August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service…

August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service…

August 11: Kakrebihar Bikash Bank has announced of adopting federal structure. Kankrebihar Bikash Bank based in Surkhet has decided to adopt federal structure along with…

August 11: Syakar Trading Company (STC), the authorised distributor of Honda for Nepal, launched Honda’s new compact SUV in the Nepali market.…

August 11: CG electronics brand has introduced battery compatible TV in the market. Now the customer can enjoy watching TV during power cut, informs the company in a press…

August 11: Mahalaxmi Finance Ltd has won ‘Best Enterprise 2016’ award nominated by prestigious organisation of UK ‘Europe Business Assembly’.…

August 11: Bishwokarma Cement has concluded its Dealer Meet at Fulbari Resort, Pokhara. According to the company, it has organised the dealers…

August 11: MAW, the authorised distributor of Yamaha motorbikes in Nepal has organised a workshop on road safety at Universal College on August 9. As a…

August 11: Sipradi Trading, the authorised distributor of Tata Motors in Nepal is organising car fair from August 10 to August 14 at Naxal,…

August 11: Soaltee Hotel is going to host food festival of Indian dishes in Kakori restaurant. According to the organiser, the fest will showcase several dishes of northern and southern parts of…

August 11: A mobile expo will be held in Pokhara for the first time at Business Complex, located in Prithvi Chowk. Narayan Subedi, Secretary of Fair Management Committee informed that the expo will be held from August 12 to August 16 amid a press conference organised on August 10. According to the organiser,…

August 10: Share trading took place for only 27 minutes on Tuesday (August 9) before it closed down due to circuit breaker. Within 15 minutes of the opening, share market saw the whooping three percent rise in NEPSE index. As a result, NEPSE led first circuit breaker and transactions were…

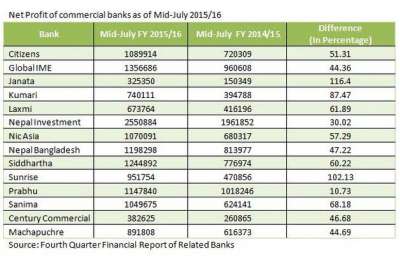

August 10: The profit figure of commercial banks has increased significantly in last fiscal year compared to the previous FY. Analysing the published annual financial reports of 14 commercial banks till August 9, the net profit of these banks has increased by 49 percent . Out of 28 commercial banks in…

August 10: Nepal Rastra Bank (NRB) has implemented the ‘Interest Rate Corridor’ (IRC) from Today. “The market still has excess liquidity. We have…

August 10: Janata Bank has appointed NCM Merchant Banking as its Issue Manager. Janata Bank and NCM made an agreement regarding the matter on August…

