 million in the third quarter of current fiscal year. The bank’s operating profit has increased by 26.85 percent in the period. The bank has been able to recover Rs 100.1 million bad debt of the last year. Similarly, the bank has earned Rs 69.6 million from foreign currency…

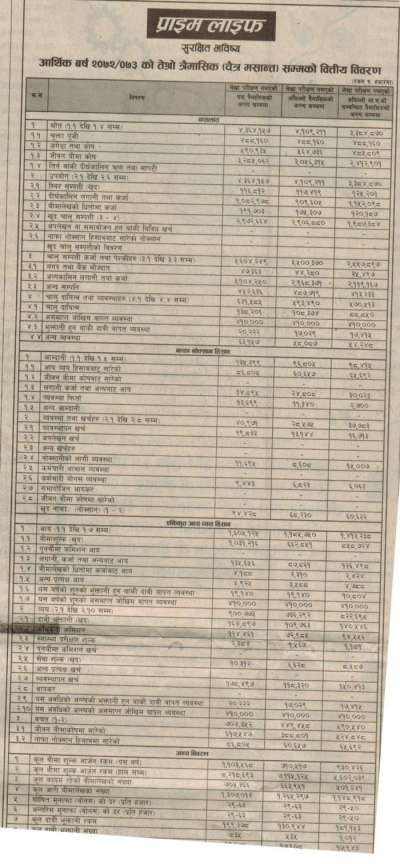

May 12: Net profit of Prime Commercial Bank has increased by 28 percent to Rs 709.5 million. Increase in net interest income by 17.41 percent, operating profit by 23.37 percent and foreign currency exchange by 49.69 percent has attributed in increase in net profit of the…

May 12: Net profit of Lumbini Bank has increased by 12 percent to Rs 277.9 million in the third quarter of current fiscal year. Similarly, net interest income has increased by 10.33 percent and during the period, bank has been able to recover Rs 92.8 million bad debt of last…

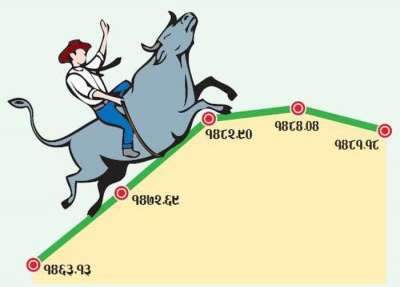

May 12: Nepali share market has witnessed the highest annual transaction of all time. In only ten months period of the current FY, Nepali share market has seen the highest transaction amount in compare to previous annual transactions. “The total transaction amount till May 10 is Rs 995 million which is itself a history in annual transaction,” says a NEPSE source. The transaction amount of Rs 1.1 billion in a single day on May 11 has attributed in crossing the annual transaction amount of Rs 100 billion in 10 months…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '3542', 'article_category_id' => '1', 'title' => 'ATM of Machhapuchchhre in Hile', 'sub_title' => '', 'summary' => 'May 15: Machhapuchchhre Bank has started its 72th ATM service in Hile, Dhankuta on May 13. “The bank aims to provide quick and reliable service to the customers of Hile through the ATM booth,” informs the bank in a press statement.', 'content' => '<p style="text-align: justify;">May 15: Machhapuchchhre Bank Limited has opened its 72th ATM counter in Hile, Dhankuta on May 13. “The bank will provide the quick and reliable service to the customers of Hile through this ATM booth,” informs the bank in a press statement.</p> <p style="text-align: justify;">The bank with the paid -up capital of Rs 3.33 billion has Rs 48.43 billion in deposits and Rs 40.81 billion in loans by the end of mid-April of the current fiscal year. During the period, the bank has logged operating profit of Rs 624.2 million.</p> <p style="text-align: justify;">Machhapuchchhre Bank, which began its service from Pokhara in the year 2000, has 56 branches, one extension counter and 72 ATMs. ”Customers should not pay any extra charge while using the Visa cards issued by the bank through its ATMs,” informs the statement.</p> ', 'published' => true, 'created' => '2016-05-15', 'modified' => '2016-05-15', 'keywords' => '', 'description' => '', 'sortorder' => '3376', 'image' => '20160515113830_atm.jpg', 'article_date' => '2016-05-15 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '3541', 'article_category_id' => '1', 'title' => 'Suzuki Showroom at Kailali', 'sub_title' => '', 'summary' => 'VG Automobiles, the authorised distributor of Suzuki two- wheelers in Nepal have opened a showroom at Tikapur, Kailali. The company has partnered with Bhandari and Sons regarding the operation of the showroom. Suman Dhital, Head of Regional Administrative Office, Adhir Kumar Shrestha, General Manager VG Automobiles and Amit Bhandari, Proprietor of Bhandari and Sons were present during the inauguration of the outlet. According to the Bhandari, Suzuki motorcycles and scooters ranging from Rs 164,900 – 279,900 are available in the showroom. ', 'content' => '<p style="text-align: justify;">May 13: VG Automobiles, the authorised distributor of Suzuki two- wheelers in Nepal have opened a showroom at Tikapur, Kailali. The company has partnered with Bhandari and Sons regarding the operation of the showroom.</p> <p style="text-align: justify;">Suman Dhital, Head of Regional Administrative Office, Adhir Kumar Shrestha, General Manager VG Automobiles and Amit Bhandari, Proprietor of Bhandari and Sons were present during the inauguration of the outlet.</p> <p style="text-align: justify;">According to the Bhandari, Suzuki motorcycles and scooters ranging from Rs 164,900 – 279,900 are available in the showroom. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3375', 'image' => '20160513052339_suzuki.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '3540', 'article_category_id' => '1', 'title' => 'Remit Agreement between Prabhu Bank and National Microfinance', 'sub_title' => '', 'summary' => 'May 13: Prabhu Money Transfer and National Microfinance Bittiya Sanstha Limited have signed a remittance agreement. Rameshwor Sapkota, Deputy General Manager of Prabhu Money Transfer and Ram Bahadur Yadav, CEO of National Microfinance signed the agreement on behalf of their respective organisations amid a program held at the head office of the microfinance in Dhading Besi. The Sanstha which has received nationwide transaction permit has 24 branches in districts including Dhading, Bhaktapur, Parsa, Sindhupalchowk, Morang, Siraha, Kailali, Banke, Palpa.', 'content' => '<p>May 13: Prabhu Money Transfer and National Microfinance Bittiya Sanstha Limited have signed a remittance agreement. Rameshwor Sapkota, Deputy General Manager of Prabhu Money Transfer and Ram Bahadur Yadav, CEO of National Microfinance signed the agreement on behalf of their respective organisations amid a program held at the head office of the microfinance in Dhading Besi. The Sanstha which has received nationwide transaction permit has 24 branches in districts including Dhading, Bhaktapur, Parsa, Sindhupalchowk, Morang, Siraha, Kailali, Banke, Palpa.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3374', 'image' => '20160513050120_prabhu.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '3539', 'article_category_id' => '1', 'title' => 'Spread Rate Helps Banks Profit Jump', 'sub_title' => '', 'summary' => 'May 13: Despite the adverse investment scenario, profit of commercial banks has increased by 36 percent due to the rise in spread rate (difference in deposit and loan interest rates). Among the total 29 banks in operation, 26 have published third quarter financial reports of the current fiscal year. Based on the reports, their profit has increased compared to same period of last FY. Profit of the banks which had totalled Rs 15.51 billion by mid-April of last FY jumped to Rs 21 billion in the same period of the current FY. The banks have increased spread rate by 0.01-1.11 percent by mid-April compared to last month of the FY 2071/72.', 'content' => '<p style="text-align:justify">May 13: Despite the adverse investment scenario, profit of commercial banks has increased by 36 percent due to the rise in spread rate (difference in deposit and loan interest rates). Among the total 29 banks in operation, 26 have published third quarter financial reports of the current fiscal year. Based on the reports, their profit has increased compared to same period of last FY. Profit of the banks which had totalled Rs 15.51 billion by mid-April of last FY jumped to Rs 21 billion in the same period of the current FY. The banks have increased spread rate by 0.01-1.11 percent by mid-April compared to last month of the FY 2071/72.