December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January…

December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January…

December 26: NMB Bank has started issuing chip based Debit, Credit and International Dollar Card. Issuing a press statement, the bank informed that the EMV (Europay, MasterCard, VISA) Chip Cards are embedded with a microprocessor chip that encrypts transaction information, thus are most secured in today’s world.…

December 26: Nepal-Bangladesh power production and trade agreement is finalizing on first week of January. The agreement will be signed by Janardan Sharma, Ministry of Energy (MoE) from Nepal and Nasrul Hamid, State Minister for Power from Bangladesh in Kathmandu. The agreement will decide the electricity trade model between Nepal and…

December 26: Nepal SBI Bank has floated 67,767.87 units of further public offering (FPO)to the general investors today. The bank floated a share with a face value of Rs 100 at a premium of Rs 871 totalling Rs 971 per unit of share. The interested investors will have to apply for minimum of 10 units of share and maximum of 670 units of shares. According to the bank, the issuance will close early on December 29 and lately on January…

December 26: Insurance Board, the regulatory body of insurance sector of Nepal will most possibly get a new Chairman on Monday. As per the sources, Maoist centre is lobbying hard to appoint former Maoist soldier or other party worker as the board's…

December 26: Dayal Trading, the authorised distributor of Glucovita Bolts for Nepal is distributing free samples in various 100 schools. Issuing a press statement, the company said that the campaign is aimed toward establishing the product in the Nepali market as well as to convince the customers about its…

December 26: Samata Microfinance Bittiya Sanstha is issuing general shares worth Rs 9 million. The 10th annual general meeting of the company held on December 24 approved the proposal of issuing the general…

December 26: Nepal Mobile Traders Association is organising 'Newroad Mobile Expo 2073' in Newroad, also known as 'Mobile Hub', from December 28 to January 3. The main sponsor of the mobile expo is…

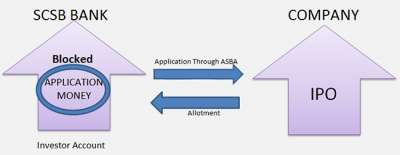

December 25: Securities Board of Nepal (SEBON) has approved 11 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. . Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application…

December 25: Japanese Company Toshiba has launched three new products; LED TV, Refrigerator and washing machine in the Nepali market. The authorised distributor of Toshiba for Nepal,EOL Pvt Ltd under Chaudhary Group launched the products organising a program on December…

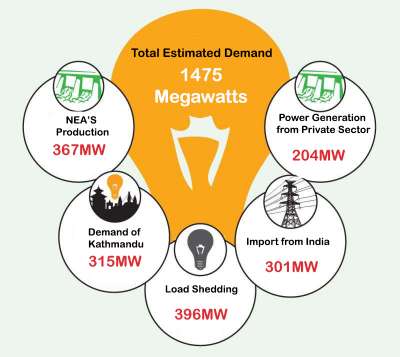

December 25: Nepal Electricity Authority is importing additional electricity from India in a bid to support its campaign against power cut. On December 22, a complementary PPA on importing additional 80MW electricity in two phases was signed by Kulman Ghising, Executive Director of NEA and Arun Kumar Garg, Executive Director of NodAl Agency NTPC Vidyut Vyapar Nigam (NVVN). According to the agreement, 40 MW electricity will be imported from January 1 and if needed, another 40MW from January 31 to June…

December 25: Upper Marsyangdi 'A', constructed at Bhulbhul of North Lamjung has started power generation in its full capacity of 50 MW. The project which is a joint venture of Chinese multinational company Sino and Nepal's Sagarmatha Hydropower Company was supplying 25MW electricity since last…

December 25: Om Development Bank is providing 29.20 per cent bonus share to its shareholders from the distributable income of FY 2072/73. The 10th annual general meeting of the bank held on December 23 endorsed the proposal of bonus…

December 25: Kumari Bank has appointed Siddhartha Capital as its issue manager to float 50 per cent right shares of its current paid-up capital amounting to Rs 2.69 billion. Rajeev Giri, Acting CEO of Kumari Bank and Dhruba Timilsina, CEO of Siddhartha Capital signed an agreement related with the matter on December…

