Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '10609',

'article_category_id' => '1',

'title' => 'Market Watch 3rd May(Friday) ',

'sub_title' => '',

'summary' => 'Today market has remained negative like yesterday. Likewise the other indexes are also negative.',

'content' => '<p>

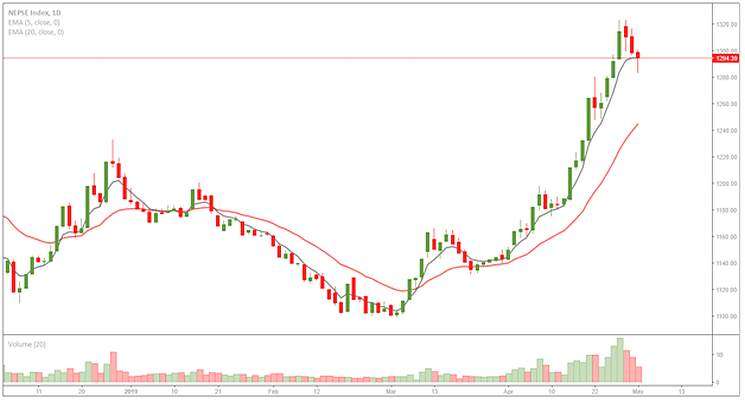

<strong> Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Article for 22<sup>nd</sup> Baisakh:</strong></p>

<p>

<strong>Current Price (CMP): 1294.39</strong></p>

<p>

<strong>OHLC Update of 19<sup>th</sup> Baisakh:</strong></p>

<p>

<strong>O: 1298.60<br />

H: 1300.43<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for 22<sup>nd</sup> Baisakh:</strong></p>

<table align="center" border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;">

<p>

<strong>1,267.27</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,275.11</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,284.75</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,292.59</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,302.23</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,310.07</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,319.71</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>OHLC Update 3<sup>rd</sup> Week of Baisakh:</strong></p>

<p>

<strong>O: 1292.12<br />

H: 1322.95<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for the 4<sup>th</sup> Week of Baisakh: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;height:37px;">

<p>

<strong>1,237.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,260.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,277.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,300.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,317.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,340.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,357.24</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for this month: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p>

<strong>1077.31</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1104.17</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1144.09</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1170.95</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1210.87</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1237.73</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1277.65</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p>

<strong>2<sup>nd</sup> week of Baisakh (8<sup>th</sup> – 12<sup>th</sup>): NRs. 494.44 Crores </strong></p>

<p>

<strong>3<sup>rd</sup> week of Baisakh (15<sup>th</sup> – 19<sup>th</sup>): NRs. 439.77 Crores </strong></p>

<p>

<strong>19<sup>th</sup> Baisakh: Nrs. 58 Crores</strong></p>

<p>

<strong>Commentary:</strong></p>

<div>

<strong>•Today market has remained negative like yesterday. Likewise the other indexes are also negative. </strong></div>

<div>

<strong>•The volume today is smaller than that of yesterdays traded volume. </strong></div>

<div>

<strong>•All of 10 Sub-indices except Hotels, Non Life Insurance and Manu.& Pro. are positive today. </strong></div>

<div>

<strong>•The noticeable changes on the Sub- Indices are of Non Life Insurance by 37.55 and Manu.& Pro. By 38.08. </strong></div>

<div>

<strong>•The CMP of 19th Baisakh is above the pivot of 22nd Baisakh and the monthly pivot but below the weekly pivot.</strong></div>

<div>

<strong>•Today NEPSE Market lost 4.21 points and the turnover of 19th Baisakh is only 58 Crores . </strong></div>

<div>

</div>

<div>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 4.35 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>314</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NLIC</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.48 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>1,002</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.47 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>342</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.01 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>155</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 1.89 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>970</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP </strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change </strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>HDL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>1,479</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>74</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>344</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>16</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UPCL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>102</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>4</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>BNT</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>6,850</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>PRVUPO</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>165</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>6</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UMHL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>113</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NEF</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>8.46</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-0</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>EDBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>300</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-15</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SINDU</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>130</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>RRHP</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>93</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-4</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Sector Wise Summary:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p>