</p> <p style="text-align:justify">Among the banks, NMB Bank logged the highest profit earning. The bank’s profit grew by 93 percent in mid-April of current FY compared to the same period last of FY. It is due to the profits accumulated by other banks that have merged with NMB.</p> <p style="text-align:justify">“This indicates that banks did not made significant reduction in loan interest rates compared to deposit interest rates during the period of high liquidity,” says Bhuwan Dhahal, CEO of Sanima Bank. The banks had set 2-4 percent interest rates on fixed deposit accounts due to lower investments caused by the devastating earthquake of last year followed by the border blockade. However, there was little reduction in interest rates of various loan categories except the short-term loans. During the period, the banks were charging 11-17 percent interest rate on various loan categories. Other than Prabhu, Standard Chartered, Lumbini, Nepal SBI and Agricultural Development Bank, spread rate of other banks are within the limit set by Nepal Rastra Bank. As per the NRB directive, such rates should not exceed 5 percent.</p> <p style="text-align:justify">Increase in spread rate has also attributed to the rise in the banks net interest income. The net interest income of the banks has increased by 17 percent to Rs 29.15 billion by mid-April of current FY compared to same period of last FY. During the period, deposit collection of the banks has increased by six percent while loans saw increment of only four percent.</p> <p style="text-align:justify"><img alt="" src="/userfiles/images/table%283%29.jpg" style="height:1007px; width:700px" /></p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3373', 'image' => null, 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '3538', 'article_category_id' => '1', 'title' => 'Ford Exchange and Test Drive Fair', 'sub_title' => '', 'summary' => ' May 13: Ford, a multinational motor company, has started exchange and test drive fair on Pokhara from May 12. The fair will end on May 14. According to Chabi Gautam, Sales Manager of Ford in Nepal, the fair has been organised keeping the customers’ benefits in mind. The fair was organised by Auto Venture, the authorised distributer of Ford in Pokhara. According to the company, customers bringing old cars during the fair will receive maximum price for their vehicles. The company is also offering special discount in exchange of cars.', 'content' => '<p style="text-align: justify;">May 13: Ford, a multinational motor company, has started exchange and test drive fair on Pokhara from May 12. The fair will end on May 14. According to Chabi Gautam, Sales Manager of Ford in Nepal, the fair has been organised keeping the customers’ benefits in mind.</p> <p style="text-align: justify;">The fair was organised by Auto Venture, the authorised distributer of Ford in Pokhara. According to the company, customers bringing old cars during the fair will receive maximum price for their vehicles. The company is also offering special discount in exchange of cars.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3372', 'image' => '20160513012146_test drive.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '3537', 'article_category_id' => '1', 'title' => 'AHF conducts 'Fund the Fund' Campaign', 'sub_title' => '', 'summary' => 'May 13: AIDS Health Care Foundation (AHF) Nepal has organised the ‘fund the fund’ campaign. "The campaign helps in gaining the commitment of the donor agency countries to increase their contribution in global fund," informs Deepak Dhungel, Country Director of AHF Nepal. AHF and HIV Association along with various other joint venture organizations, through fund the fund campaign are requesting economically strong countries like Germany, China and Japan for collecting the 5th round global fund of Rs 13 billion. "Global fund is not able to meet its targeted fund since 2010 due to decreasing commitment of donor agencies," mentions Dhungel. AHF has submitted memorandum to the respective embassies on May 12, 2016 regarding the issue.', 'content' => '<p>May 13: AIDS Health Care Foundation (AHF) Nepal has organised the ‘fund the fund’ campaign. "The campaign helps in gaining the commitment of the donor agency countries to increase their contribution in global fund," informs Deepak Dhungel, Country Director of AHF Nepal. AHF and HIV Association along with various other joint venture organizations, through fund the fund campaign are requesting economically strong countries like Germany, China and Japan for collecting the 5th round global fund of Rs 13 billion. "Global fund is not able to meet its targeted fund since 2010 due to decreasing commitment of donor agencies," mentions Dhungel. AHF has submitted memorandum to the respective embassies on May 12, 2016 regarding the issue.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3371', 'image' => '20160513011454_ahf.JPG', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '3536', 'article_category_id' => '1', 'title' => 'EU and TI Nepal Join Hands to Promote Integrity in Reconstruction', 'sub_title' => '', 'summary' => 'May 13: The European Union and Transparency International Nepal in Kathmandu launched a support program to foster integrity in the post-earthquake reconstruction and rehabilitation process on May 12. Head of the Delegation of the European Union to Nepal, Ambassador Rensje Teerink and President of Transparency International (TI) Nepal, Bharat Bahadur Thapa signed the project documents on behalf of their organizations. “The 1 million Euros project, which is a part of a broader package of 105 million euro, will run for a period of 5 years to complement the rebuilding campaign with various accountability and transparency activities,” informs the joint press statement of two organizations.', 'content' => '<p>May 13: The European Union and Transparency International Nepal launched a support program to foster integrity in the post-earthquake reconstruction and rehabilitation process on May 12.</p> <p>Head of the Delegation of the European Union to Nepal, Ambassador Rensje Teerink and President of Transparency International (TI) Nepal, Bharat Bahadur Thapa signed the project documents on behalf of their organizations. “The Euro 1 million project, which is a part of a broader package of Euro 105 million, will run for a period of five years to complement the rebuilding campaign with various accountability and transparency activities,” informs a joint press statement of two organizations.