August 27: Remittance inflow to Nepal has remained above average in recent months despite widespread speculations that it would decline due to the global impact of Covid-19.…

August 27: Remittance inflow to Nepal has remained above average in recent months despite widespread speculations that it would decline due to the global impact of Covid-19.…

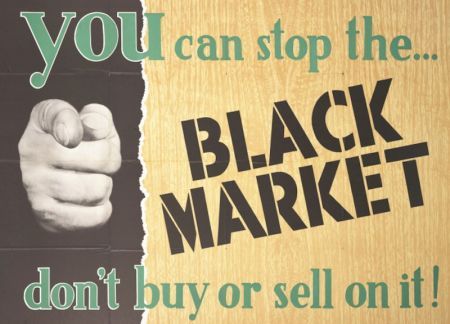

August 26: District Administration Office, Saptari has issued a prohibitory order to control the spread of coronavirus.…

August 26: The Civil Aviation Authority of Nepal (CAAN) is preparing to make the airfare uniform for both foreigners and Nepali nationals during domestic…

August 26: Nepal Rastra Bank has authorised Nepal Clearing House Limited (NCHL) to prepare a national payment switch at a time when the country is struggling for affordable and safe electronic transaction due to lack of such…

August 26: Soybean oil has taken the place of refined palm oil as Nepal’s chief export product after India imposed a ban on import of palm oil from Nepal since the last four…

August 25: Coronavirus pandemic has strengthened the external sector of economy despite affecting the country’s economy.…

August 25: Two trains for Janakpur-Jayanagar Railway have arrived at Hajipur of…

August 25: Dambar Bahadur Katuwal, a tea farmer in Kanyam, Illam, is ecstatic to get a fair price for…

August 25: Stock market trading in Nepal has taken a positive direction in recent days due to online transaction for stock…

August 25: The Nepal-India Trade Treaty mentions that both countries will promote each other’s products in their respective…

August 25: Insurance Board, the regulatory body of insurance companies in Nepal, has directed non-life insurance companies to provide discount on insurance fees to the industries that were closed during the lockdown…

August 25: Purna Prasad Acharya has been appointed as the chief executive officer (CEO) of CDS and Clearing Limited, a depository and subsidiary of Nepal Stock Exchange…

August 24: Despite the attempts of banks to disburse loans by lowering the interest rates and setting new base rates, flow of new credit has still not happened.…

August 24: Energy producers and entrepreneurs have expressed their dissatisfaction towards the merger directives of the Electricity Regulatory Commission.…