December 23: The government of Japan is providing Rs 15.28 billion loan assistant to the Nepal government for the construction of Thankot-Naubise tunnel road. Shanta Raj Subedi, Finance Secretary and Masashi Ogawa, Ambassador of Japan to Nepal signed the agreement paper regarding the matter on behalf of their respective governments in a program organised at the Ministry of Finance (MoF) on December…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '5017', 'article_category_id' => '34', 'title' => 'Century Acquires Securities Application Collection Approval', 'sub_title' => '', 'summary' => 'December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January 15.', 'content' => '<p style="text-align:justify">December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January 15.</p> <p> </p> ', 'published' => true, 'created' => '2016-12-27', 'modified' => '2016-12-27', 'keywords' => '', 'description' => '', 'sortorder' => '4829', 'image' => '20161227123935_century.jpg', 'article_date' => '2016-12-27 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '5014', 'article_category_id' => '1', 'title' => 'NMB Bank starts issuing EMV Chip Cards', 'sub_title' => '', 'summary' => 'December 26: NMB Bank has started issuing chip based Debit, Credit and International Dollar Card. Issuing a press statement, the bank informed that the EMV (Europay, MasterCard, VISA) Chip Cards are embedded with a microprocessor chip that encrypts transaction information, thus are most secured in today’s world. ', 'content' => '<p style="text-align: justify;">December 26: NMB Bank has started issuing chip based Debit, Credit and International Dollar Card. </p> <p style="text-align: justify;">Issuing a press statement, the bank informed that the EMV (Europay, MasterCard, VISA) Chip Cards are embedded with a microprocessor chip that encrypts transaction information, thus are most secured in today’s world. </p> <p style="text-align: justify;">"Each time the chip card is used, the transaction data changes using complex algorithm, making it difficult to copy or counterfeit the card. The new chip-enabled cards will improve security of customer transactions when using the card abroad and at home" reads the statement.</p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4828', 'image' => '20161226051843_nmb.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '5013', 'article_category_id' => '1', 'title' => 'Nepal-Bangladesh Power Trade Agreement within the current month', 'sub_title' => '', 'summary' => 'December 26: Nepal-Bangladesh power production and trade agreement is finalizing on first week of January. The agreement will be signed by Janardan Sharma, Ministry of Energy (MoE) from Nepal and Nasrul Hamid, State Minister for Power from Bangladesh in Kathmandu. The agreement will decide the electricity trade model between Nepal and Bangladesh.', 'content' => '<p style="text-align: justify;">December 26: Nepal-Bangladesh power production and trade agreement is finalizing on first week of January. The agreement will be signed by Janardan Sharma, Ministry of Energy (MoE) from Nepal and Nasrul Hamid, State Minister for Power from Bangladesh in Kathmandu. The agreement will decide the electricity trade model between Nepal and Bangladesh.</p> <p style="text-align: justify;">According to a source at MoE, the major agenda of the agreement will be whether the government companies (including joint ventures) on government level or through private company or through any other power trading company will trade the power between the two countries. Previously, Bangladeshi Prime Minister Sheikh Hasina Wazed expressed 'keen interest ' in developing large hydropower projects in Nepal during a meeting with Energy Minister Janardan Sharma in Dhaka on December 8. Bangladesh with a plan to purchase electricity from Nepal, proposed Rs 100 billion investments in hydro sector of Nepal. The bilateral agreement is the result of the proposed investment made by Bangladesh on the energy sector of Nepal.</p> <p style="text-align: justify;">Bangladesh has also proposed of forming a joint task force in order to discuss whether to make joint investment in energy sector or to purchase electricity produced in Nepal or to adopt any other alternative.</p> <p style="text-align: justify;">Presently, Bangladesh is producing 15000 MW of electricity. Similarly, Bangladesh predicts increase in electricity demand to 35,000 MW by 2030. “For the fulfillment of the demand, the investment and power trade process with the neighboring countries is being forwarded,” said Mashfee Binte Shams, Bangladesh Ambassador for Nepal addressing the power summit held on December 15.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4827', 'image' => '20161226042541_PTA-1.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '5012', 'article_category_id' => '1', 'title' => 'Nepal SBI Bank's FPO from Today', 'sub_title' => '', 'summary' => 'December 26: Nepal SBI Bank has floated 67,767.87 units of further public offering (FPO)to the general investors today. The bank floated a share with a face value of Rs 100 at a premium of Rs 871 totalling Rs 971 per unit of share. The interested investors will have to apply for minimum of 10 units of share and maximum of 670 units of shares. According to the bank, the issuance will close early on December 29 and lately on January 9.', 'content' => '<p style="text-align: justify;">December 26: Nepal SBI Bank has floated 67,767.87 units of further public offering (FPO)to the general investors today. The bank floated a share with a face value of Rs 100 at a premium of Rs 871 totalling Rs 971 per unit of share. The interested investors will have to apply for minimum of 10 units of share and maximum of 670 units of shares. According to the bank, the issuance will close early on December 29 and lately on January 9.</p> <p style="text-align: justify;">NMB Capital has been appointed as Issue Manager by the bank. The interested investors can apply from share registrar NMB Capital, all the branch offices of Nepal SBI Bank and Nepal SBI Merchant Banking. After the issuance, the paid-up capital of the bank will reach Rs 3.89 billion. ICRA Nepal has granted 'ICRA Nepal IPO Grade 2' to the issuance.</p> <p style="text-align: justify;">Nepal SBI is floating the FPO in a bid to maintain its promoter: general shareholder ratio to 70:30. By the first quarter of the current FY, the bank earned Rs 350 million net profit. The bank has earning per share (EPS)of Rs 36.48 and net worth of 188.79. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4826', 'image' => '20161226031128_sbi.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '5011', 'article_category_id' => '1', 'title' => 'Groups Lobbying Hard to Appoint Insurance Board Chairman', 'sub_title' => '', 'summary' => 'December 26: Insurance Board, the regulatory body of insurance sector of Nepal will most possibly get a new Chairman on Monday. As per the sources, Maoist centre is lobbying hard to appoint former Maoist soldier or other party worker as the board's chairman.', 'content' => '<p style="text-align:justify">December 26: Insurance Board, the regulatory body of insurance sector of Nepal will most possibly get a new Chairman on Monday. As per the sources, Maoist centre is lobbying hard to appoint former Maoist soldier or other party worker as the board's chairman.</p> <p style="text-align:justify">Although Dr Fatte Bahadur KC, Chairman of IB seemed interested for his third tenure as the Chairman, he is now out of race with the end of his second tenure on December 22. </p> <p style="text-align:justify">After the exit of KC, dozen above persons are tripping political centre of power for the appointment. However, the names of Ramesh Bhattarai, CEO of Mahalaxmi Bikash Bank, Chiranjibi Chapagain, Director of NRB Pokhara Branch, Rishi Ram Gautam, Director of Prabhu Bank and Rabindra Ghimire of Pokhara University are coming to the surface as the candidates for the post. Among them also, Bhattarai and Chapagain are the most possible candidate for the post.