</p> <p>Both parties reiterated the importance of promoting integrity in the context of post-Earthquake reconstruction. Ambassador Teerink stated, "Building Back Better Nepal is an opportunity to foster accountability and social cohesion in the country. We need to reach out in particular to the most vulnerable. With this action, launched today on the first anniversary of the second big quake, we underline the pivotal importance of the Civil Society in the process."</p> <p>Meanwhile, TI Nepal President Thapa expressed that disaster situations often exacerbate corruption; hence a more vigilant approach from civil society is crucial.</p> <p>The project is shrduled to work on three key levels in the earthquake reconstruction process: policy level, implementation level and post implementation level. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3370', 'image' => '20160513115846_eu.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '3535', 'article_category_id' => '1', 'title' => 'Janata Bank Joins NCHL-IPS System', 'sub_title' => '', 'summary' => 'May 13: Janata Bank has signed Interbank Payment System (NCHL-IPS) with Nepal Clearing House Limited (NCHL). As per the agreement, NCHL will provide NCHL-IPS service for electronic payment system to Janata Bank. Neelesh Man Singh Pradhan, CEO of NCHL and Kumar LAmsal, CEO of Janata bank signed the agreement to this effect on May 12.', 'content' => '<p>May 13: Janata Bank has signed Interbank Payment System (NCHL-IPS) with Nepal Clearing House Limited (NCHL). As per the agreement, NCHL will provide NCHL-IPS service for electronic payment system to the bank. Neelesh Man Singh Pradhan, CEO of NCHL and Kumar LAmsal, CEO of Janata Bank signed the agreement to this effect on May 12.</p> <p>Customers can withdraw and make payments from any account of the banks and financial institutions under the NCHL-IPS system. “Under this service customers can make payments of cash, dividends, IPO refund, bills, insurance premium, social welfare allowance, pension/salary, remittance and all other types of payments,” informs the service provider in a press statement. NCHL has aimed to include financial institutions in this service as large bulk of transactions can be done easily with transparency while also reducing the associated risks. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3369', 'image' => '20160513113101_jananta.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '3534', 'article_category_id' => '1', 'title' => ' New Outlet of Toyota Used Cars ', 'sub_title' => '', 'summary' => 'May 12: United Traders Syndicate, the authorised distributor of Toyota in Nepal has opened a separate outlet, Galaxy Automobiles for its Toyota Certified Used Car Division. The Lalitpur-based outlet located at Bakhundol, will allow the customers to sell any brand of cars and also to exchange new models of Toyota cars.', 'content' => '<p style="text-align: justify;">May 12: United Traders Syndicate, the authorised distributor of Toyota in Nepal has opened a separate outlet, Galaxy Automobiles for its Toyota Certified Used Car Division. The Lalitpur-based outlet located at Bakhundol, will allow the customers to sell any brand of cars and also to exchange new models of Toyota cars.</p> <p style="text-align: justify;">Suraj Vaidya, President of Vaidya Organisation of Industries and Trading Houses inaugurated the outlet on May 9. The international standard outlet will certify cars by examining their condition, capacity and life span. The company claimed that the evaluation of vehicles will be correct as the staffs doing the evaluation are trained as per international standards. According to the company, an Exchange Fair will be organised on May 10-15 at the outlet.</p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3368', 'image' => '20160512044725_toyota.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '3533', 'article_category_id' => '1', 'title' => 'BG Mall Opens in Gongabu', 'sub_title' => '', 'summary' => 'May 12: A modern shopping complex has opened in Gongabu of Kathmandu. BG Mall located at New Bus Park area has started its operation officially from May 11. Former finance minister Dr Ramsharan Mahat and Pashupati Murarka, President of Federation of Nepalese Commerce and Industry (FNCCI) jointly inaugurated the shopping mall amid a function on Wednesday. Speaking at the program, Mahat urged the government to remove policy hurdles in order to foster entrepreneurship in the country.', 'content' => '<p>May 12<strong>: </strong>A modern shopping complex has opened in Gongabu of Kathmandu. BG Mall located at New Bus Park area has started its operation officially from May 11. Former finance minister Dr Ramsharan Mahat and Pashupati Murarka, President of Federation of Nepalese Commerce and Industry (FNCCI) jointly inaugurated the shopping mall amid a function on Wednesday. Speaking at the program, Mahat urged the government to remove policy hurdles in order to foster entrepreneurship in the country.</p> <p>Similarly, Murarka stated that the opening of one shopping mall can support factories and industries along with the generation of employment. Chudamani Sharma, Director General of Internal Revenue Department hailed the opening of the Mall as the country can prosper economically with the establishment of shopping complexes.</p> <p>On the occasion, Raju Giri, Director of the complex informed that the Mall has almost all essential items including an entertainment zone. The Mall has 60 shops and showrooms of household goods, electrical items, mobile phones, apparels and cosmetics and beauty products. Similarly, the shopping mall also has restaurants, a movie theater, banks and ATM counters.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3367', 'image' => '20160512043925_bg.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '3532', 'article_category_id' => '1', 'title' => 'Sujal Re-launches Crave Candy', 'sub_title' => '', 'summary' => 'May 12: Sujal food has launched ‘Crave Candy’ in new packaging in the market. “The candy has been launched in round shape with new packaging in the market,” informs the company. The company stated that company has drawn new wrapper in a bid to attract children with its impressive new design. The company has planned of starting advertisement campaign across the country with a new theme “Kwappai Khau Swad Ma Ramau.”', 'content' => '<p>May 12: Sujal Food has re-launched the Crave Candy in the domestic market wrapped in new packaging. Issuing a press statement, the company informed that Crave candy has been re-launched in the market with an attractive round shape wrapped in new packaging. According to the company, the new wrapper comes with dreams of the world that attracts the children. The company’s plans to start an advertisement campaign across the country with a new theme for the re-launched product. The company has decided a slogan ‘Kuppa Khaum Swaad Ma Ramau’ for the purpose.