Warning (2): getimagesize(/var/www/html/newbusinessage.com/app/webroot/img/news/thumbnails/20161114101214_mum\'s.jpg): failed to open stream: No such file or directory [APP/View/Articles/index.ctp, line 35]Code Context

<?php

list($width, $height) = getimagesize(WWW_ROOT.'img'.DS.'news'.DS.'thumbnails'.DS.$article['Article']['image']);

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/index.ctp'

$dataForView = array(

'articles' => array(

(int) 0 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 1 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 2 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 3 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 4 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 5 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 6 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 7 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 8 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 9 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 10 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 11 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 12 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 13 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 14 => array(

'Article' => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$articles = array(

(int) 0 => array(

'Article' => array(

'id' => '4728',

'article_category_id' => '1',

'title' => 'Net Profit of Nepal Gramin Bikash Bank Increases Two Folds',

'sub_title' => '',

'summary' => 'November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.',

'content' => '<p style="text-align: justify;">November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.</p>

<p style="text-align: justify;">Similarly, the operating profit of the bank has increased by 3 times to Rs 45.5 million in the first quarter of the current FY in compare to the same period of the last FY. Moreover, the loan extension of the bank has increased by 21.31 percent to Rs 6.85 billion. However, the reserve fund of the bank has decreased by 80.21 percent to Rs 45.8 million during the review period in compare to the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4558',

'image' => '20161114104810_profit.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 1 => array(

'Article' => array(

'id' => '4727',

'article_category_id' => '1',

'title' => 'Pokhara Finance's 100 days Fixed Deposit Scheme',

'sub_title' => '',

'summary' => 'November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. ',

'content' => '<p style="text-align: justify;">November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4557',

'image' => '20161114103421_pokhara.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 2 => array(

'Article' => array(

'id' => '4726',

'article_category_id' => '1',

'title' => 'Kakrebihar to distribute Bonus share',

'sub_title' => '',

'summary' => 'November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.',

'content' => '<p style="text-align: justify;">November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.</p>

<p style="text-align: justify;">"The BOD proposal has been sent to Nepal Rastra Bank (NRB) for approval," said Jagat Bahadur Thapa, Chief Manager of the bank. The bank informed of extending Rs 474.7 loan while collecting Rs 798.1 deposit during the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4556',

'image' => '20161114102340_kakrebihar.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 3 => array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 4 => array(

'Article' => array(

'id' => '4724',

'article_category_id' => '1',

'title' => 'Financial Market Losing Excess Liquidity',

'sub_title' => '',

'summary' => 'November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.',

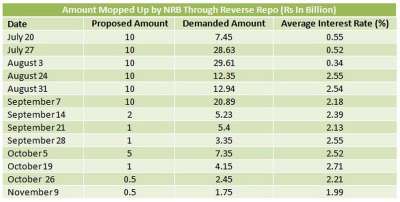

'content' => '<p style="text-align: justify;">November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.</p>

<p style="text-align: justify;">NRB that was regularly mopping up Rs 10 billion regularly in 1 or 2 weeks time lag through reverse repo has reduced the amount to Rs 500 million. The bank issued the reverse repo of Rs 3.20 billion only once since September. "The bank which was issuing reverse repo of Rs 10billion has decreased the amount to Rs 500 million which clearly indicates the declining liquidity in the market," said a former banker.</p>

<p style="text-align: justify;">The bank was issuing reverse repo of Rs 10 billion weekly till September 7 which it decreased to Rs 4 billion on September 14 indicating the lack of excess liquidity. After that, the bank mopped up Rs 1 billion each time except for October 5, in which the bank issued reverse repo of Rs 5 billion. However, as the banks demanded high interest rate, the bank moped up Rs 3.20 billion from the market. The incident proved that the excess liquidity that was prevailed in the financial market has ended, as per the banker.</p>

<p style="text-align: justify;"> "After October 26, the NRB has issued reverse repo of Rs 500 million only. Moreover, the BFIs are also attracting deposit on an increased interest rate. Thus, the market is surely losing the excess liquidity," he said. Narayan Prasad Poudel, Spokesperson of NRB also accepts the decline in excess liquidity. "Bankers have started to mention the liquidity problem. On early September also, the market had no significantly higher liquidity when the NRB issued Rs 10 billion worth of reverse repo. However, demand of loan might have been decreased," he said. He opined that the NRB reduces the reverse repo amount as mopping up of higher amount increased the interbank interest rate. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4554',

'image' => '20161113015213_reverse repo.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 5 => array(