August 9: With the Supreme Court’s latest decision of dismissing the writ petition on the polymer note scandal, various government bodies are preparing to forward the suspended process related with the scandal. Earlier, the Australian government had requested the Government of Nepal to provide…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4178', 'article_category_id' => '1', 'title' => 'Hyundai Opens 3S Center in Birtamod', 'sub_title' => '', 'summary' => 'August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service c', 'content' => '<p style="text-align: justify;">August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service center with the collaboration of New Auto Plaza Concern.</p> <p style="text-align: justify;">The newly opened center will provide customers with a complete experience of sales, service and spare parts, all under one roof. The service center made with international standard provides facilities of lounge and full hi-tech workshop staffed by professionally trained technicians for its customers.</p> <p style="text-align: justify;">According to the company, the service center will provide quality repairing services after the purchase of vehicles through well trained technicians. The center provides air-conditioned and WiFi zone lounge with adequate parking space for the customers. It possesses the capacity to repair and provide servicing of 450 vehicles monthly. </p> ', 'published' => true, 'created' => '2016-08-12', 'modified' => '2016-08-12', 'keywords' => '', 'description' => '', 'sortorder' => '4011', 'image' => '20160812104357_hundai.jpg', 'article_date' => '2016-08-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4177', 'article_category_id' => '1', 'title' => 'Kakrebihar Bikash Bank to Adopt Federal Structure', 'sub_title' => '', 'summary' => 'August 11: Kakrebihar Bikash Bank has announced of adopting federal structure. Kankrebihar Bikash Bank based in Surkhet has decided to adopt federal structure along with me', 'content' => '<p style="text-align: justify;">August 11: Kakrebihar Bikash Bank has announced of adopting federal structure. Kankrebihar Bikash Bank based in Surkhet has decided to adopt federal structure along with merger with three other banks and financial institutions (BFIs) after Nepal Rastra Bank's directive.</p> <p style="text-align: justify;"> The bank is merging with Kathmandu based Kasthamandap Development Bank, Butwal based Pashchimanchal Finance and Kanchanpur based Mahakali Development Bank. Earlier, these BFIs had already conducted principle agreement for the merger. Kankrebihar Bikash Bank is merging with the BFIs in order to meet the minimum paid-up capital of Rs 2.5 billion for a national level development bank as per the NRB directive.</p> <p style="text-align: justify;">Previously, NRB initiated the merger policy in a bid to decrease the number of BFIs in Nepal. Merger is a mandatory provision for small institutions that lacks paid-up capital, have increasing operational risks and competition as well. “Discussion regarding the merger between the four BFIs is in final stage,” said Karna Bahadur Sijali, Executive Officer of the bank. After the merger, the merged entity will start transaction in the name of Kasthamandap Development Bank with the paid up of Rs 2.8 billion.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4010', 'image' => '20160811043843_kakre.JPG', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4176', 'article_category_id' => '1', 'title' => 'Honda Launches Compact Premium SUV BR-V', 'sub_title' => '', 'summary' => 'August 11: Syakar Trading Company (STC), the authorised distributor of Honda for Nepal, launched Honda’s new compact SUV in the Nepali market. S', 'content' => '<p style="text-align:justify">August 11: Syakar Trading Company (STC), the authorised distributor of Honda for Nepal, launched Honda’s new compact SUV in the Nepali market. Syakar Trading launched BR-V (Bold Run out Vehicle) amid a program on Tuesday August 9. Speaking at the program, Saurav Jyoti, Chairman of the company said that BR-V is Nepal’s first seven-seat SUV. </p> <p style="text-align:justify">The new BR-V has 210mm of ground clearance. Issuing a press statement, the company informed that different First in-class features are provided via the new vehicle. The new car has first in-class features like heat absorbing windshield, CVT with paddle shifter, second row sliding and reclining function, and third row seating with reclining function.</p> <p style="text-align:justify">The BR-V is powered by 16-valve 4-cylinder 1.5-liter i-VTEC engine. The i-VTEC petrol engine delivers maximum power of 119 PS at 6,600 rpm and maximum torque of 145 Nm at 4,600 rpm. </p> <p style="text-align:justify">“The new car also has 6 speed manual transmission and first in-class Continually Variable Transmission (CVT),”said the company. According to the company, the new car can be operated using the Sports Car inspired paddle switches located just behind the steering spoke.</p> <p style="text-align:justify">The car is available in six colors: carnelian red pearl, white orchid pearl, alabaster silver metallic, golden brown metallic, urban titanium metallic, alabaster silver metallic and taffeta white. The price of the BR-V starts from Rs 4 million, informed the company. Similarly, the price of top model of the new car is priced Rs 5.3 million. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4009', 'image' => '20160811032452_honda.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4175', 'article_category_id' => '1', 'title' => 'CG’s Battery Compatible TV in Market', 'sub_title' => '', 'summary' => 'August 11: CG electronics brand has introduced battery compatible TV in the market. Now the customer can enjoy watching TV during power cut, informs the company in a press statement.', 'content' => '<p style="text-align: justify;">August 11: CG electronics brand has introduced battery compatible TV in the market. Now the customer can enjoy watching TV during power cut, informs the company in a press statement.</p> <p style="text-align: justify;">The company has introduced 20, 24 and 32 inch LED TV that can be operated in 12 volt. “The new LED television has been brought in the market targeting customers reeling under acute power shortage and resided in the rural areas of the nation,” reads the statement.</p> <p style="text-align: justify;">According to the company, the television can be operated through the battery charged from solar panel and can use both AC and DC power supply. External adapter has been installed in the TV to operate from AC. The adapter will protect internal motherboard of TV at the time of thundering. Likewise, DC cable will be provided with the television to operate from DC. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4008', 'image' => '20160811012808_cg.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4174', 'article_category_id' => '1', 'title' => 'Mahalaxmi Finance Wins Best Enterprise Award', 'sub_title' => '', 'summary' => 'August 11: Mahalaxmi Finance Ltd has won ‘Best Enterprise 2016’ award nominated by prestigious organisation of UK ‘Europe Business Assembly’. Moreover,', 'content' => '<p style="text-align: justify;">August 11: Mahalaxmi Finance Ltd has won ‘Best Enterprise 2016’ award nominated by prestigious organisation of UK ‘Europe Business Assembly’. Moreover, Ramesh Kumar Bhattarai, CEO of the company has also won ‘Manager of the Year’ award.</p> <p style="text-align: justify;">The awards will be provided in France on October 7 amid a special program. Mahalaxmi Finance has been able to earn profit and distribute dividend in each year during its 20<sup>th</sup> year of operation.</p> <p style="text-align: justify;">Bhattarai , the present CEO who is also a promoter Managing Director has played an important role in the success and popularity of the institution. The finance informed of emerging as Mahalaxmi Bikash Bank after merging with Malika Bikash Bank and Siddhartha Finance within Mid-September. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4007', 'image' => '20160811011631_mahalaxmi.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4173', 'article_category_id' => '1', 'title' => 'Bishwokarma Cement's Dealers Meet', 'sub_title' => '', 'summary' => 'August 11: Bishwokarma Cement has concluded its Dealer Meet at Fulbari Resort, Pokhara. According to the company, it has organised the dealers m', 'content' => '<p style="text-align: justify;">August 11: Bishwokarma Cement has concluded its Dealer Meet at Fulbari Resort, Pokhara. According to the company, it has organised the dealers meet on the occasion of its 20<sup>th</sup> Anniversary. The company informed that the meet was attended by dealers and retailers from all across the country. Artist Jitu Nepal had given a performance in the program where retailers were provided appreciation certificates.</p> <p style="text-align: justify;">“Bishwokarma cement has been producing international standard cement through advance technology machine,” said Nanda Kishor Sharma, Marketing Head of the company. He informed that the company has planned of selling its high quality clinker in the international market in coming future. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4006', 'image' => '20160811122257_bishwokarma.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4172', 'article_category_id' => '1', 'title' => 'Yamaha's 'Safe Riding Science' at Universal College', 'sub_title' => '', 'summary' => 'August 11: MAW, the authorised distributor of Yamaha motorbikes in Nepal has organised a workshop on road safety at Universal College on August 9. As a p', 'content' => '<p style="text-align:justify">August 11: MAW, the authorised distributor of Yamaha motorbikes in Nepal has organised a workshop on road safety at Universal College on August 9. As a part of its corporate social responsibility (CSR), the company has been organising 'Yamaha Safe Riding Science' in colleges and public places since few years.</p> <p style="text-align:justify">Because of age factor, college students are most vulnerable to road accidents. Keeping the fact in mind, MAW has been conducting awareness programmes targeting the youngsters. According to the company, the workshop was participated by more than 100 students. They were taught about the causes of accidents, ways to avoid them, precautions to be taken while riding, scientific evaluation of critical traffic conditions, proper riding posture, and tips on braking and the significance of traffic rules. According to the organiser, the workshop also provided special training sessions to rookie riders and 42 students participated in test ride.</p> <p style="text-align:justify">YSRS is a CSR initiative of Yamaha worldwide, conducted successfully in Japan, India and many other South Asian countries.</p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4005', 'image' => '20160811115957_yamaha.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4171', 'article_category_id' => '1', 'title' => 'Tata Motors Car Mela Begins', 'sub_title' => '', 'summary' => 'August 11: Sipradi Trading, the authorised distributor of Tata Motors in Nepal is organising car fair from August 10 to August 14 at Naxal, Kathmand', 'content' => '<p style="text-align: justify;">August 11: Sipradi Trading, the authorised distributor of Tata Motors in Nepal is organising car fair from August 10 to August 14 at Naxal, Kathmandu. The company which has been organising car fair annually is also conducting various entertaining programs. According to the organiser, the main attractions of the fair are exhibition of Tata passenger vehicles, immediate vehicle exchange offer and easy financing facilities.</p> <p style="text-align: justify;">The organiser informed that the fair contains food-stalls, b-boying, nail painting, game stalls and contests and musical programs. As per the company, the customers will get full or third party insurance services, 6.5 percent interest rate and discount up to Rs 400,000 in the purchase of the vehicle. During the fair, the company will provide two movie tickets for each test drive and one customer will get inverter among the bookings made. The company will also provide free Thailand trip for a couple through lucky draw during the fair. The company claims to host more than 3,000 visitors in the fair. Entrance to the fair has been made free.</p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4004', 'image' => '20160811115340_car mela.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4170', 'article_category_id' => '1', 'title' => 'Uttar-Dakshin Food Festival in Kakori, Soaltee Hotel', 'sub_title' => '', 'summary' => 'August 11: Soaltee Hotel is going to host food festival of Indian dishes in Kakori restaurant. According to the organiser, the fest will showcase several dishes of northern and southern parts of India.', 'content' => '<p style="text-align: justify;">August 11: Soaltee Hotel is going to host food festival of Indian dishes in Kakori restaurant. According to the organiser, the fest will showcase several dishes of northern and southern parts of India.</p> <p style="text-align: justify;">Issuing a press statement by Soaltee Hotel, the fest will exhibit major dishes of Punjab, Rajasthan, Kashmir, Kerala and Andra Pradesh. The fest will be organised on the occasion of Indian Independence Day on August 15 and last for few days. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4003', 'image' => '20160811114311_soaltee.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4169', 'article_category_id' => '1', 'title' => 'Mobile Expo in Pokhara', 'sub_title' => '', 'summary' => 'August 11: A mobile expo will be held in Pokhara for the first time at Business Complex, located in Prithvi Chowk. Narayan Subedi, Secretary of Fair Management Committee informed that the expo will be held from August 12 to August 16 amid a press conference organised on August 10. According to the organiser, the', 'content' => '<p style="text-align: justify;">August 11: A mobile expo will be held in Pokhara for the first time at Business Complex, located in Prithvi Chowk. Narayan Subedi, Secretary of Fair Management Committee informed that the expo will be held from August 12 to August 16 amid a press conference organised on August 10.</p> <p style="text-align: justify;">According to the organiser, the expo will showcase mobile brands of various 25 companies. The expo will contain 40 stalls providing the information of new technologies. The customers will get five to 10 percent discount while purchasing mobile phones during the expo. Subedi said, "We believe that more customers will be attracted due to discount schemes." The customers visiting the expo will provided five gift hampers daily through lucky draw.</p> <p style="text-align: justify;">As per Mitra Kunwar, Chairman of the complex, customers will get special discount on mobile repairing charges. Shree Prasad Ghale, President of Federation of Electrical Entrepreneur of Nepal informed that the fair will conduct mobile exchange offer aiming to provide services to the customers rather than to earn profit. The expo is being sponsored by Gionee mobile company. “Gionee is sponsoring the expo in a bid to promote the brand,” said Ramji Poudel, Area Sales Manager of Gionee. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4002', 'image' => '20160811113214_expo.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4168', 'article_category_id' => '1', 'title' => 'NEPSE Rises Again', 'sub_title' => '', 'summary' => 'August 10: Share trading took place for only 27 minutes on Tuesday (August 9) before it closed down due to circuit breaker. Within 15 minutes of the opening, share market saw the whooping three percent rise in NEPSE index. As a result, NEPSE led first circuit breaker and transactions were clos', 'content' => '<p>August 10: Share trading took place for only 27 minutes on Tuesday (August 9) before it closed down due to circuit breaker. Within 15 minutes of the opening, share market saw the whooping three percent rise in NEPSE index. As a result, NEPSE led first circuit breaker and transactions were closed for fifteen minutes. When the transaction started for second time, it again saw increase of four percent resulting another half an hour closure of the transaction. Similarly, when the market opened for third time, the stock market witnessed even more growth of five percent. As a result, the share market was closed on Tuesday.