</p> <p style="text-align:justify">Dr KC who got appointed during then Finance Minister Dr Baburam Bhattrai spent 8 years in IB as the Chairman. However, he didn't get additional tenure citing unsupportive toward Maoist Centre. Presently, as the Ministry of Finance is under Maoist Centre, the Maoist party is trying hard to bring Maoist supporter to the post. Similarly, there is another group lobbying to bring a Chairman who is well known of the insurance sector. As per the source, there is much possibility that the IB will get a new Chairman on Monday.</p> <p style="text-align:justify">Moreover, various business houses are also lobbying in the Chairman appointment process of the IB. According to the sources, business houses are offering up to Rs 20 million for the post and deals are accordingly being conducted. As per the sources, the business houses are influencing the appointment process as it will give them ease in restructuring the insurance regulation as per their requirement.</p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4825', 'image' => '20161226014130_insurance.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '5010', 'article_category_id' => '1', 'title' => 'Glucovita Distributing Free Sample of 'Glucovita Bolts'', 'sub_title' => '', 'summary' => 'December 26: Dayal Trading, the authorised distributor of Glucovita Bolts for Nepal is distributing free samples in various 100 schools. Issuing a press statement, the company said that the campaign is aimed toward establishing the product in the Nepali market as well as to convince the customers about its quality.', 'content' => '<p style="text-align: justify;">December 26: Dayal Trading, the authorised distributor of Glucovita Bolts for Nepal is distributing free samples in various 100 schools. Issuing a press statement, the company said that the campaign is aimed toward establishing the product in the Nepali market as well as to convince the customers about its quality.</p> <p style="text-align: justify;">According to the company, Glucovita Bolts with glucose and iron gives instant energy for body and brain anytime and anywhere.</p> <p style="text-align: justify;">"Be it football match that leaves your child exhausted or a surprise quiz that challenges the mind, you never know when your child needs instant energy. That's why you need Glucovita Bolts. Offering an instant recharge- before, after or during any activity, Glucovita Bolts helps children power through any situation, be it mental or physical," reads the statement.</p> <p style="text-align: justify;">The Glucovita Bolts are available in orange and strawberry taste in the market with a price tag of Rs 20. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4824', 'image' => '20161226120421_glucovita-bolts-orange.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '5009', 'article_category_id' => '1', 'title' => 'Samata Microfinance to issue General Shares', 'sub_title' => '', 'summary' => 'December 26: Samata Microfinance Bittiya Sanstha is issuing general shares worth Rs 9 million. The 10th annual general meeting of the company held on December 24 approved the proposal of issuing the general shares.', 'content' => '<p style="text-align: justify;">December 26: Samata Microfinance Bittiya Sanstha is issuing general shares worth Rs 9 million. The 10<sup>th</sup> annual general meeting of the company held on December 24 approved the proposal of issuing the general shares.</p> <p style="text-align: justify;">Similarly, the AGM also endorsed the proposal of expanding its work area. "The organisation mobilising nearly Rs 250 million earned Rs 10 million net profit," said Dammar Mani Thebe Limbu, Chairman of the company.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4823', 'image' => '20161226113653_samata.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '5008', 'article_category_id' => '1', 'title' => 'Newroad Mobile Expo from December 28', 'sub_title' => '', 'summary' => 'December 26: Nepal Mobile Traders Association is organising 'Newroad Mobile Expo 2073' in Newroad, also known as 'Mobile Hub', from December 28 to January 3. The main sponsor of the mobile expo is Ncell.', 'content' => '<p style="text-align: justify;">December 26: Nepal Mobile Traders Association is organising 'Newroad Mobile Expo 2073' in Newroad, also known as 'Mobile Hub', from December 28 to January 3. The main sponsor of the mobile expo is Ncell.</p> <p style="text-align: justify;">According to the organiser, the expo that is being organised with a slogan 'Jahaan Mobile Bazaar Tyahaan Mobile Mahotsav' is aimed at selling superior mobile phones and save customers from frauds. Moreover, the expo also aims on disseminating information on new technology that is available in the market.</p> <p style="text-align: justify;">Purushottam Basnet, President of the association and conveyor of the expo claimed that the expo will be grand and historic till date. He informed of finishing all the expo preparations.</p> <p style="text-align: justify;">As per the organiser, the expo will start from Newroad Gate. Newroad will be decorated by various tools, banners and LCD screen. Big LCD screens installed at Pipalbot will be providing latest technological and brand information to the customers. For the convenience of customers in getting food and coffee, mobile food-court will be mobilised in various places.</p> <p style="text-align: justify;">"On the occasion of the expo, various schemes have been launched on the purchase of mobile phones for the customers," said Aabiskar Lal Shrestha, co-conveyor of the expo. "Every customer will be getting sure shot prizes. In the expo, all smart-phone purchasers will be given free Ncell SIM and 100MB data," he said. "The customers can also win smart-phone through daily lucky draw."</p> <p style="text-align: justify;">The expo will have separate kids zone and gaming zone. Shrestha claims that the expo will be visited by more than 300,000 visitors daily. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4822', 'image' => '20161226112119_newroad mobile expo.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '5007', 'article_category_id' => '1', 'title' => 'SEBON Approves 11 BFIs for ASBA Implementation', 'sub_title' => '', 'summary' => 'December 25: Securities Board of Nepal (SEBON) has approved 11 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. . Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application contain', 'content' => '<p style="text-align: justify;">December 25: Securities Board of Nepal (SEBON) has approved 11 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. . Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. Additional 6 BFIs have applied to SEBON for carrying out the system. As per the board, approvals will be given soon after a detail study of the applications.</p> <p style="text-align: justify;">The board has given approval to Century Commercial, Sunrise, Kailash Bikash, Ace Development, Citizens International, Sanima, Laxmi Bank, Sanima Bank, Siddhartha Bank, NIC Asia Bank, NB Bank and Kumari Bank for the implementation of ASBA. The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4821', 'image' => '20161225041913_ASBA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '5006', 'article_category_id' => '1', 'title' => 'Toshiba Launches 3 New Products in Nepali Market', 'sub_title' => '', 'summary' => 'December 25: Japanese Company Toshiba has launched three new products; LED TV, Refrigerator and washing machine in the Nepali market. The authorised distributor of Toshiba for Nepal,EOL Pvt Ltd under Chaudhary Group launched the products organising a program on December 23.', 'content' => '<p style="text-align: justify;">December 25: Japanese Company Toshiba has launched three new products; LED TV, Refrigerator and washing machine in the Nepali market. The authorised distributor of Toshiba for Nepal,EOL Pvt Ltd under Chaudhary Group launched the products organising a program on December 23.