January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your…

January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your…

January 13: Panchakanya Group has been conducting various activities towards conserving the ecological under its corporate social responsibility. The group informed of planting trees on the sidewalks of Kathmandu Metropolitan and Lalitpur Sub- Metropolitan under the campaign. The group planted trees in the one-way sidewalk of Maitighar, Singhadurbar and Padmodaya School. Similarly, it also conducted plantation of trees in the two-way sidewalk in Bhrikutimandap and in the one-way sidewalk from the Stadium to Sundhara. Likewise, the group informed of conducting the plantation program in various locations of Lalitpur Sub-Metropolitan.…

January 13: The Japanese multinational electronics and electrical equipment company Brother has bagged 'Readers' Choice Award & Business Choice Award 2016' for its printers. Brother was crowned with Readers’ Choice Award for Best Printers by PC Magazine, an international magazine based in New York,…

January 13: Nepal Bangladesh (NB) Bank in co-ordination with Ministry of Women, Children and Social Welfare is providing microfinance loan facility. The bank will be providing microfinance loan to women groups, women co-operatives and deprived and local income earning individuals or community of the groups promoted by the Ministry. The bank will be extending the microfinance loan to the groups existed in the working area of its various branches. The bank has recently signed a memorandum of understanding (MoU) with the ministry on the…

January 13: Sunrise Bank has appointed Prabhu Capital as its Issue Manager. Ratna Raj Bajracharya, CEO of Sunrise Bank and Shanker Prasad Kalikot, General Manager of Prabhu Capital signed an agreement paper regarding the matter amid a program on January 12. According to the bank, the agreement was made considering the right issue to be floated in the ratio of 1:0.30.…

January 12: The newly appointed chairman of Insurance Board (IB) Chiranjibi Chapagain has said that the increase in accessibility of insurance sector by making the sector persistent and reliable will be his first priority. Chaipagain who was serving as Director of Nepal Rastra Bank (NRB), Pokhara Branch was appointed as Chairman of IB by the decision of Ministers' Council taken on December…

January 12: Industrialist have questioned Prime Minister that if the government cannot spend the money why should it collect tax. The participants of 66th annual general meeting of Nepal Chamber of Commerce put forward the question to the PM who came for inauguration of the program on January 11. The industrialists, mentioning that the country is being import based, stressed the government to keep export promotion in priority. Moreover, they requested PM for initiation to solve liquidity problem prevailed in banking…

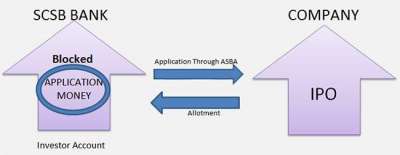

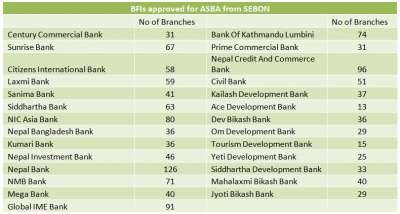

January 11: Securities Board of Nepal (SEBON) is preparing to provide approval to 'C' listed financial institutions (FIs) for ASBA (Application Supported by Blocked Amount) from mid-February 2017. The board which has approved only 'A' and 'B' listed BFIs for ASBA is providing the approval to 'C' listed FIs considering the request of Nepal Financial Institutions Association (NFIA). The association had requested SEBON to grant approval to 'C' listed BFIs for ASBA…

January 12: Sagarmatha Insurance Company is distributing 23 per cent bonus. The 20th annual general meeting of the company held on January 11 approved a proposal of distributing 22 per cent bonus share and 1.157 per cent cash dividend to its…

January 12: Gionee mobile has organised a two-day promotional program in Dhankuta. The program that started on Wednesday, January 11 is being organised by…

January 12: Rural Microfinance Development Centre (RMDC) is providing bonus share and cash dividend to its shareholders. The 18th annual general meeting of the company held on January 11 endorsed a proposal of distributing 10 per cent bonus share and 10 per cent cash dividend to its shareholders. In the AGM, Gorakh Rana, Chairman of the company presented the annual report, balance sheet, profit and loss account and cash flow of the FY 2072/73. During the review period, the company earned Rs 266.7million operating profit. The company with the paid-up capital of Rs 690.2 million extended Rs 17.26 billion loans.…

January 12: Jebils Finance is providing 12.5 per cent bonus share and 0.66 per cent cash dividend. The 7th annual general meeting of the finance held on January 11 approved a proposal of distributing the bonus share to its shareholders. In the AGM, Binod Manandhar, Chairman of the finance company presented the annual report of the FY 2072/73. During the period, the company collected Rs 972 million deposits and extended Rs 949.2 million loans. Similarly, the company earned Rs 43 million net profit during the period. Moreover, the company will be floating 1:1 right shares of the paid-up capital maintained after distribution of bonus share.…

January 12: Deprosc Laghubitta Bikash Bank has entered in 18th year of operation. The bank handed over cupboards and books to Kalika Secondary School for establishing a library on the occasion of its anniversary. Sharada Prasad Kattle, CEO of the bank handed over the merchandise amid a program on January 11. The Laghubitta Bikash Bank established from the investment of Nabil, Agriculture Development, Nepal Bank, Bikash Aayojana Sewa Kendra, Lumbini Finance and Leasing Company is providing microfinance services to 54 districts through 78 branches.…

January 11: Indian flooring brand Green Floormax has started a showroom at Kumaripati of Lalitpur. Anil Kedia, Chairman of Kedia Organisation and Aayush Kedi of RIPL international jointly inaugurated the showroom amid a…