</p> <p>Earlier, SEBON had dissolved the committee established to study about money laundering on Monday. According to the brokers, dissolvent of the committee is the main reason for the five percent growth in the index. SEBON had established the committee with an aim to track the black money in the stock market which had resulted dilemma among investors and created negative impact in the share market. Investors were reluctant and unable to expose their income source. However, on Tuesday, SEBON dissolved the committee issuing a communiqué which had created an investment friendly environment in the share market. </p> <p>During the 27 minutes transaction on Tuesday, NEPSE index was increased by 84 percent reaching 1,760 points. On the same day, the indexes of three companies including Prime Commercial Bank, Nepal Bank and Sikhar Insurance increased by 10 percent resulting the circuit break. Moreover, the share price of other ten more companies also increased by about 10 percent on August 9. Among the transaction companies on Tuesday share price of 81 companies increased while three companies saw decrease in their share price. On Tuesday AD ratio of NEPSE was 27 indicating the market is in bullish trend.</p> <p> </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '4001', 'image' => null, 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4167', 'article_category_id' => '1', 'title' => ' Commercial Banks' Profit Increased by 49%', 'sub_title' => '', 'summary' => 'August 10: The profit figure of commercial banks has increased significantly in last fiscal year compared to the previous FY. Analysing the published annual financial reports of 14 commercial banks till August 9, the net profit of these banks has increased by 49 percent . Out of 28 commercial banks in t', 'content' => '<p style="text-align:justify">August 10: The profit figure of commercial banks has increased significantly in last fiscal year compared to the previous FY. Analysing the published annual financial reports of 14 commercial banks till August 9, the net profit of these banks has increased by 49 percent . Out of 28 commercial banks in the country, the remaining 14 have yet to publish their annual financial reports.</p> <p style="text-align:justify">The commercial banks releasing annual financial report earned combinely Rs 14.70 billion in the FY 2015/16 compared to Rs 9.86 billion in FY 2014/15. The last year's earthquake and border blockade created difficult scenario in the country that resulted in less demand of loans and piling up of investment grade liquidity. Nevertheless, the profit of the banks increased sharply defying negative predictions.</p> <p style="text-align:justify">The last year's earthquake and border blockade affected adversely in financial sector. Nepal Rastra Bank has provided facilities to commercial banks such as categorisation of bad debts, loans re-categorisation and res-structuring and expansion of grace period to tackle such problems. Following the policy subsidies provided by the central bank, the profits of commercial banks were not affected.</p> <p style="text-align:justify">Among the commercial banks, Nepal Investment Bank earned the highest net profit of Rs 2.55 billion in last FY. The bank's profit increased by 30 percent compared to previous FY. Similarly, Global IME registered net profit of Rs 1.38 billion in the period increasing by 44.36 percent. In previous FY, the bank's profit was Rs 960.6 million. Similarly, the other six banks overlapped the profit of Rs 1 billion whereas the profit of remaining six banks was under Rs 1billion. Though Janata Bank made highest profit in terms of percentage, the profit earned by the bank is less in amount. On the basis of paid-up capital, the net profit of all banks has increased except the Prabhu Bank.</p> <p style="text-align:justify">The data shows that Nepal Investment Bank ranked the first in terms of total deposits collection and flow of loans. The bank's total deposits increased to Rs 100.8 billion and the flow of loans of Rs 87 billion. In contrast, Janata Bank ranked the lowest in both categories by collecting total deposits of Rs 24.6 billion. The bank's loan totaled Rs 20.47 billion during the review period. Similarly, Sanima Bank ranked top in terms of percentage. The net interest income of Sanima Bank reached Rs 1.72 billion rising by 51.21 percent in the last FY compared to the previous FY. Meanwhile, the net interest income of other banks also increased significantly.</p> <p style="text-align:justify">As per the data, Sanima Bank also leads the line in terms of having lowest bad debts with 0.2 percent. Prabhu Bank, meanwhile, has highest bad debt rate of 8.38 percent crossing the five percent limit set by NRB. </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '4000', 'image' => '20160810015718_COMMER.JPG', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4166', 'article_category_id' => '1', 'title' => 'NRB Activates Interest Rate Corridor', 'sub_title' => '', 'summary' => 'August 10: Nepal Rastra Bank (NRB) has implemented the ‘Interest Rate Corridor’ (IRC) from Today. “The market still has excess liquidity. We have impl', 'content' => '<p>August 10: Nepal Rastra Bank (NRB) has implemented the ‘Interest Rate Corridor’ (IRC). “The market still has excess liquidity. We have implemented the policy in order to bring stability to the interest rates,” says Nar Bahadur Thapa, Executive Director of Research Department at NRB.</p> <p>NRB decided to implement the IRC mechanism to manage liquidity and to lend/borrow loans from banks and financial institutions (BFIs). It comprises of upper bound and lower bound of interest rates. The upper bound interest rate provides liquidity to BFIs whereas, lower bound mops the excess liquidity. Prior to the implementation of IRC, BFIs used to quote the interest rates. With the IRC in place, the central bank will now determine the rates. “IRC is being implemented in a bid to stabilise fluctuation of short-term interest rates as well as to manage excess liquidity in the market,” mentions Thapa.</p> <p>The concept of IRC was first introduced by the then NRB Governor Yuba Raj Khatiwada four years ago. However, it was not implemented. The present NRB Governor, Dr Chiranjivi Nepal once again initiated the IRC mechanism by announcing its implementation it in the monetary policy of the current FY. As per the IRC formulae, NRB will quote interest rate of the tool to be issued by reducing 0.10 percent from the interbank rate before two days. In order to implement corridor, the central monetary authority will issue liquidity mopping tool for two weeks from Wednesday. Presently, the market has excess liquidity of Rs 25 billion. According to Thapa, NRB will issue tool equivalent to Rs 20 billion.</p> <p>“The BFIs will have to deposit money in the set interest rate which will control the interest rates volatility,” he adds. The interest rate corridor has been fixed at 0.3045 percent for the current issue. </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3999', 'image' => '20160810010319_nrb.jpg', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4165', 'article_category_id' => '1', 'title' => 'Janata Bank appoints NCM as Issue Manager', 'sub_title' => '', 'summary' => 'August 10: Janata Bank has appointed NCM Merchant Banking as its Issue Manager. Janata Bank and NCM made an agreement regarding the matter on August 9.', 'content' => '<p style="text-align: justify;">August 10: Janata Bank has appointed NCM Merchant Banking as its Issue Manager. Janata Bank and NCM made an agreement regarding the matter on August 9. Kumar Lamsal, CEO of Janata Bank and Bijay Lal Shrestha, Managing Director of NCM signed the agreement on behalf of their respective organisationS.