December 17: The liquidity crisis in Nepal has deepened in the last 4-5…

December 17: The liquidity crisis in Nepal has deepened in the last 4-5…

December 17: Minister for Urban Development Ram Kumari Jhankri has expressed her dissatisfaction over the so-called priority projects of the federal government.…

December 17: Buddha Air, one of the leading private airline companies of Nepal, is facing problems with its aircraft of…

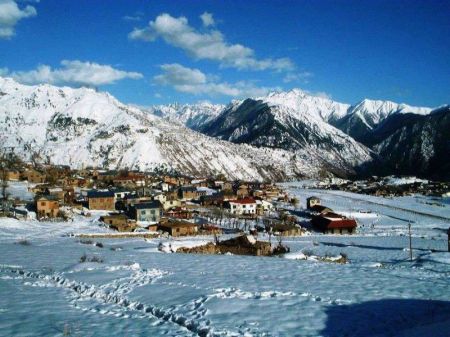

December 17: There are chances of snowfall in high hills and mountainous region of the country from Friday (December 17) onwards due to the western low pressure system (westerly trough) advancing along with the westerly…

December 17: The World Bank has announced a US$ 93 billion replenishment package of the International Development Association (IDA) to help low-income countries respond to the COVID-19 crisis and build a greener, more resilient, and inclusive…

December 16: Finance Minister Janardan Sharma has called upon the private sector to operate government-owned industrial establishments that have been shut down due to various…

December 16: Global IME Bank is all set to borrow $25 million (almost Rs 3 billion) from CDC Group, a development finance institution based in the…

December 16: The Commission for the Investigation of Abuse of Authority (CIAA) has filed a corruption case at the Special Court against five officials of the Kathmandu Metropolitan City (KMC) including KMC Director Bhairav Bahadur…

December 16: Nepal Rastra Bank has appointed Dr Gunakar Bhatta as its new spokesperson.…

December 16: The year-on-year consumer price inflation stood at 5.32 percent in the fourth month of the current fiscal year (FY 2021/22) compared to 4.05 percent a year…

December 16: Nepal’s total trade deficit increased by 56.8 percent to Rs 568.17 billion during the first four months of the current fiscal year (FY…

December 16: Inflow of remittance into Nepal has declined in the fourth month of the current fiscal year compared to the corresponding period of last fiscal…

December 15: The Sixth Chitwan International Industrial Expo is to be organised here from December 17 to 19.…

December 15: Balance of Payments (BOP) of Nepal remained at a deficit of Rs 150.38 billion in the fourth month of the current fiscal year against a surplus of Rs 110.65 billion in the same period of the previous…