'Article' => array(

'id' => '4723',

'article_category_id' => '1',

'title' => 'Net Profit of Commercial Banks Increases in the 1st Quarter',

'sub_title' => '',

'summary' => 'November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.',

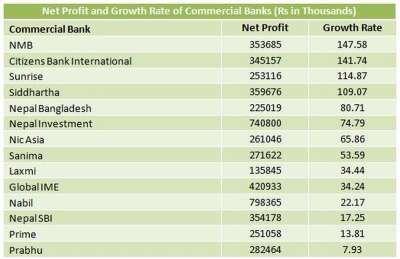

'content' => '<p style="text-align: justify;">November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.</p>

<p style="text-align: justify;">Among the first quarter report publisher commercial banks, NMB bank has been able to obtain the highest net profit. In the first three months of the current FY, the net profit of the bank increased by 147.58 percent to Rs 353.6 million. The bank earned Rs 140 million in the corresponding period of the last FY. In the review period, the bank increased its investment by 111 percent, loan extension by 102 percent, net interest income by 159 percent and operational profit by 102 percent. The bank was also able to recover 160 million non-performing loan of the last FY.</p>

<p style="text-align: justify;">Similarly, Citizens Bank International has been able to increase its net profit by 141.74 percent to Rs 345.1 million from Rs 140 million of the corresponding period of the last FY.</p>

<p style="text-align: justify;">Likewise, Sunrise Bank has earned Rs 253.1 million net profit in the first three months of the current FY which is 114 percent growth than the corresponding period of the last FY. Meanwhile, Siddhartha Bank increased its net profit by 109.07 percent to Rs 359.3 million.</p>

<p style="text-align: justify;">On the basis of total amount, Nabil Bank has topped the list. Nabil Bank has been able to earn Rs 798.3 million net profit in the first quarter of the current FY. The amount is 22.17 percent more than the corresponding period of the last FY. Similarly, Nepal Investment Bank earned Rs 740.8 million net profit during the first three months of the current FY which is 74 percent growth from the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4553',

'image' => '20161113122514_net profit.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 6 => array(

'Article' => array(

'id' => '4722',

'article_category_id' => '1',

'title' => 'Innovative Undertakes Social Work on the Occasion of 7th Anniversary',

'sub_title' => '',

'summary' => 'November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7th anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.',

'content' => '<p style="text-align: justify;">November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7<sup>th</sup> anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.</p>

<p style="text-align: justify;">On the occasion, the bank distributed essential supplies to vision impaired children of Birendra Secondary School, Chappiya. The program was organised on the chairmanship of Parshu Ram Parajuli, Director of the bank.</p>

<p style="text-align: justify;">Similarly, the bank organised town cleaning program in which the Chief of the City, Gopal Prasad Regmi was the Chief Guest. The program was participated by the bank employees, local people, social workers and municipality employees.</p>

<p style="text-align: justify;">Likewise, the bank also organised blood donation program on the occasion. The program organised under the chairmanship of Dr Rishi Ram Sharma in the premises of central offices was participated by the bank's employees, employees of various BFIs and wellwishers. A total of 25 units of blood were collected from the program. Prabin Kumar Dahal, CEO of the bank informed that the programs were organised under the corporate social responsibility of the bank. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4552',

'image' => '20161113112305_innovative.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 7 => array(

'Article' => array(

'id' => '4721',

'article_category_id' => '1',

'title' => 'Kamana Bikash Bank in 10th Year',

'sub_title' => '',

'summary' => 'November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. ',

'content' => '<p style="text-align: justify;">November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4551',

'image' => '20161113104321_KAMANA.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 8 => array(

'Article' => array(

'id' => '4720',

'article_category_id' => '1',

'title' => 'Sidhu Bikash Bank to distribute 16.8% Bonus Share',

'sub_title' => '',

'summary' => 'November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. ',

'content' => '<p style="text-align: justify;">November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4550',

'image' => '20161113103626_sidhu.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 9 => array(

'Article' => array(

'id' => '4719',

'article_category_id' => '1',

'title' => '5 Banks to Provide Consortium Loan to Upper Balephi 'A'',

'sub_title' => '',

'summary' => 'November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.',

'content' => '<p style="text-align: justify;">November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.</p>

<p style="text-align: justify;">The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed by the banks. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche. The company has targeted to conclude the project within December 2018. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4549',

'image' => '20161113102556_global.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 10 => array(

'Article' => array(

'id' => '4718',

'article_category_id' => '1',

'title' => 'APRACA Nominates NRB as President',

'sub_title' => '',

'summary' => 'November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.',

'content' => '<p style="text-align: justify;">November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.</p>

<p style="text-align: justify;">Similarly, the association organized a workshop ‘Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region' which was inaugurated by Dr Chiranjivi Nepal, Governor of NRB. Speaking at the workshop, Governor Nepal said that lack of reach in economic sources and financial illiteracy are the global challenges for the economic prosperity. “Everyone should practice for inclusive financial growth utilizing the digital payment system for maximum,” he pointed.</p>