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>NRs. 38.5 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>1,289,448</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>3,344</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>NRs. 0.32 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>25,112</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>106</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.99 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>27,937</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>64</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.74 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>22,114</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>145</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:35px;">

<p>

<strong>Others</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>NRs. 0.83 Crores</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>27,667</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>143</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p>

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>NRs. 13.49 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>603,974</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>2,175</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 6.27 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>110,875</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>610</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 3.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>152,750</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>508</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Mutual Fund</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.33 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>335,963</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>72</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Tradings </strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.01 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>70</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>5</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<div>

<strong>Analysis: </strong></div>

<div>

<strong>1.The market found increasing number of sellers when the market resistant reached 1320 for booking profit.</strong></div>

<div>

<strong>2.Market can expect prominent buyers at 1260 to 1280 so this can lead to increase in transactions.</strong></div>

<div>

<strong>3.Breaking below 1240 will be a big event while breaking above 1330 can be silver shining for NEPSE.</strong></div>

<div>

<strong>4.The upcoming closing of Baisakh may weigh in the market and give us some idea about days ahead. Still, the Fourth closing of the fiscal year will be risk mitigating period for the corporate rather than going aggressive in the market</strong></div>

<div>

</div>

</div>

<p>

</p>

',

'published' => true,

'created' => '2019-05-03',

'modified' => '2019-05-03',

'keywords' => '',

'description' => '',

'sortorder' => '10360',

'image' => '20190503125816_3.jpg',

'article_date' => '2019-05-03 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => false,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '10609',

'article_category_id' => '1',

'title' => 'Market Watch 3rd May(Friday) ',

'sub_title' => '',

'summary' => 'Today market has remained negative like yesterday. Likewise the other indexes are also negative.',

'content' => '<p>

<strong> Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Article for 22<sup>nd</sup> Baisakh:</strong></p>

<p>

<strong>Current Price (CMP): 1294.39</strong></p>

<p>

<strong>OHLC Update of 19<sup>th</sup> Baisakh:</strong></p>

<p>

<strong>O: 1298.60<br />

H: 1300.43<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for 22<sup>nd</sup> Baisakh:</strong></p>

<table align="center" border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;">

<p>

<strong>1,267.27</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,275.11</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,284.75</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,292.59</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,302.23</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,310.07</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,319.71</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>OHLC Update 3<sup>rd</sup> Week of Baisakh:</strong></p>

<p>

<strong>O: 1292.12<br />

H: 1322.95<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for the 4<sup>th</sup> Week of Baisakh: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;height:37px;">

<p>

<strong>1,237.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,260.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,277.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,300.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,317.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,340.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,357.24</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for this month: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p>

<strong>1077.31</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1104.17</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1144.09</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1170.95</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1210.87</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1237.73</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1277.65</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p>

<strong>2<sup>nd</sup> week of Baisakh (8<sup>th</sup> – 12<sup>th</sup>): NRs. 494.44 Crores </strong></p>

<p>

<strong>3<sup>rd</sup> week of Baisakh (15<sup>th</sup> – 19<sup>th</sup>): NRs. 439.77 Crores </strong></p>

<p>

<strong>19<sup>th</sup> Baisakh: Nrs. 58 Crores</strong></p>

<p>

<strong>Commentary:</strong></p>

<div>

<strong>•Today market has remained negative like yesterday. Likewise the other indexes are also negative. </strong></div>

<div>

<strong>•The volume today is smaller than that of yesterdays traded volume. </strong></div>

<div>

<strong>•All of 10 Sub-indices except Hotels, Non Life Insurance and Manu.& Pro. are positive today. </strong></div>

<div>

<strong>•The noticeable changes on the Sub- Indices are of Non Life Insurance by 37.55 and Manu.& Pro. By 38.08. </strong></div>

<div>

<strong>•The CMP of 19th Baisakh is above the pivot of 22nd Baisakh and the monthly pivot but below the weekly pivot.</strong></div>