December 15: Siddhipur village of Chaudandigadhi Municipality in Udayapur has lately become popular for commercial production of…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '14495', 'article_category_id' => '1', 'title' => 'Real Estate Business Flourishing amid Liquidity Crisis ', 'sub_title' => '', 'summary' => 'December 17: The liquidity crisis in Nepal has deepened in the last 4-5 months. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 17: The liquidity crisis in Nepal has deepened in the last 4-5 months. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">All the economic indicators are disappointing while businessmen are not getting loans from banks even for urgent work. The stock market and remittance inflow have also been steadily declining. However, despite most of the economic indicators looking disappointing, the real estate business in November has been very encouraging. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Although the post-Dashain and Tihar season is considered as the peak season for real estate business, the real estate business was expected to be affected this year as banks were unable to provide loans. But the figures of buying and selling of housings and land in November have dismissed all such apprehensions. And the assumption that large sums of money outside the banking system are active in the real estate business in Nepal has been further strengthened. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">A total of Rs 7 billion revenue has been collected from the purchase and sale of 70,000 houses and land plots in November this year against the transaction of 65,000 houses and land plots during the corresponding period of last fiscal year, when only Rs 5.5 billion revenue was collected. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Although slightly higher in numbers, the situation is quite different this year compared to last year. While liquidity was plentiful in the banking sector last year, it is not possible to get loan from banks even for urgent work this year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Revenue worth Rs 5 billion was collected in October from the transactions of 50,000 houses this year. But in November, when the number of transactions increased by 20,000, the revenue increased by about Rs 1.5 billion. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Chartered Accountant Sudarshan Raj Pandey says this data further confirms the suspicion that the real estate business has been booming even when the economy is in crisis because a large amount of money has been circulating outside the banking system. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">“In Nepal, among the total money sent to the market by Nepal Rastra Bank, not more than 30 percent has reached the banking channels,” said Pandey, “Even if 10 percent of the money is with people, 60 percent of the money is circulating in the non-banking sector.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">He said that one of the areas where money flows through non-banking channels is the real estate. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><em><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">How does black money run on real estate? </span></span></em></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The land administration has not been able to determine the scientific value of real estate. Banks assesse the price for the disbursement of the loan, while the Department of Land Reforms and Management sets the price for the purpose of raising revenue through land and housing transactions. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Real estate experts say that the price is up to 10 times higher than the minimum valuation and a large amount of money is dealt through cash-in-hand.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif""> “Nepalese businessmen are not allowed to invest their earned money abroad. Keeping a large amount of money raises eyebrows. The best solution is to buy a house and land. When buying land, they transfer half of the money through the banking channel and the other half through the non-banking channel,” a source said. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Experts say that the real estate sector is the safest place to keep the money earned by any industrialist through tax evasion or through corruption by politicians and government employees. </span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14241', 'image' => '20211217121523_20211213123222_20170320111604_ep.jpg', 'article_date' => '2021-12-17 12:14:42', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '14497', 'article_category_id' => '1', 'title' => 'Minister Expresses Displeasure over Selection of Project Plans', 'sub_title' => '', 'summary' => 'December 17: Minister for Urban Development Ram Kumari Jhankri has expressed her dissatisfaction over the so-called priority projects of the federal government. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 17: Minister for Urban Development Ram Kumari Jhankri has expressed her dissatisfaction over the so-called priority projects of the federal government. She said that the projects are profiting a handful of people who have access to power centers.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">“People with access to the federal government have been misusing the priority projects. It is the politicians who determine the future course of action of a nation but the politicians are not able to choose proper plans,” said Minister Jhankri while speaking at the meeting of the Development and Technology Committee of federal parliament on Thursday.