January 11: Securities Board of Nepal (SEBON) has approved 27 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. The board has also requested other BFIs meeting the criteria for ASBA implementation to submit applications.…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '5137', 'article_category_id' => '1', 'title' => 'LG Enjoy TV Range in Nepali Market', 'sub_title' => '', 'summary' => 'January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your Life'.', 'content' => '<p style="text-align: justify;">January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your Life'.</p> <p style="text-align: justify;">Issuing a press statement, the company said that the TV is totally different and incomparable with the other brands and TVs. According to the company, the TV comes with LG's speciality, true colour accuracy, vast size, clarity, metallic design, reality and smoothness in its anti shock screen. The TV series comes with IPS panel in 32 and above inches TV of all models. The newly launched Enjoy TV series will provide complete entertainment to the viewers relieving them from noise and light related complications, claims the company. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4940', 'image' => '20170113010357_enjoy.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '5136', 'article_category_id' => '1', 'title' => 'Panchakanya Group in Ecological Conservation', 'sub_title' => '', 'summary' => 'January 13: Panchakanya Group has been conducting various activities towards conserving the ecological under its corporate social responsibility. The group informed of planting trees on the sidewalks of Kathmandu Metropolitan and Lalitpur Sub- Metropolitan under the campaign. The group planted trees in the one-way sidewalk of Maitighar, Singhadurbar and Padmodaya School. Similarly, it also conducted plantation of trees in the two-way sidewalk in Bhrikutimandap and in the one-way sidewalk from the Stadium to Sundhara. Likewise, the group informed of conducting the plantation program in various locations of Lalitpur Sub-Metropolitan. ', 'content' => '<p style="text-align:justify">January 13: Panchakanya Group has been conducting various activities towards conserving the ecological under its corporate social responsibility. The group informed of planting trees on the sidewalks of Kathmandu Metropolitan and Lalitpur Sub- Metropolitan under the campaign. The group planted trees in the one-way sidewalk of Maitighar, Singhadurbar and Padmodaya School. Similarly, it also conducted plantation of trees in the two-way sidewalk in Bhrikutimandap and in the one-way sidewalk from the Stadium to Sundhara. Likewise, the group informed of conducting the plantation program in various locations of Lalitpur Sub-Metropolitan. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4939', 'image' => '20170113121056_panchakanya.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '5135', 'article_category_id' => '1', 'title' => 'Brother Printer Bags Readers' Choice Award & Business Choice Award 2016', 'sub_title' => '', 'summary' => 'January 13: The Japanese multinational electronics and electrical equipment company Brother has bagged 'Readers' Choice Award & Business Choice Award 2016' for its printers. Brother was crowned with Readers’ Choice Award for Best Printers by PC Magazine, an international magazine based in New York, USA.', 'content' => '<p style="text-align: justify;">January 13: The Japanese multinational electronics and electrical equipment company Brother has bagged 'Readers' Choice Award & Business Choice Award 2016' for its printers. Brother was crowned with Readers’ Choice Award for Best Printers by PC Magazine, an international magazine based in New York, USA.</p> <p style="text-align: justify;">"Brother, a brand well known as a leader in office workflow solutions has continued its dominance over the rest. This is the 8th consecutive year that Brother received Readers’ Choice Award for Best Printers. Brother Printers were also recognised with PC Magazine’s Business Choice Award for the 4th year in a row," reads the statement issued by the company. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4938', 'image' => '20170113112212_Brother.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '5134', 'article_category_id' => '1', 'title' => 'NB Bank to provide Microfinance Loan', 'sub_title' => '', 'summary' => 'January 13: Nepal Bangladesh (NB) Bank in co-ordination with Ministry of Women, Children and Social Welfare is providing microfinance loan facility. The bank will be providing microfinance loan to women groups, women co-operatives and deprived and local income earning individuals or community of the groups promoted by the Ministry. The bank will be extending the microfinance loan to the groups existed in the working area of its various branches. The bank has recently signed a memorandum of understanding (MoU) with the ministry on the matter.', 'content' => '<p style="text-align: justify;">January 13: Nepal Bangladesh (NB) Bank in co-ordination with Ministry of Women, Children and Social Welfare is providing microfinance loan facility. The bank will be providing microfinance loan to women groups, women co-operatives and deprived and local income earning individuals or community of the groups promoted by the Ministry. The bank will be extending the microfinance loan to the groups existed in the working area of its various branches. The bank has recently signed a memorandum of understanding (MoU) with the ministry on the matter.</p> <p style="text-align: justify;">According to the bank, it will start the services from Ghorahi of Dang, Bhairahawa of Rupandehi, Narayangadh of Chitwan, Galchi of Dhading, Sankrantibazaar of Tehrathum and Phidim of Panchthar initially. The bank aims to extend nearly Rs 500 million microfinance loan in the current FY. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4937', 'image' => '20170113110840_nb.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '5133', 'article_category_id' => '1', 'title' => 'Sunrise Appoints Prabhu Capital as Issue Manager', 'sub_title' => '', 'summary' => 'January 13: Sunrise Bank has appointed Prabhu Capital as its Issue Manager. Ratna Raj Bajracharya, CEO of Sunrise Bank and Shanker Prasad Kalikot, General Manager of Prabhu Capital signed an agreement paper regarding the matter amid a program on January 12. According to the bank, the agreement was made considering the right issue to be floated in the ratio of 1:0.30. ', 'content' => '<p style="text-align: justify;">January 13: Sunrise Bank has appointed Prabhu Capital as its Issue Manager. Ratna Raj Bajracharya, CEO of Sunrise Bank and Shanker Prasad Kalikot, General Manager of Prabhu Capital signed an agreement paper regarding the matter amid a program on January 12. According to the bank, the agreement was made considering the right issue to be floated in the ratio of 1:0.30. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4936', 'image' => '20170113105050_sunrise.