</p> <p>As per the company, Crave Candy is available in butter scotch and coffee flavors and is priced Rs 1. Sujal foods, the sister organisation of Laxmi Group, has been producing quality confectionery since 1974. </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3366', 'image' => '20160512041922_candy.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '3531', 'article_category_id' => '1', 'title' => 'Net Profit of Civil Bank Increases 4%', 'sub_title' => '', 'summary' => 'May 12: Net Profit of Civil Bank has increased by 4 percent to Rs 199 million in the third quarter of current fiscal year. The bank’s operating profit has increased by 26.85 percent in the period. The bank has been able to recover Rs 100.1 million bad debt of the last year. Similarly, the bank has earned Rs 69.6 million from foreign currency exchange.', 'content' => '<p style="text-align:justify">May 12: Net Profit of Civil Bank has increased by 4 percent to Rs 199 million in the third quarter of current fiscal year. The bank’s operating profit has increased by 26.85 percent in the period. The bank has been able to recover Rs 100.1 million bad debt of the last year. Similarly, the bank has earned Rs 69.6 million from foreign currency exchange.</p> <p style="text-align:justify">Likewise, investment of the bank has increased by 3.80 percent to Rs 4.36 billion in the third quarter and reserve fund of the bank has also increased by 9 percent to Rs 404.3 million. The bank has allocated Rs 219.1 million in its provision for possible losses.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3365', 'image' => '20160512040143_CIVIL.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '3530', 'article_category_id' => '1', 'title' => 'Profit of Prime Commercial Bank Rs 709.5 Million', 'sub_title' => '', 'summary' => 'May 12: Net profit of Prime Commercial Bank has increased by 28 percent to Rs 709.5 million. Increase in net interest income by 17.41 percent, operating profit by 23.37 percent and foreign currency exchange by 49.69 percent has attributed in increase in net profit of the bank.', 'content' => '<p>May 12: Net profit of Prime Commercial Bank has increased by 28 percent to Rs 709.5 million in the third quarter of current FY. Increase in net interest income by 17.41 percent, operating profit by 23.37 percent and foreign currency exchange by 49.69 percent has attributed in increase in net profit of the bank.</p> <p>Similarly, in the third quarter of current FY reserve fund of the bank has increased by 29.77 percent, whereas, investment has decreased by 20 percent. The bank has been able to recover Rs 250.2 million bad debt of the last FY.</p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3364', 'image' => '20160512035125_PRIME.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '15' ) ), (int) 13 => array( 'Article' => array( 'id' => '3529', 'article_category_id' => '1', 'title' => 'Net Profit of Lumbini Bank Increases 12 %', 'sub_title' => '', 'summary' => 'May 12: Net profit of Lumbini Bank has increased by 12 percent to Rs 277.9 million in the third quarter of current fiscal year. Similarly, net interest income has increased by 10.33 percent and during the period, bank has been able to recover Rs 92.8 million bad debt of last FY.', 'content' => '<p style="text-align: justify;">May 12: Net profit of Lumbini Bank has increased by 12 percent to Rs 277.9 million in the third quarter of current fiscal year. Similarly, net interest income has increased by 10.33 percent and during the period, bank has been able to recover Rs 92.8 million bad debt of last FY.</p> <p style="text-align: justify;">The foreign exchange income of the bank has increased by 38.31 percent to Rs 49.6 million. Meanwhile, investment of the bank has decreased by 1.88 billion. Likewise, provision for possible loss has increased by 34.12 percent to Rs 147.8 million. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3363', 'image' => '20160512033210_lumbini.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '3527', 'article_category_id' => '1', 'title' => 'NEPSE Logs Rs 100 Billion in Transactions in 10 Months', 'sub_title' => 'Annual transactions also broke record', 'summary' => 'May 12: Nepali share market has witnessed the highest annual transaction of all time. In only ten months period of the current FY, Nepali share market has seen the highest transaction amount in compare to previous annual transactions. “The total transaction amount till May 10 is Rs 995 million which is itself a history in annual transaction,” says a NEPSE source. The transaction amount of Rs 1.1 billion in a single day on May 11 has attributed in crossing the annual transaction amount of Rs 100 billion in 10 months period.', 'content' => '<p style="text-align: justify;">May 12: Nepali share market has witnessed highest annual transaction of all time. In only ten months of the current fiscal year, NEPSE, the benchmark index of the country’s capital market, has registered highest transaction amount compared to previous annual transactions. “The total transaction amount till May 10 is Rs 995 million which itself is a historical annual transaction amount,” informs a NEPSE source. The transaction amount of Rs 1.1 billion in a single day on May 11 has attributed to cross the annual transaction amount of Rs 100 billion in 10 months.</p> <p style="text-align: justify;">According to the annual report of NEPSE, transaction amount of Rs 65.33 billion took place in FY 2071/72. Despite being in a bullish trend, total transaction amount in the FY 2071/72 was 15 percent less than the previous FY. The report has attributed the decrease to the last year’s devastating earthquake followed by the border blockade. “Investors of all sectors are attracted towards the bull market. The numbers of liquid investors (investors who have less knowledge on investments but have sufficient money) have sharply risen,” says share analyst Dr Gopal Bhatta. According to him, investors of all kind enter share market in every country when the market follows a bullish trend. It has happened in every bullish period in Nepal too.</p> <p style="text-align: justify;">Due to the lack of investment opportunity in other sectors, low bank interest rates alongwith easy loan for share investments have strongly supported investments in share market, analysts say. Alongside the surge in the number of investors in the market, daily average share transaction amount is also increasing.