<p style="text-align: justify;"> Likewise, S.K. Sur Chowdhury, Governor of Bangladesh Bank opined that poverty has created social discrimination and economic inclusion is necessary to end the discrimination.</p>

<p style="text-align: justify;">According to the NRB, more than 120 member organization from 21 different countries took participations in workshop.</p>

<p style="text-align: justify;">Established in 1977, APRACA is regional organization that motivates rural economics and agriculture for its member countries. NRB is a founding member of the Association where other five Nepali organizations working on rural finance are also members of it. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4548',

'image' => '20161111022951_apraca.JPG',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 11 => array(

'Article' => array(

'id' => '4717',

'article_category_id' => '1',

'title' => 'India Banknotes Ban Hit Nepali Market',

'sub_title' => '',

'summary' => 'November 11: In the wake of ban on banknotes of denominations INR 500 and INR 1,000 in India, many Nepalis have also been facing problems. The affected ones include general people, businessmen, employees and those travelling for education and treatment to India. Not only the ones who regularly used to go to the other side of the Nepal-India border for shopping',

'content' => '<p style="text-align: justify;">November 11:<strong> </strong>In the wake of ban on banknotes of denominations INR 500 and INR 1,000 in India, many Nepalis have also been facing problems. The affected ones include general people, businessmen, employees and those travelling for education and treatment to India. Not only the ones who regularly used to go to the other side of the Nepal-India border for shopping, people who have kept small amount of Indian Currency with themselves also have been affected by the demonetisation. The Indian government earlier this week ordered the withdrawal of the bank notes from circulation in a bid to take out untaxed money. </p>

<p style="text-align: justify;">Due to the decision, the Indian citizens who have come for treatment purposes in Nepal have also been experiencing troubles. Nepal Rastra Bank (NRB) has prohibited the exchange of INR 500 and INR 1000 banknotes from Wednesday after the demonetisation move in India. This has led to problems in cash transactions in the markets of Nepal-India border areas. Not only the residents of border areas, general people in Kathmandu are also worried about the exchange of the Indian currency. On Thursday, around 400 people queued in front of NRB office Thapathali to exchange their money. According to NRB Spokesperson Narayan Prashad Poudel, the central bank has requested the Reserve Bank of India (RBI) to exchange the demonetised banknotes. NRB has requested RBI to facilitate the Nepalis to exchange the banknotes they have with INR 25,000 rupees per person. "The government, foreign ministry and the finance ministry are also in talks with RBI to resolve this issue," says Paudel. However, Nepali authorities have not received any response from the Indian banking authority.</p>

<p style="text-align: justify;">Border markets directly affected</p>

<p style="text-align: justify;">The border market in the country's eastern region including Kakadvitta, Biratnagar and Mechinagar along with the western areas of Mahendranagar, Nepalgunj, Dhangadi, Bhimduttanagar and Gaddachauki have been directly affected by the ban.</p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4547',

'image' => '20161111014111_nrb.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 12 => array(

'Article' => array(

'id' => '4716',

'article_category_id' => '1',

'title' => 'NEEK Electro Tech-2016 to Kick-off on Nov 22',

'sub_title' => '',

'summary' => 'November 11: Federation of Electrical Entrepreneurs of Nepal (FEEN) will be organising 8th Electro Tech-2016 in exhibition hall of Bhrikutimandap. The federation will showcase various types of electric and electronics products in the event scheduled from November 18 to November 22. According to Tej Narayan Kharel, President of federation, th',

'content' => '<p style="text-align: justify;">November 11: Federation of Electrical Entrepreneurs of Nepal (FEEN) will be organising 8<sup>th</sup> Electro Tech-2016 in exhibition hall of Bhrikutimandap. The federation will showcase various types of electric and electronics products in the event scheduled from November 18 to November 22. According to Tej Narayan Kharel, President of federation, the expo will enhance the trade of electric and electronics products as well as provide support to ease the national and international business related to the sector. He said, “The expo is likely to provide favorable business environment among traders, businessmen and customers.”</p>

<p style="text-align: justify;">According to the organiser, the event of this year will be organized with a slogan 'Safety in Rebuilding’ in a bid to aware all stakeholders about using safe and quality electronic products.</p>

<p style="text-align: justify;">The expo aims to promote the sector by bringing the national and international industrialists under one roof. The expo organiser informs that all 114 stalls including big and small have been booked. The expo will showcase the products of various brands such as Schneider, Legrand, HPL, C&S, Philips, Havells, Siemens, L&T, Crompton, Usha, Electra-Electric, Orient, NEEK, CG, Himstar, Rathi. The exhibition is expected to be visited by 100,000 visitors as per the federation. </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4546',

'image' => '20161111012316_neek.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 13 => array(