</p> <p style="text-align: justify;">"Toshiba LED TV has entered the Nepali market in three new series including L56, L36 and L26," said K N Jha, General Manager of CG. The L56 smart series TV has feature of cloud base platform in which all applications can be stored in cloud server without using TV memory. It also has essential PQ Technology and screen mirroring.</p> <p style="text-align: justify;">Similarly, the TV series L36 and L26 has 5 star protection and 20 Dolby sound output features that encourage environment friendly lifestyle. Moreover, L36 series has been installed with MHL function. "Available in 24-55 inches, these TVs are priced at Rs 24,000 to Rs 92,000 in the market," said Niraj Kumar Thakur, Senior Sales Manager of the company.</p> <p style="text-align: justify;">"Likewise, the refrigerator and washing machines are also in attractive design. They come in S-DD (Super Direct Drive) inverter technology preferred by the customers," he added. Toshiba refrigerator comes with 170-240 litres capacity and priced at Rs 28,000 to 78,000 in the market. Moreover, the washing machines are of 6.5-12 kilograms capacity and are priced at Rs 37,000 to Rs 110,000 in the market. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4820', 'image' => '20161225034152_TOSHIBA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '5005', 'article_category_id' => '1', 'title' => 'NEA Importing Additional Electricity from India to End Power Cut', 'sub_title' => '', 'summary' => 'December 25: Nepal Electricity Authority is importing additional electricity from India in a bid to support its campaign against power cut. On December 22, a complementary PPA on importing additional 80MW electricity in two phases was signed by Kulman Ghising, Executive Director of NEA and Arun Kumar Garg, Executive Director of NodAl Agency NTPC Vidyut Vyapar Nigam (NVVN). According to the agreement, 40 MW electricity will be imported from January 1 and if needed, another 40MW from January 31 to June 1.', 'content' => '<p style="text-align: justify;">December 25: Nepal Electricity Authority is importing additional electricity from India in a bid to support its campaign against power cut. On December 22, a complementary PPA on importing additional 80MW electricity in two phases was signed by Kulman Ghising, Executive Director of NEA and Arun Kumar Garg, Executive Director of NodAl Agency NTPC Vidyut Vyapar Nigam (NVVN). According to the agreement, 40 MW electricity will be imported from January 1 and if needed, another 40MW from January 31 to June 1.</p> <p style="text-align: justify;">The electricity is being imported from Muzaffarpur-Dhalkebar transmission line under Nepal-India cross border transmission line. Presently, Nepal is importing 80MW electricity from the same transmission line. The additional electricity will cost Nepal the prevailing rate i.e. Rs 5.75 per unit. The additional electricity will be transmitted to Nepal from the newly installed 100 AVA transformer installed by Power Grid Corporation India as the earlier 100 AVA transformer at Muzaffarpur substation became deficient for the additional power import.</p> <p style="text-align: justify;">The 40 MW electricity imported at the first phase will be connected to Hetauda Substation. As the transmission line toward Kathmandu cannot hold the additional electricity, the power will be distributed to the eastern part of the Hetauda. "Doing this, the power generated from western region and other projects nearer to the capital shall not be send to that area equalling the electricity imported from India to Kathmandu," said Prabal Adhikari, Spokesperson of NEA. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4819', 'image' => '20161225015243_NEA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '5004', 'article_category_id' => '1', 'title' => 'Upper Marsyangdi 'A' Operating in Full Capacity', 'sub_title' => '', 'summary' => 'December 25: Upper Marsyangdi 'A', constructed at Bhulbhul of North Lamjung has started power generation in its full capacity of 50 MW. The project which is a joint venture of Chinese multinational company Sino and Nepal's Sagarmatha Hydropower Company was supplying 25MW electricity since last mid-October.', 'content' => '<p style="text-align: justify;">December 25: Upper Marsyangdi 'A', constructed at Bhulbhul of North Lamjung has started power generation in its full capacity of 50 MW. The project which is a joint venture of Chinese multinational company Sino and Nepal's Sagarmatha Hydropower Company was supplying 25MW electricity since last mid-October.</p> <p style="text-align: justify;">"Upper Marsyangdi 'A' started generating additional 25MW of power to its full capacity from December 23," said Karna Adhikari, Public Relation Officer of the project. He added "The produced electricity will be connected to Nepal Electricity Authority's 'Metering Unit' within a week."</p> <p style="text-align: justify;">Two turbines with the capacity of 25MW each has been installed in the project. According to the project, 40MW electricity is being generated from both units at present. Earlier, the project was operating on only one turbine.</p> <p style="text-align: justify;">"The power generation fluctuate as per the direction of NEA," said Adhikari. The project constructed transmission line on its own expenses. The electricity generated from the project has been connected to NEA's Damauli transmission line. According to the project, it will produce 57 million units of electricity in the current dry season and 260.6 million units in rainy season totalling 317.6 million units of electricity in one year.</p> <p style="text-align: justify;">The project has been constructed with a total of Rs 16 billion investment in which Chinese company Sino Hydro and Sagarmatha Hydropower share 90 and 10 per cent respectively. The project which is 5.2 kilometres long is based on run of the river technology. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4818', 'image' => '20161225121919_marshyandi.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '5003', 'article_category_id' => '1', 'title' => 'Om Development to provide 29.20% Bonus Share', 'sub_title' => '', 'summary' => 'December 25: Om Development Bank is providing 29.20 per cent bonus share to its shareholders from the distributable income of FY 2072/73. The 10th annual general meeting of the bank held on December 23 endorsed the proposal of bonus share.', 'content' => '<p style="text-align: justify;">December 25: Om Development Bank is providing 29.20 per cent bonus share to its shareholders from the distributable income of FY 2072/73. The 10<sup>th</sup> annual general meeting of the bank held on December 23 endorsed the proposal of bonus share.</p> <p style="text-align: justify;">According to the bank, it earned Rs 296.5 million net profit by mobilising Rs 11.85 billion deposit collection and loan extension of Rs 9.93 billion.</p> <p style="text-align: justify;">The AGM also unanimously elected eight board members; four each from promoters and general shareholders. Among the elected board members, Sushil Kumar Goshali, Yogendra Lal Pradhan, Rajendra Kumar Bataju and Nikesh Dwa were elected from promoter shareholders. Similarly, Srikrishna Regmi, Karma Kumari Gurung, Niranjan Shrestha and Rabindra Bastola were elected from general shareholders. The board of directors meeting held after the election selected Sushil Kumar Goshali as its Chairman. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4817', 'image' => '20161225113304_om devel.