Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '11421',

'article_category_id' => '1',

'title' => 'Market watch 17th September(Tuesday)',

'sub_title' => '',

'summary' => 'Today, the NEPSE market has increased and become positive along with it sub-indices',

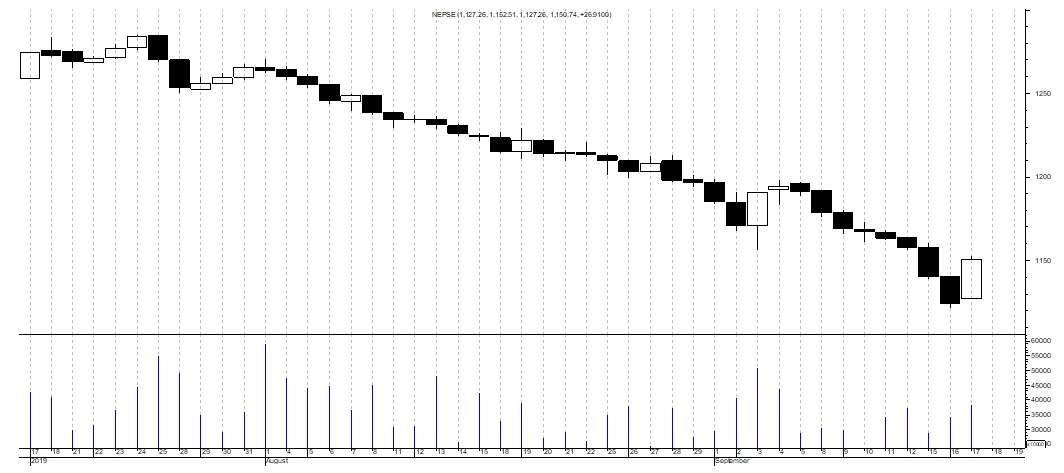

'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing NEPSE Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Current Price (CMP): 1150.74</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">OHLC Update of 31<sup>st</sup> Bhadra:</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">O: 1127.26<br />

H: 1152.51<br />

L: 1127.26<br />

C: 1150.74</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for 1<sup>st</sup> Ashoj: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1109.25</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1118.25</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1134.50</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1143.50</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1159.75</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1168.75</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1185.00</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the 4<sup>th</sup> Week (29<sup>th</sup> Bhadra- 2<sup>nd</sup> Ashoj):</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1109.45</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1132.91</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1145.40</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1168.86</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1181.35</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1204.81</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1217.30</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the month of Bhadra:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1139.02</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1180.41</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1202.22</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1243.61</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1265.42</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1306.81</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1328.62</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover Update:</span></span></strong><br />

<span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">On Month of Ashad : 1080.72 Crores<br />

On Month of Shrawan : 888.27 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Volume of 1<sup>st</sup> Week of Bhadra: NRs. 154.59 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Volume of 2<sup>nd</sup> Week of Bhadra: NRs. 162.48 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Volume of 3<sup>rd</sup> Week of Bhadra: NRs. 194.21 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">29<sup>th</sup> Bhadra : NRs. 28.80 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">30<sup>th</sup> Bhadra : NRs. 34.39 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">31<sup>st</sup> Bhadra : NRs. 38.39 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Commentary:</span></span></strong></span></span></p>

<ul>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>1.</strong>Today the NEPSE market has increased by 2.39 %. Similarly, Sensitive index has also increased by 2.12%. The Float index has gained 2.27% and Sensitive Float has gained 1.92% today.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>2.</strong>The turnover of today is more than that of previous day.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>3.</strong>Out of the 12 Sub-indices traded today, all of them are positive except Mutual Fund. The noticeable changes are positive on Manufacture and Production by 4.52%, Hydropower by 4.27%, Microfinance by 2.1% and Banking by 2.04%. Similarly, the negative changes are on Mutual Fund by 0.04%.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>4.</strong>The CMP of 31<sup>st</sup> Bhadra is above the pivot of 1<sup>st</sup> Ashoj but it is below the weekly pivot and the monthly pivot. </span></span></span></span></li>

</ul>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Scrips by turnovers:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Closing Price</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 3.49 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">325.00</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 3.05 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">317.00</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NLIC</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 2.84 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">762.00</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SHIVM</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 2.03 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">544.00</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:37px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">PRVU</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:37px; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 1.48 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:37px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">263.00</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Gainers: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">LTP</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Percentage Change(in%)</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">SHIVM</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">544.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">9.90</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">GLBSL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">456.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">9.62</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">RADHI</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">139.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">9.45</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">API</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">119.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">9.17</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">KRBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">110.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">8.91</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Losers: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">LTP</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Percentage Change(in%)</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">EIC</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">270.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-5.59</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">AKJCL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">53.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-5.35</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">CZBIL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">200.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-5.06</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SINDU</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">120.00</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-4.76</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SAEF</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">8.30</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-3.03</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p> </p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Sector Wise Summary: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Sector</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover Values</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover volume</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Total Transaction</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:29px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Commercial Banks</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 18.51 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">639,765</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">2,399</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Finance</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.29 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">19,637</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">126</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Hotels</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.20 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">7,176</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">50</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Manufacturing And Processing</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 2.26 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">39,234</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">246</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:35px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Others</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 1.62 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">21,543</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">114</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Hydro Power</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 4.32 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">298,589</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">2,000</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Tradings</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.0014 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">10</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Non Life Insurance</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 1.41 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">40,070</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">418</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Development Banks</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 2.02 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">106,876</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">323</span></span></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Mutual Fund</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.05 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">68,874</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">31</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><img alt="" src="/app/webroot/userfiles/images/4%2820%29.jpg" style="height:475px; width:1055px" /></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing Sensitive Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Conclusion: </span></span></strong></span></span></p>

<ul>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>1.</strong>Today, the NEPSE market has increased and become positive along with it sub-indices.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>2.</strong>Observing today’s candle stick, it is a White Long with small upper shadow. It signifies the market would bull although the market is still in bearish trend.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>3.</strong>The CMP of today is above the pivot for the next day. </span></span></span></span></li>

</ul>

',

'published' => true,

'created' => '2019-09-17',

'modified' => '2019-09-17',

'keywords' => '',

'description' => '',

'sortorder' => '11171',

'image' => '20190917050800_3.jpg',

'article_date' => '2019-09-17 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => null,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '11421',

'article_category_id' => '1',

'title' => 'Market watch 17th September(Tuesday)',

'sub_title' => '',

'summary' => 'Today, the NEPSE market has increased and become positive along with it sub-indices',

'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing NEPSE Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Current Price (CMP): 1150.74</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">OHLC Update of 31<sup>st</sup> Bhadra:</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">O: 1127.26<br />

H: 1152.51<br />

L: 1127.26<br />

C: 1150.74</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for 1<sup>st</sup> Ashoj: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1109.25</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1118.25</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1134.50</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1143.50</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1159.75</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1168.75</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1185.00</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the 4<sup>th</sup> Week (29<sup>th</sup> Bhadra- 2<sup>nd</sup> Ashoj):</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1109.45</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1132.91</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1145.40</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1168.86</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1181.35</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1204.81</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1217.30</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the month of Bhadra:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">