'Article' => array(

'id' => '4714',

'article_category_id' => '1',

'title' => 'United Cement Organises Contractors Meet',

'sub_title' => '',

'summary' => 'November 11: United Cements has organised a meet/program targeting construction contractors in a bid to provide technical information about earthquake resilient construction and retrofitting. The company organising a program provided the information to masons and contractors at Lalitpur. ',

'content' => '<p style="text-align: justify;">November 11: United Cements has organised a meet/program targeting construction contractors in a bid to provide technical information about earthquake resilient construction and retrofitting. The company organising a program provided the information to masons and contractors at Lalitpur. </p>

<p style="text-align: justify;">The company believes that the program will create awareness among contractors and masons to build solid constructions along with to use quality materials in constructions. Moreover, the company also started a brand new, first of its kind, program honouring the constructions, which the company believes that it will provide additional enthusiasm to the constructors. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4545',

'image' => '20161111122013_united.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 14 => array(

'Article' => array(

'id' => '4715',

'article_category_id' => '1',

'title' => 'Global IME and IFC to Exchange Support',

'sub_title' => '',

'summary' => 'November 11: Chandra Prasad Dhakal, Chairman of Global IME Bank and Mengistu Alemayehu , Regional director of International Finance Corporation (IFC) has recently conducted a meet. During the meet, Dhakal and Alemayehu discussed regarding exchange of corporate support between Global IME and IFC. The meet was participated by Anil Gyawali, Chief Executive Officer of Global IME, Wendy Warner, Country Manager of IFC, Rehan Rashid, Residential Representative of IFC among others. ',

'content' => '<p>November 11: Chandra Prasad Dhakal, Chairman of Global IME Bank and Mengistu Alemayehu , Regional director of International Finance Corporation (IFC) has recently conducted a meet. During the meet, Dhakal and Alemayehu discussed regarding exchange of corporate support between Global IME and IFC. The meet was participated by Anil Gyawali, Chief Executive Officer of Global IME, Wendy Warner, Country Manager of IFC, Rehan Rashid, Residential Representative of IFC among others. </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4544',

'image' => '20161111125925_global ime.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

)

$current_user = null

$logged_in = false

$article = array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

$width = (int) 400

$height = (int) 396

$ratio = (float) 1.010101010101

$img_width = (int) 280

$img_height = (float) 277.2

$date = '2016-11-14 00:00:00'

$dateFromDatabase = (int) 1479060900

$dateTwentyforHoursAgo = (int) 1757552443

$today = '2025-09-12 06:45:43am'

$today2 = (int) 1757638843

$newDate = 'Nov 14, 2016'

$commentCount = (int) 0

$word_count = (int) 79

$time_to_read = (float) 0.4

$time_to_read_min = (float) 0

$time_to_read_second = (float) 24

getimagesize - [internal], line ??

include - APP/View/Articles/index.ctp, line 35

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Warning (2): Division by zero [APP/View/Articles/index.ctp, line 36]Code Context <?php

list($width, $height) = getimagesize(WWW_ROOT.'img'.DS.'news'.DS.'thumbnails'.DS.$article['Article']['image']);

$ratio = $width / $height;

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/index.ctp'

$dataForView = array(

'articles' => array(

(int) 0 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 1 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 2 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 3 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 4 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 5 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 6 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 7 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 8 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 9 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 10 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 11 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 12 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 13 => array(

'Article' => array(

[maximum depth reached]

)

),

(int) 14 => array(

'Article' => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$articles = array(

(int) 0 => array(

'Article' => array(

'id' => '4728',

'article_category_id' => '1',

'title' => 'Net Profit of Nepal Gramin Bikash Bank Increases Two Folds',

'sub_title' => '',

'summary' => 'November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.',

'content' => '<p style="text-align: justify;">November 14: The net profit of Nepal Gramin Bikash Bank has increased by 2 folds during the first quarter of the current FY. During the review period, the bank earned Rs 30 million net profit. The increase in net profit of the bank is attributed to the increase in operating profit and net interest income.</p>

<p style="text-align: justify;">Similarly, the operating profit of the bank has increased by 3 times to Rs 45.5 million in the first quarter of the current FY in compare to the same period of the last FY. Moreover, the loan extension of the bank has increased by 21.31 percent to Rs 6.85 billion. However, the reserve fund of the bank has decreased by 80.21 percent to Rs 45.8 million during the review period in compare to the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4558',

'image' => '20161114104810_profit.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 1 => array(

