Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '11347',

'article_category_id' => '1',

'title' => 'Market watch 4th September(Wednesday)',

'sub_title' => '',

'summary' => 'Today, the market has increased and become positive along with it sub-indices.',

'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing NEPSE Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Current Price (CMP): 1194.77</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">OHLC Update of 18<sup>th</sup> Bhadra:</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">O: 1192.22<br />

H: 1198.48<br />

L: 1183.40<br />

C: 1194.77</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for 19<sup>th</sup> Bhadra: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1170.87</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1177.14</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1185.95</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1192.22</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1201.03</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1207.30</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1216.11</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the 2<sup>nd</sup> Week (15<sup>th</sup> Bhadra- 19<sup>th</sup> Bhadra):</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1169.83</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1181.96</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1189.19</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1201.32</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1208.55</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1220.68</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1227.91</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the month of Bhadra:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1139.02</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1180.41</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1202.22</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1243.61</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1265.42</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1306.81</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1328.62</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover Update:</span></span></strong><br />

<span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">On Month of Ashad : 1080.72 Crores<br />

On Month of Shrawan : 888.27 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Volume of 1<sup>st</sup> Week of Bhadra: NRs. 154.59 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Volume of 2<sup>nd</sup> Week of Bhadra: NRs. 162.48 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">16<sup>th</sup> Bhadra : NRs. 40.75 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">17<sup>th</sup> Bhadra : NRs. 51.05 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">18<sup>th</sup> Bhadra : NRs. 43.64 Crores</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Commentary:</span></span></strong></span></span></p>

<ul>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>1.</strong>Today the NEPSE market has increased by 0.32 %. The Sensitive index has also increased by 0.24%. The Float index has gained 0.42% and Sensitive Float has gained 0.47% today.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>2.</strong>The turnover of today is less than that of previous day.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>3.</strong>Out of the 11 Sub-indices traded today, all of them are positive except Finance, Manufacture and Production, and Others. The noticeable changes are positive on Life Mutual Fund by 0.99%, Banking by 2.75% and Microfinance by 2.27%. Likewise, the negative changes are Finance by 0.62%. </span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>4.</strong>The CMP of 18<sup>th</sup> Bhadra is above the pivot of 19<sup>th</sup> Bhadra but it is below the weekly pivot and the monthly pivot. </span></span></span></span></li>

</ul>

<p> </p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Scrips by turnovers:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Closing Price</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">MBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 9.30 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">258</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 2.02 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">320</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">CIT</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 1.97 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">2,297</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">PRVU</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 1.64 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">269</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:37px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SANIMA</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:37px; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Rs. 1.57 Crores</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:37px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">354</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Gainers: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">LTP</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Percentage Change(in%)</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">PPCL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">106</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">9.28</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">RHPC</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">85</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:42px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">4.94</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">KRBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">110</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">4.76</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">NMFBS</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1,558</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">4.35</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Inherit",serif">GLBSL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">490</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:1px; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">4.03</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Top 5 Losers: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:602px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Scrips</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">LTP</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; vertical-align:top; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Percentage Change(in%)</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">HIDCL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">141</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-3.42</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SFFIL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">255</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-3.40</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">UFL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">180</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-3.22</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">SMFBS</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">813</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-3.21</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:bottom; width:201px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">KSBBL</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:202px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">145</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:bottom; width:199px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">-2.68</span></span></strong></span></span></p>

</td>

</tr>

</tbody>

</table>

<p> </p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Sector Wise Summary: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Sector</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover Values</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Turnover volume</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:45px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Total Transaction</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:29px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Commercial Banks</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 24.84 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">871,927</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:29px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">2,004</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Finance</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.26 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">17,516</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">82</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Hotels</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.07 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">3,080</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">17</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Manufacturing And Processing</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 1.43 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">22,633</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">154</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:35px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Others</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 2.96 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">28,288</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:35px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">265</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Hydro Power</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 2.47 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">153,933</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">1,660</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Non Life Insurance</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 1.82 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">43,885</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:36px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">302</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Development Banks</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 1.95 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">90,738</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">280</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Mutual Fund</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.04 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">47,235</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">27</span></span></p>

</td>

</tr>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:165px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Promoter Share</span></span></strong></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; vertical-align:top; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">NRs. 0.88 Crores</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:143px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">16,947</span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:41px; width:154px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">16</span></span></p>

</td>

</tr>

</tbody>

</table>

<p><img alt="" src="/app/webroot/userfiles/images/sep%204%20NEPSE2.jpg" style="height:557px; width:1172px" /></p>