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '5002', 'article_category_id' => '1', 'title' => 'Kumari Bank appoints Siddhartha Capital as Issue Manager', 'sub_title' => '', 'summary' => 'December 25: Kumari Bank has appointed Siddhartha Capital as its issue manager to float 50 per cent right shares of its current paid-up capital amounting to Rs 2.69 billion. Rajeev Giri, Acting CEO of Kumari Bank and Dhruba Timilsina, CEO of Siddhartha Capital signed an agreement related with the matter on December 23.', 'content' => '<p style="text-align: justify;">December 25: Kumari Bank has appointed Siddhartha Capital as its issue manager to float 50 per cent right shares of its current paid-up capital amounting to Rs 2.69 billion. Rajeev Giri, Acting CEO of Kumari Bank and Dhruba Timilsina, CEO of Siddhartha Capital signed an agreement related with the matter on December 23.</p> <p style="text-align: justify;">Earlier, Kumari Bank signed memorandum of understanding (MoU) papers with Kasthamandap Development Bank, Paschimanchal Finance Company, Mahakali Bikash Bank and Kakrebihar Bikash Bank for their acquirement. After acquiring these financial institutions, Kumari Bank will attend paid-up capital of Rs 6.35 billion. Similarly, its branch network will reach 74 and loan extension and deposit will reach Rs 40 billion and 50 billion respectively. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4816', 'image' => '20161225105816_kumari bank.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4998', 'article_category_id' => '1', 'title' => 'Japan to Provide Rs 15.28 billion Loan for Thankot-Naubise Tunnel Road', 'sub_title' => '', 'summary' => 'December 23: The government of Japan is providing Rs 15.28 billion loan assistant to the Nepal government for the construction of Thankot-Naubise tunnel road. Shanta Raj Subedi, Finance Secretary and Masashi Ogawa, Ambassador of Japan to Nepal signed the agreement paper regarding the matter on behalf of their respective governments in a program organised at the Ministry of Finance (MoF) on December 22.', 'content' => '<p style="text-align:justify">December 23: The government of Japan is providing Rs 15.28 billion loan assistant to the Nepal government for the construction of Thankot-Naubise tunnel road. Shanta Raj Subedi, Finance Secretary and Masashi Ogawa, Ambassador of Japan to Nepal signed the agreement paper regarding the matter on behalf of their respective governments in a program organised at the Ministry of Finance (MoF) on December 22.</p> <p style="text-align:justify">Meanwhile, Baikuntha Aryal, Chief of International Economic Cooperation Coordination Division under the MoF and Jun Sakuma, chief representative of Japan International Cooperation Agency (JICA) signed the loan agreement paper on tunnel road construction.</p> <p style="text-align:justify">The Thankot-Naubise tunnel road is the first tunnel road of Nepal and is targeted to finish by 2022. The government initiated the project in a bid to make transportation network more effective. It has allocated Rs 1.86 billion in the budget for the construction of the tunnel road.</p> <p style="text-align:justify">The government made the loan agreement with Japan Government to manage the remaining expenses including technicians. The loan is repayable to Japan in 40 years period with 0.01 interest rate. According to the agreement, interest for first 10 years has been exempted.</p> <p style="text-align:justify">According to the agreement, in the five Kilometres long road from Thankot (Baad Bhanjyang) to Naubise of Dhading, 2.5 kilometres will be a two-lane tunnel and remaining 2.5 kilometres will be an approach road. The 2.2 kilometres approach road will be constructed in Kathmandu and nearly half kilometre will be constructed in Dhading. Two bridges and two culverts will also be constructed in the approach road. After the completion of the project, it is expected that the traffic jams and travel time will significantly decrease at the entry point of the capital. </p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-23', 'modified' => '2016-12-23', 'keywords' => '', 'description' => '', 'sortorder' => '4815', 'image' => '20161223020830_sitapaila-to-naubise.jpg', 'article_date' => '2016-12-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '5017', 'article_category_id' => '34', 'title' => 'Century Acquires Securities Application Collection Approval', 'sub_title' => '', 'summary' => 'December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January 15.', 'content' => '<p style="text-align:justify">December 27: Century Commercial Bank has acquired approval for collection of securities application from Securities Board of Nepal (SEBON). Issuing a press statement, the bank informed of starting the function from January 15.</p> <p> </p> ', 'published' => true, 'created' => '2016-12-27', 'modified' => '2016-12-27', 'keywords' => '', 'description' => '', 'sortorder' => '4829', 'image' => '20161227123935_century.jpg', 'article_date' => '2016-12-27 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '5014', 'article_category_id' => '1', 'title' => 'NMB Bank starts issuing EMV Chip Cards', 'sub_title' => '', 'summary' => 'December 26: NMB Bank has started issuing chip based Debit, Credit and International Dollar Card. Issuing a press statement, the bank informed that the EMV (Europay, MasterCard, VISA) Chip Cards are embedded with a microprocessor chip that encrypts transaction information, thus are most secured in today’s world. ', 'content' => '<p style="text-align: justify;">December 26: NMB Bank has started issuing chip based Debit, Credit and International Dollar Card. </p> <p style="text-align: justify;">Issuing a press statement, the bank informed that the EMV (Europay, MasterCard, VISA) Chip Cards are embedded with a microprocessor chip that encrypts transaction information, thus are most secured in today’s world. </p> <p style="text-align: justify;">"Each time the chip card is used, the transaction data changes using complex algorithm, making it difficult to copy or counterfeit the card. The new chip-enabled cards will improve security of customer transactions when using the card abroad and at home" reads the statement.</p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4828', 'image' => '20161226051843_nmb.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '5013', 'article_category_id' => '1', 'title' => 'Nepal-Bangladesh Power Trade Agreement within the current month', 'sub_title' => '', 'summary' => 'December 26: Nepal-Bangladesh power production and trade agreement is finalizing on first week of January. The agreement will be signed by Janardan Sharma, Ministry of Energy (MoE) from Nepal and Nasrul Hamid, State Minister for Power from Bangladesh in Kathmandu. The agreement will decide the electricity trade model between Nepal and Bangladesh.', 'content' => '<p style="text-align: justify;">December 26: Nepal-Bangladesh power production and trade agreement is finalizing on first week of January. The agreement will be signed by Janardan Sharma, Ministry of Energy (MoE) from Nepal and Nasrul Hamid, State Minister for Power from Bangladesh in Kathmandu. The agreement will decide the electricity trade model between Nepal and Bangladesh.</p> <p style="text-align: justify;">According to a source at MoE, the major agenda of the agreement will be whether the government companies (including joint ventures) on government level or through private company or through any other power trading company will trade the power between the two countries. Previously, Bangladeshi Prime Minister Sheikh Hasina Wazed expressed 'keen interest ' in developing large hydropower projects in Nepal during a meeting with Energy Minister Janardan Sharma in Dhaka on December 8. Bangladesh with a plan to purchase electricity from Nepal, proposed Rs 100 billion investments in hydro sector of Nepal. The bilateral agreement is the result of the proposed investment made by Bangladesh on the energy sector of Nepal.</p> <p style="text-align: justify;">Bangladesh has also proposed of forming a joint task force in order to discuss whether to make joint investment in energy sector or to purchase electricity produced in Nepal or to adopt any other alternative.