</p> <p style="text-align: justify;">As per the monthly report of NEPSE, average daily transaction has increased to Rs 960 million in 2072 Chaitra from Rs 770 million in 2071 Chaitra.</p> <p style="text-align: justify;">Along with the growth in size of investment in the market, assets of investors are also growing. In the last FY, total share assets of investors was Rs 989 billion which has increased to Rs 1,596 billion by May 12, 2016. </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3361', 'image' => '20160512122349_nepse.JPG', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '3542', 'article_category_id' => '1', 'title' => 'ATM of Machhapuchchhre in Hile', 'sub_title' => '', 'summary' => 'May 15: Machhapuchchhre Bank has started its 72th ATM service in Hile, Dhankuta on May 13. “The bank aims to provide quick and reliable service to the customers of Hile through the ATM booth,” informs the bank in a press statement.', 'content' => '<p style="text-align: justify;">May 15: Machhapuchchhre Bank Limited has opened its 72th ATM counter in Hile, Dhankuta on May 13. “The bank will provide the quick and reliable service to the customers of Hile through this ATM booth,” informs the bank in a press statement.</p> <p style="text-align: justify;">The bank with the paid -up capital of Rs 3.33 billion has Rs 48.43 billion in deposits and Rs 40.81 billion in loans by the end of mid-April of the current fiscal year. During the period, the bank has logged operating profit of Rs 624.2 million.</p> <p style="text-align: justify;">Machhapuchchhre Bank, which began its service from Pokhara in the year 2000, has 56 branches, one extension counter and 72 ATMs. ”Customers should not pay any extra charge while using the Visa cards issued by the bank through its ATMs,” informs the statement.</p> ', 'published' => true, 'created' => '2016-05-15', 'modified' => '2016-05-15', 'keywords' => '', 'description' => '', 'sortorder' => '3376', 'image' => '20160515113830_atm.jpg', 'article_date' => '2016-05-15 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '3541', 'article_category_id' => '1', 'title' => 'Suzuki Showroom at Kailali', 'sub_title' => '', 'summary' => 'VG Automobiles, the authorised distributor of Suzuki two- wheelers in Nepal have opened a showroom at Tikapur, Kailali. The company has partnered with Bhandari and Sons regarding the operation of the showroom. Suman Dhital, Head of Regional Administrative Office, Adhir Kumar Shrestha, General Manager VG Automobiles and Amit Bhandari, Proprietor of Bhandari and Sons were present during the inauguration of the outlet. According to the Bhandari, Suzuki motorcycles and scooters ranging from Rs 164,900 – 279,900 are available in the showroom. ', 'content' => '<p style="text-align: justify;">May 13: VG Automobiles, the authorised distributor of Suzuki two- wheelers in Nepal have opened a showroom at Tikapur, Kailali. The company has partnered with Bhandari and Sons regarding the operation of the showroom.</p> <p style="text-align: justify;">Suman Dhital, Head of Regional Administrative Office, Adhir Kumar Shrestha, General Manager VG Automobiles and Amit Bhandari, Proprietor of Bhandari and Sons were present during the inauguration of the outlet.</p> <p style="text-align: justify;">According to the Bhandari, Suzuki motorcycles and scooters ranging from Rs 164,900 – 279,900 are available in the showroom. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3375', 'image' => '20160513052339_suzuki.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '3540', 'article_category_id' => '1', 'title' => 'Remit Agreement between Prabhu Bank and National Microfinance', 'sub_title' => '', 'summary' => 'May 13: Prabhu Money Transfer and National Microfinance Bittiya Sanstha Limited have signed a remittance agreement. Rameshwor Sapkota, Deputy General Manager of Prabhu Money Transfer and Ram Bahadur Yadav, CEO of National Microfinance signed the agreement on behalf of their respective organisations amid a program held at the head office of the microfinance in Dhading Besi. The Sanstha which has received nationwide transaction permit has 24 branches in districts including Dhading, Bhaktapur, Parsa, Sindhupalchowk, Morang, Siraha, Kailali, Banke, Palpa.', 'content' => '<p>May 13: Prabhu Money Transfer and National Microfinance Bittiya Sanstha Limited have signed a remittance agreement. Rameshwor Sapkota, Deputy General Manager of Prabhu Money Transfer and Ram Bahadur Yadav, CEO of National Microfinance signed the agreement on behalf of their respective organisations amid a program held at the head office of the microfinance in Dhading Besi. The Sanstha which has received nationwide transaction permit has 24 branches in districts including Dhading, Bhaktapur, Parsa, Sindhupalchowk, Morang, Siraha, Kailali, Banke, Palpa.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3374', 'image' => '20160513050120_prabhu.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '3539', 'article_category_id' => '1', 'title' => 'Spread Rate Helps Banks Profit Jump', 'sub_title' => '', 'summary' => 'May 13: Despite the adverse investment scenario, profit of commercial banks has increased by 36 percent due to the rise in spread rate (difference in deposit and loan interest rates). Among the total 29 banks in operation, 26 have published third quarter financial reports of the current fiscal year. Based on the reports, their profit has increased compared to same period of last FY. Profit of the banks which had totalled Rs 15.51 billion by mid-April of last FY jumped to Rs 21 billion in the same period of the current FY. The banks have increased spread rate by 0.01-1.11 percent by mid-April compared to last month of the FY 2071/72.', 'content' => '<p style="text-align:justify">May 13: Despite the adverse investment scenario, profit of commercial banks has increased by 36 percent due to the rise in spread rate (difference in deposit and loan interest rates). Among the total 29 banks in operation, 26 have published third quarter financial reports of the current fiscal year. Based on the reports, their profit has increased compared to same period of last FY. Profit of the banks which had totalled Rs 15.51 billion by mid-April of last FY jumped to Rs 21 billion in the same period of the current FY. The banks have increased spread rate by 0.01-1.11 percent by mid-April compared to last month of the FY 2071/72.</p> <p style="text-align:justify">Among the banks, NMB Bank logged the highest profit earning. The bank’s profit grew by 93 percent in mid-April of current FY compared to the same period last of FY. It is due to the profits accumulated by other banks that have merged with NMB.