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to Jhankri, the choice of projects is made without considering the economic impacts and do not comply with the provisions of the Financial Procedure and Financial Accountability Act.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">She said there is no need to build a view tower worth more than Rs 500 million on a hill at a time when hundreds of families are living under makeshift tents. According to Minister Jhankri, the parliament should curb the imbalance in the choice of plans. She said that housing reconstruction and urban development could not be carried properly out due to the lack of coordination among the different tiers of government.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">During the meeting, the chairperson of the committee Kalyani Khadka directed the ministry to ensure proper standard and criteria for construction of buildings at a time when the government itself was constructing buildings for various bodies without giving due consideration to impact on environment and other issues.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to Chairperson Khadka, in order to address the people's intense desire for development in the changed political context, the committee has directed the government to identify the projects that have stalled due to lack of budget and expedite them immediately.</span></span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14240', 'image' => '20211217124210_1639701173.jpg', 'article_date' => '2021-12-17 12:41:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '14494', 'article_category_id' => '1', 'title' => 'Buddha Air Facing Recurring Technical Problems during Flights', 'sub_title' => '', 'summary' => 'December 17: Buddha Air, one of the leading private airline companies of Nepal, is facing problems with its aircraft of late.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">December 17: Buddha Air, one of the leading private airline companies of Nepal, is facing problems with its aircraft of late. The company carries passengers three times more than other airline companies of Nepal. However, Buddha Air has been facing recurring problems with its aircraft. The problem was repeated once again on Thursday. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">An aircraft of Buddha Air that took off from Bharatpur for Kathmandu had to make an emergency landing soon after take-off due to a technical problem in the aircraft’s engine.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Buddha Air said in a press statement that the Beechcraft with call sign 9N-AEE landed safely at Bharatpur Airport after a technical problem in the aircraft’s engine was reported after the take-off.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Altogether 19 passengers including two children were on board the plane. The crew members included a captain, a co-pilot and an air hostess. Buddha Air carried the passengers to Kathmandu with another aircraft.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Earlier on September 27, an aircraft belonging to Buddha Air had faced a technical problem during its flight from Kathmandu to Biratnagar.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">A total of 73 passengers were travelling on the plane, which reported landing gear problems. The aircraft returned back to Kathmandu and made a safe landing after consuming fuel while it circled the valley for some hours. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">In another such incident, a Buddha Air aircraft reported problems during Kathmandu-Bhairahawa flight on December 8. The U4-810 aircraft of Buddha Air made an emergency landing during the occasion. The aircraft was forced to land after a technical problem emerged on the right propeller of the aircraft. Buddha Air informed that it sent the passengers to Kathmandu through another aircraft.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">An official of Buddha Air said these incidents have come to the public’s attention because the company maintains transparency and issues notices regarding minor incidents. The official maintained the company has given high priority to technical security.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> “We are more alert regarding such issues because we have a large fleet and we serve more passengers compared to other airline companies,” said the official, adding, “The aircraft are properly checked while they are on ground and even during flights.”</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14239', 'image' => '20211217114833_1639701101.jpg', 'article_date' => '2021-12-17 11:47:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '14493', 'article_category_id' => '1', 'title' => 'Chances of Snowfall from Today', 'sub_title' => '', 'summary' => 'December 17: There are chances of snowfall in high hills and mountainous region of the country from Friday (December 17) onwards due to the western low pressure system (westerly trough) advancing along with the westerly winds.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 17: There are chances of snowfall in high hills and mountainous region of the country from Friday (December 17) onwards due to the western low pressure system (westerly trough) advancing along with the westerly winds, the Department of Hydrology and Meteorology said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The weather will be partly to generally cloudy in Sudurpaschim, Karnali, Lumbini and Gandaki provinces with the clouds moving towards the east through Sudurpaschim Province from Friday. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">There is possibility of light snowfall at some places of the high hills and mountainous regions in Sudurpaschim, Karnali and Gandaki provinces. Likewise, there are chances of light rain at some places of Sudurpaschim Province. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The department has forecast an increase in cold as the mercury level will further plummet due to the influence of this weather system. It has urged people to adopt necessary safety measures and precaution to protect oneself from the possible impact of the snowfall and cold weather. The influence of this weather system is is likely have an impact on the daily lives of people including mountaineering activities and air transport. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">As per the latest weather bulletin of the department, the Kathmandu Valley recorded the lowest temperature of this year so far at 3.0 degrees Celsius and the highest of 17.5 degrees Celsius. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Jumla recorded the lowest minimum temperature (minus 5.7 degrees Celsius) while Bhairahawa recorded the highest temperature (28.4 degrees Celsius) throughout the country on Thursday. -- RSS </span></span></span><br /> </p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14238', 'image' => '20211217082241_20190220014933_facebook.jpg', 'article_date' => '2021-12-17 08:22:12', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '14492', 'article_category_id' => '1', 'title' => 'World Bank Announces US$ 93.5 Billion Package for World's Poorest Countries', 'sub_title' => '', 'summary' => 'December 17: The World Bank has announced a US$ 93 billion replenishment package of the International Development Association (IDA) to help low-income countries respond to the COVID-19 crisis and build a greener, more resilient, and inclusive future.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">December 17: The World Bank has announced a US$ 93 billion replenishment package of the International Development Association (IDA) to help low-income countries respond to the COVID-19 crisis and build a greener, more resilient, and inclusive future.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">According to a statement issued by the World Bank on December 15, the financing brings together $23.5 billion of contributions from 48 high and middle-income countries with financing raised in the capital markets, repayments, and the World Bank’s own contributions.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The financing package, agreed over a two-day meeting hosted virtually by Japan, is the largest ever mobilized in IDA’s 61-year history, the statement further said.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The World Bank said that IDA’s unique leveraging model enables it to achieve greater value from donor resources. According to the World Bank, every $1 that donors contribute to IDA is now leveraged into almost $4 of financial support for the poorest countries. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> “Today’s generous commitment by our partners is a critical step toward supporting poor countries in their efforts to recover from the COVID-19 crisis,” said World Bank Group's President David Malpass. “We are grateful for the confidence our partners have in IDA as a non-fragmented and efficient platform to tackle development challenges and improve the lives of millions of people around the world.”</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The funds will be delivered to the world’s 74 poorest countries under the 20th replenishment (IDA20) programme, which focuses on helping countries recover from the impacts of the COVID-19 crisis. The World Bank noted that the ongoing pandemic is worsening poverty, undermining growth, and jeopardizing the prospects of a resilient and inclusive development in these countries.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">"Countries are struggling with falling government revenues; increasing debt vulnerabilities; rising risks to fragility, conflict, and instability; and dropping literacy rates. About a third of IDA countries are facing a looming food crisis," the statement added. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">To help countries build back greener, a substantial portion of these funds go to tackling climate change, with a focus on helping countries to adapt to rising climate impacts and preserve biodiversity. IDA will also deepen support to countries to better prepare for future crises, including pandemics, financial shocks, and natural hazards, the statement added.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">With this strong package, the World Bank expects IDA will be able to scale up its support in the pandemic and address health challenges, helping 400 million people receive essential health and nutrition resources. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> The World Bank’s International Development Association (IDA), established in 1960, helps the world’s poorest countries by providing grants and low to zero-interest loans for projects and programs that boost economic growth, reduce poverty, and improve poor people’s lives.</span></span></p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14237', 'image' => '20211217081712_World Bank (2).jpg', 'article_date' => '2021-12-17 08:16:33', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '14491', 'article_category_id' => '1', 'title' => 'FNCCI Organizes Post COVID-19 Economic Revival Conference', 'sub_title' => '', 'summary' => 'December 16: Finance Minister Janardan Sharma has called upon the private sector to operate government-owned industrial establishments that have been shut down due to various reasons.