</p> <p style="text-align: justify;">Presently, Bangladesh is producing 15000 MW of electricity. Similarly, Bangladesh predicts increase in electricity demand to 35,000 MW by 2030. “For the fulfillment of the demand, the investment and power trade process with the neighboring countries is being forwarded,” said Mashfee Binte Shams, Bangladesh Ambassador for Nepal addressing the power summit held on December 15.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4827', 'image' => '20161226042541_PTA-1.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '5012', 'article_category_id' => '1', 'title' => 'Nepal SBI Bank's FPO from Today', 'sub_title' => '', 'summary' => 'December 26: Nepal SBI Bank has floated 67,767.87 units of further public offering (FPO)to the general investors today. The bank floated a share with a face value of Rs 100 at a premium of Rs 871 totalling Rs 971 per unit of share. The interested investors will have to apply for minimum of 10 units of share and maximum of 670 units of shares. According to the bank, the issuance will close early on December 29 and lately on January 9.', 'content' => '<p style="text-align: justify;">December 26: Nepal SBI Bank has floated 67,767.87 units of further public offering (FPO)to the general investors today. The bank floated a share with a face value of Rs 100 at a premium of Rs 871 totalling Rs 971 per unit of share. The interested investors will have to apply for minimum of 10 units of share and maximum of 670 units of shares. According to the bank, the issuance will close early on December 29 and lately on January 9.</p> <p style="text-align: justify;">NMB Capital has been appointed as Issue Manager by the bank. The interested investors can apply from share registrar NMB Capital, all the branch offices of Nepal SBI Bank and Nepal SBI Merchant Banking. After the issuance, the paid-up capital of the bank will reach Rs 3.89 billion. ICRA Nepal has granted 'ICRA Nepal IPO Grade 2' to the issuance.</p> <p style="text-align: justify;">Nepal SBI is floating the FPO in a bid to maintain its promoter: general shareholder ratio to 70:30. By the first quarter of the current FY, the bank earned Rs 350 million net profit. The bank has earning per share (EPS)of Rs 36.48 and net worth of 188.79. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4826', 'image' => '20161226031128_sbi.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '5011', 'article_category_id' => '1', 'title' => 'Groups Lobbying Hard to Appoint Insurance Board Chairman', 'sub_title' => '', 'summary' => 'December 26: Insurance Board, the regulatory body of insurance sector of Nepal will most possibly get a new Chairman on Monday. As per the sources, Maoist centre is lobbying hard to appoint former Maoist soldier or other party worker as the board's chairman.', 'content' => '<p style="text-align:justify">December 26: Insurance Board, the regulatory body of insurance sector of Nepal will most possibly get a new Chairman on Monday. As per the sources, Maoist centre is lobbying hard to appoint former Maoist soldier or other party worker as the board's chairman.</p> <p style="text-align:justify">Although Dr Fatte Bahadur KC, Chairman of IB seemed interested for his third tenure as the Chairman, he is now out of race with the end of his second tenure on December 22. </p> <p style="text-align:justify">After the exit of KC, dozen above persons are tripping political centre of power for the appointment. However, the names of Ramesh Bhattarai, CEO of Mahalaxmi Bikash Bank, Chiranjibi Chapagain, Director of NRB Pokhara Branch, Rishi Ram Gautam, Director of Prabhu Bank and Rabindra Ghimire of Pokhara University are coming to the surface as the candidates for the post. Among them also, Bhattarai and Chapagain are the most possible candidate for the post.</p> <p style="text-align:justify">Dr KC who got appointed during then Finance Minister Dr Baburam Bhattrai spent 8 years in IB as the Chairman. However, he didn't get additional tenure citing unsupportive toward Maoist Centre. Presently, as the Ministry of Finance is under Maoist Centre, the Maoist party is trying hard to bring Maoist supporter to the post. Similarly, there is another group lobbying to bring a Chairman who is well known of the insurance sector. As per the source, there is much possibility that the IB will get a new Chairman on Monday.</p> <p style="text-align:justify">Moreover, various business houses are also lobbying in the Chairman appointment process of the IB. According to the sources, business houses are offering up to Rs 20 million for the post and deals are accordingly being conducted. As per the sources, the business houses are influencing the appointment process as it will give them ease in restructuring the insurance regulation as per their requirement.</p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4825', 'image' => '20161226014130_insurance.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '5010', 'article_category_id' => '1', 'title' => 'Glucovita Distributing Free Sample of 'Glucovita Bolts'', 'sub_title' => '', 'summary' => 'December 26: Dayal Trading, the authorised distributor of Glucovita Bolts for Nepal is distributing free samples in various 100 schools. Issuing a press statement, the company said that the campaign is aimed toward establishing the product in the Nepali market as well as to convince the customers about its quality.', 'content' => '<p style="text-align: justify;">December 26: Dayal Trading, the authorised distributor of Glucovita Bolts for Nepal is distributing free samples in various 100 schools. Issuing a press statement, the company said that the campaign is aimed toward establishing the product in the Nepali market as well as to convince the customers about its quality.</p> <p style="text-align: justify;">According to the company, Glucovita Bolts with glucose and iron gives instant energy for body and brain anytime and anywhere.</p> <p style="text-align: justify;">"Be it football match that leaves your child exhausted or a surprise quiz that challenges the mind, you never know when your child needs instant energy. That's why you need Glucovita Bolts. Offering an instant recharge- before, after or during any activity, Glucovita Bolts helps children power through any situation, be it mental or physical," reads the statement.</p> <p style="text-align: justify;">The Glucovita Bolts are available in orange and strawberry taste in the market with a price tag of Rs 20. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4824', 'image' => '20161226120421_glucovita-bolts-orange.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '5009', 'article_category_id' => '1', 'title' => 'Samata Microfinance to issue General Shares', 'sub_title' => '', 'summary' => 'December 26: Samata Microfinance Bittiya Sanstha is issuing general shares worth Rs 9 million. The 10th annual general meeting of the company held on December 24 approved the proposal of issuing the general shares.', 'content' => '<p style="text-align: justify;">December 26: Samata Microfinance Bittiya Sanstha is issuing general shares worth Rs 9 million. The 10<sup>th</sup> annual general meeting of the company held on December 24 approved the proposal of issuing the general shares.</p> <p style="text-align: justify;">Similarly, the AGM also endorsed the proposal of expanding its work area. "The organisation mobilising nearly Rs 250 million earned Rs 10 million net profit," said Dammar Mani Thebe Limbu, Chairman of the company.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4823', 'image' => '20161226113653_samata.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '5008', 'article_category_id' => '1', 'title' => 'Newroad Mobile Expo from December 28', 'sub_title' => '', 'summary' => 'December 26: Nepal Mobile Traders Association is organising 'Newroad Mobile Expo 2073' in Newroad, also known as 'Mobile Hub', from December 28 to January 3. The main sponsor of the mobile expo is Ncell.', 'content' => '<p style="text-align: justify;">December 26: Nepal Mobile Traders Association is organising 'Newroad Mobile Expo 2073' in Newroad, also known as 'Mobile Hub', from December 28 to January 3. The main sponsor of the mobile expo is Ncell.