</p> <p style="text-align:justify">“This indicates that banks did not made significant reduction in loan interest rates compared to deposit interest rates during the period of high liquidity,” says Bhuwan Dhahal, CEO of Sanima Bank. The banks had set 2-4 percent interest rates on fixed deposit accounts due to lower investments caused by the devastating earthquake of last year followed by the border blockade. However, there was little reduction in interest rates of various loan categories except the short-term loans. During the period, the banks were charging 11-17 percent interest rate on various loan categories. Other than Prabhu, Standard Chartered, Lumbini, Nepal SBI and Agricultural Development Bank, spread rate of other banks are within the limit set by Nepal Rastra Bank. As per the NRB directive, such rates should not exceed 5 percent.</p> <p style="text-align:justify">Increase in spread rate has also attributed to the rise in the banks net interest income. The net interest income of the banks has increased by 17 percent to Rs 29.15 billion by mid-April of current FY compared to same period of last FY. During the period, deposit collection of the banks has increased by six percent while loans saw increment of only four percent.</p> <p style="text-align:justify"><img alt="" src="/userfiles/images/table%283%29.jpg" style="height:1007px; width:700px" /></p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3373', 'image' => null, 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '3538', 'article_category_id' => '1', 'title' => 'Ford Exchange and Test Drive Fair', 'sub_title' => '', 'summary' => ' May 13: Ford, a multinational motor company, has started exchange and test drive fair on Pokhara from May 12. The fair will end on May 14. According to Chabi Gautam, Sales Manager of Ford in Nepal, the fair has been organised keeping the customers’ benefits in mind. The fair was organised by Auto Venture, the authorised distributer of Ford in Pokhara. According to the company, customers bringing old cars during the fair will receive maximum price for their vehicles. The company is also offering special discount in exchange of cars.', 'content' => '<p style="text-align: justify;">May 13: Ford, a multinational motor company, has started exchange and test drive fair on Pokhara from May 12. The fair will end on May 14. According to Chabi Gautam, Sales Manager of Ford in Nepal, the fair has been organised keeping the customers’ benefits in mind.</p> <p style="text-align: justify;">The fair was organised by Auto Venture, the authorised distributer of Ford in Pokhara. According to the company, customers bringing old cars during the fair will receive maximum price for their vehicles. The company is also offering special discount in exchange of cars.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3372', 'image' => '20160513012146_test drive.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '3537', 'article_category_id' => '1', 'title' => 'AHF conducts 'Fund the Fund' Campaign', 'sub_title' => '', 'summary' => 'May 13: AIDS Health Care Foundation (AHF) Nepal has organised the ‘fund the fund’ campaign. "The campaign helps in gaining the commitment of the donor agency countries to increase their contribution in global fund," informs Deepak Dhungel, Country Director of AHF Nepal. AHF and HIV Association along with various other joint venture organizations, through fund the fund campaign are requesting economically strong countries like Germany, China and Japan for collecting the 5th round global fund of Rs 13 billion. "Global fund is not able to meet its targeted fund since 2010 due to decreasing commitment of donor agencies," mentions Dhungel. AHF has submitted memorandum to the respective embassies on May 12, 2016 regarding the issue.', 'content' => '<p>May 13: AIDS Health Care Foundation (AHF) Nepal has organised the ‘fund the fund’ campaign. "The campaign helps in gaining the commitment of the donor agency countries to increase their contribution in global fund," informs Deepak Dhungel, Country Director of AHF Nepal. AHF and HIV Association along with various other joint venture organizations, through fund the fund campaign are requesting economically strong countries like Germany, China and Japan for collecting the 5th round global fund of Rs 13 billion. "Global fund is not able to meet its targeted fund since 2010 due to decreasing commitment of donor agencies," mentions Dhungel. AHF has submitted memorandum to the respective embassies on May 12, 2016 regarding the issue.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3371', 'image' => '20160513011454_ahf.JPG', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '3536', 'article_category_id' => '1', 'title' => 'EU and TI Nepal Join Hands to Promote Integrity in Reconstruction', 'sub_title' => '', 'summary' => 'May 13: The European Union and Transparency International Nepal in Kathmandu launched a support program to foster integrity in the post-earthquake reconstruction and rehabilitation process on May 12. Head of the Delegation of the European Union to Nepal, Ambassador Rensje Teerink and President of Transparency International (TI) Nepal, Bharat Bahadur Thapa signed the project documents on behalf of their organizations. “The 1 million Euros project, which is a part of a broader package of 105 million euro, will run for a period of 5 years to complement the rebuilding campaign with various accountability and transparency activities,” informs the joint press statement of two organizations.', 'content' => '<p>May 13: The European Union and Transparency International Nepal launched a support program to foster integrity in the post-earthquake reconstruction and rehabilitation process on May 12.</p> <p>Head of the Delegation of the European Union to Nepal, Ambassador Rensje Teerink and President of Transparency International (TI) Nepal, Bharat Bahadur Thapa signed the project documents on behalf of their organizations. “The Euro 1 million project, which is a part of a broader package of Euro 105 million, will run for a period of five years to complement the rebuilding campaign with various accountability and transparency activities,” informs a joint press statement of two organizations.</p> <p>Both parties reiterated the importance of promoting integrity in the context of post-Earthquake reconstruction. Ambassador Teerink stated, "Building Back Better Nepal is an opportunity to foster accountability and social cohesion in the country. We need to reach out in particular to the most vulnerable. With this action, launched today on the first anniversary of the second big quake, we underline the pivotal importance of the Civil Society in the process."</p> <p>Meanwhile, TI Nepal President Thapa expressed that disaster situations often exacerbate corruption; hence a more vigilant approach from civil society is crucial.