'Article' => array(

'id' => '4727',

'article_category_id' => '1',

'title' => 'Pokhara Finance's 100 days Fixed Deposit Scheme',

'sub_title' => '',

'summary' => 'November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. ',

'content' => '<p style="text-align: justify;">November 14: Pokhara Finance, headquartered at Pokhara, Newroad has launched a new product '100 Days Fixed Deposit' scheme. "The scheme that carries eight percent annual interest rate has been launched for limited period," said Raj Kumar Gurung, Chief Executive Officer of the company. The finance company has a total of Rs 491.1 million paid-up capital. Moreover, the recently held annual general meeting of the finance has approved the proposal of distributing 14.21 percent profit to its shareholders. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4557',

'image' => '20161114103421_pokhara.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 2 => array(

'Article' => array(

'id' => '4726',

'article_category_id' => '1',

'title' => 'Kakrebihar to distribute Bonus share',

'sub_title' => '',

'summary' => 'November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.',

'content' => '<p style="text-align: justify;">November 14: Kakrebihar Bikash Bank is distributing bonus share to its shareholders. The board of directors meeting of the bank has proposed to distribute 19 percent bonus share to its shareholders.</p>

<p style="text-align: justify;">"The BOD proposal has been sent to Nepal Rastra Bank (NRB) for approval," said Jagat Bahadur Thapa, Chief Manager of the bank. The bank informed of extending Rs 474.7 loan while collecting Rs 798.1 deposit during the last FY. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4556',

'image' => '20161114102340_kakrebihar.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 3 => array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 4 => array(

'Article' => array(

'id' => '4724',

'article_category_id' => '1',

'title' => 'Financial Market Losing Excess Liquidity',

'sub_title' => '',

'summary' => 'November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.',

'content' => '<p style="text-align: justify;">November 13: The excess liquidity that was prevailed in the financial market is apparently declining in the recent days. It has been proved by the interest rate provided on deposit and loan extension by the banks and financial institutions (BFIs) and the open market operation of Nepal Rastra Bank (NRB. According to experts, increase in deposit and lending interest rate by the most of the BFIs and significant reduction in the amount of reverse repo by the NRB signifies the lowering liquidity in the market.</p>

<p style="text-align: justify;">NRB that was regularly mopping up Rs 10 billion regularly in 1 or 2 weeks time lag through reverse repo has reduced the amount to Rs 500 million. The bank issued the reverse repo of Rs 3.20 billion only once since September. "The bank which was issuing reverse repo of Rs 10billion has decreased the amount to Rs 500 million which clearly indicates the declining liquidity in the market," said a former banker.</p>

<p style="text-align: justify;">The bank was issuing reverse repo of Rs 10 billion weekly till September 7 which it decreased to Rs 4 billion on September 14 indicating the lack of excess liquidity. After that, the bank mopped up Rs 1 billion each time except for October 5, in which the bank issued reverse repo of Rs 5 billion. However, as the banks demanded high interest rate, the bank moped up Rs 3.20 billion from the market. The incident proved that the excess liquidity that was prevailed in the financial market has ended, as per the banker.</p>

<p style="text-align: justify;"> "After October 26, the NRB has issued reverse repo of Rs 500 million only. Moreover, the BFIs are also attracting deposit on an increased interest rate. Thus, the market is surely losing the excess liquidity," he said. Narayan Prasad Poudel, Spokesperson of NRB also accepts the decline in excess liquidity. "Bankers have started to mention the liquidity problem. On early September also, the market had no significantly higher liquidity when the NRB issued Rs 10 billion worth of reverse repo. However, demand of loan might have been decreased," he said. He opined that the NRB reduces the reverse repo amount as mopping up of higher amount increased the interbank interest rate. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4554',

'image' => '20161113015213_reverse repo.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 5 => array(

'Article' => array(

'id' => '4723',

'article_category_id' => '1',

'title' => 'Net Profit of Commercial Banks Increases in the 1st Quarter',

'sub_title' => '',

'summary' => 'November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.',

'content' => '<p style="text-align: justify;">November 13: The 14 out of 28 commercial banks which have published the quarterly report of the first three months of the current FY have increased their net profit. The banks have been successful to increase their net profit through increasing investment, interest income and recovery of non-performing loans of the last FY.</p>

<p style="text-align: justify;">Among the first quarter report publisher commercial banks, NMB bank has been able to obtain the highest net profit. In the first three months of the current FY, the net profit of the bank increased by 147.58 percent to Rs 353.6 million. The bank earned Rs 140 million in the corresponding period of the last FY. In the review period, the bank increased its investment by 111 percent, loan extension by 102 percent, net interest income by 159 percent and operational profit by 102 percent. The bank was also able to recover 160 million non-performing loan of the last FY.</p>

<p style="text-align: justify;">Similarly, Citizens Bank International has been able to increase its net profit by 141.74 percent to Rs 345.1 million from Rs 140 million of the corresponding period of the last FY.</p>