</p> <p style="text-align: justify;">According to the organiser, the expo that is being organised with a slogan 'Jahaan Mobile Bazaar Tyahaan Mobile Mahotsav' is aimed at selling superior mobile phones and save customers from frauds. Moreover, the expo also aims on disseminating information on new technology that is available in the market.</p> <p style="text-align: justify;">Purushottam Basnet, President of the association and conveyor of the expo claimed that the expo will be grand and historic till date. He informed of finishing all the expo preparations.</p> <p style="text-align: justify;">As per the organiser, the expo will start from Newroad Gate. Newroad will be decorated by various tools, banners and LCD screen. Big LCD screens installed at Pipalbot will be providing latest technological and brand information to the customers. For the convenience of customers in getting food and coffee, mobile food-court will be mobilised in various places.</p> <p style="text-align: justify;">"On the occasion of the expo, various schemes have been launched on the purchase of mobile phones for the customers," said Aabiskar Lal Shrestha, co-conveyor of the expo. "Every customer will be getting sure shot prizes. In the expo, all smart-phone purchasers will be given free Ncell SIM and 100MB data," he said. "The customers can also win smart-phone through daily lucky draw."</p> <p style="text-align: justify;">The expo will have separate kids zone and gaming zone. Shrestha claims that the expo will be visited by more than 300,000 visitors daily. </p> ', 'published' => true, 'created' => '2016-12-26', 'modified' => '2016-12-26', 'keywords' => '', 'description' => '', 'sortorder' => '4822', 'image' => '20161226112119_newroad mobile expo.jpg', 'article_date' => '2016-12-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '5007', 'article_category_id' => '1', 'title' => 'SEBON Approves 11 BFIs for ASBA Implementation', 'sub_title' => '', 'summary' => 'December 25: Securities Board of Nepal (SEBON) has approved 11 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. . Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application contain', 'content' => '<p style="text-align: justify;">December 25: Securities Board of Nepal (SEBON) has approved 11 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. . Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. Additional 6 BFIs have applied to SEBON for carrying out the system. As per the board, approvals will be given soon after a detail study of the applications.</p> <p style="text-align: justify;">The board has given approval to Century Commercial, Sunrise, Kailash Bikash, Ace Development, Citizens International, Sanima, Laxmi Bank, Sanima Bank, Siddhartha Bank, NIC Asia Bank, NB Bank and Kumari Bank for the implementation of ASBA. The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4821', 'image' => '20161225041913_ASBA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '5006', 'article_category_id' => '1', 'title' => 'Toshiba Launches 3 New Products in Nepali Market', 'sub_title' => '', 'summary' => 'December 25: Japanese Company Toshiba has launched three new products; LED TV, Refrigerator and washing machine in the Nepali market. The authorised distributor of Toshiba for Nepal,EOL Pvt Ltd under Chaudhary Group launched the products organising a program on December 23.', 'content' => '<p style="text-align: justify;">December 25: Japanese Company Toshiba has launched three new products; LED TV, Refrigerator and washing machine in the Nepali market. The authorised distributor of Toshiba for Nepal,EOL Pvt Ltd under Chaudhary Group launched the products organising a program on December 23.</p> <p style="text-align: justify;">"Toshiba LED TV has entered the Nepali market in three new series including L56, L36 and L26," said K N Jha, General Manager of CG. The L56 smart series TV has feature of cloud base platform in which all applications can be stored in cloud server without using TV memory. It also has essential PQ Technology and screen mirroring.</p> <p style="text-align: justify;">Similarly, the TV series L36 and L26 has 5 star protection and 20 Dolby sound output features that encourage environment friendly lifestyle. Moreover, L36 series has been installed with MHL function. "Available in 24-55 inches, these TVs are priced at Rs 24,000 to Rs 92,000 in the market," said Niraj Kumar Thakur, Senior Sales Manager of the company.</p> <p style="text-align: justify;">"Likewise, the refrigerator and washing machines are also in attractive design. They come in S-DD (Super Direct Drive) inverter technology preferred by the customers," he added. Toshiba refrigerator comes with 170-240 litres capacity and priced at Rs 28,000 to 78,000 in the market. Moreover, the washing machines are of 6.5-12 kilograms capacity and are priced at Rs 37,000 to Rs 110,000 in the market. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4820', 'image' => '20161225034152_TOSHIBA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '5005', 'article_category_id' => '1', 'title' => 'NEA Importing Additional Electricity from India to End Power Cut', 'sub_title' => '', 'summary' => 'December 25: Nepal Electricity Authority is importing additional electricity from India in a bid to support its campaign against power cut. On December 22, a complementary PPA on importing additional 80MW electricity in two phases was signed by Kulman Ghising, Executive Director of NEA and Arun Kumar Garg, Executive Director of NodAl Agency NTPC Vidyut Vyapar Nigam (NVVN). According to the agreement, 40 MW electricity will be imported from January 1 and if needed, another 40MW from January 31 to June 1.', 'content' => '<p style="text-align: justify;">December 25: Nepal Electricity Authority is importing additional electricity from India in a bid to support its campaign against power cut. On December 22, a complementary PPA on importing additional 80MW electricity in two phases was signed by Kulman Ghising, Executive Director of NEA and Arun Kumar Garg, Executive Director of NodAl Agency NTPC Vidyut Vyapar Nigam (NVVN). According to the agreement, 40 MW electricity will be imported from January 1 and if needed, another 40MW from January 31 to June 1.</p> <p style="text-align: justify;">The electricity is being imported from Muzaffarpur-Dhalkebar transmission line under Nepal-India cross border transmission line. Presently, Nepal is importing 80MW electricity from the same transmission line. The additional electricity will cost Nepal the prevailing rate i.e. Rs 5.75 per unit. The additional electricity will be transmitted to Nepal from the newly installed 100 AVA transformer installed by Power Grid Corporation India as the earlier 100 AVA transformer at Muzaffarpur substation became deficient for the additional power import.</p> <p style="text-align: justify;">The 40 MW electricity imported at the first phase will be connected to Hetauda Substation. As the transmission line toward Kathmandu cannot hold the additional electricity, the power will be distributed to the eastern part of the Hetauda. "Doing this, the power generated from western region and other projects nearer to the capital shall not be send to that area equalling the electricity imported from India to Kathmandu," said Prabal Adhikari, Spokesperson of NEA. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4819', 'image' => '20161225015243_NEA.