</p> <p style="text-align: justify;">The bank is preparing to issue 50 percent right shares from its total paid-up capital. Along with the right shares, the bank is planning to issue bonus shares and proceed merger or acquisition process in order to meet the minimum paid-up capital as directed by NRB. The bank is also planning to start 6 branches in various locations within the current FY. </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3998', 'image' => '20160810104752_janata bank.jpg', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4164', 'article_category_id' => '1', 'title' => 'Government Bodies Ready to Implement SC's Order', 'sub_title' => '', 'summary' => 'August 9: With the Supreme Court’s latest decision of dismissing the writ petition on the polymer note scandal, various government bodies are preparing to forward the suspended process related with the scandal. Earlier, the Australian government had requested the Government of Nepal to provide ban', 'content' => '<p style="text-align:justify">August 9: With the Supreme Court’s latest decision of dismissing the writ petition on the polymer note scandal, various government bodies are preparing to forward the suspended process related with the scandal. Earlier, the Australian government had requested the Government of Nepal to provide bank details and other related information of those involved through diplomatic channels citing a large scale corruption on the printing of polymer notes.</p> <p style="text-align:justify">Pandey and Poudel jointly filed a writ on Mangsir 2071 asking for the court’s order to stop the handover of bank details claiming that handover of such details to another country would violate their fundamental rights. However, the joint bench of Chief Justice Sushila Karki and Justice Ishwor Khatiwada on Sunday stated that handover of such details do not violate the writ petitioner’s right to privacy and other rights guaranteed by the constitution.</p> <p style="text-align:justify">“As per the Supreme Court order, the bank account details of all the related individuals will be send to the Australian Government,” said Trilochan Pangeni, Spokesperson of NRB. “After the court order, such details should be handed over also for the diplomatic relation between the two countries. The matter will be coordinated by the Foreign Ministry,” he added. He further added that NRB has not received any order regarding the handover of bank account details on Monday.</p> <p style="text-align:justify">“Following the court order, investigation should be started from the same stage and from the same department where it was suspended earlier,” said Gyanendra Poudel, Spokesperson and Deputy Director General of Money Laundering Investigation Department. According to Commission for the Investigation of Abuse of Authority (CIAA), if Australian Government asked for the bank account details of any individual, it could be provided so as to keep it confidential as per the international law. “Presently, nothing can be commented given that the matter is still under investigation and Nepal government has not given any order as well,” said a high level official of CIAA.</p> <p style="text-align:justify">As per the investigation of the AFP, Note Printing Australia (NPA) through its agents Prithivi Bahadur Pandey and his brother Himalaya Pandey bribed high officials of NRB in order to get the contract of printing of Rs 10 polymer notes. It is not the issue related with Australia only. It is the issue where the higher government officials of Nepal have taken the bribe given by Nepali citizens</p> ', 'published' => true, 'created' => '2016-08-09', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3997', 'image' => '20160809034204_pandy.jpg', 'article_date' => '2016-08-09 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4178', 'article_category_id' => '1', 'title' => 'Hyundai Opens 3S Center in Birtamod', 'sub_title' => '', 'summary' => 'August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service c', 'content' => '<p style="text-align: justify;">August 1: Laxmi Intercontinental, the authorised distributor of Hyundai vehicles for Nepal has opened new 3S center in Birtamod. The company has opened the new service center with the collaboration of New Auto Plaza Concern.</p> <p style="text-align: justify;">The newly opened center will provide customers with a complete experience of sales, service and spare parts, all under one roof. The service center made with international standard provides facilities of lounge and full hi-tech workshop staffed by professionally trained technicians for its customers.</p> <p style="text-align: justify;">According to the company, the service center will provide quality repairing services after the purchase of vehicles through well trained technicians. The center provides air-conditioned and WiFi zone lounge with adequate parking space for the customers. It possesses the capacity to repair and provide servicing of 450 vehicles monthly. </p> ', 'published' => true, 'created' => '2016-08-12', 'modified' => '2016-08-12', 'keywords' => '', 'description' => '', 'sortorder' => '4011', 'image' => '20160812104357_hundai.jpg', 'article_date' => '2016-08-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4177', 'article_category_id' => '1', 'title' => 'Kakrebihar Bikash Bank to Adopt Federal Structure', 'sub_title' => '', 'summary' => 'August 11: Kakrebihar Bikash Bank has announced of adopting federal structure. Kankrebihar Bikash Bank based in Surkhet has decided to adopt federal structure along with me', 'content' => '<p style="text-align: justify;">August 11: Kakrebihar Bikash Bank has announced of adopting federal structure. Kankrebihar Bikash Bank based in Surkhet has decided to adopt federal structure along with merger with three other banks and financial institutions (BFIs) after Nepal Rastra Bank's directive.</p> <p style="text-align: justify;"> The bank is merging with Kathmandu based Kasthamandap Development Bank, Butwal based Pashchimanchal Finance and Kanchanpur based Mahakali Development Bank. Earlier, these BFIs had already conducted principle agreement for the merger. Kankrebihar Bikash Bank is merging with the BFIs in order to meet the minimum paid-up capital of Rs 2.5 billion for a national level development bank as per the NRB directive.</p> <p style="text-align: justify;">Previously, NRB initiated the merger policy in a bid to decrease the number of BFIs in Nepal. Merger is a mandatory provision for small institutions that lacks paid-up capital, have increasing operational risks and competition as well. “Discussion regarding the merger between the four BFIs is in final stage,” said Karna Bahadur Sijali, Executive Officer of the bank. After the merger, the merged entity will start transaction in the name of Kasthamandap Development Bank with the paid up of Rs 2.8 billion.</p> <p style="text-align: justify;"> </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4010', 'image' => '20160811043843_kakre.JPG', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4176', 'article_category_id' => '1', 'title' => 'Honda Launches Compact Premium SUV BR-V', 'sub_title' => '', 'summary' => 'August 11: Syakar Trading Company (STC), the authorised distributor of Honda for Nepal, launched Honda’s new compact SUV in the Nepali market. S', 'content' => '<p style="text-align:justify">August 11: Syakar Trading Company (STC), the authorised distributor of Honda for Nepal, launched Honda’s new compact SUV in the Nepali market. Syakar Trading launched BR-V (Bold Run out Vehicle) amid a program on Tuesday August 9. Speaking at the program, Saurav Jyoti, Chairman of the company said that BR-V is Nepal’s first seven-seat SUV. </p> <p style="text-align:justify">The new BR-V has 210mm of ground clearance. Issuing a press statement, the company informed that different First in-class features are provided via the new vehicle. The new car has first in-class features like heat absorbing windshield, CVT with paddle shifter, second row sliding and reclining function, and third row seating with reclining function.