August 24: Janak Educational Material Centre (JEMC) is preparing to start printing the excise duty stickers for liquor and cigarettes within one…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '12381', 'article_category_id' => '1', 'title' => 'Inflow of Remittance Remains Above Average Despite Current Crisis', 'sub_title' => '', 'summary' => 'August 27: Remittance inflow to Nepal has remained above average in recent months despite widespread speculations that it would decline due to the global impact of Covid-19. ', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 27: Remittance inflow to Nepal has remained above average in recent months despite widespread speculations that it would decline due to the global impact of Covid-19. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The inflow of remittance was above average in the first month of the current fiscal year (mid-July to mid-August). Remittance inflow was above average in the previous two months as well.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Nepal received remittance around Rs 90 billion in mid-July to mid-August, according to Nepal Remitters Association. The figure is 20 percent more compared to the remittance inflow of last fiscal year. During the corresponding period of last FY 2019/20, the inflow of remittance to Nepal was Rs 75.40 billion.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Chairman of Nepal Remitters Association, Suman Pokharel, said that the country received remittance of around Rs 90 billion according to their estimate.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“The inflow of remittance during the month of Shrawn (mid-July to mid-August) seems to be above average despite Covid-19 crisis,” said Pokharel.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to Nepal Remitters Association, the inflow of remittance during the review period however has declined by 10 percent compared to the previous month (mid-June/mid-July). During that period, Nepal had received remittance of Rs 101 billion.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">During normal circumstances, the average inflow of remittance to Nepal is around Rs 73 billion. However, during the first two months of the lockdown imposed in March, the inflow of remittance had dropped below average. However, it has picked up pace again.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to the data kept by Nepal Rastra Bank, the inflow of remittance in Chaitra (mid-March to mid-April) was Rs 34 billion followed by Rs 54 billion in Baishakh (mid-April to mid-May).</span></span></span></span></p> ', 'published' => true, 'created' => '2020-08-27', 'modified' => '2020-08-27', 'keywords' => '', 'description' => '', 'sortorder' => '12128', 'image' => '20200827110732_1598476383.2.jpg', 'article_date' => '2020-08-27 11:07:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '12380', 'article_category_id' => '1', 'title' => 'Prohibitory Order Fueling Black Marketing of Consumer Goods in Saptari', 'sub_title' => '', 'summary' => 'August 26: District Administration Office, Saptari has issued a prohibitory order to control the spread of coronavirus. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">August 26: District Administration Office, Saptari has issued a prohibitory order to control the spread of coronavirus. However, this prohibitory order has become an opportunity for some traders to cheat the customers and make fast money from them. Customers complain that the traders are selling grocery items at double price. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The traders are charging high price to the customers saying that the goods have not been imported as per the demand. Goods like lentil, rice, cooking oil, spices, sugar and biscuits are sold at high price openly. Ramesh Kumar Yadav of Bishnupur rural municipality – 1, says that they are obliged to buy goods at high price as only limited shops are open. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Stating that they are forced to buy essential items in high price, he says, “The daily essential items are openly being sold at high price in the markets of Rajbiraj. Despite this, the local government and administration have not shown any interest to curb this malpractice.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Mayadevi Shah also shares a similar experience. She says that the shopkeepers arbitrarily charge high prices from customers under the pretext of lockdown. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman""> “Teams of police and army come in Rajbiraj every now and then,” she says, “There is a rush to buy goods. Chaos is seen in the market when the police and army teams arrive. So, even though the goods are expensive, we are obliged to buy them.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Nagmani Shah of Nagmani grocery store says that the supply of goods in the market is not so easy like before due to the lockdown and as the wholesale price has increased, they have to sell the products in a bit higher price. He admits that the price of oil, sugar, pulses and other goods has slightly increased than the previous month. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Shankar Dar, president of Saptari Chamber of Commerce and Industry, claims that there is no shortage of goods in the market. He informed that the monitoring work has been started after they received the information that the goods are being sold at high price. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">"Unnecessary rumors have been spread that goods have been sold at higher prices," he said, adding, “If any shopkeeper is charging high price, let us know immediately. We will take action instantly.” </span></span></span></span></p> ', 'published' => true, 'created' => '2020-08-26', 'modified' => '2020-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '12127', 'image' => '20200826025232_20200327122456_11.jpg', 'article_date' => '2020-08-26 14:51:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '12379', 'article_category_id' => '1', 'title' => 'CAAN Preparing to Lower Airfare for Foreigners ', 'sub_title' => '', 'summary' => 'August 26: The Civil Aviation Authority of Nepal (CAAN) is preparing to make the airfare uniform for both foreigners and Nepali nationals during domestic flights.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">August 26: The Civil Aviation Authority of Nepal (CAAN) is preparing to make the airfare uniform for both foreigners and Nepali nationals during domestic flights.