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 16: Finance Minister Janardan Sharma has called upon the private sector to operate government-owned industrial establishments that have been shut down due to various reasons. He said that the government was ready to cooperate with the private sector in this regard. He made such remarks durng a conference organized to discuss post-COVID-19 economic revival strategies</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Addressing the inaugural session of the conference organized by the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) on December 15, Finance Minister Sharma said that economic prosperity cannot be achieved without the participation of the private sector.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">He also shared that the government is amending laws that are detrimental to the development and progress of business establishments. He also asked the private sector to provide suggestions to solve the current liquidity crisis and the government will help accordingly. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The finance minister also claimed that recent political events are attributed to low capital expenditure and liquidity crisis. He said it would be resolved by February. Until the second week of December, the total capital expenditure of the country is 6.13 percent. Finance Minister Sharma said that such expenditure will increase from the next three months of the current fiscal year. There is lack of liquidity in the market due to the government's inability to increase development expendiure. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to Sharma, trade deficit cannot be reduced by selling electricity alone but it is possible by increasing domestic consumption of electricity. The government will bring a policy to increase electricity consumption by providing electricity to industries at concessional rates, asserted the minister.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Arjun Prasad Pokhrel, secretary at the Ministry of Industry, said the government would increase investment in industrial infrastructure. Stating that domestic, small and micro industries are the backbone of the country's economy, industrial areas are being developed targeting such industries. The discussions are being held with all the three levels of government to simplify the process of registering such industries.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Neelam Dhungana, deputy governor of Nepal Rastra Bank, said that the central bank is concerned to resolve the liquidity problem in banks and financial institutions. It is not possible to switch to CCD ratio now from CD ratio, said Dhungana The central bank would not affect the business of the capital market, but would only check where the loans of banks are headed to.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">FNCCI President Shekhar Golchha said that despite the risk of COVID-19, the economy is witnessing positive changes which should be supported through government policies. The government should not delay in prioritizing the economic revival. He also demanded the government to endorse the US-funded MCC project, as the country has not received any foreign aid.</span></span></span></span></p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14236', 'image' => '20211216033026_1639612404.Clipboard03.jpg', 'article_date' => '2021-12-16 15:28:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '14489', 'article_category_id' => '1', 'title' => 'Global IME Bank to Borrow $25 million from CDC Group', 'sub_title' => '', 'summary' => 'December 16: Global IME Bank is all set to borrow $25 million (almost Rs 3 billion) from CDC Group, a development finance institution based in the UK.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 16: Global IME Bank is all set to borrow $25 million (almost Rs 3 billion) from CDC Group, a development finance institution based in the UK. An agreement to this effect was signed on Wednesday, December 15. As per the agreement, the fund needs to be invested in priority sector.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Ratna Raj Bajracharya, CEO of Global IME Bank, and Rabi Rayamajhi, country representative of CDC Group, signed the agreement amid a function. The bank stated that the borrowed amount will help increase the credit flow capacity during the time of liquidity crisis as well as mobilize resources for investment in priority sector specified by the government.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Hydropower, renewable energy, infrastructure construction, manufacture, agriculture, and tourism sectors fall under Nepal’s priority sector lending. The bank has said that the funding will help with post-COVID recovery and to create jobs that will facilitate sustained inclusive growth across all segments of society in Nepal.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Srini Nagarajan, the managing director as well as the head of Asia at CDC Group, said that Nepal has always been a high priority country for CDC Group. Nagarajan also said that the CDC Group is committed to continue supporting the economic recovery and sustainable growth of Nepal. Nagarajan said, “Amidst slowdown in global capital flow due to the pandemic, this partnership signifies the vast opportunities in Nepal”.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Ratna Raj Bajracharya, the CEO of Global IME Bank. expressed his excitement over the partnership and commented that the sanctioned amount would enhance and bolster the lending capacity to businesses across the key economic sectors that fall under priority sector lending.