</p> <p>The project is shrduled to work on three key levels in the earthquake reconstruction process: policy level, implementation level and post implementation level. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3370', 'image' => '20160513115846_eu.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '3535', 'article_category_id' => '1', 'title' => 'Janata Bank Joins NCHL-IPS System', 'sub_title' => '', 'summary' => 'May 13: Janata Bank has signed Interbank Payment System (NCHL-IPS) with Nepal Clearing House Limited (NCHL). As per the agreement, NCHL will provide NCHL-IPS service for electronic payment system to Janata Bank. Neelesh Man Singh Pradhan, CEO of NCHL and Kumar LAmsal, CEO of Janata bank signed the agreement to this effect on May 12.', 'content' => '<p>May 13: Janata Bank has signed Interbank Payment System (NCHL-IPS) with Nepal Clearing House Limited (NCHL). As per the agreement, NCHL will provide NCHL-IPS service for electronic payment system to the bank. Neelesh Man Singh Pradhan, CEO of NCHL and Kumar LAmsal, CEO of Janata Bank signed the agreement to this effect on May 12.</p> <p>Customers can withdraw and make payments from any account of the banks and financial institutions under the NCHL-IPS system. “Under this service customers can make payments of cash, dividends, IPO refund, bills, insurance premium, social welfare allowance, pension/salary, remittance and all other types of payments,” informs the service provider in a press statement. NCHL has aimed to include financial institutions in this service as large bulk of transactions can be done easily with transparency while also reducing the associated risks. </p> ', 'published' => true, 'created' => '2016-05-13', 'modified' => '2016-05-13', 'keywords' => '', 'description' => '', 'sortorder' => '3369', 'image' => '20160513113101_jananta.jpg', 'article_date' => '2016-05-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '3534', 'article_category_id' => '1', 'title' => ' New Outlet of Toyota Used Cars ', 'sub_title' => '', 'summary' => 'May 12: United Traders Syndicate, the authorised distributor of Toyota in Nepal has opened a separate outlet, Galaxy Automobiles for its Toyota Certified Used Car Division. The Lalitpur-based outlet located at Bakhundol, will allow the customers to sell any brand of cars and also to exchange new models of Toyota cars.', 'content' => '<p style="text-align: justify;">May 12: United Traders Syndicate, the authorised distributor of Toyota in Nepal has opened a separate outlet, Galaxy Automobiles for its Toyota Certified Used Car Division. The Lalitpur-based outlet located at Bakhundol, will allow the customers to sell any brand of cars and also to exchange new models of Toyota cars.</p> <p style="text-align: justify;">Suraj Vaidya, President of Vaidya Organisation of Industries and Trading Houses inaugurated the outlet on May 9. The international standard outlet will certify cars by examining their condition, capacity and life span. The company claimed that the evaluation of vehicles will be correct as the staffs doing the evaluation are trained as per international standards. According to the company, an Exchange Fair will be organised on May 10-15 at the outlet.</p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3368', 'image' => '20160512044725_toyota.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '3533', 'article_category_id' => '1', 'title' => 'BG Mall Opens in Gongabu', 'sub_title' => '', 'summary' => 'May 12: A modern shopping complex has opened in Gongabu of Kathmandu. BG Mall located at New Bus Park area has started its operation officially from May 11. Former finance minister Dr Ramsharan Mahat and Pashupati Murarka, President of Federation of Nepalese Commerce and Industry (FNCCI) jointly inaugurated the shopping mall amid a function on Wednesday. Speaking at the program, Mahat urged the government to remove policy hurdles in order to foster entrepreneurship in the country.', 'content' => '<p>May 12<strong>: </strong>A modern shopping complex has opened in Gongabu of Kathmandu. BG Mall located at New Bus Park area has started its operation officially from May 11. Former finance minister Dr Ramsharan Mahat and Pashupati Murarka, President of Federation of Nepalese Commerce and Industry (FNCCI) jointly inaugurated the shopping mall amid a function on Wednesday. Speaking at the program, Mahat urged the government to remove policy hurdles in order to foster entrepreneurship in the country.</p> <p>Similarly, Murarka stated that the opening of one shopping mall can support factories and industries along with the generation of employment. Chudamani Sharma, Director General of Internal Revenue Department hailed the opening of the Mall as the country can prosper economically with the establishment of shopping complexes.</p> <p>On the occasion, Raju Giri, Director of the complex informed that the Mall has almost all essential items including an entertainment zone. The Mall has 60 shops and showrooms of household goods, electrical items, mobile phones, apparels and cosmetics and beauty products. Similarly, the shopping mall also has restaurants, a movie theater, banks and ATM counters.</p> <p> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3367', 'image' => '20160512043925_bg.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '3532', 'article_category_id' => '1', 'title' => 'Sujal Re-launches Crave Candy', 'sub_title' => '', 'summary' => 'May 12: Sujal food has launched ‘Crave Candy’ in new packaging in the market. “The candy has been launched in round shape with new packaging in the market,” informs the company. The company stated that company has drawn new wrapper in a bid to attract children with its impressive new design. The company has planned of starting advertisement campaign across the country with a new theme “Kwappai Khau Swad Ma Ramau.”', 'content' => '<p>May 12: Sujal Food has re-launched the Crave Candy in the domestic market wrapped in new packaging. Issuing a press statement, the company informed that Crave candy has been re-launched in the market with an attractive round shape wrapped in new packaging. According to the company, the new wrapper comes with dreams of the world that attracts the children. The company’s plans to start an advertisement campaign across the country with a new theme for the re-launched product. The company has decided a slogan ‘Kuppa Khaum Swaad Ma Ramau’ for the purpose.</p> <p>As per the company, Crave Candy is available in butter scotch and coffee flavors and is priced Rs 1. Sujal foods, the sister organisation of Laxmi Group, has been producing quality confectionery since 1974. </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3366', 'image' => '20160512041922_candy.