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">CAAN is preparing to lower the charge for foreigners upon the recommendation of the Airfare Review Committee chaired by Deputy Director-General of CAAN Narendra Thapa.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The committee also includes Anoj Rimal, CEO of Yeti Air, and Manoj Karki, managing director of Summit Air.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">However, Nepali airline operators have protested against such a decision informing that the airfare can cost even higher than the current fare if the foreigners will have to pay less than the rate fixed at present. Currently, domestic airlines in Nepal have been charging fares in dollars for foreigners on all the domestic flights.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Airline operators inform that they are providing their air transportation service to Nepali passengers at a concessional rate because they make up for the loss by charging dollars with foreigners.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The committee has made a proposal with the provision for airline operators to charge high fare for foreigners only for flights to Bharatpur in Chitwan, Jomsom in Mustang, Pokhara in Kaski, Lukla in Solukhumbu and Tumlingtar Airport in Sankhuwasabha.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Minister for Tourism Yogesh Bhattarai while addressing the annual progress report of the last fiscal year at the ministry on Tuesday informed that preparations are underway to lower the airfare for foreigners.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-26', 'modified' => '2020-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '12126', 'image' => '20200826024213_1598389402.Clipboard08.jpg', 'article_date' => '2020-08-26 14:41:41', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '12378', 'article_category_id' => '1', 'title' => 'NCHL Conducting Feasibility Study for National Payment Switch', 'sub_title' => '', 'summary' => 'August 26: Nepal Rastra Bank has authorised Nepal Clearing House Limited (NCHL) to prepare a national payment switch at a time when the country is struggling for affordable and safe electronic transaction due to lack of such switch.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 26: Nepal Rastra Bank has authorised Nepal Clearing House Limited (NCHL) to prepare a national payment switch at a time when the country is struggling for affordable and safe electronic transaction due to lack of such switch.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The central bank assigned the job to NCHL about a month ago. NCHL has already started feasibility study for establishing the national payment gateway. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Chief Executive of NCHL Nilesh Man Singh Pradhan says they will discuss about the modality of the payment switch after the feasibility study gets completed.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Banks and financial institutions (BFIs) have been paying hefty price for digital transaction through international payment gateway like Visa and MasterCard due to lack of Nepal’s own payment gateway. The switch is crucial for connecting all the institutions involved in electronic transaction.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Currently, banks have been relying on international switch for the payment through debit and credit cards as well as for the use of ATMs. Some banks have made their own switch for this purpose.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Nepal Rastra Bank has been paying Rs 12 per transaction to the operators of foreign switch, according to NRB Spokesperson Gunakar Bhatta.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"> </span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">Nepal Rastra Bank had prepared a report on the National Payment Gateway in April.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">NRB had formed a five-member committee headed by Subash Ghimire, director of the Payments System Department, to prepare the report after the finance ministry instructed the central bank to establish a national switch for electronic payment through banks. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">A representative each from the finance ministry, Financial Comptroller General’s Office, Information Technology Centre and Nepal Bankers’ Association were the members of the committee.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">The report had provided various suggestions to the central bank regarding the operation process of the payment gateway. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">The national switch of NRB will incorporate revenue collection and payment of the government in the first phase.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS"">In the second phase, the central bank plans to bring all the payments across the country under a single channel. </span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-08-26', 'modified' => '2020-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '12125', 'image' => '20200826122725_1598389522.Clipboard09.jpg', 'article_date' => '2020-08-26 12:26:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '12377', 'article_category_id' => '1', 'title' => 'Soybean Oil Replaces Palm Oil as Nepal’s Major Export Product', 'sub_title' => '', 'summary' => 'August 26: Soybean oil has taken the place of refined palm oil as Nepal’s chief export product after India imposed a ban on import of palm oil from Nepal since the last four months.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 26: Soybean oil has taken the place of refined palm oil as Nepal’s chief export product after India imposed a ban on import of palm oil from Nepal since the last four months.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to the data kept by the Department of Customs, Nepal exported soybean oil worth Rs 2.27 billion in the first month of the current fiscal year. India is the major market of soybean oil produced in Nepal. The export of soybean oil to India in the first month of FY 2020/21 increased by five folds compared to the export during the corresponding period of the previous fiscal year.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">In the first month of FY 2019/20, Nepal had exported soybean oil worth Rs 450 million to India.