</p> <p style="text-align:justify">The BR-V is powered by 16-valve 4-cylinder 1.5-liter i-VTEC engine. The i-VTEC petrol engine delivers maximum power of 119 PS at 6,600 rpm and maximum torque of 145 Nm at 4,600 rpm. </p> <p style="text-align:justify">“The new car also has 6 speed manual transmission and first in-class Continually Variable Transmission (CVT),”said the company. According to the company, the new car can be operated using the Sports Car inspired paddle switches located just behind the steering spoke.</p> <p style="text-align:justify">The car is available in six colors: carnelian red pearl, white orchid pearl, alabaster silver metallic, golden brown metallic, urban titanium metallic, alabaster silver metallic and taffeta white. The price of the BR-V starts from Rs 4 million, informed the company. Similarly, the price of top model of the new car is priced Rs 5.3 million. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4009', 'image' => '20160811032452_honda.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4175', 'article_category_id' => '1', 'title' => 'CG’s Battery Compatible TV in Market', 'sub_title' => '', 'summary' => 'August 11: CG electronics brand has introduced battery compatible TV in the market. Now the customer can enjoy watching TV during power cut, informs the company in a press statement.', 'content' => '<p style="text-align: justify;">August 11: CG electronics brand has introduced battery compatible TV in the market. Now the customer can enjoy watching TV during power cut, informs the company in a press statement.</p> <p style="text-align: justify;">The company has introduced 20, 24 and 32 inch LED TV that can be operated in 12 volt. “The new LED television has been brought in the market targeting customers reeling under acute power shortage and resided in the rural areas of the nation,” reads the statement.</p> <p style="text-align: justify;">According to the company, the television can be operated through the battery charged from solar panel and can use both AC and DC power supply. External adapter has been installed in the TV to operate from AC. The adapter will protect internal motherboard of TV at the time of thundering. Likewise, DC cable will be provided with the television to operate from DC. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4008', 'image' => '20160811012808_cg.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4174', 'article_category_id' => '1', 'title' => 'Mahalaxmi Finance Wins Best Enterprise Award', 'sub_title' => '', 'summary' => 'August 11: Mahalaxmi Finance Ltd has won ‘Best Enterprise 2016’ award nominated by prestigious organisation of UK ‘Europe Business Assembly’. Moreover,', 'content' => '<p style="text-align: justify;">August 11: Mahalaxmi Finance Ltd has won ‘Best Enterprise 2016’ award nominated by prestigious organisation of UK ‘Europe Business Assembly’. Moreover, Ramesh Kumar Bhattarai, CEO of the company has also won ‘Manager of the Year’ award.</p> <p style="text-align: justify;">The awards will be provided in France on October 7 amid a special program. Mahalaxmi Finance has been able to earn profit and distribute dividend in each year during its 20<sup>th</sup> year of operation.</p> <p style="text-align: justify;">Bhattarai , the present CEO who is also a promoter Managing Director has played an important role in the success and popularity of the institution. The finance informed of emerging as Mahalaxmi Bikash Bank after merging with Malika Bikash Bank and Siddhartha Finance within Mid-September. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4007', 'image' => '20160811011631_mahalaxmi.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4173', 'article_category_id' => '1', 'title' => 'Bishwokarma Cement's Dealers Meet', 'sub_title' => '', 'summary' => 'August 11: Bishwokarma Cement has concluded its Dealer Meet at Fulbari Resort, Pokhara. According to the company, it has organised the dealers m', 'content' => '<p style="text-align: justify;">August 11: Bishwokarma Cement has concluded its Dealer Meet at Fulbari Resort, Pokhara. According to the company, it has organised the dealers meet on the occasion of its 20<sup>th</sup> Anniversary. The company informed that the meet was attended by dealers and retailers from all across the country. Artist Jitu Nepal had given a performance in the program where retailers were provided appreciation certificates.</p> <p style="text-align: justify;">“Bishwokarma cement has been producing international standard cement through advance technology machine,” said Nanda Kishor Sharma, Marketing Head of the company. He informed that the company has planned of selling its high quality clinker in the international market in coming future. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4006', 'image' => '20160811122257_bishwokarma.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4172', 'article_category_id' => '1', 'title' => 'Yamaha's 'Safe Riding Science' at Universal College', 'sub_title' => '', 'summary' => 'August 11: MAW, the authorised distributor of Yamaha motorbikes in Nepal has organised a workshop on road safety at Universal College on August 9. As a p', 'content' => '<p style="text-align:justify">August 11: MAW, the authorised distributor of Yamaha motorbikes in Nepal has organised a workshop on road safety at Universal College on August 9. As a part of its corporate social responsibility (CSR), the company has been organising 'Yamaha Safe Riding Science' in colleges and public places since few years.</p> <p style="text-align:justify">Because of age factor, college students are most vulnerable to road accidents. Keeping the fact in mind, MAW has been conducting awareness programmes targeting the youngsters. According to the company, the workshop was participated by more than 100 students. They were taught about the causes of accidents, ways to avoid them, precautions to be taken while riding, scientific evaluation of critical traffic conditions, proper riding posture, and tips on braking and the significance of traffic rules. According to the organiser, the workshop also provided special training sessions to rookie riders and 42 students participated in test ride.</p> <p style="text-align:justify">YSRS is a CSR initiative of Yamaha worldwide, conducted successfully in Japan, India and many other South Asian countries.</p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4005', 'image' => '20160811115957_yamaha.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4171', 'article_category_id' => '1', 'title' => 'Tata Motors Car Mela Begins', 'sub_title' => '', 'summary' => 'August 11: Sipradi Trading, the authorised distributor of Tata Motors in Nepal is organising car fair from August 10 to August 14 at Naxal, Kathmand', 'content' => '<p style="text-align: justify;">August 11: Sipradi Trading, the authorised distributor of Tata Motors in Nepal is organising car fair from August 10 to August 14 at Naxal, Kathmandu. The company which has been organising car fair annually is also conducting various entertaining programs. According to the organiser, the main attractions of the fair are exhibition of Tata passenger vehicles, immediate vehicle exchange offer and easy financing facilities.</p> <p style="text-align: justify;">The organiser informed that the fair contains food-stalls, b-boying, nail painting, game stalls and contests and musical programs. As per the company, the customers will get full or third party insurance services, 6.5 percent interest rate and discount up to Rs 400,000 in the purchase of the vehicle. During the fair, the company will provide two movie tickets for each test drive and one customer will get inverter among the bookings made. The company will also provide free Thailand trip for a couple through lucky draw during the fair. The company claims to host more than 3,000 visitors in the fair. Entrance to the fair has been made free.