<p style="text-align: justify;">Likewise, Sunrise Bank has earned Rs 253.1 million net profit in the first three months of the current FY which is 114 percent growth than the corresponding period of the last FY. Meanwhile, Siddhartha Bank increased its net profit by 109.07 percent to Rs 359.3 million.</p>

<p style="text-align: justify;">On the basis of total amount, Nabil Bank has topped the list. Nabil Bank has been able to earn Rs 798.3 million net profit in the first quarter of the current FY. The amount is 22.17 percent more than the corresponding period of the last FY. Similarly, Nepal Investment Bank earned Rs 740.8 million net profit during the first three months of the current FY which is 74 percent growth from the corresponding period of the last FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4553',

'image' => '20161113122514_net profit.JPG',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 6 => array(

'Article' => array(

'id' => '4722',

'article_category_id' => '1',

'title' => 'Innovative Undertakes Social Work on the Occasion of 7th Anniversary',

'sub_title' => '',

'summary' => 'November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7th anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.',

'content' => '<p style="text-align: justify;">November 13: Innovative Development Bank, headquartered at Bhairahawa, has carried out various programs on the occasion of its 7<sup>th</sup> anniversary. On the occasion, the bank organised distribution of essential supplies to vision impaired children, town cleaning and blood donation program.</p>

<p style="text-align: justify;">On the occasion, the bank distributed essential supplies to vision impaired children of Birendra Secondary School, Chappiya. The program was organised on the chairmanship of Parshu Ram Parajuli, Director of the bank.</p>

<p style="text-align: justify;">Similarly, the bank organised town cleaning program in which the Chief of the City, Gopal Prasad Regmi was the Chief Guest. The program was participated by the bank employees, local people, social workers and municipality employees.</p>

<p style="text-align: justify;">Likewise, the bank also organised blood donation program on the occasion. The program organised under the chairmanship of Dr Rishi Ram Sharma in the premises of central offices was participated by the bank's employees, employees of various BFIs and wellwishers. A total of 25 units of blood were collected from the program. Prabin Kumar Dahal, CEO of the bank informed that the programs were organised under the corporate social responsibility of the bank. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4552',

'image' => '20161113112305_innovative.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 7 => array(

'Article' => array(

'id' => '4721',

'article_category_id' => '1',

'title' => 'Kamana Bikash Bank in 10th Year',

'sub_title' => '',

'summary' => 'November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. ',

'content' => '<p style="text-align: justify;">November 13: Kamana Development Bank, headquartered at Srijana Chowk of Pokhara, has entered into 10 years of establishment from November 12. "The bank is providing its financial services through its network of 21 branches and 9 ATMs," said Toya Raj Adhikari, Chief Executive Officer of the bank. He also informed of collecting Rs 6.91 billion deposit and extending loan of Rs 6.15 billion by the first quarter of the current FY. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4551',

'image' => '20161113104321_KAMANA.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 8 => array(

'Article' => array(

'id' => '4720',

'article_category_id' => '1',

'title' => 'Sidhu Bikash Bank to distribute 16.8% Bonus Share',

'sub_title' => '',

'summary' => 'November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. ',

'content' => '<p style="text-align: justify;">November 13: Sidhu bikash bank has approved its dividend. The seventh annual general meeting of the bank held on November 13 approved the proposal of distributing 16.8 bonus share and 0.88 percent cash dividend from the distributable income of the FY 2072/73. Moreover, the bank also endorsed the proposal of issuing 10:8 right shares. The bank informs of providing high standard overall banking services to its customers. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4550',

'image' => '20161113103626_sidhu.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 9 => array(

'Article' => array(

'id' => '4719',

'article_category_id' => '1',

'title' => '5 Banks to Provide Consortium Loan to Upper Balephi 'A'',

'sub_title' => '',

'summary' => 'November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.',

'content' => '<p style="text-align: justify;">November 13: A consortium loan agreement has been signed for the 36MW upper Balephi 'A' hydropower project under the initiation of Global IME Bank. The bank along with four other banks finalised the agreement with Huwaning Development regarding the consortium loan for the project. Other than Global IME, Sanima, Everest, SBI and NIDC Development Bank is providing the consortium loan to the project.</p>

<p style="text-align: justify;">The project's total cost is estimated to be Rs 6.08 billion cost of which Rs 4.35 billion will be financed by the banks. The power house of the project which is being constructed at Golche and Gumba VDC of Sindhupalchok will be built at Golche. The company has targeted to conclude the project within December 2018. </p>

',

'published' => true,

'created' => '2016-11-13',

'modified' => '2016-11-13',

'keywords' => '',

'description' => '',

'sortorder' => '4549',

'image' => '20161113102556_global.jpg',

'article_date' => '2016-11-13 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 10 => array(