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">During the last fiscal year, refined palm oil topped the list of products exported to India from Nepal. In FY 2019/20, Nepal exported refined palm oil worth Rs 19.31 billion to India. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">However, the Department of Foreign Trade of India in May revoked the license of palm oil importers in the country due to which Nepali exporters were unable to sell the product in the Indian market.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to the operator of OCB Foods, Suresh Rungata, his industry has scaled up manufacturing soybean oil after India halted the export of palm oil from Nepal. He informed New Business Age that soybean oil accounts for more than 50 percent of the total production in the industry.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“We opted for production of soybean and sunflower oils as an alternative to palm oil after India imposed the ban,” says Rungata.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Pradeep Muraraka, a businessman based in Biratnagar, says the demand for soybean oil has been increasing in the recent days.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“Although all industries are not operating in full capacity due to coronavirus pandemic, those that are operational have received high demand for soybean oil,” said Muraraka.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Industries in Nepal basically import crude soybean oil from Argentina, Brazil, Paraguay, Indonesia and Ukraine. They then refine the oil and export it to India and third countries.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Besides soybean oil, other major export products of Nepal in the first month of the current fiscal year were tea, cardamom and carpet.</span></span></span></span></p> ', 'published' => true, 'created' => '2020-08-26', 'modified' => '2020-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '12124', 'image' => '20200826113011_1598389808.3.jpg', 'article_date' => '2020-08-26 11:29:35', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '12376', 'article_category_id' => '1', 'title' => 'Balance of Payment in Surplus due to Coronavirus Pandemic', 'sub_title' => '', 'summary' => 'August 25: Coronavirus pandemic has strengthened the external sector of economy despite affecting the country’s economy. ', 'content' => '<h1><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">August 25: Coronavirus pandemic has strengthened the external sector of economy despite affecting the country’s economy. Nepal’s Balance of Payment (BoP) surplus reached Rs 282 billion in the last fiscal year due to the decline in imports while the remittance did not decrease as estimated. A report published by the Nepal Rastra Bank on Monday which sheds light on the economic situation of the country in the last fiscal year showed that the Balance of Payment surplus has increased significantly.</span></span></span></h1> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Although the country’s exports were affected by the coronavirus pandemic, it also decreased the imports. Nepal’s imports decreased by 15.6 percent to Rs 1196 billion in the last fiscal year as compared to the previous year. The imports had increased by 13.9 percent in the fiscal year 2075/76.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Imports of crude palm oil, soybean, chemical fertilizers, edible oils, computers and its spare parts had increased whereas the imports of petroleum products, means of transportation and their spare parts, MS billets, gold, other machinery and their spare parts had declined in the last fiscal year.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Nepal’s exports improved by 0.6 percent during the review period. Nepal exported goods worth Rs 97.71 billion in the last fiscal year. Exports of palm oil, ayurvedic medicines, herbs, plastic utensils, fruits and other items increased while the exports of CGI sheets, wire, polyester yarn and threads, readymade garments, carpets have decreased in the recent times.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><strong><span style="font-size:14.0pt">Contraction of Trade Deficit</span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The trade deficit shrunk by 16.8 percent to Rs 1099.9 billion in the fiscal year 2076/77. The deficit had increased by 13.5 percent in the previous year. The ratio of trade deficit to GDP is 29.2 percent. The ratio of export to import has become 8.2 percent in the year under review. This ratio was 6.8 percent in the previous year.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><strong><span style="font-size:14.0pt">Improvement on Foreign Exchange Reserves</span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The foreign exchange reserves have improved by 35 percent amounting to Rs 141 billion. The current reserves will be enough to support the imports of 14.4 months’ worth of goods and 12.7 months’ worth of goods and services.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Similarly, the current account deficit has decreased from Rs 265.37 billion in the previous year to Rs 32.6 billion last year by 87.9 percent.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><strong><span style="font-size:14.0pt">Remittance Income Did Not Decrease by Much</span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The remittance income has decreased by much less than it was estimated due to coronavirus. Remittance declined by 0.5 percent. The total remittance inflow was Rs 875.3 billion in the last fiscal year. Remittance decreased by 3.3 percent in terms of American dollars. Under normal circumstances, Nepal, in an average has an inflow of remittance of around Rs 73 billion per month. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><strong><span style="font-size:14.0pt">Increased Inflation</span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The rate of inflation was 6.15 percent in the fiscal year 2076/77. According to the annual report published by Nepal Rastra Bank, the average rate of annual inflation on food and beverages has increased by 8.16 percent. The inflation rate was limited to 3.9 percent in the fiscal year 2076/77. Similarly, the rate of inflation on non-food and services group has reached 4.61 percent. The group had an inflation rate of 5.86 percent in the previous year.