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '5004', 'article_category_id' => '1', 'title' => 'Upper Marsyangdi 'A' Operating in Full Capacity', 'sub_title' => '', 'summary' => 'December 25: Upper Marsyangdi 'A', constructed at Bhulbhul of North Lamjung has started power generation in its full capacity of 50 MW. The project which is a joint venture of Chinese multinational company Sino and Nepal's Sagarmatha Hydropower Company was supplying 25MW electricity since last mid-October.', 'content' => '<p style="text-align: justify;">December 25: Upper Marsyangdi 'A', constructed at Bhulbhul of North Lamjung has started power generation in its full capacity of 50 MW. The project which is a joint venture of Chinese multinational company Sino and Nepal's Sagarmatha Hydropower Company was supplying 25MW electricity since last mid-October.</p> <p style="text-align: justify;">"Upper Marsyangdi 'A' started generating additional 25MW of power to its full capacity from December 23," said Karna Adhikari, Public Relation Officer of the project. He added "The produced electricity will be connected to Nepal Electricity Authority's 'Metering Unit' within a week."</p> <p style="text-align: justify;">Two turbines with the capacity of 25MW each has been installed in the project. According to the project, 40MW electricity is being generated from both units at present. Earlier, the project was operating on only one turbine.</p> <p style="text-align: justify;">"The power generation fluctuate as per the direction of NEA," said Adhikari. The project constructed transmission line on its own expenses. The electricity generated from the project has been connected to NEA's Damauli transmission line. According to the project, it will produce 57 million units of electricity in the current dry season and 260.6 million units in rainy season totalling 317.6 million units of electricity in one year.</p> <p style="text-align: justify;">The project has been constructed with a total of Rs 16 billion investment in which Chinese company Sino Hydro and Sagarmatha Hydropower share 90 and 10 per cent respectively. The project which is 5.2 kilometres long is based on run of the river technology. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4818', 'image' => '20161225121919_marshyandi.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '5003', 'article_category_id' => '1', 'title' => 'Om Development to provide 29.20% Bonus Share', 'sub_title' => '', 'summary' => 'December 25: Om Development Bank is providing 29.20 per cent bonus share to its shareholders from the distributable income of FY 2072/73. The 10th annual general meeting of the bank held on December 23 endorsed the proposal of bonus share.', 'content' => '<p style="text-align: justify;">December 25: Om Development Bank is providing 29.20 per cent bonus share to its shareholders from the distributable income of FY 2072/73. The 10<sup>th</sup> annual general meeting of the bank held on December 23 endorsed the proposal of bonus share.</p> <p style="text-align: justify;">According to the bank, it earned Rs 296.5 million net profit by mobilising Rs 11.85 billion deposit collection and loan extension of Rs 9.93 billion.</p> <p style="text-align: justify;">The AGM also unanimously elected eight board members; four each from promoters and general shareholders. Among the elected board members, Sushil Kumar Goshali, Yogendra Lal Pradhan, Rajendra Kumar Bataju and Nikesh Dwa were elected from promoter shareholders. Similarly, Srikrishna Regmi, Karma Kumari Gurung, Niranjan Shrestha and Rabindra Bastola were elected from general shareholders. The board of directors meeting held after the election selected Sushil Kumar Goshali as its Chairman. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4817', 'image' => '20161225113304_om devel.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '5002', 'article_category_id' => '1', 'title' => 'Kumari Bank appoints Siddhartha Capital as Issue Manager', 'sub_title' => '', 'summary' => 'December 25: Kumari Bank has appointed Siddhartha Capital as its issue manager to float 50 per cent right shares of its current paid-up capital amounting to Rs 2.69 billion. Rajeev Giri, Acting CEO of Kumari Bank and Dhruba Timilsina, CEO of Siddhartha Capital signed an agreement related with the matter on December 23.', 'content' => '<p style="text-align: justify;">December 25: Kumari Bank has appointed Siddhartha Capital as its issue manager to float 50 per cent right shares of its current paid-up capital amounting to Rs 2.69 billion. Rajeev Giri, Acting CEO of Kumari Bank and Dhruba Timilsina, CEO of Siddhartha Capital signed an agreement related with the matter on December 23.</p> <p style="text-align: justify;">Earlier, Kumari Bank signed memorandum of understanding (MoU) papers with Kasthamandap Development Bank, Paschimanchal Finance Company, Mahakali Bikash Bank and Kakrebihar Bikash Bank for their acquirement. After acquiring these financial institutions, Kumari Bank will attend paid-up capital of Rs 6.35 billion. Similarly, its branch network will reach 74 and loan extension and deposit will reach Rs 40 billion and 50 billion respectively. </p> ', 'published' => true, 'created' => '2016-12-25', 'modified' => '2016-12-25', 'keywords' => '', 'description' => '', 'sortorder' => '4816', 'image' => '20161225105816_kumari bank.jpg', 'article_date' => '2016-12-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4998', 'article_category_id' => '1', 'title' => 'Japan to Provide Rs 15.28 billion Loan for Thankot-Naubise Tunnel Road', 'sub_title' => '', 'summary' => 'December 23: The government of Japan is providing Rs 15.28 billion loan assistant to the Nepal government for the construction of Thankot-Naubise tunnel road. Shanta Raj Subedi, Finance Secretary and Masashi Ogawa, Ambassador of Japan to Nepal signed the agreement paper regarding the matter on behalf of their respective governments in a program organised at the Ministry of Finance (MoF) on December 22.', 'content' => '<p style="text-align:justify">December 23: The government of Japan is providing Rs 15.28 billion loan assistant to the Nepal government for the construction of Thankot-Naubise tunnel road. Shanta Raj Subedi, Finance Secretary and Masashi Ogawa, Ambassador of Japan to Nepal signed the agreement paper regarding the matter on behalf of their respective governments in a program organised at the Ministry of Finance (MoF) on December 22.</p> <p style="text-align:justify">Meanwhile, Baikuntha Aryal, Chief of International Economic Cooperation Coordination Division under the MoF and Jun Sakuma, chief representative of Japan International Cooperation Agency (JICA) signed the loan agreement paper on tunnel road construction.</p> <p style="text-align:justify">The Thankot-Naubise tunnel road is the first tunnel road of Nepal and is targeted to finish by 2022. The government initiated the project in a bid to make transportation network more effective. It has allocated Rs 1.86 billion in the budget for the construction of the tunnel road.</p> <p style="text-align:justify">The government made the loan agreement with Japan Government to manage the remaining expenses including technicians. The loan is repayable to Japan in 40 years period with 0.01 interest rate. According to the agreement, interest for first 10 years has been exempted.</p> <p style="text-align:justify">According to the agreement, in the five Kilometres long road from Thankot (Baad Bhanjyang) to Naubise of Dhading, 2.5 kilometres will be a two-lane tunnel and remaining 2.5 kilometres will be an approach road. The 2.2 kilometres approach road will be constructed in Kathmandu and nearly half kilometre will be constructed in Dhading. Two bridges and two culverts will also be constructed in the approach road. After the completion of the project, it is expected that the traffic jams and travel time will significantly decrease at the entry point of the capital. </p> <p style="text-align:justify"> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-12-23', 'modified' => '2016-12-23', 'keywords' => '', 'description' => '', 'sortorder' => '4815', 'image' => '20161223020830_sitapaila-to-naubise.jpg', 'article_date' => '2016-12-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117