'Article' => array(

'id' => '4718',

'article_category_id' => '1',

'title' => 'APRACA Nominates NRB as President',

'sub_title' => '',

'summary' => 'November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.',

'content' => '<p style="text-align: justify;">November 11: Nepal Rastra Bank (NRB) has been nominated as President of Asia Pacific Rural and Agriculture Credit Association (APRACA). The 20th General Assembly started from November 9 and 37th Executive Committee Meeting of the association handed over the workload to NRB from 2016 to 2018.</p>

<p style="text-align: justify;">Similarly, the association organized a workshop ‘Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region' which was inaugurated by Dr Chiranjivi Nepal, Governor of NRB. Speaking at the workshop, Governor Nepal said that lack of reach in economic sources and financial illiteracy are the global challenges for the economic prosperity. “Everyone should practice for inclusive financial growth utilizing the digital payment system for maximum,” he pointed.</p>

<p style="text-align: justify;"> Likewise, S.K. Sur Chowdhury, Governor of Bangladesh Bank opined that poverty has created social discrimination and economic inclusion is necessary to end the discrimination.</p>

<p style="text-align: justify;">According to the NRB, more than 120 member organization from 21 different countries took participations in workshop.</p>

<p style="text-align: justify;">Established in 1977, APRACA is regional organization that motivates rural economics and agriculture for its member countries. NRB is a founding member of the Association where other five Nepali organizations working on rural finance are also members of it. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4548',

'image' => '20161111022951_apraca.JPG',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 11 => array(

'Article' => array(

'id' => '4717',

'article_category_id' => '1',

'title' => 'India Banknotes Ban Hit Nepali Market',

'sub_title' => '',

'summary' => 'November 11: In the wake of ban on banknotes of denominations INR 500 and INR 1,000 in India, many Nepalis have also been facing problems. The affected ones include general people, businessmen, employees and those travelling for education and treatment to India. Not only the ones who regularly used to go to the other side of the Nepal-India border for shopping',

'content' => '<p style="text-align: justify;">November 11:<strong> </strong>In the wake of ban on banknotes of denominations INR 500 and INR 1,000 in India, many Nepalis have also been facing problems. The affected ones include general people, businessmen, employees and those travelling for education and treatment to India. Not only the ones who regularly used to go to the other side of the Nepal-India border for shopping, people who have kept small amount of Indian Currency with themselves also have been affected by the demonetisation. The Indian government earlier this week ordered the withdrawal of the bank notes from circulation in a bid to take out untaxed money. </p>

<p style="text-align: justify;">Due to the decision, the Indian citizens who have come for treatment purposes in Nepal have also been experiencing troubles. Nepal Rastra Bank (NRB) has prohibited the exchange of INR 500 and INR 1000 banknotes from Wednesday after the demonetisation move in India. This has led to problems in cash transactions in the markets of Nepal-India border areas. Not only the residents of border areas, general people in Kathmandu are also worried about the exchange of the Indian currency. On Thursday, around 400 people queued in front of NRB office Thapathali to exchange their money. According to NRB Spokesperson Narayan Prashad Poudel, the central bank has requested the Reserve Bank of India (RBI) to exchange the demonetised banknotes. NRB has requested RBI to facilitate the Nepalis to exchange the banknotes they have with INR 25,000 rupees per person. "The government, foreign ministry and the finance ministry are also in talks with RBI to resolve this issue," says Paudel. However, Nepali authorities have not received any response from the Indian banking authority.</p>

<p style="text-align: justify;">Border markets directly affected</p>

<p style="text-align: justify;">The border market in the country's eastern region including Kakadvitta, Biratnagar and Mechinagar along with the western areas of Mahendranagar, Nepalgunj, Dhangadi, Bhimduttanagar and Gaddachauki have been directly affected by the ban.</p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4547',

'image' => '20161111014111_nrb.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 12 => array(

'Article' => array(

'id' => '4716',

'article_category_id' => '1',

'title' => 'NEEK Electro Tech-2016 to Kick-off on Nov 22',

'sub_title' => '',

'summary' => 'November 11: Federation of Electrical Entrepreneurs of Nepal (FEEN) will be organising 8th Electro Tech-2016 in exhibition hall of Bhrikutimandap. The federation will showcase various types of electric and electronics products in the event scheduled from November 18 to November 22. According to Tej Narayan Kharel, President of federation, th',

'content' => '<p style="text-align: justify;">November 11: Federation of Electrical Entrepreneurs of Nepal (FEEN) will be organising 8<sup>th</sup> Electro Tech-2016 in exhibition hall of Bhrikutimandap. The federation will showcase various types of electric and electronics products in the event scheduled from November 18 to November 22. According to Tej Narayan Kharel, President of federation, the expo will enhance the trade of electric and electronics products as well as provide support to ease the national and international business related to the sector. He said, “The expo is likely to provide favorable business environment among traders, businessmen and customers.”</p>