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Gunakar Bhatts, spokesperson for Nepal Rastra Bank, said that even though the overall annual inflation had increased, it declined to some extent till mid-July. However, he expressed that the lockdown since the past 4 months has caused a loss of business for everyone and has decreased the consumption capacity due to the lack of income.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><strong><span style="font-size:14.0pt">Surplus on Balance of Services</span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Balance of Services are in surplus because of the decline in the visit of foreign countries for travel as well as for education in their universities. The net balance of services was in surplus of Rs 1.22 billion in the fiscal year 2076/77 when it was in deficit of Rs 15.23 billion in the previous year. Meanwhile, the travel expenditure account has decreased by 40.1 percent to Rs 53.14 billion.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12123', 'image' => '20200825044730_115237_NRB.jpg', 'article_date' => '2020-08-25 16:47:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '12373', 'article_category_id' => '1', 'title' => 'Train Engines and Carriages for Janakpur-Jayanagar Railway arrive at Patna', 'sub_title' => '', 'summary' => 'August 25: Two trains for Janakpur-Jayanagar Railway have arrived at Hajipur of Patna.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">August 25: Two trains for Janakpur-Jayanagar Railway have arrived at Hajipur of Patna. The train carriages and engines were manufactured by India’s International Coach Factory at a cost of Rs 860 million. The trains have been stranded in Patna due to the crisis created by coronavirus. The pandemic has cast uncertainty over the operation of the trains.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">Nepal has paid 20 percent amount for the two trains. The remaining amount will be paid after test operation in Nepal, informed Director General of the Department of Railways, Balaram Mishra. The two trains have the capacity to carry 2,600 people (1,300 each).</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">The underconstruction Jayanagar-Janakpur-Bardibas Railway is 69 kilometers long. A 34-kilometer section of the railway track between Janakpur and Jayanagar is already complete. The trains will be operated along this section for the time being.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">Nepal is planning to bring technicians from Indian on contract basis for the operation of the trains.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">Director General Mishra informed that they have reached an understanding with the Indian Railway Board in a recent virtual meeting that the trains would be handed over to Nepal within mid-September. However, he added that the date might be postponed if the current situation persists.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">The railways department is preparing to announce vacancy for human resource required to operate the trains. The selected candidates would be sent to India for training, said Mishra.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">The Ministry of Physical Infrastructure and Transport had earlier sent around a dozen employees to China for training related to railway construction. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">The government will have to bear additional cost to pay the Indian technicians for operating the trains for the time being on top of the training expenses of its own employees.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Bangla MN"">The Indian company has given one year’s guarantee for the trains.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12122', 'image' => '20200825030614_1598305318.Clipboard09.jpg', 'article_date' => '2020-08-25 15:05:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '12372', 'article_category_id' => '1', 'title' => 'Farmers get Good Price for Tea Leaves this Year ', 'sub_title' => '', 'summary' => 'August 25: Dambar Bahadur Katuwal, a tea farmer in Kanyam, Illam, is ecstatic to get a fair price for tea.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">August 25: Dambar Bahadur Katuwal, a tea farmer in Kanyam, Illam, is ecstatic to get a fair price for tea. Tea farmers like Katuwal, who were worried that the lockdown might affect their sales, are now excited as the industries have bought tea for Rs 40 per kg from them. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">Suryodaya municipality has fixed a minimum price of tea for farmers at Rs 40. Although some industrialists protested against the pricing of the tea, the tea industry has started buying green leaves at Rs 40 with the farmers after they started going to Darjeeling without processing. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">The green leaves are being sold at more than Rs 40 per kg in Illam and Jhapa. Besides orthodox tea, the leaves are plucked for CTC tea. The first tea leaves are used to make green tea for third countries. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">CTC tea is made from the leaves plucked after that. Tea farmers say that even the lowest quality tea leaves are being sold at Rs 30 per kg. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">June is considered the middle of tea picking season which starts from April. Since most tea leaves are produced in the mid season, its price tends to be cheaper. However, this time the farmers are relieved as the price of tea has increased at a time when it usually decreases. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">Shiva Kumar Gupta, manager of Bharatpur-based Star Tea Industry, who has been involved in tea business for two decades, says that he is buying the green leaves at Rs 20 to Rs 22 for manufacturing CTC tea throughout the year in the industry. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">He claims that the price hike this year is highest than previous years. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">According to him, the price of green leaves has increased after an increase in demand for Nepali tea in Indian market. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Times New Roman"">Indian traders have been buying CTC tea at Rs 250 to Rs 300 per kg. The price is double than that of last year. During last year, the price of CTC tea was Rs 130 per kg. </span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12121', 'image' => '20200825014401_1598303364.1.jpg', 'article_date' => '2020-08-25 13:43:22', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '12371', 'article_category_id' => '1', 'title' => 'Online Transaction Boosts Up Stock Market Trading ', 'sub_title' => '', 'summary' => 'August 25: Stock market trading in Nepal has taken a positive direction in recent days due to online transaction for stock trading.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">August 25: Stock market trading in Nepal has taken a positive direction in recent days due to online transaction for stock trading. The value of stocks in the capital market is growing up despite other businesses being shut down amid coronavirus crisis.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Nepal Stock Exchange (NEPSE) on Monday, August 24, recorded share transaction of more than Rs 2.13 billion. Amidst the growing fear of fall in trading activity due to Covid-19, the NEPSE index rose by 21.26 points on Monday.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Investors inform that industries and businesses are closed due to Covid-19 and there are no other investment options. This has led to the growth of stock trading. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Tilak Koirala, chairman of the Share Investors Pressure Group, inform that the market has gained momentum despite the lockdown, as the online system has made it convenient to invest in stock trading from home.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">According to NEPSE, more than 90 percent of the shares have been bought and sold through the online trading system in recent time. It also informed that the number of investors registering in online system has increased. The traders logging for usernames and passwords is increasing making them active in stock trading as there are no other options for investing from home.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Chandra Singh Saud, chief executive officer of NEPSE, informed that stock trading has become easy and effective because of access to online transactions. Saud said that 83 percent of Monday's transactions were done online.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12120', 'image' => '20200825123834_20150909021332_nep.jpg', 'article_date' => '2020-08-25 12:38:01', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '12370', 'article_category_id' => '1', 'title' => 'India’s Obstruction Causing Unnecessary Hassles for Nepali Exporters', 'sub_title' => '', 'summary' => 'August 25: The Nepal-India Trade Treaty mentions that both countries will promote each other’s products in their respective markets.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 25: The Nepal-India Trade Treaty mentions that both countries will promote each other’s products in their respective markets. As per the provision of the treaty, Nepali goods that meets all the required standard set by the government deserves fair treatment in the Indian market.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">However, there are lots of instances in which Nepali products get stranded in the border points due to obstruction created by India time and again. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">There was a time when such obstruction created by India affected the export of vegetable ghee, copper and zinc from Nepal. Of late, Nepali exporters have been facing myriads of problems in exporting cardamom, tea, ginger, jute, lentil, and broom grass.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Nepali exporters are facing problems not only for exporting the goods that are sold in the Indian market but also in third countries.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Industrialists in Nepal say that a large quantity of refined palm oil has been lying in warehouses due to the ban imposed by India on the product since the last five months. Operator of OCB Foods. Suresh Rungata, says they are forced to store more than 100,000 metric tons of refined palm oil as well as raw materials due to the ban on the product by India. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The investments made by 14 oil industries in Nepal are under risk due to such restriction created by India. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“New industries were set up for exporting oil to India. Most of the industrialists upgraded their capacity. But the investors are worried about that their investment might go in vain,” says Rungata.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The private sector has been complaining that the authorities of Nepal do not prepare well during bilateral talks with India resulting in India’s domination. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The Trade and Transit Treaty of 1996 between Nepal and India allowed export of Nepali goods in the Indian market without any customs duty and obstruction. However, the treaty was amended in 2001, authorizing India to ban goods from India. This provision badly affected the industries that were established for exporting goods to India.</span></span></span></span></p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12119', 'image' => '20200825110853_1598303471.Clipboard05.jpg', 'article_date' => '2020-08-25 11:08:19', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '12375', 'article_category_id' => '1', 'title' => 'Insurance Board Directs Insurance Companies to Reduce Insurance Fees During Lockdown Period', 'sub_title' => '', 'summary' => 'August 25: Insurance Board, the regulatory body of insurance companies in Nepal, has directed non-life insurance companies to provide discount on insurance fees to the industries that were closed during the lockdown period.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 25: Insurance Board, the regulatory body of insurance companies in Nepal, has directed non-life insurance companies to provide discount on insurance fees to the industries that were closed during the lockdown period.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The board issued the directive through a circular to all non-life insurance companies on Monday (August 24), according to the state-owned national news agency of Nepal (RSS). </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">In the circular, the board has asked the insurance companies to provide discount on the insurance fees in line with the Property Insurance Guidelines 2075, informed Executive Director of Insurance Board Raju Raman Poudel. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The board has instructed the companies to reduce the insurance fee of the industries under risk zone by 50 percent as per the provision in the budget for the current fiscal year. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Insurance Board has made it clear that the discount will be valid for up to 83 days.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12118', 'image' => '20200825040928_bima_samiti.jpg', 'article_date' => '2020-08-25 16:08:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '12374', 'article_category_id' => '1', 'title' => 'Acharya Appointed CEO of CDS and Clearing Limited', 'sub_title' => '', 'summary' => 'August 25: Purna Prasad Acharya has been appointed as the chief executive officer (CEO) of CDS and Clearing Limited, a depository and subsidiary of Nepal Stock Exchange (Nepse).', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 25: Purna Prasad Acharya has been appointed as the chief executive officer (CEO) of CDS and Clearing Limited, a depository and subsidiary of Nepal Stock Exchange (Nepse).</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The post had remained vacant since the last 11 months. A selection committee had recently recommended the names of Acharya along with Krishna Giri and Bhisma Chalise for the post of the company’s CEO.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">A meeting of the committee on Monday (August 24) decided to appoint Acharya as the CEO of the company. Acharya is a retired employee of Agriculture Development Bank.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">CDC and Clearing was without a CEO ever since the term of former CEO Dev Prakash Gupta September 26 last year. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Kanchan Sapkota was appointed as the acting CEO until now.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-25', 'modified' => '2020-08-25', 'keywords' => '', 'description' => '', 'sortorder' => '12117', 'image' => '20200825034928_1598280156.jpg', 'article_date' => '2020-08-25 15:48:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '12369', 'article_category_id' => '1', 'title' => 'Banks Indulge in ‘Unhealthy Competition’ by Lowering Interest Rates for Swapping Loans', 'sub_title' => 'Credit Flow Becoming Negative Due to the Lack of New Demand', 'summary' => 'August 24: Despite the attempts of banks to disburse loans by lowering the interest rates and setting new base rates, flow of new credit has still not happened. ', 'content' => '<h1><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">August 24: Despite the attempts of banks to disburse loans by lowering the interest rates and setting new base rates, flow of new credit has still not happened. The increase in liquidity in the market is causing the old debtors to shift to the banks with lower interest rates. Banks are trying to sustain their old debtors by offering them lower interest rates.</span></span></span></h1> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Bankers have complained about the unhealthy competition that has surfaced because of the lowering of interest rates in order to attract the customers of other banks. Some bankers claim that some of the debtors have been swapping their loans with other banks by making a full payment of the loan before its maturity. Nepal Rastra Bank has, for the first time, announced the cost of prepayment of loans along with the service fee for banks and financial institutions, because of the coronavirus pandemic.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">According to the announcement made by Nepal Rastra Bank last month, in case of prepayment or swapping of loans, commercial banks are liable to receive 0.15% of the total amount , development banks are liable to receive 0.2% and finance companies are liable to receive 0.3% from their borrowers.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">“Commercial, development banks and finance companies receive a maximum of 0.75%, 1% and 1.25% respectively as the loan management fee. However, there is a provision for them to receive up to 20% on their working capital loans of renewable nature as a renewable and commitment fee, advance payment fee and loan-swap fee.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Ganeshraj Pokharel, the chief executive officer of Citizens Bank, said that it has been easier for old borrowers to move to another bank because of the lowered cost for swapping of loans. He added that the interest rates on deposits are similar for small and big banks, but the bigger banks are pulling the customers of the smaller banks by decreasing their rates greatly with their schemes.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"> “There is high liquidity everywhere. There is no new borrower. However, the tendency of a bank pulling another bank’s customer has increased,” he told New Business Age, adding, “Nepal Rastra Bank has fixed a very low rate for prepayment and swapping of loans. The low charge is the reason for the borrowers to move to other banks that have comparatively lower interest rates.”</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Meanwhile, the Banks and Financial Institution Regulation Department of Nepal Rastra Bank informed that they decided on the cost of swap and prepayment of loans because there wasn’t enough competition in the market.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"> “The fee should be lowered as per the competition. It was important for us to set the limits now because banks are independent while determining such fees,” said an official of the department.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Previously, banks like Mega, NIC Asia, Standard Chartered, Sunrise, Himalayan, Everest, Global IME, Nabil, etc had determined their new base rates or increased their base rates by a little to determine their interest rates on home loans, and small and medium loans. Rates determined in this way range between 7% to 9%. The rates for such loans had also gone as high as 14% when the market didn’t have much investable capital.