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '3531', 'article_category_id' => '1', 'title' => 'Net Profit of Civil Bank Increases 4%', 'sub_title' => '', 'summary' => 'May 12: Net Profit of Civil Bank has increased by 4 percent to Rs 199 million in the third quarter of current fiscal year. The bank’s operating profit has increased by 26.85 percent in the period. The bank has been able to recover Rs 100.1 million bad debt of the last year. Similarly, the bank has earned Rs 69.6 million from foreign currency exchange.', 'content' => '<p style="text-align:justify">May 12: Net Profit of Civil Bank has increased by 4 percent to Rs 199 million in the third quarter of current fiscal year. The bank’s operating profit has increased by 26.85 percent in the period. The bank has been able to recover Rs 100.1 million bad debt of the last year. Similarly, the bank has earned Rs 69.6 million from foreign currency exchange.</p> <p style="text-align:justify">Likewise, investment of the bank has increased by 3.80 percent to Rs 4.36 billion in the third quarter and reserve fund of the bank has also increased by 9 percent to Rs 404.3 million. The bank has allocated Rs 219.1 million in its provision for possible losses.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3365', 'image' => '20160512040143_CIVIL.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '3530', 'article_category_id' => '1', 'title' => 'Profit of Prime Commercial Bank Rs 709.5 Million', 'sub_title' => '', 'summary' => 'May 12: Net profit of Prime Commercial Bank has increased by 28 percent to Rs 709.5 million. Increase in net interest income by 17.41 percent, operating profit by 23.37 percent and foreign currency exchange by 49.69 percent has attributed in increase in net profit of the bank.', 'content' => '<p>May 12: Net profit of Prime Commercial Bank has increased by 28 percent to Rs 709.5 million in the third quarter of current FY. Increase in net interest income by 17.41 percent, operating profit by 23.37 percent and foreign currency exchange by 49.69 percent has attributed in increase in net profit of the bank.</p> <p>Similarly, in the third quarter of current FY reserve fund of the bank has increased by 29.77 percent, whereas, investment has decreased by 20 percent. The bank has been able to recover Rs 250.2 million bad debt of the last FY.</p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3364', 'image' => '20160512035125_PRIME.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '15' ) ), (int) 13 => array( 'Article' => array( 'id' => '3529', 'article_category_id' => '1', 'title' => 'Net Profit of Lumbini Bank Increases 12 %', 'sub_title' => '', 'summary' => 'May 12: Net profit of Lumbini Bank has increased by 12 percent to Rs 277.9 million in the third quarter of current fiscal year. Similarly, net interest income has increased by 10.33 percent and during the period, bank has been able to recover Rs 92.8 million bad debt of last FY.', 'content' => '<p style="text-align: justify;">May 12: Net profit of Lumbini Bank has increased by 12 percent to Rs 277.9 million in the third quarter of current fiscal year. Similarly, net interest income has increased by 10.33 percent and during the period, bank has been able to recover Rs 92.8 million bad debt of last FY.</p> <p style="text-align: justify;">The foreign exchange income of the bank has increased by 38.31 percent to Rs 49.6 million. Meanwhile, investment of the bank has decreased by 1.88 billion. Likewise, provision for possible loss has increased by 34.12 percent to Rs 147.8 million. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3363', 'image' => '20160512033210_lumbini.jpg', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '3527', 'article_category_id' => '1', 'title' => 'NEPSE Logs Rs 100 Billion in Transactions in 10 Months', 'sub_title' => 'Annual transactions also broke record', 'summary' => 'May 12: Nepali share market has witnessed the highest annual transaction of all time. In only ten months period of the current FY, Nepali share market has seen the highest transaction amount in compare to previous annual transactions. “The total transaction amount till May 10 is Rs 995 million which is itself a history in annual transaction,” says a NEPSE source. The transaction amount of Rs 1.1 billion in a single day on May 11 has attributed in crossing the annual transaction amount of Rs 100 billion in 10 months period.', 'content' => '<p style="text-align: justify;">May 12: Nepali share market has witnessed highest annual transaction of all time. In only ten months of the current fiscal year, NEPSE, the benchmark index of the country’s capital market, has registered highest transaction amount compared to previous annual transactions. “The total transaction amount till May 10 is Rs 995 million which itself is a historical annual transaction amount,” informs a NEPSE source. The transaction amount of Rs 1.1 billion in a single day on May 11 has attributed to cross the annual transaction amount of Rs 100 billion in 10 months.</p> <p style="text-align: justify;">According to the annual report of NEPSE, transaction amount of Rs 65.33 billion took place in FY 2071/72. Despite being in a bullish trend, total transaction amount in the FY 2071/72 was 15 percent less than the previous FY. The report has attributed the decrease to the last year’s devastating earthquake followed by the border blockade. “Investors of all sectors are attracted towards the bull market. The numbers of liquid investors (investors who have less knowledge on investments but have sufficient money) have sharply risen,” says share analyst Dr Gopal Bhatta. According to him, investors of all kind enter share market in every country when the market follows a bullish trend. It has happened in every bullish period in Nepal too.</p> <p style="text-align: justify;">Due to the lack of investment opportunity in other sectors, low bank interest rates alongwith easy loan for share investments have strongly supported investments in share market, analysts say. Alongside the surge in the number of investors in the market, daily average share transaction amount is also increasing.</p> <p style="text-align: justify;">As per the monthly report of NEPSE, average daily transaction has increased to Rs 960 million in 2072 Chaitra from Rs 770 million in 2071 Chaitra.</p> <p style="text-align: justify;">Along with the growth in size of investment in the market, assets of investors are also growing. In the last FY, total share assets of investors was Rs 989 billion which has increased to Rs 1,596 billion by May 12, 2016. </p> ', 'published' => true, 'created' => '2016-05-12', 'modified' => '2016-05-12', 'keywords' => '', 'description' => '', 'sortorder' => '3361', 'image' => '20160512122349_nepse.JPG', 'article_date' => '2016-05-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117