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Nicola Politt, the British Ambassador to Nepal, said that the UK has been supporting Nepal against the impacts of climate change and on post-Covid-19 recovery. She also added that this investment will increase access of domestic businesses to finance.</span></span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14235', 'image' => '20211216031152_1639571741.jpg', 'article_date' => '2021-12-16 15:11:04', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '14488', 'article_category_id' => '1', 'title' => 'CIAA Files Corruption Case against 5 Officials of KMC', 'sub_title' => '', 'summary' => 'December 16: The Commission for the Investigation of Abuse of Authority (CIAA) has filed a corruption case at the Special Court against five officials of the Kathmandu Metropolitan City (KMC) including KMC Director Bhairav Bahadur Bogati.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 16: The Commission for the Investigation of Abuse of Authority (CIAA) has filed a corruption case at the Special Court against five officials of the Kathmandu Metropolitan City (KMC) including KMC Director Bhairav Bahadur Bogati. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Other officials charged by the CIAA include chief of KMC’s procurement unit Bakhat Bahadur Saud, Deputy Director Suman Adhikari, Deputy Director Bir Bahadur Khadka and engineer Umesh Kumar Budhathoki. They have been accused of corruption and misappropriating public property. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In the charge-sheet, CIAA has stated that the accused officials selected a contractor for the construction of a building in KMC Ward-12, Teku by preparing a false evaluation report of the applications received through electronic bidding process. The CIAA started investigation after receiving a complaint against the KMC officials for their alleged involvement in forging documents of contract number 33185 NCBW KMC.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to CIAA, the case was filed as they were found to be involved in corruption by preparing forged documents during the technical evaluation process of the contract. </span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14234', 'image' => '20211216025213_20211210115020_20210624124455_20190205023717_aaaa.jpg', 'article_date' => '2021-12-16 14:51:27', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '14490', 'article_category_id' => '1', 'title' => 'Nepal Rastra Bank appoints Dr Bhatta as New Spokesperson', 'sub_title' => '', 'summary' => 'December 16: Nepal Rastra Bank has appointed Dr Gunakar Bhatta as its new spokesperson. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 16: Nepal Rastra Bank has appointed Dr Gunakar Bhatta as its new spokesperson. Dr Bhatta is also the Executive Director of the Supervision Department of the central bank.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Earlier, Dev Kumar Dhakal was the spokesperson of the bank.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Bhatta, who holds a doctorate in economics, had taken the responsibility as the spokesperson before this appointment as well.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14233', 'image' => '20211216031743_1639637575.jpg', 'article_date' => '2021-12-16 15:16:49', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '14487', 'article_category_id' => '1', 'title' => 'Consumer Price Inflation Increases to 5.32 Percent', 'sub_title' => '', 'summary' => 'December 16: The year-on-year consumer price inflation stood at 5.32 percent in the fourth month of the current fiscal year (FY 2021/22) compared to 4.05 percent a year ago.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">December 16: The year-on-year consumer price inflation stood at 5.32 percent in the fourth month of the current fiscal year (FY 2021/22) compared to 4.05 percent a year ago. According to a report made public by the Nepal Rastra Bank (NRB) on Wednesday, food and beverage inflation stood at 4.79 percent whereas non-food and service inflation stood at 5.73 percent in the review month. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The price of ghee and oil; transportation; meat and fish; non-alcoholic drinks; tobacco products and pulses and legumes sub-categories rose 29.11 percent, 12.36 percent, 10.91 percent, 10.70 percent 10.30 percent and 10.24 percent respectively on y-o-y basis, says the Current Marcoeconomic and Financial Situation Report published by the NRB. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">In the review month, the Kathmandu Valley, Terai, hill and mountain areas recorded 6.14 percent, 3.95 percent, 7.14 percent and 5.00 percent inflation respectively. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Similarly, the y-o-y wholesale price inflation stood at 6.68 percent in the review month compared to 9.41 percent a year ago. According to the report, the y-o-y wholesale price of consumption goods, intermediate goods and capital goods increased 7.43 percent, 6.15 percent and 7.26 percent respectively. The wholesale price of construction materials increased 20.10 percent in the review month. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Likewise, the y-o-y salary and wage rate index increased 5.03 percent in the review month. Such a growth rate was 0.85 percent a year ago. In the review month, salary index and wage rate index increased 9.44 and 3.77 percent, respectively. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The y-o-y consumer price inflation in Nepal in the fourth month of 2020/21 remained 5.32 percent, while inflation in India was 4.91 percent in November 2021.