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The credit flow of commercial banks have become negative after having no new demand for loans and having recovered the interests and installments from old borrowers by mid-August. Nepal Bankers’ Association informed that even though commercial banks had a credit flow of Rs 86 billion by mid-July, the credit flow was negative by Rs 25 billion by mid-August. According to the association, all 27 commercial banks had to recover a combined amount of Rs 293 billion from their debtors till mid-July but the loans to be recovered has become only Rs 286.8 billion as of mid-August.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The credit flow of commercial banks was negative in mid-April to mid-June because they were not able to disburse new loans. The net credit flow was negative by Rs 16 billion toward mid-May. </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-24', 'modified' => '2020-08-24', 'keywords' => '', 'description' => '', 'sortorder' => '12116', 'image' => '20200824042834_INTEREST-RATE.jpg', 'article_date' => '2020-08-24 16:27:44', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '12368', 'article_category_id' => '1', 'title' => 'Energy Producers Dissatisfied with Merger Directive', 'sub_title' => '', 'summary' => 'August 24: Energy producers and entrepreneurs have expressed their dissatisfaction towards the merger directives of the Electricity Regulatory Commission. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">August 24: Energy producers and entrepreneurs have expressed their dissatisfaction towards the merger directives of the Electricity Regulatory Commission. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The Electricity Regulatory Commission has issued a directive to the energy companies for the merge of private projects to enhance power generation, transmission, distribution, and customer service. However, energy entrepreneurs have said that such directive is not justifiable. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Private energy promoters say that the commission has not provided any concessions to encourage merger of companies and therefore the merger policy is not justifiable.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">They allege that the commission issued such directive just to complete the administrative and legal processes. Last week, the commission had issued a directive allowing the promoters of private hydropower projects to merge, acquire, purchase and sale the share and transfer of ownership of the projects.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The entrepreneurs had demanded arrangements for royalty, income tax exemption, and license extension for production of the companies willing to merge. However, the entrepreneurs have expressed their dissatisfaction with the directive as the commission has not addressed these demands.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Nepal Rastra Bank has been providing various incentives to the banks and financial institutions that opt for merger. The power producers demand similar incentives from the commission for merger. The companies inform that merging two or more companies will only reduce their administrative expenses and there are no other benefits besides that.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Krishna Acharya, chairman of the Independent Power Producers Association of Nepal (IPPAN), informs that the promoters will not merge unless an incentive package is introduced. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">“Companies from the same business house can merge. However, the directive does not encourage other companies to merge. It is practically difficult to merge hydropower projects. The merger is possible only if concessions are given,” he says. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-08-24', 'modified' => '2020-08-24', 'keywords' => '', 'description' => '', 'sortorder' => '12115', 'image' => '20200824035450_unnamed.jpg', 'article_date' => '2020-08-24 15:54:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '12367', 'article_category_id' => '1', 'title' => 'JEMC to Start Printing Excise Duty Stickers within a Month', 'sub_title' => '', 'summary' => 'August 24: Janak Educational Material Centre (JEMC) is preparing to start printing the excise duty stickers for liquor and cigarettes within one month.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">August 24: Janak Educational Material Centre (JEMC) is preparing to start printing the excise duty stickers for liquor and cigarettes within one month. The government, which is running out of stock of excise duty stickers, has handed the responsibility of printing the stickers to the state-owned JEMC.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">JEMC is preparing to sign an agreement with Kagaj Kothi to procure papers for printing the stickers.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Kagaj Kothi was selected for supplying papers as it proposed the lowest bid for the tender in which five companies had taken part in, informed an official of JEMC.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Chairman of Kagaj Kothi, Manohar Das Mool, informed New Business Age that they are preparing to sign the agreement as soon as possible.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“We have received confirmation that our company has been selected. We will sign the agreement as soon as the prohibitory order is lifted,” he told NBA.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to JEMC, Kagaj Kothi will have to supply 40 metric tons of paper within 20 days of signing the agreement. If the company does not supply paper on time, JEMC reserves the right to scrap the deal, says Director General of JEMC Mahesh Prasad Timilsina.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">He further informed that they also issued tender bids for other necessary equipment along with the papers to begin printing within a month.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“We will start printing the stickers within a month at any cost. There won’t be any delay under any pretext,” said Timilsina.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Meanwhile, chairman Mool says that the government must facilitate the transport of papers due to the prohibitory order issued in various districts.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-08-24', 'modified' => '2020-08-24', 'keywords' => '', 'description' => '', 'sortorder' => '12114', 'image' => '20200824030025_1598216411.Clipboard12.jpg', 'article_date' => '2020-08-24 14:59:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117