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '5132', 'article_category_id' => '1', 'title' => ''First Priority on Empowerment and Reliability of IB'', 'sub_title' => '', 'summary' => 'January 12: The newly appointed chairman of Insurance Board (IB) Chiranjibi Chapagain has said that the increase in accessibility of insurance sector by making the sector persistent and reliable will be his first priority. Chaipagain who was serving as Director of Nepal Rastra Bank (NRB), Pokhara Branch was appointed as Chairman of IB by the decision of Ministers' Council taken on December 29.', 'content' => '<p style="text-align: justify;">January 12: The newly appointed chairman of Insurance Board (IB) Chiranjibi Chapagain has said that the increase in accessibility of insurance sector by making the sector persistent and reliable will be his first priority. Chaipagain who was serving as Director of Nepal Rastra Bank (NRB), Pokhara Branch was appointed as Chairman of IB by the decision of Ministers' Council taken on December 29.</p> <p style="text-align: justify;">Chapagain attended an introductory and welcome program on Janaury 11 after being seated in the post. In the program, Chaipagain said that the insurance sector has not developed as expected despite having history of more than 70 years. He said "Therefore, my tenure will be centralised on empowerment and improvement of the sector." He opined that the Acts and Regulation related to the sector will be made up-to-date as the present rules and regulations are age-old. "The history of insurance sector of Nepal lags behind only few years than the banking sector. However, the growth of banking and insurance sector is beyond comparison which should be evaluated," he said.</p> <p style="text-align: justify;">Stressing that the regulatory body should be tough, he said "Presently, there are 26/27 insurance companies. The number will rise tomorrow. If there is no good corporate governance, the sector will lose the confidence. Thus, the insurance companies should expand its area through good corporate governance and improved employee's efficiency." </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4935', 'image' => '20170112042922_INSUARNCE BOARD.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '5131', 'article_category_id' => '1', 'title' => 'Government Should Decline Tax Collection If It Cannot Spend: Industrialists', 'sub_title' => '', 'summary' => 'January 12: Industrialist have questioned Prime Minister that if the government cannot spend the money why should it collect tax. The participants of 66th annual general meeting of Nepal Chamber of Commerce put forward the question to the PM who came for inauguration of the program on January 11. The industrialists, mentioning that the country is being import based, stressed the government to keep export promotion in priority. Moreover, they requested PM for initiation to solve liquidity problem prevailed in banking sector.', 'content' => '<p style="text-align: justify;">January 12: Industrialist have questioned Prime Minister that if the government cannot spend the money why should it collect tax. The participants of 66<sup>th</sup> annual general meeting of Nepal Chamber of Commerce put forward the question to the PM who came for inauguration of the program on January 11. The industrialists, mentioning that the country is being import based, stressed the government to keep export promotion in priority. Moreover, they requested PM for initiation to solve liquidity problem prevailed in banking sector.</p> <p style="text-align: justify;">Meanwhile, Pashupati Murarka, President of Federation of Nepalese Chamber of Commerce and Industries (FNCCI) expressed contentment on receiving electricity for operating industries. He stressed on solving other problems of industrial sector so that to achieve the stated growth rate by the government. Pointing out to the liquidity problems of financial sector, he said "The government should increase the capital expenditure before any monetary crisis arise resulting negative effect in the economy."</p> <p style="text-align: justify;">After hearing the complaints and suggestions from the industrialists, PM Pushpa Kamal Dahal said that the government is attempting to bring the national politics into right direction as it is the base for economic prosperity of any country. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4934', 'image' => '20170112033158_ncc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '5130', 'article_category_id' => '1', 'title' => ''C' Listed FIs in ASBA from mid-February', 'sub_title' => '', 'summary' => 'January 11: Securities Board of Nepal (SEBON) is preparing to provide approval to 'C' listed financial institutions (FIs) for ASBA (Application Supported by Blocked Amount) from mid-February 2017. The board which has approved only 'A' and 'B' listed BFIs for ASBA is providing the approval to 'C' listed FIs considering the request of Nepal Financial Institutions Association (NFIA). The association had requested SEBON to grant approval to 'C' listed BFIs for ASBA implementation', 'content' => '<p style="text-align: justify;">January 11: Securities Board of Nepal (SEBON) is preparing to provide approval to 'C' listed financial institutions (FIs) for ASBA (Application Supported by Blocked Amount) from mid-February 2017. The board which has approved only 'A' and 'B' listed BFIs for ASBA is providing the approval to 'C' listed FIs considering the request of Nepal Financial Institutions Association (NFIA). The association had requested SEBON to grant approval to 'C' listed BFIs for ASBA implementation.</p> <p style="text-align: justify;">"In the initial phase, the board in order to map the success of ASBA system has given approval to commercial banks and development banks as a trial," said Niranjan Ghimire, Assistant Spokesperson of SEBON. He added "Thus, the decision has been taken considering the demand of NFIA to implement ASBA from 'C' listed as well." According to a source, the board is planning make ASBA mandatory by including 'C' listed FIs in the system from mid-February.</p> <p style="text-align: justify;">On January 10, NFIA submitted memorandum to SEBON, Ministry of Finance and Nepal Rastra Bank demanding to include 'C' listed financial institution in ASBA system. The association also submitted the memorandum to Minister of Finance, governor, and chairman of Nepal Chartered Accountant Association. SEBON took a decision of giving approval to 'C' listed FIs for ASBA implementation from mid-February after a day of submission of the memorandum.</p> <p style="text-align: justify;">Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue.</p> <p style="text-align: justify;">The BFIs that were granted approval from SEBON for ASBA includes 18 commercial banks and 9 development banks. SEBON is planning to implement ASBA through all the BFIs so that to provide easy services to the customers.</p> <p style="text-align: justify;">The board informed of receiving additional few application from the BFIs and few in the process. The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. According to the board, the system will not be made mandatory but optional in its initial phase. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4933', 'image' => '20170112025923_ASBA.