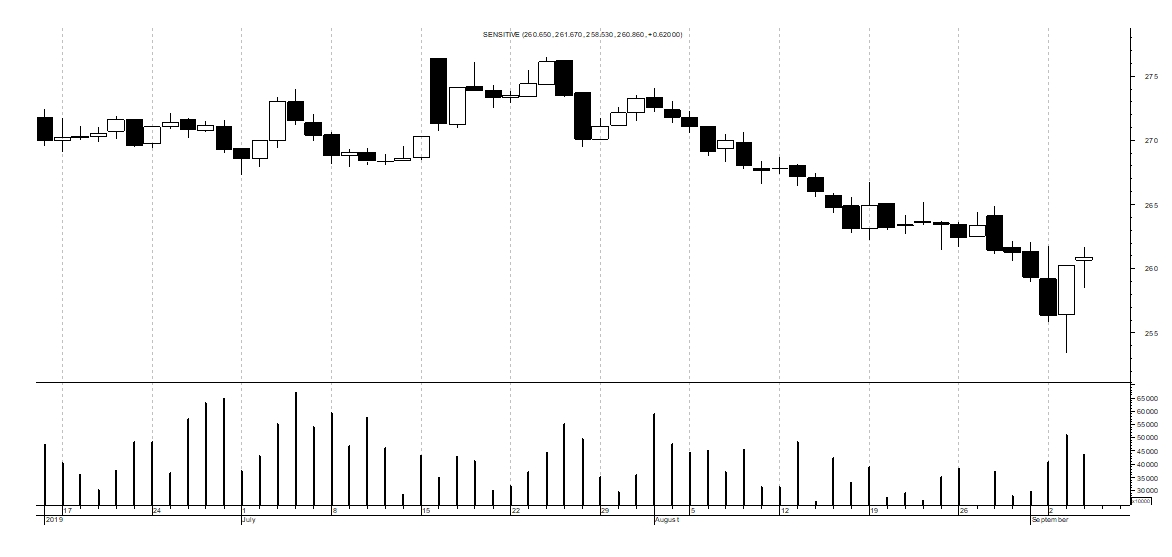

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing Sensitive Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Conclusion: </span></span></strong></span></span></p>

<ul>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>1.</strong>Today, the market has increased and become positive along with it sub-indices.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>2.</strong>Observing today’s candle stick, it is Hammer. By the end of the trading day, the market closes near to its high for the day. This signifies a weakening of the previous bearish sentiment.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>3.</strong>Since the certainty for a Hammer indicator is low, the trend reversal can be confirmed by a higher open and an even higher close on the next trading day.</span></span></span></span></li>

<li><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"><strong>4.</strong>The CMP of today is above the pivot for the next day. </span></span></span></span></li>

</ul>

',

'published' => true,

'created' => '2019-09-04',

'modified' => '2019-09-04',

'keywords' => '',

'description' => '',

'sortorder' => '11097',

'image' => '20190904060121_sep 4 NEPSE1.jpg',

'article_date' => '2019-09-04 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => false,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '11347',

'article_category_id' => '1',

'title' => 'Market watch 4th September(Wednesday)',

'sub_title' => '',

'summary' => 'Today, the market has increased and become positive along with it sub-indices.',

'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif"> Pic. Showing NEPSE Candle Stick Chart</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Current Price (CMP): 1194.77</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">OHLC Update of 18<sup>th</sup> Bhadra:</span></span></strong></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">O: 1192.22<br />

H: 1198.48<br />

L: 1183.40<br />

C: 1194.77</span></span></span></span></p>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for 19<sup>th</sup> Bhadra: </span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1170.87</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1177.14</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1185.95</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1192.22</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1201.03</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1207.30</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1216.11</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the 2<sup>nd</sup> Week (15<sup>th</sup> Bhadra- 19<sup>th</sup> Bhadra):</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R3</span></span></strong></span></span></p>

</td>

</tr>

<tr>

<td style="border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:none; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1169.83</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1181.96</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1189.19</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1201.32</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1208.55</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1220.68</span></span></span></span></p>

</td>

<td style="border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:none; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">1227.91</span></span></span></span></p>

</td>

</tr>

</tbody>

</table>

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot for the month of Bhadra:</span></span></strong></span></span></p>

<table cellspacing="0" style="border-collapse:collapse; width:632px">

<tbody>

<tr>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:1px solid black; border-right:1px solid black; border-top:1px solid black; height:34px; width:79px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S3</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S2</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">S1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">Pivot</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">

<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:12.0pt"><span style="font-family:"Times New Roman",serif">R1</span></span></strong></span></span></p>

</td>

<td style="background-color:#bfbfbf; border-bottom:1px solid black; border-left:none; border-right:1px solid black; border-top:1px solid black; height:34px; width:92px">