</p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4004', 'image' => '20160811115340_car mela.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4170', 'article_category_id' => '1', 'title' => 'Uttar-Dakshin Food Festival in Kakori, Soaltee Hotel', 'sub_title' => '', 'summary' => 'August 11: Soaltee Hotel is going to host food festival of Indian dishes in Kakori restaurant. According to the organiser, the fest will showcase several dishes of northern and southern parts of India.', 'content' => '<p style="text-align: justify;">August 11: Soaltee Hotel is going to host food festival of Indian dishes in Kakori restaurant. According to the organiser, the fest will showcase several dishes of northern and southern parts of India.</p> <p style="text-align: justify;">Issuing a press statement by Soaltee Hotel, the fest will exhibit major dishes of Punjab, Rajasthan, Kashmir, Kerala and Andra Pradesh. The fest will be organised on the occasion of Indian Independence Day on August 15 and last for few days. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4003', 'image' => '20160811114311_soaltee.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4169', 'article_category_id' => '1', 'title' => 'Mobile Expo in Pokhara', 'sub_title' => '', 'summary' => 'August 11: A mobile expo will be held in Pokhara for the first time at Business Complex, located in Prithvi Chowk. Narayan Subedi, Secretary of Fair Management Committee informed that the expo will be held from August 12 to August 16 amid a press conference organised on August 10. According to the organiser, the', 'content' => '<p style="text-align: justify;">August 11: A mobile expo will be held in Pokhara for the first time at Business Complex, located in Prithvi Chowk. Narayan Subedi, Secretary of Fair Management Committee informed that the expo will be held from August 12 to August 16 amid a press conference organised on August 10.</p> <p style="text-align: justify;">According to the organiser, the expo will showcase mobile brands of various 25 companies. The expo will contain 40 stalls providing the information of new technologies. The customers will get five to 10 percent discount while purchasing mobile phones during the expo. Subedi said, "We believe that more customers will be attracted due to discount schemes." The customers visiting the expo will provided five gift hampers daily through lucky draw.</p> <p style="text-align: justify;">As per Mitra Kunwar, Chairman of the complex, customers will get special discount on mobile repairing charges. Shree Prasad Ghale, President of Federation of Electrical Entrepreneur of Nepal informed that the fair will conduct mobile exchange offer aiming to provide services to the customers rather than to earn profit. The expo is being sponsored by Gionee mobile company. “Gionee is sponsoring the expo in a bid to promote the brand,” said Ramji Poudel, Area Sales Manager of Gionee. </p> ', 'published' => true, 'created' => '2016-08-11', 'modified' => '2016-08-11', 'keywords' => '', 'description' => '', 'sortorder' => '4002', 'image' => '20160811113214_expo.jpg', 'article_date' => '2016-08-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4168', 'article_category_id' => '1', 'title' => 'NEPSE Rises Again', 'sub_title' => '', 'summary' => 'August 10: Share trading took place for only 27 minutes on Tuesday (August 9) before it closed down due to circuit breaker. Within 15 minutes of the opening, share market saw the whooping three percent rise in NEPSE index. As a result, NEPSE led first circuit breaker and transactions were clos', 'content' => '<p>August 10: Share trading took place for only 27 minutes on Tuesday (August 9) before it closed down due to circuit breaker. Within 15 minutes of the opening, share market saw the whooping three percent rise in NEPSE index. As a result, NEPSE led first circuit breaker and transactions were closed for fifteen minutes. When the transaction started for second time, it again saw increase of four percent resulting another half an hour closure of the transaction. Similarly, when the market opened for third time, the stock market witnessed even more growth of five percent. As a result, the share market was closed on Tuesday.</p> <p>Earlier, SEBON had dissolved the committee established to study about money laundering on Monday. According to the brokers, dissolvent of the committee is the main reason for the five percent growth in the index. SEBON had established the committee with an aim to track the black money in the stock market which had resulted dilemma among investors and created negative impact in the share market. Investors were reluctant and unable to expose their income source. However, on Tuesday, SEBON dissolved the committee issuing a communiqué which had created an investment friendly environment in the share market. </p> <p>During the 27 minutes transaction on Tuesday, NEPSE index was increased by 84 percent reaching 1,760 points. On the same day, the indexes of three companies including Prime Commercial Bank, Nepal Bank and Sikhar Insurance increased by 10 percent resulting the circuit break. Moreover, the share price of other ten more companies also increased by about 10 percent on August 9. Among the transaction companies on Tuesday share price of 81 companies increased while three companies saw decrease in their share price. On Tuesday AD ratio of NEPSE was 27 indicating the market is in bullish trend.</p> <p> </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '4001', 'image' => null, 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4167', 'article_category_id' => '1', 'title' => ' Commercial Banks' Profit Increased by 49%', 'sub_title' => '', 'summary' => 'August 10: The profit figure of commercial banks has increased significantly in last fiscal year compared to the previous FY. Analysing the published annual financial reports of 14 commercial banks till August 9, the net profit of these banks has increased by 49 percent . Out of 28 commercial banks in t', 'content' => '<p style="text-align:justify">August 10: The profit figure of commercial banks has increased significantly in last fiscal year compared to the previous FY. Analysing the published annual financial reports of 14 commercial banks till August 9, the net profit of these banks has increased by 49 percent . Out of 28 commercial banks in the country, the remaining 14 have yet to publish their annual financial reports.</p> <p style="text-align:justify">The commercial banks releasing annual financial report earned combinely Rs 14.70 billion in the FY 2015/16 compared to Rs 9.86 billion in FY 2014/15. The last year's earthquake and border blockade created difficult scenario in the country that resulted in less demand of loans and piling up of investment grade liquidity. Nevertheless, the profit of the banks increased sharply defying negative predictions.</p> <p style="text-align:justify">The last year's earthquake and border blockade affected adversely in financial sector. Nepal Rastra Bank has provided facilities to commercial banks such as categorisation of bad debts, loans re-categorisation and res-structuring and expansion of grace period to tackle such problems. Following the policy subsidies provided by the central bank, the profits of commercial banks were not affected.</p> <p style="text-align:justify">Among the commercial banks, Nepal Investment Bank earned the highest net profit of Rs 2.55 billion in last FY. The bank's profit increased by 30 percent compared to previous FY. Similarly, Global IME registered net profit of Rs 1.38 billion in the period increasing by 44.36 percent. In previous FY, the bank's profit was Rs 960.6 million. Similarly, the other six banks overlapped the profit of Rs 1 billion whereas the profit of remaining six banks was under Rs 1billion. Though Janata Bank made highest profit in terms of percentage, the profit earned by the bank is less in amount. On the basis of paid-up capital, the net profit of all banks has increased except the Prabhu Bank.