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '5129', 'article_category_id' => '1', 'title' => 'Sagarmatha Insurance Endorses 23% Bonus', 'sub_title' => '', 'summary' => 'January 12: Sagarmatha Insurance Company is distributing 23 per cent bonus. The 20th annual general meeting of the company held on January 11 approved a proposal of distributing 22 per cent bonus share and 1.157 per cent cash dividend to its shareholders.', 'content' => '<p style="text-align: justify;">January 12: Sagarmatha Insurance Company is distributing 23 per cent bonus. The 20<sup>th</sup> annual general meeting of the company held on January 11 approved a proposal of distributing 22 per cent bonus share and 1.157 per cent cash dividend to its shareholders.</p> <p style="text-align: justify;">Ram Krishna Manandhar, Chairman of the company presenting the annual report of the company said that the company increased its business by 8.86 per cent compared to the previous FY. In the review period, the company earned Rs 1.11 billion premium and Rs 206.7 million net profit.</p> <p style="text-align: justify;">"The customer's claim that has purchased vehicle insurance under the scheme 'Sagarmatha VIP on the spot' will be cleared immediately," said Chankey Chettri, CEO of the company. The scheme was launched aiming to provide quick services to the purchasers of vehicle insurance.</p> <p style="text-align: justify;">Chettri informed that the company targets to increase its branch network to 42 within the current FY from the present 33 branches and sub-branches.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4932', 'image' => '20170112021622_sagar.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '5128', 'article_category_id' => '1', 'title' => 'Gionee's Promotional Program in Dhankuta', 'sub_title' => '', 'summary' => 'January 12: Gionee mobile has organised a two-day promotional program in Dhankuta. The program that started on Wednesday, January 11 is being organised by Teletalk.', 'content' => '<p style="text-align: justify;">January 12: Gionee mobile has organised a two-day promotional program in Dhankuta. The program that started on Wednesday, January 11 is being organised by Teletalk.</p> <p style="text-align: justify;">"The program organised with a co-operation of Om Sai Electronics, the authorised distributor of Gionee for Dhankuta will provide various prizes and discount facility during the program," said Sanjeeb Dhahal, Area Manager of the company. According to Dhahal, customers will be provided cash discount of Rs 200-1000 and prizes including selfie sticks and bags.</p> <p style="text-align: justify;">"Earlier, the company earned Rs 2.5 million by organising such programs in Dharan, Bhojpur, Khandbari. In Dhankuta, the company targets of earning above Rs 700,000," said Pankaj Agrawal, Marketing Assistant of the company. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4931', 'image' => '20170112020048_gionee.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '5127', 'article_category_id' => '1', 'title' => 'RMDC Endorses Dividend', 'sub_title' => '', 'summary' => 'January 12: Rural Microfinance Development Centre (RMDC) is providing bonus share and cash dividend to its shareholders. The 18th annual general meeting of the company held on January 11 endorsed a proposal of distributing 10 per cent bonus share and 10 per cent cash dividend to its shareholders. In the AGM, Gorakh Rana, Chairman of the company presented the annual report, balance sheet, profit and loss account and cash flow of the FY 2072/73. During the review period, the company earned Rs 266.7million operating profit. The company with the paid-up capital of Rs 690.2 million extended Rs 17.26 billion loans. ', 'content' => '<p style="text-align: justify;">January 12: Rural Microfinance Development Centre (RMDC) is providing bonus share and cash dividend to its shareholders. The 18<sup>th</sup> annual general meeting of the company held on January 11 endorsed a proposal of distributing 10 per cent bonus share and 10 per cent cash dividend to its shareholders. In the AGM, Gorakh Rana, Chairman of the company presented the annual report, balance sheet, profit and loss account and cash flow of the FY 2072/73. During the review period, the company earned Rs 266.7million operating profit. The company with the paid-up capital of Rs 690.2 million extended Rs 17.26 billion loans. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4930', 'image' => '20170112013043_rmdc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '5126', 'article_category_id' => '1', 'title' => 'Jebils to Distribute 12.5% Bonus Share', 'sub_title' => '', 'summary' => 'January 12: Jebils Finance is providing 12.5 per cent bonus share and 0.66 per cent cash dividend. The 7th annual general meeting of the finance held on January 11 approved a proposal of distributing the bonus share to its shareholders. In the AGM, Binod Manandhar, Chairman of the finance company presented the annual report of the FY 2072/73. During the period, the company collected Rs 972 million deposits and extended Rs 949.2 million loans. Similarly, the company earned Rs 43 million net profit during the period. Moreover, the company will be floating 1:1 right shares of the paid-up capital maintained after distribution of bonus share. ', 'content' => '<p style="text-align: justify;">January 12: Jebils Finance is providing 12.5 per cent bonus share and 0.66 per cent cash dividend. The 7<sup>th</sup> annual general meeting of the finance held on January 11 approved a proposal of distributing the bonus share to its shareholders. In the AGM, Binod Manandhar, Chairman of the finance company presented the annual report of the FY 2072/73. During the period, the company collected Rs 972 million deposits and extended Rs 949.2 million loans. Similarly, the company earned Rs 43 million net profit during the period. Moreover, the company will be floating 1:1 right shares of the paid-up capital maintained after distribution of bonus share. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4929', 'image' => '20170112012210_jubils.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '5125', 'article_category_id' => '1', 'title' => 'Deprosc Bank in 18th year', 'sub_title' => '', 'summary' => 'January 12: Deprosc Laghubitta Bikash Bank has entered in 18th year of operation. The bank handed over cupboards and books to Kalika Secondary School for establishing a library on the occasion of its anniversary. Sharada Prasad Kattle, CEO of the bank handed over the merchandise amid a program on January 11. The Laghubitta Bikash Bank established from the investment of Nabil, Agriculture Development, Nepal Bank, Bikash Aayojana Sewa Kendra, Lumbini Finance and Leasing Company is providing microfinance services to 54 districts through 78 branches. ', 'content' => '<p style="text-align: justify;">January 12: Deprosc Laghubitta Bikash Bank has entered in 18<sup>th</sup> year of operation. The bank handed over cupboards and books to Kalika Secondary School for establishing a library on the occasion of its anniversary. Sharada Prasad Kattle, CEO of the bank handed over the merchandise amid a program on January 11. The Laghubitta Bikash Bank established from the investment of Nabil, Agriculture Development, Nepal Bank, Bikash Aayojana Sewa Kendra, Lumbini Finance and Leasing Company is providing microfinance services to 54 districts through 78 branches. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4928', 'image' => '20170112011145_diprosc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '5124', 'article_category_id' => '1', 'title' => 'Green Floormax Showroom in Kumaripati', 'sub_title' => '', 'summary' => 'January 11: Indian flooring brand Green Floormax has started a showroom at Kumaripati of Lalitpur. Anil Kedia, Chairman of Kedia Organisation and Aayush Kedi of RIPL international jointly inaugurated the showroom amid a program.', 'content' => '<p style="text-align: justify;">January 11: Indian flooring brand Green Floormax has started a showroom at Kumaripati of Lalitpur. Anil Kedia, Chairman of Kedia Organisation and Aayush Kedi of RIPL international jointly inaugurated the showroom amid a program.</p> <p style="text-align: justify;">The company along with a slogan 'Let the Customer Feel and Experience the product by themselves' brought the showroom into operation. Issuing a press statement, the company informed that the showroom is not for retail sales. The green ply, a product of Green Floormax is brought to the Nepali market by IRPL International, a sister concern of Kedia Organisation. </p> ', 'published' => true, 'created' => '2017-01-11', 'modified' => '2017-01-11', 'keywords' => '', 'description' => '', 'sortorder' => '4927', 'image' => '20170111031612_floormax.jpg', 'article_date' => '2017-01-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '5123', 'article_category_id' => '1', 'title' => '27 BFIs Enter ASBA System', 'sub_title' => '', 'summary' => 'January 11: Securities Board of Nepal (SEBON) has approved 27 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. The board has also requested other BFIs meeting the criteria for ASBA implementation to submit applications. ', 'content' => '<p style="text-align: justify;">January 11: Securities Board of Nepal (SEBON) has approved 27 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. The board has also requested other BFIs meeting the criteria for ASBA implementation to submit applications. </p> <p style="text-align: justify;"><br /> Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. </p> <p style="text-align: justify;"><br /> The BFIs that were granted approval from SEBON for ASBA includes 18 commercial banks and 9 development banks. SEBON is planning to implement ASBA through all the BFIs so that to provide easy services to the customers. </p> <p style="text-align: justify;"><br /> The board informed of receiving additional few application from the BFIs and few in the process. "After thorough study of the applications, more BFIs will be given the approval in coming days," said Neeraj Giri, Spokesperson of the board. </p> <p style="text-align: justify;"><br /> The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. According to the board, the system will not be made mandatory but optional in its initial phase. </p> <p> </p> ', 'published' => true, 'created' => '2017-01-11', 'modified' => '2017-01-11', 'keywords' => '', 'description' => '', 'sortorder' => '4926', 'image' => '20170111025827_ASBA.jpg', 'article_date' => '2017-01-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '5137', 'article_category_id' => '1', 'title' => 'LG Enjoy TV Range in Nepali Market', 'sub_title' => '', 'summary' => 'January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your Life'.', 'content' => '<p style="text-align: justify;">January 13: LG Company has launched Enjoy TV Series in the Nepali market. CG Electronics, the authorised distributor of LG for Nepal launched the TV Series in the market with a slogan 'Bringing Joy in Your Life'.</p> <p style="text-align: justify;">Issuing a press statement, the company said that the TV is totally different and incomparable with the other brands and TVs. According to the company, the TV comes with LG's speciality, true colour accuracy, vast size, clarity, metallic design, reality and smoothness in its anti shock screen. The TV series comes with IPS panel in 32 and above inches TV of all models. The newly launched Enjoy TV series will provide complete entertainment to the viewers relieving them from noise and light related complications, claims the company. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4940', 'image' => '20170113010357_enjoy.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '5136', 'article_category_id' => '1', 'title' => 'Panchakanya Group in Ecological Conservation', 'sub_title' => '', 'summary' => 'January 13: Panchakanya Group has been conducting various activities towards conserving the ecological under its corporate social responsibility. The group informed of planting trees on the sidewalks of Kathmandu Metropolitan and Lalitpur Sub- Metropolitan under the campaign. The group planted trees in the one-way sidewalk of Maitighar, Singhadurbar and Padmodaya School. Similarly, it also conducted plantation of trees in the two-way sidewalk in Bhrikutimandap and in the one-way sidewalk from the Stadium to Sundhara. Likewise, the group informed of conducting the plantation program in various locations of Lalitpur Sub-Metropolitan. ', 'content' => '<p style="text-align:justify">January 13: Panchakanya Group has been conducting various activities towards conserving the ecological under its corporate social responsibility. The group informed of planting trees on the sidewalks of Kathmandu Metropolitan and Lalitpur Sub- Metropolitan under the campaign. The group planted trees in the one-way sidewalk of Maitighar, Singhadurbar and Padmodaya School. Similarly, it also conducted plantation of trees in the two-way sidewalk in Bhrikutimandap and in the one-way sidewalk from the Stadium to Sundhara. Likewise, the group informed of conducting the plantation program in various locations of Lalitpur Sub-Metropolitan. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4939', 'image' => '20170113121056_panchakanya.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '5135', 'article_category_id' => '1', 'title' => 'Brother Printer Bags Readers' Choice Award & Business Choice Award 2016', 'sub_title' => '', 'summary' => 'January 13: The Japanese multinational electronics and electrical equipment company Brother has bagged 'Readers' Choice Award & Business Choice Award 2016' for its printers. Brother was crowned with Readers’ Choice Award for Best Printers by PC Magazine, an international magazine based in New York, USA.', 'content' => '<p style="text-align: justify;">January 13: The Japanese multinational electronics and electrical equipment company Brother has bagged 'Readers' Choice Award & Business Choice Award 2016' for its printers. Brother was crowned with Readers’ Choice Award for Best Printers by PC Magazine, an international magazine based in New York, USA.</p> <p style="text-align: justify;">"Brother, a brand well known as a leader in office workflow solutions has continued its dominance over the rest. This is the 8th consecutive year that Brother received Readers’ Choice Award for Best Printers. Brother Printers were also recognised with PC Magazine’s Business Choice Award for the 4th year in a row," reads the statement issued by the company. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4938', 'image' => '20170113112212_Brother.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '5134', 'article_category_id' => '1', 'title' => 'NB Bank to provide Microfinance Loan', 'sub_title' => '', 'summary' => 'January 13: Nepal Bangladesh (NB) Bank in co-ordination with Ministry of Women, Children and Social Welfare is providing microfinance loan facility. The bank will be providing microfinance loan to women groups, women co-operatives and deprived and local income earning individuals or community of the groups promoted by the Ministry. The bank will be extending the microfinance loan to the groups existed in the working area of its various branches. The bank has recently signed a memorandum of understanding (MoU) with the ministry on the matter.', 'content' => '<p style="text-align: justify;">January 13: Nepal Bangladesh (NB) Bank in co-ordination with Ministry of Women, Children and Social Welfare is providing microfinance loan facility. The bank will be providing microfinance loan to women groups, women co-operatives and deprived and local income earning individuals or community of the groups promoted by the Ministry. The bank will be extending the microfinance loan to the groups existed in the working area of its various branches. The bank has recently signed a memorandum of understanding (MoU) with the ministry on the matter.</p> <p style="text-align: justify;">According to the bank, it will start the services from Ghorahi of Dang, Bhairahawa of Rupandehi, Narayangadh of Chitwan, Galchi of Dhading, Sankrantibazaar of Tehrathum and Phidim of Panchthar initially. The bank aims to extend nearly Rs 500 million microfinance loan in the current FY. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4937', 'image' => '20170113110840_nb.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '5133', 'article_category_id' => '1', 'title' => 'Sunrise Appoints Prabhu Capital as Issue Manager', 'sub_title' => '', 'summary' => 'January 13: Sunrise Bank has appointed Prabhu Capital as its Issue Manager. Ratna Raj Bajracharya, CEO of Sunrise Bank and Shanker Prasad Kalikot, General Manager of Prabhu Capital signed an agreement paper regarding the matter amid a program on January 12. According to the bank, the agreement was made considering the right issue to be floated in the ratio of 1:0.30. ', 'content' => '<p style="text-align: justify;">January 13: Sunrise Bank has appointed Prabhu Capital as its Issue Manager. Ratna Raj Bajracharya, CEO of Sunrise Bank and Shanker Prasad Kalikot, General Manager of Prabhu Capital signed an agreement paper regarding the matter amid a program on January 12. According to the bank, the agreement was made considering the right issue to be floated in the ratio of 1:0.30. </p> ', 'published' => true, 'created' => '2017-01-13', 'modified' => '2017-01-13', 'keywords' => '', 'description' => '', 'sortorder' => '4936', 'image' => '20170113105050_sunrise.jpg', 'article_date' => '2017-01-13 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '5132', 'article_category_id' => '1', 'title' => ''First Priority on Empowerment and Reliability of IB'', 'sub_title' => '', 'summary' => 'January 12: The newly appointed chairman of Insurance Board (IB) Chiranjibi Chapagain has said that the increase in accessibility of insurance sector by making the sector persistent and reliable will be his first priority. Chaipagain who was serving as Director of Nepal Rastra Bank (NRB), Pokhara Branch was appointed as Chairman of IB by the decision of Ministers' Council taken on December 29.', 'content' => '<p style="text-align: justify;">January 12: The newly appointed chairman of Insurance Board (IB) Chiranjibi Chapagain has said that the increase in accessibility of insurance sector by making the sector persistent and reliable will be his first priority. Chaipagain who was serving as Director of Nepal Rastra Bank (NRB), Pokhara Branch was appointed as Chairman of IB by the decision of Ministers' Council taken on December 29.</p> <p style="text-align: justify;">Chapagain attended an introductory and welcome program on Janaury 11 after being seated in the post. In the program, Chaipagain said that the insurance sector has not developed as expected despite having history of more than 70 years. He said "Therefore, my tenure will be centralised on empowerment and improvement of the sector." He opined that the Acts and Regulation related to the sector will be made up-to-date as the present rules and regulations are age-old. "The history of insurance sector of Nepal lags behind only few years than the banking sector. However, the growth of banking and insurance sector is beyond comparison which should be evaluated," he said.</p> <p style="text-align: justify;">Stressing that the regulatory body should be tough, he said "Presently, there are 26/27 insurance companies. The number will rise tomorrow. If there is no good corporate governance, the sector will lose the confidence. Thus, the insurance companies should expand its area through good corporate governance and improved employee's efficiency." </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4935', 'image' => '20170112042922_INSUARNCE BOARD.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '5131', 'article_category_id' => '1', 'title' => 'Government Should Decline Tax Collection If It Cannot Spend: Industrialists', 'sub_title' => '', 'summary' => 'January 12: Industrialist have questioned Prime Minister that if the government cannot spend the money why should it collect tax. The participants of 66th annual general meeting of Nepal Chamber of Commerce put forward the question to the PM who came for inauguration of the program on January 11. The industrialists, mentioning that the country is being import based, stressed the government to keep export promotion in priority. Moreover, they requested PM for initiation to solve liquidity problem prevailed in banking sector.', 'content' => '<p style="text-align: justify;">January 12: Industrialist have questioned Prime Minister that if the government cannot spend the money why should it collect tax. The participants of 66<sup>th</sup> annual general meeting of Nepal Chamber of Commerce put forward the question to the PM who came for inauguration of the program on January 11. The industrialists, mentioning that the country is being import based, stressed the government to keep export promotion in priority. Moreover, they requested PM for initiation to solve liquidity problem prevailed in banking sector.</p> <p style="text-align: justify;">Meanwhile, Pashupati Murarka, President of Federation of Nepalese Chamber of Commerce and Industries (FNCCI) expressed contentment on receiving electricity for operating industries. He stressed on solving other problems of industrial sector so that to achieve the stated growth rate by the government. Pointing out to the liquidity problems of financial sector, he said "The government should increase the capital expenditure before any monetary crisis arise resulting negative effect in the economy."