<div>

<strong>•Today NEPSE Market lost 4.21 points and the turnover of 19th Baisakh is only 58 Crores . </strong></div>

<div>

</div>

<div>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 4.35 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>314</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NLIC</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.48 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>1,002</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.47 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>342</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.01 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>155</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 1.89 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>970</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP </strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change </strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>HDL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>1,479</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>74</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>344</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>16</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UPCL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>102</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>4</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>BNT</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>6,850</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>PRVUPO</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>165</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>6</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UMHL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>113</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NEF</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>8.46</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-0</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>EDBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>300</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-15</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SINDU</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>130</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>RRHP</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>93</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-4</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Sector Wise Summary:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p>

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>NRs. 38.5 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>1,289,448</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>3,344</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>NRs. 0.32 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>25,112</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>106</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.99 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>27,937</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>64</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.74 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>22,114</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>145</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:35px;">

<p>

<strong>Others</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>NRs. 0.83 Crores</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>27,667</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>143</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p>

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>NRs. 13.49 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>603,974</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>2,175</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 6.27 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>110,875</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>610</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 3.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>152,750</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>508</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Mutual Fund</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.33 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>335,963</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>72</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Tradings </strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.01 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>70</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>5</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<div>

<strong>Analysis: </strong></div>

<div>

<strong>1.The market found increasing number of sellers when the market resistant reached 1320 for booking profit.</strong></div>

<div>

<strong>2.Market can expect prominent buyers at 1260 to 1280 so this can lead to increase in transactions.</strong></div>

<div>

<strong>3.Breaking below 1240 will be a big event while breaking above 1330 can be silver shining for NEPSE.</strong></div>

<div>

<strong>4.The upcoming closing of Baisakh may weigh in the market and give us some idea about days ahead. Still, the Fourth closing of the fiscal year will be risk mitigating period for the corporate rather than going aggressive in the market</strong></div>

<div>

</div>

</div>

<p>

</p>

',

'published' => true,

'created' => '2019-05-03',

'modified' => '2019-05-03',

'keywords' => '',

'description' => '',

'sortorder' => '10360',

'image' => '20190503125816_3.jpg',

'article_date' => '2019-05-03 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => false,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

'article_id' => '10609',

'hit' => '1113'

)

),

'Slider' => array()

)

$current_user = null

$logged_in = false

$image = 'https://www.old.newbusinessage.com/app/webroot/img/news/20190503125816_3.jpg'

$user = null include - APP/View/Articles/view.ctp, line 115

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117 Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '10609',

'article_category_id' => '1',

'title' => 'Market Watch 3rd May(Friday) ',

'sub_title' => '',

'summary' => 'Today market has remained negative like yesterday. Likewise the other indexes are also negative.',

'content' => '<p>

<strong> Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Article for 22<sup>nd</sup> Baisakh:</strong></p>

<p>

<strong>Current Price (CMP): 1294.39</strong></p>

<p>

<strong>OHLC Update of 19<sup>th</sup> Baisakh:</strong></p>

<p>

<strong>O: 1298.60<br />

H: 1300.43<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for 22<sup>nd</sup> Baisakh:</strong></p>

<table align="center" border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;">

<p>

<strong>1,267.27</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,275.11</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,284.75</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,292.59</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,302.23</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,310.07</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,319.71</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>OHLC Update 3<sup>rd</sup> Week of Baisakh:</strong></p>

<p>

<strong>O: 1292.12<br />

H: 1322.95<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for the 4<sup>th</sup> Week of Baisakh: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;height:37px;">

<p>

<strong>1,237.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,260.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,277.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,300.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,317.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,340.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,357.24</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for this month: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p>

<strong>1077.31</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1104.17</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1144.09</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1170.95</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1210.87</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1237.73</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1277.65</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p>

<strong>2<sup>nd</sup> week of Baisakh (8<sup>th</sup> – 12<sup>th</sup>): NRs. 494.44 Crores </strong></p>