<p style="text-align: justify;">According to the organiser, the event of this year will be organized with a slogan 'Safety in Rebuilding’ in a bid to aware all stakeholders about using safe and quality electronic products.</p>

<p style="text-align: justify;">The expo aims to promote the sector by bringing the national and international industrialists under one roof. The expo organiser informs that all 114 stalls including big and small have been booked. The expo will showcase the products of various brands such as Schneider, Legrand, HPL, C&S, Philips, Havells, Siemens, L&T, Crompton, Usha, Electra-Electric, Orient, NEEK, CG, Himstar, Rathi. The exhibition is expected to be visited by 100,000 visitors as per the federation. </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4546',

'image' => '20161111012316_neek.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 13 => array(

'Article' => array(

'id' => '4714',

'article_category_id' => '1',

'title' => 'United Cement Organises Contractors Meet',

'sub_title' => '',

'summary' => 'November 11: United Cements has organised a meet/program targeting construction contractors in a bid to provide technical information about earthquake resilient construction and retrofitting. The company organising a program provided the information to masons and contractors at Lalitpur. ',

'content' => '<p style="text-align: justify;">November 11: United Cements has organised a meet/program targeting construction contractors in a bid to provide technical information about earthquake resilient construction and retrofitting. The company organising a program provided the information to masons and contractors at Lalitpur. </p>

<p style="text-align: justify;">The company believes that the program will create awareness among contractors and masons to build solid constructions along with to use quality materials in constructions. Moreover, the company also started a brand new, first of its kind, program honouring the constructions, which the company believes that it will provide additional enthusiasm to the constructors. </p>

<p style="text-align: justify;"> </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4545',

'image' => '20161111122013_united.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

),

(int) 14 => array(

'Article' => array(

'id' => '4715',

'article_category_id' => '1',

'title' => 'Global IME and IFC to Exchange Support',

'sub_title' => '',

'summary' => 'November 11: Chandra Prasad Dhakal, Chairman of Global IME Bank and Mengistu Alemayehu , Regional director of International Finance Corporation (IFC) has recently conducted a meet. During the meet, Dhakal and Alemayehu discussed regarding exchange of corporate support between Global IME and IFC. The meet was participated by Anil Gyawali, Chief Executive Officer of Global IME, Wendy Warner, Country Manager of IFC, Rehan Rashid, Residential Representative of IFC among others. ',

'content' => '<p>November 11: Chandra Prasad Dhakal, Chairman of Global IME Bank and Mengistu Alemayehu , Regional director of International Finance Corporation (IFC) has recently conducted a meet. During the meet, Dhakal and Alemayehu discussed regarding exchange of corporate support between Global IME and IFC. The meet was participated by Anil Gyawali, Chief Executive Officer of Global IME, Wendy Warner, Country Manager of IFC, Rehan Rashid, Residential Representative of IFC among others. </p>

',

'published' => true,

'created' => '2016-11-11',

'modified' => '2016-11-11',

'keywords' => '',

'description' => '',

'sortorder' => '4544',

'image' => '20161111125925_global ime.jpg',

'article_date' => '2016-11-11 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

)

$current_user = null

$logged_in = false

$article = array(

'Article' => array(

'id' => '4725',

'article_category_id' => '1',

'title' => 'Mum's Brand Enters Nepali Market',

'sub_title' => '',

'summary' => 'November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. ',

'content' => '<p>November 14: Aamrapali Biotech India, an Indian company has entered the Nepali market. The company launched its new breakfast range in the Nepali market by organising a program in the capital on November 12. The company under its Mum's brand launched choco-flakes, choco-fills, muesli and porridge. </p>

',

'published' => true,

'created' => '2016-11-14',

'modified' => '2016-11-14',

'keywords' => '',

'description' => '',

'sortorder' => '4555',

'image' => '20161114101214_mum\'s.jpg',

'article_date' => '2016-11-14 00:00:00',

'homepage' => false,

'breaking_news' => false,

'main_news' => true,

'in_scroller' => false,

'user_id' => '16'

)

)

$width = null

$height = null

$ratio = (float) 1.010101010101

$img_width = (int) 280

$img_height = (float) 277.2

$date = '2016-11-14 00:00:00'

$dateFromDatabase = (int) 1479060900

$dateTwentyforHoursAgo = (int) 1757552443

$today = '2025-09-12 06:45:43am'

$today2 = (int) 1757638843

$newDate = 'Nov 14, 2016'

$commentCount = (int) 0

$word_count = (int) 79

$time_to_read = (float) 0.4

$time_to_read_min = (float) 0

$time_to_read_second = (float) 24

include - APP/View/Articles/index.ctp, line 36

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117