</p> <p style="text-align: justify;">After hearing the complaints and suggestions from the industrialists, PM Pushpa Kamal Dahal said that the government is attempting to bring the national politics into right direction as it is the base for economic prosperity of any country. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4934', 'image' => '20170112033158_ncc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '5130', 'article_category_id' => '1', 'title' => ''C' Listed FIs in ASBA from mid-February', 'sub_title' => '', 'summary' => 'January 11: Securities Board of Nepal (SEBON) is preparing to provide approval to 'C' listed financial institutions (FIs) for ASBA (Application Supported by Blocked Amount) from mid-February 2017. The board which has approved only 'A' and 'B' listed BFIs for ASBA is providing the approval to 'C' listed FIs considering the request of Nepal Financial Institutions Association (NFIA). The association had requested SEBON to grant approval to 'C' listed BFIs for ASBA implementation', 'content' => '<p style="text-align: justify;">January 11: Securities Board of Nepal (SEBON) is preparing to provide approval to 'C' listed financial institutions (FIs) for ASBA (Application Supported by Blocked Amount) from mid-February 2017. The board which has approved only 'A' and 'B' listed BFIs for ASBA is providing the approval to 'C' listed FIs considering the request of Nepal Financial Institutions Association (NFIA). The association had requested SEBON to grant approval to 'C' listed BFIs for ASBA implementation.</p> <p style="text-align: justify;">"In the initial phase, the board in order to map the success of ASBA system has given approval to commercial banks and development banks as a trial," said Niranjan Ghimire, Assistant Spokesperson of SEBON. He added "Thus, the decision has been taken considering the demand of NFIA to implement ASBA from 'C' listed as well." According to a source, the board is planning make ASBA mandatory by including 'C' listed FIs in the system from mid-February.</p> <p style="text-align: justify;">On January 10, NFIA submitted memorandum to SEBON, Ministry of Finance and Nepal Rastra Bank demanding to include 'C' listed financial institution in ASBA system. The association also submitted the memorandum to Minister of Finance, governor, and chairman of Nepal Chartered Accountant Association. SEBON took a decision of giving approval to 'C' listed FIs for ASBA implementation from mid-February after a day of submission of the memorandum.</p> <p style="text-align: justify;">Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue.</p> <p style="text-align: justify;">The BFIs that were granted approval from SEBON for ASBA includes 18 commercial banks and 9 development banks. SEBON is planning to implement ASBA through all the BFIs so that to provide easy services to the customers.</p> <p style="text-align: justify;">The board informed of receiving additional few application from the BFIs and few in the process. The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. According to the board, the system will not be made mandatory but optional in its initial phase. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4933', 'image' => '20170112025923_ASBA.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '5129', 'article_category_id' => '1', 'title' => 'Sagarmatha Insurance Endorses 23% Bonus', 'sub_title' => '', 'summary' => 'January 12: Sagarmatha Insurance Company is distributing 23 per cent bonus. The 20th annual general meeting of the company held on January 11 approved a proposal of distributing 22 per cent bonus share and 1.157 per cent cash dividend to its shareholders.', 'content' => '<p style="text-align: justify;">January 12: Sagarmatha Insurance Company is distributing 23 per cent bonus. The 20<sup>th</sup> annual general meeting of the company held on January 11 approved a proposal of distributing 22 per cent bonus share and 1.157 per cent cash dividend to its shareholders.</p> <p style="text-align: justify;">Ram Krishna Manandhar, Chairman of the company presenting the annual report of the company said that the company increased its business by 8.86 per cent compared to the previous FY. In the review period, the company earned Rs 1.11 billion premium and Rs 206.7 million net profit.</p> <p style="text-align: justify;">"The customer's claim that has purchased vehicle insurance under the scheme 'Sagarmatha VIP on the spot' will be cleared immediately," said Chankey Chettri, CEO of the company. The scheme was launched aiming to provide quick services to the purchasers of vehicle insurance.</p> <p style="text-align: justify;">Chettri informed that the company targets to increase its branch network to 42 within the current FY from the present 33 branches and sub-branches.</p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4932', 'image' => '20170112021622_sagar.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '5128', 'article_category_id' => '1', 'title' => 'Gionee's Promotional Program in Dhankuta', 'sub_title' => '', 'summary' => 'January 12: Gionee mobile has organised a two-day promotional program in Dhankuta. The program that started on Wednesday, January 11 is being organised by Teletalk.', 'content' => '<p style="text-align: justify;">January 12: Gionee mobile has organised a two-day promotional program in Dhankuta. The program that started on Wednesday, January 11 is being organised by Teletalk.</p> <p style="text-align: justify;">"The program organised with a co-operation of Om Sai Electronics, the authorised distributor of Gionee for Dhankuta will provide various prizes and discount facility during the program," said Sanjeeb Dhahal, Area Manager of the company. According to Dhahal, customers will be provided cash discount of Rs 200-1000 and prizes including selfie sticks and bags.</p> <p style="text-align: justify;">"Earlier, the company earned Rs 2.5 million by organising such programs in Dharan, Bhojpur, Khandbari. In Dhankuta, the company targets of earning above Rs 700,000," said Pankaj Agrawal, Marketing Assistant of the company. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4931', 'image' => '20170112020048_gionee.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '5127', 'article_category_id' => '1', 'title' => 'RMDC Endorses Dividend', 'sub_title' => '', 'summary' => 'January 12: Rural Microfinance Development Centre (RMDC) is providing bonus share and cash dividend to its shareholders. The 18th annual general meeting of the company held on January 11 endorsed a proposal of distributing 10 per cent bonus share and 10 per cent cash dividend to its shareholders. In the AGM, Gorakh Rana, Chairman of the company presented the annual report, balance sheet, profit and loss account and cash flow of the FY 2072/73. During the review period, the company earned Rs 266.7million operating profit. The company with the paid-up capital of Rs 690.2 million extended Rs 17.26 billion loans. ', 'content' => '<p style="text-align: justify;">January 12: Rural Microfinance Development Centre (RMDC) is providing bonus share and cash dividend to its shareholders. The 18<sup>th</sup> annual general meeting of the company held on January 11 endorsed a proposal of distributing 10 per cent bonus share and 10 per cent cash dividend to its shareholders. In the AGM, Gorakh Rana, Chairman of the company presented the annual report, balance sheet, profit and loss account and cash flow of the FY 2072/73. During the review period, the company earned Rs 266.7million operating profit. The company with the paid-up capital of Rs 690.2 million extended Rs 17.26 billion loans. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4930', 'image' => '20170112013043_rmdc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '5126', 'article_category_id' => '1', 'title' => 'Jebils to Distribute 12.5% Bonus Share', 'sub_title' => '', 'summary' => 'January 12: Jebils Finance is providing 12.5 per cent bonus share and 0.66 per cent cash dividend. The 7th annual general meeting of the finance held on January 11 approved a proposal of distributing the bonus share to its shareholders. In the AGM, Binod Manandhar, Chairman of the finance company presented the annual report of the FY 2072/73. During the period, the company collected Rs 972 million deposits and extended Rs 949.2 million loans. Similarly, the company earned Rs 43 million net profit during the period. Moreover, the company will be floating 1:1 right shares of the paid-up capital maintained after distribution of bonus share. ', 'content' => '<p style="text-align: justify;">January 12: Jebils Finance is providing 12.5 per cent bonus share and 0.66 per cent cash dividend. The 7<sup>th</sup> annual general meeting of the finance held on January 11 approved a proposal of distributing the bonus share to its shareholders. In the AGM, Binod Manandhar, Chairman of the finance company presented the annual report of the FY 2072/73. During the period, the company collected Rs 972 million deposits and extended Rs 949.2 million loans. Similarly, the company earned Rs 43 million net profit during the period. Moreover, the company will be floating 1:1 right shares of the paid-up capital maintained after distribution of bonus share. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4929', 'image' => '20170112012210_jubils.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '5125', 'article_category_id' => '1', 'title' => 'Deprosc Bank in 18th year', 'sub_title' => '', 'summary' => 'January 12: Deprosc Laghubitta Bikash Bank has entered in 18th year of operation. The bank handed over cupboards and books to Kalika Secondary School for establishing a library on the occasion of its anniversary. Sharada Prasad Kattle, CEO of the bank handed over the merchandise amid a program on January 11. The Laghubitta Bikash Bank established from the investment of Nabil, Agriculture Development, Nepal Bank, Bikash Aayojana Sewa Kendra, Lumbini Finance and Leasing Company is providing microfinance services to 54 districts through 78 branches. ', 'content' => '<p style="text-align: justify;">January 12: Deprosc Laghubitta Bikash Bank has entered in 18<sup>th</sup> year of operation. The bank handed over cupboards and books to Kalika Secondary School for establishing a library on the occasion of its anniversary. Sharada Prasad Kattle, CEO of the bank handed over the merchandise amid a program on January 11. The Laghubitta Bikash Bank established from the investment of Nabil, Agriculture Development, Nepal Bank, Bikash Aayojana Sewa Kendra, Lumbini Finance and Leasing Company is providing microfinance services to 54 districts through 78 branches. </p> ', 'published' => true, 'created' => '2017-01-12', 'modified' => '2017-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '4928', 'image' => '20170112011145_diprosc.jpg', 'article_date' => '2017-01-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '5124', 'article_category_id' => '1', 'title' => 'Green Floormax Showroom in Kumaripati', 'sub_title' => '', 'summary' => 'January 11: Indian flooring brand Green Floormax has started a showroom at Kumaripati of Lalitpur. Anil Kedia, Chairman of Kedia Organisation and Aayush Kedi of RIPL international jointly inaugurated the showroom amid a program.', 'content' => '<p style="text-align: justify;">January 11: Indian flooring brand Green Floormax has started a showroom at Kumaripati of Lalitpur. Anil Kedia, Chairman of Kedia Organisation and Aayush Kedi of RIPL international jointly inaugurated the showroom amid a program.</p> <p style="text-align: justify;">The company along with a slogan 'Let the Customer Feel and Experience the product by themselves' brought the showroom into operation. Issuing a press statement, the company informed that the showroom is not for retail sales. The green ply, a product of Green Floormax is brought to the Nepali market by IRPL International, a sister concern of Kedia Organisation. </p> ', 'published' => true, 'created' => '2017-01-11', 'modified' => '2017-01-11', 'keywords' => '', 'description' => '', 'sortorder' => '4927', 'image' => '20170111031612_floormax.jpg', 'article_date' => '2017-01-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '5123', 'article_category_id' => '1', 'title' => '27 BFIs Enter ASBA System', 'sub_title' => '', 'summary' => 'January 11: Securities Board of Nepal (SEBON) has approved 27 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. The board has also requested other BFIs meeting the criteria for ASBA implementation to submit applications. ', 'content' => '<p style="text-align: justify;">January 11: Securities Board of Nepal (SEBON) has approved 27 banks and financial institutions (BFIs) to implement ASBA (Application Supported by Blocked Amount) system. The board has also requested other BFIs meeting the criteria for ASBA implementation to submit applications. </p> <p style="text-align: justify;"><br /> Under the ASBA system, general investors can apply for initial public offering (IPO) directly through their bank accounts and an IPO applicant's account doesn't get debited until shares are allotted to them. Moreover, ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. </p> <p style="text-align: justify;"><br /> The BFIs that were granted approval from SEBON for ASBA includes 18 commercial banks and 9 development banks. SEBON is planning to implement ASBA through all the BFIs so that to provide easy services to the customers. </p> <p style="text-align: justify;"><br /> The board informed of receiving additional few application from the BFIs and few in the process. "After thorough study of the applications, more BFIs will be given the approval in coming days," said Neeraj Giri, Spokesperson of the board. </p> <p style="text-align: justify;"><br /> The ASBA system is being implemented in order to make the securities issuance faster and transparent providing ease to general investors while trading securities. According to the board, the system will not be made mandatory but optional in its initial phase. </p> <p> </p> ', 'published' => true, 'created' => '2017-01-11', 'modified' => '2017-01-11', 'keywords' => '', 'description' => '', 'sortorder' => '4926', 'image' => '20170111025827_ASBA.jpg', 'article_date' => '2017-01-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117