<p>

<strong>3<sup>rd</sup> week of Baisakh (15<sup>th</sup> – 19<sup>th</sup>): NRs. 439.77 Crores </strong></p>

<p>

<strong>19<sup>th</sup> Baisakh: Nrs. 58 Crores</strong></p>

<p>

<strong>Commentary:</strong></p>

<div>

<strong>•Today market has remained negative like yesterday. Likewise the other indexes are also negative. </strong></div>

<div>

<strong>•The volume today is smaller than that of yesterdays traded volume. </strong></div>

<div>

<strong>•All of 10 Sub-indices except Hotels, Non Life Insurance and Manu.& Pro. are positive today. </strong></div>

<div>

<strong>•The noticeable changes on the Sub- Indices are of Non Life Insurance by 37.55 and Manu.& Pro. By 38.08. </strong></div>

<div>

<strong>•The CMP of 19th Baisakh is above the pivot of 22nd Baisakh and the monthly pivot but below the weekly pivot.</strong></div>

<div>

<strong>•Today NEPSE Market lost 4.21 points and the turnover of 19th Baisakh is only 58 Crores . </strong></div>

<div>

</div>

<div>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 4.35 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>314</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NLIC</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.48 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>1,002</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.47 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>342</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.01 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>155</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 1.89 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>970</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP </strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change </strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>HDL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>1,479</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>74</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>344</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>16</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UPCL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>102</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>4</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>BNT</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>6,850</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>PRVUPO</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>165</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>6</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UMHL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>113</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NEF</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>8.46</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-0</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>EDBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>300</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-15</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SINDU</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>130</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>RRHP</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>93</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-4</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Sector Wise Summary:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p>

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>NRs. 38.5 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>1,289,448</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>3,344</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>NRs. 0.32 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>25,112</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>106</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.99 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>27,937</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>64</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.74 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>22,114</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>145</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:35px;">

<p>

<strong>Others</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>NRs. 0.83 Crores</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>27,667</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>143</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p>

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>NRs. 13.49 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>603,974</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>2,175</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 6.27 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>110,875</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>610</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 3.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>152,750</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>508</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Mutual Fund</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.33 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>335,963</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>72</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Tradings </strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.01 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>70</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>5</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<div>

<strong>Analysis: </strong></div>

<div>

<strong>1.The market found increasing number of sellers when the market resistant reached 1320 for booking profit.</strong></div>

<div>

<strong>2.Market can expect prominent buyers at 1260 to 1280 so this can lead to increase in transactions.</strong></div>

<div>

<strong>3.Breaking below 1240 will be a big event while breaking above 1330 can be silver shining for NEPSE.</strong></div>

<div>

<strong>4.The upcoming closing of Baisakh may weigh in the market and give us some idea about days ahead. Still, the Fourth closing of the fiscal year will be risk mitigating period for the corporate rather than going aggressive in the market</strong></div>

<div>

</div>

</div>

<p>

</p>

',

'published' => true,

'created' => '2019-05-03',

'modified' => '2019-05-03',

'keywords' => '',

'description' => '',

'sortorder' => '10360',

'image' => '20190503125816_3.jpg',

'article_date' => '2019-05-03 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => false,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '10609',

'article_category_id' => '1',

'title' => 'Market Watch 3rd May(Friday) ',

'sub_title' => '',

'summary' => 'Today market has remained negative like yesterday. Likewise the other indexes are also negative.',

'content' => '<p>

<strong> Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Article for 22<sup>nd</sup> Baisakh:</strong></p>

<p>

<strong>Current Price (CMP): 1294.39</strong></p>

<p>

<strong>OHLC Update of 19<sup>th</sup> Baisakh:</strong></p>

<p>

<strong>O: 1298.60<br />

H: 1300.43<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for 22<sup>nd</sup> Baisakh:</strong></p>

<table align="center" border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;">

<p>

<strong>1,267.27</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,275.11</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,284.75</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,292.59</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,302.23</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,310.07</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1,319.71</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>OHLC Update 3<sup>rd</sup> Week of Baisakh:</strong></p>