</span></span></p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14232', 'image' => '20211216114757_Macroeconomic-Influencers-19-September.jpg', 'article_date' => '2021-12-16 11:47:14', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '14486', 'article_category_id' => '1', 'title' => 'Nepal’s Trade Deficit Increases by 56.8 Percent', 'sub_title' => '', 'summary' => 'December 16: Nepal’s total trade deficit increased by 56.8 percent to Rs 568.17 billion during the first four months of the current fiscal year (FY 2021/22).', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">December 16: Nepal’s total trade deficit increased by 56.8 percent to Rs 568.17 billion during the first four months of the current fiscal year (FY 2021/22). According to Nepal Rastra Bank (NRB), such a deficit had contracted 12.5 percent in the corresponding period of the previous fiscal year. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The export-import ratio increased to 12.6 percent in the review period from 10.0 percent in the corresponding period of the previous year, states the Current Marcoeconomic and Financial Situation Report published by the NRB on Wednesday (December 15). </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the report, merchandise exports increased by 104.3 percent to Rs 82.12 billion in the first four months of the current fiscal year compared to an increase of 10.8 percent in the same period of the previous year. Destination-wise, exports to India, China and other countries increased 140.2 percent, 7.3 percent, and 23.5 percent respectively. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The export of palm oil, soybean oil, oil cakes, polyester yarn and thread, jute products, among others, increased whereas the export of tea, cardamom, wire, zinc sheet, copper wire rod, among others, decreased in the review period. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">During the first four months of FY 2021/22, merchandise imports increased 61.6 percent to Rs 650.29 billion against a decrease of 10.6 percent a year ago. Destination-wise, imports from India, China and other countries increased 46.1 percent, 56.9 percent, and 117.2 percent respectively, states the NRB report. Imports of petroleum products, transport equipment, vehicle and spare parts, crude palm oil, crude soybean oil, silver, among others, increased whereas imports of cement, chemical fertilizer, pulses, molasses sugar, rice/paddy, among others, decreased in the review period. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Based on customs points, exports from Kanchanpur, Krishnanagar, Mechi and Nepalgunj Customs Office decreased whereas exports from all the other customs points increased in the review period. On the import side, imports from all the major customs points increased in the review period. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14231', 'image' => '20211216113529_Trade.jpg', 'article_date' => '2021-12-16 11:34:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '14485', 'article_category_id' => '1', 'title' => 'Inflow of Remittance Declines by 7.5 Percent: Central Bank', 'sub_title' => '', 'summary' => 'December 16: Inflow of remittance into Nepal has declined in the fourth month of the current fiscal year compared to the corresponding period of last fiscal year.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">December 16: Inflow of remittance into Nepal has declined in the fourth month of the current fiscal year compared to the corresponding period of last fiscal year.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">According to Nepal Rastra Bank (NRB), the inflow of remittance decreased 7.5 percent to Rs 312.42 billion in the review period against an increase of 11.2 percent in the same period of the previous year. In the US dollar terms, remittance inflows decreased 7.8 percent to 2.63 billion in the review period against an increase of 6.4 percent in the same period of the previous year, shows the Current Marcoeconomic and Financial Situation Report published by NRB on Wednesday, December 15.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">According to the report, the number of Nepali migrant workers taking approval for foreign employment increased significantly to 96,382 during the review period. It had decreased 95.7 percent in the same period of the previous year owing to the Covid-19 pandemic.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""> The number of Nepali migrant workers (renew entry) taking approval for foreign employment increased 249.1 percent to 59,723 in the review period. It had decreased 78.9 percent in the same period of the previous year, the NRB report further stated. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Similarly, the net transfer decreased 7.4 percent to Rs 345.65 billion in the review period. Such a transfer had increased 8.9 percent in the same period of the previous year.</span></span></p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14230', 'image' => '20211216112240_Remittance.jpg', 'article_date' => '2021-12-16 11:21:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '14484', 'article_category_id' => '1', 'title' => 'Chitwan International Industrial Expo from December 17 ', 'sub_title' => '', 'summary' => 'December 15: The Sixth Chitwan International Industrial Expo is to be organised here from December 17 to 19. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 15: The Sixth Chitwan International Industrial Expo is to be organised here from December 17 to 19. The event is being co-organised by the Chitwan Association of Industries and the Confederation of Nepalese Industries. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The organizers said in a recent press conference that the preparation for the expo has reached the final stage. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">President of Chitwan Association of Industries Trilochan Kandel said the expo will feature 200 stalls including 50 from India. The expo aims to promote industrial sector affected by COVID-19. The objective of the expo is to support in revival of the nation’s economy hit by the pandemic instead of securing a profit, the organizers said. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2021-12-16', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14229', 'image' => '20211216081758_Chitwan-International-Industrial-Expo-2021-01.jpg', 'article_date' => '2021-12-16 08:17:01', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '14483', 'article_category_id' => '1', 'title' => 'Country’s Balance of Payments in Deficit of Rs 150 Billion', 'sub_title' => '', 'summary' => 'December 15: Balance of Payments (BOP) of Nepal remained at a deficit of Rs 150.38 billion in the fourth month of the current fiscal year against a surplus of Rs 110.65 billion in the same period of the previous year.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">December 15: Balance of Payments (BOP) of Nepal remained at a deficit of Rs 150.38 billion in the fourth month of the current fiscal year against a surplus of Rs 110.65 billion in the same period of the previous year.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">According to the current macroeconomic and financial situation report of the country unveiled by the Nepal Rastra Bank (NRB) on Wednesday (December 15), the BOP remained at a deficit of 1.26 billion in terms of US dollars in the review period against a surplus of 931.7 million in the same period of the previous year.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The report states that the current account remained at a deficit of Rs 223.19 billion in the review period against a surplus of Rs 19.01 billion in the same period of the previous year. In the US Dollar terms, the current account registered a deficit of 1.88 billion in the review period against a surplus of 158.6 million in the same period last year. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">In the review period, capital transfer decreased 39.3 percent to Rs 2.52 billion and net foreign direct investment (FDI) increased 77.0 percent to Rs 6.63 billion, the report further states. In the same period of the previous year, capital transfer and net FDI amounted to Rs 4.15 billion and Rs 3.75 billion respectively.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Similarly, gross foreign exchange reserves decreased 11.0 percent to Rs 1244.85 billion in mid-November 2021 from Rs 1399.03 billion in mid-July 2021. </span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Of the total foreign exchange reserves, reserves held by NRB decreased 11.0 percent to Rs 1107.47 billion in mid-November 2021 from Rs 1244.63 billion in mid-July 2021. Reserves held by banks and financial institutions (except NRB) decreased 11.0 percent to Rs 137.38 billion in mid-November 2021 from Rs 154.39 billion in mid-July 2021. The share of Indian currency in total reserves stood at 26.1 percent in mid-November 2021. </span></span></p> <p> </p> <p> </p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-12-15', 'modified' => '2021-12-16', 'keywords' => '', 'description' => '', 'sortorder' => '14228', 'image' => '20211215094940_Nepal_Rastra_Bank2 2.jpg', 'article_date' => '2021-12-15 21:48:37', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '14481', 'article_category_id' => '1', 'title' => 'Commercial Farming of Turmeric Flourishing in Udayapur ', 'sub_title' => '', 'summary' => 'December 15: Siddhipur village of Chaudandigadhi Municipality in Udayapur has lately become popular for commercial production of turmeric. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 15: Siddhipur village of Chaudandigadhi Municipality in Udayapur has lately become popular for commercial production of turmeric. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Farmers of Siddhipur had started commercial farming of turmeric 10 years ago. Until two years ago, the farmers of Siddhipur used to produce turmeric worth Rs 10 million annually. But the production has increased since last year. Turmeric worth Rs 15 million was produced last year, according to the state-owned national news agency RSS.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Mayor of the Chaudandigadhi Municipality, Khagendra Kumar Rai, said that Siddhipur area has been declared as top turmeric pocket area of the district. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Around 40 farmers of Siddhipur are currently involved in commercial farming of turmeric, RSS further reported. Chief of the District Agriculture Knowledge Centre, Udayapur, Mahesh Chaudhary, informed that commercial farming of turmeric has increased in the area. Commercial turmeric farming is being done in around 137 hectares of land in the district and around 800 metric tonnes of turmeric is produced here annually, he informed. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">According to RSS, Biratnagar-based Golchha and Dugad Mills buy most of the turmeric produced in the district. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Moreover, Saune Khanbu of Triyuga Municipality, Mainamaini and Babala of Belaka, Risku of Katari Municipality and Sirise, Hardeni, Bhalayadanda, and Danuwarbesi areas are also the pocket areas of turmeric, according to the Centre. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2021-12-15', 'modified' => '2021-12-15', 'keywords' => '', 'description' => '', 'sortorder' => '14226', 'image' => '20211215043215_85427212.jpg', 'article_date' => '2021-12-15 16:31:37', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117