</p> <p style="text-align:justify">The data shows that Nepal Investment Bank ranked the first in terms of total deposits collection and flow of loans. The bank's total deposits increased to Rs 100.8 billion and the flow of loans of Rs 87 billion. In contrast, Janata Bank ranked the lowest in both categories by collecting total deposits of Rs 24.6 billion. The bank's loan totaled Rs 20.47 billion during the review period. Similarly, Sanima Bank ranked top in terms of percentage. The net interest income of Sanima Bank reached Rs 1.72 billion rising by 51.21 percent in the last FY compared to the previous FY. Meanwhile, the net interest income of other banks also increased significantly.</p> <p style="text-align:justify">As per the data, Sanima Bank also leads the line in terms of having lowest bad debts with 0.2 percent. Prabhu Bank, meanwhile, has highest bad debt rate of 8.38 percent crossing the five percent limit set by NRB. </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '4000', 'image' => '20160810015718_COMMER.JPG', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4166', 'article_category_id' => '1', 'title' => 'NRB Activates Interest Rate Corridor', 'sub_title' => '', 'summary' => 'August 10: Nepal Rastra Bank (NRB) has implemented the ‘Interest Rate Corridor’ (IRC) from Today. “The market still has excess liquidity. We have impl', 'content' => '<p>August 10: Nepal Rastra Bank (NRB) has implemented the ‘Interest Rate Corridor’ (IRC). “The market still has excess liquidity. We have implemented the policy in order to bring stability to the interest rates,” says Nar Bahadur Thapa, Executive Director of Research Department at NRB.</p> <p>NRB decided to implement the IRC mechanism to manage liquidity and to lend/borrow loans from banks and financial institutions (BFIs). It comprises of upper bound and lower bound of interest rates. The upper bound interest rate provides liquidity to BFIs whereas, lower bound mops the excess liquidity. Prior to the implementation of IRC, BFIs used to quote the interest rates. With the IRC in place, the central bank will now determine the rates. “IRC is being implemented in a bid to stabilise fluctuation of short-term interest rates as well as to manage excess liquidity in the market,” mentions Thapa.</p> <p>The concept of IRC was first introduced by the then NRB Governor Yuba Raj Khatiwada four years ago. However, it was not implemented. The present NRB Governor, Dr Chiranjivi Nepal once again initiated the IRC mechanism by announcing its implementation it in the monetary policy of the current FY. As per the IRC formulae, NRB will quote interest rate of the tool to be issued by reducing 0.10 percent from the interbank rate before two days. In order to implement corridor, the central monetary authority will issue liquidity mopping tool for two weeks from Wednesday. Presently, the market has excess liquidity of Rs 25 billion. According to Thapa, NRB will issue tool equivalent to Rs 20 billion.</p> <p>“The BFIs will have to deposit money in the set interest rate which will control the interest rates volatility,” he adds. The interest rate corridor has been fixed at 0.3045 percent for the current issue. </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3999', 'image' => '20160810010319_nrb.jpg', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4165', 'article_category_id' => '1', 'title' => 'Janata Bank appoints NCM as Issue Manager', 'sub_title' => '', 'summary' => 'August 10: Janata Bank has appointed NCM Merchant Banking as its Issue Manager. Janata Bank and NCM made an agreement regarding the matter on August 9.', 'content' => '<p style="text-align: justify;">August 10: Janata Bank has appointed NCM Merchant Banking as its Issue Manager. Janata Bank and NCM made an agreement regarding the matter on August 9. Kumar Lamsal, CEO of Janata Bank and Bijay Lal Shrestha, Managing Director of NCM signed the agreement on behalf of their respective organisationS.</p> <p style="text-align: justify;">The bank is preparing to issue 50 percent right shares from its total paid-up capital. Along with the right shares, the bank is planning to issue bonus shares and proceed merger or acquisition process in order to meet the minimum paid-up capital as directed by NRB. The bank is also planning to start 6 branches in various locations within the current FY. </p> ', 'published' => true, 'created' => '2016-08-10', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3998', 'image' => '20160810104752_janata bank.jpg', 'article_date' => '2016-08-10 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4164', 'article_category_id' => '1', 'title' => 'Government Bodies Ready to Implement SC's Order', 'sub_title' => '', 'summary' => 'August 9: With the Supreme Court’s latest decision of dismissing the writ petition on the polymer note scandal, various government bodies are preparing to forward the suspended process related with the scandal. Earlier, the Australian government had requested the Government of Nepal to provide ban', 'content' => '<p style="text-align:justify">August 9: With the Supreme Court’s latest decision of dismissing the writ petition on the polymer note scandal, various government bodies are preparing to forward the suspended process related with the scandal. Earlier, the Australian government had requested the Government of Nepal to provide bank details and other related information of those involved through diplomatic channels citing a large scale corruption on the printing of polymer notes.</p> <p style="text-align:justify">Pandey and Poudel jointly filed a writ on Mangsir 2071 asking for the court’s order to stop the handover of bank details claiming that handover of such details to another country would violate their fundamental rights. However, the joint bench of Chief Justice Sushila Karki and Justice Ishwor Khatiwada on Sunday stated that handover of such details do not violate the writ petitioner’s right to privacy and other rights guaranteed by the constitution.</p> <p style="text-align:justify">“As per the Supreme Court order, the bank account details of all the related individuals will be send to the Australian Government,” said Trilochan Pangeni, Spokesperson of NRB. “After the court order, such details should be handed over also for the diplomatic relation between the two countries. The matter will be coordinated by the Foreign Ministry,” he added. He further added that NRB has not received any order regarding the handover of bank account details on Monday.</p> <p style="text-align:justify">“Following the court order, investigation should be started from the same stage and from the same department where it was suspended earlier,” said Gyanendra Poudel, Spokesperson and Deputy Director General of Money Laundering Investigation Department. According to Commission for the Investigation of Abuse of Authority (CIAA), if Australian Government asked for the bank account details of any individual, it could be provided so as to keep it confidential as per the international law. “Presently, nothing can be commented given that the matter is still under investigation and Nepal government has not given any order as well,” said a high level official of CIAA.</p> <p style="text-align:justify">As per the investigation of the AFP, Note Printing Australia (NPA) through its agents Prithivi Bahadur Pandey and his brother Himalaya Pandey bribed high officials of NRB in order to get the contract of printing of Rs 10 polymer notes. It is not the issue related with Australia only. It is the issue where the higher government officials of Nepal have taken the bribe given by Nepali citizens</p> ', 'published' => true, 'created' => '2016-08-09', 'modified' => '2016-08-10', 'keywords' => '', 'description' => '', 'sortorder' => '3997', 'image' => '20160809034204_pandy.jpg', 'article_date' => '2016-08-09 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117