<p>

<strong>O: 1292.12<br />

H: 1322.95<br />

L: 1282.95<br />

C: 1294.39</strong></p>

<p>

<strong>Pivot for the 4<sup>th</sup> Week of Baisakh: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:78px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:78px;height:37px;">

<p>

<strong>1,237.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,260.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,277.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,300.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,317.24</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,340.1</strong></p>

</td>

<td style="width:91px;height:37px;">

<p>

<strong>1,357.24</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for this month: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p>

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p>

<strong>1077.31</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1104.17</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1144.09</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1170.95</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1210.87</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1237.73</strong></p>

</td>

<td style="width:91px;">

<p>

<strong>1277.65</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p>

<strong>2<sup>nd</sup> week of Baisakh (8<sup>th</sup> – 12<sup>th</sup>): NRs. 494.44 Crores </strong></p>

<p>

<strong>3<sup>rd</sup> week of Baisakh (15<sup>th</sup> – 19<sup>th</sup>): NRs. 439.77 Crores </strong></p>

<p>

<strong>19<sup>th</sup> Baisakh: Nrs. 58 Crores</strong></p>

<p>

<strong>Commentary:</strong></p>

<div>

<strong>•Today market has remained negative like yesterday. Likewise the other indexes are also negative. </strong></div>

<div>

<strong>•The volume today is smaller than that of yesterdays traded volume. </strong></div>

<div>

<strong>•All of 10 Sub-indices except Hotels, Non Life Insurance and Manu.& Pro. are positive today. </strong></div>

<div>

<strong>•The noticeable changes on the Sub- Indices are of Non Life Insurance by 37.55 and Manu.& Pro. By 38.08. </strong></div>

<div>

<strong>•The CMP of 19th Baisakh is above the pivot of 22nd Baisakh and the monthly pivot but below the weekly pivot.</strong></div>

<div>

<strong>•Today NEPSE Market lost 4.21 points and the turnover of 19th Baisakh is only 58 Crores . </strong></div>

<div>

</div>

<div>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 4.35 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>314</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NLIC</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.48 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>1,002</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.47 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>342</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 2.01 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>155</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>CBBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>NRs. 1.89 Crores</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>970</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP </strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change </strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>HDL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>1,479</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>74</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>344</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>16</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UPCL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>102</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>4</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>BNT</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>6,850</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>PRVUPO</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>165</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>6</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:201px;">

<p>

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>UMHL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>113</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>NEF</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>8.46</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-0</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>EDBL</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>300</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-15</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>SINDU</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>130</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-6</strong></p>

</td>

</tr>

<tr>

<td style="width:201px;">

<p>

<strong>RRHP</strong></p>

</td>

<td style="width:202px;">

<p>

<strong>93</strong></p>

</td>

<td style="width:199px;">

<p>

<strong>-4</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Sector Wise Summary:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p>

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>NRs. 38.5 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>1,289,448</strong></p>

</td>

<td style="width:160px;height:29px;">

<p>

<strong>3,344</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p>

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>NRs. 0.32 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>25,112</strong></p>

</td>

<td style="width:160px;height:34px;">

<p>

<strong>106</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.99 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>27,937</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>64</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p>

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>NRs. 0.74 Crores</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>22,114</strong></p>

</td>

<td style="width:160px;">

<p>

<strong>145</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:35px;">

<p>

<strong>Others</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>NRs. 0.83 Crores</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>27,667</strong></p>

</td>

<td style="width:160px;height:35px;">

<p>

<strong>143</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p>

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>NRs. 13.49 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>603,974</strong></p>

</td>

<td style="width:160px;height:36px;">

<p>

<strong>2,175</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 6.27 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>110,875</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>610</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 3.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>152,750</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>508</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Mutual Fund</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.33 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>335,963</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>72</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p>

<strong>Tradings </strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>NRs. 0.01 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>70</strong></p>

</td>

<td style="width:160px;height:41px;">

<p>

<strong>5</strong></p>

</td>

</tr>