October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October…

October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October…

October 26: Arun Kabeli has commenced issuance of its 3 million units general shares to public from October 26. The company informed of closing the issuance early on October 28. The company has appointed Siddhartha Capital as issue manager for the share issuance. Moreover, it is setting up 64 collection center across the country for the convenience of applicants and interested investors.…

October 26: The 20th Annual General Meeting (AGM) of Pokhara Finance has endorsed a proposal of distributing 14.21 percent dividend of its total paid-up capital to its shareholders in the fiscal year 2072/73. According to the company, the total paid-up capital of the company will reach around Rs 550 million after distribution of dividend. Speaking in the program, Rajkumar Gurung, CEO of the company said that the meeting has also endorsed a proposal of issuing 15 percent right…

October 26: NIC Asia Bank has inaugurated two new branch offices at Urlabari and Puspalal Chowk of Morang district. Issuing a press statement, the company informed that Jagadish Prasad Agrawal, Chairman of the bank, inaugurated the branch offices on October…

October 26: The Confederation of Nepalese Industries (CNI) has launched CNI Think Tank. Organising an event in the capital on October 25, the private sector body announced the formation of the group comprising of 15 prominent personalities from various walks of life. According to CNI, the newly formed Think Tank will be active in policy advocacy and providing the government and lawmakers with suggestions for formulating and implementing sound policies for the economic betterment of…

October 26: Nepal's ranking on the World Bank’s Doing Business 2017 report has slipped at 107 compared to 99 last year. According to the World Bank, the main reasons behind the drop are a decline in Nepal’s business regulatory environment and data revisions. However, Nepal ranks second highest in South Asia after Bhutan (73) and ahead of Sri Lanka…

October 26: Sangrila Development Bank has been able to earn Rs 69.7 million operating profit in the first quarter of the current FY. During the period, the bank collected deposit of Rs 10.94 billion and extended loan of Rs 9.80 million.…

October 26: Sanima Mai Hydropower has appointed NCM Merchant Banking as its issue manager for the issuance of right share. The hydropower is issuing 1:1 (100 percent) right shares to its existing shareholders as per the decision of its 5th annual general meeting (AGM).…

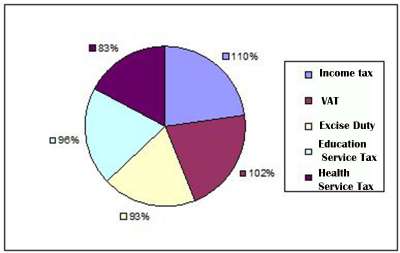

October 25: Revenue collection has increased by 38 percent in the first quarter of the fiscal year 2073/74 compared to the corresponding period of the last FY. In the current FY, the government had targeted to collect Rs 40.28 billion revenue by mid-October 2016. According to the latest data of the Inland Revenue Department (IRD), the revenue collection has reached Rs 41.37 billion. As per IRD, the growth of the revenue collection is 103 percent of the targeted amount.…

October 25: Nepal Electricity Authority (NEA) has granted approval of generating solar power from eight different projects to Api Power Company. Api received the solar power approval based on the government's quest of eliminating present power crisis through the generation of 64 MW solar energy in collaboration with NEA. In the due process, the government had, earlier, called out tender quotation on solar power generation from interest companies.…

October 25: Nepal Motorcycle Federation Club (NMFC) in association with Nepal Cultural and Adventure Events (NCA Events) is organising ‘National Stunt Battle 2016’ in national level on mid-week of…

October 25: Best Remit Nepal and Ramaroshan Microfinance, headquartered at Mangalsen, Acchaam, have entered in an agreement regarding remittance payment. Pradip Shrestha, Marketing and Operation Manager of Best Remit and Bakhat Bahadur Batala, Chief Executive Officer of Microfinance signed the agreement paper on behalf of their respective…

October 25: Tinau Development Bank has concluded its 10th annual general meeting (AGM) at Butwal under the chairmanship of Rajendra Prasad Ojha, Chairman of the bank.…

October 25: Chaudhary Group (CG), the authorized distributor of TCL television for Nepal, has launched a Curve TV in the Nepali…

October 25: The 22nd annual general meeting (AGM) of Nepal Bangladesh Bank (NB Bank) has approved 32 percent bonus shares and 1.6 percent cash dividend for the tax…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4656', 'article_category_id' => '1', 'title' => 'Laxmi Bank Starts Two New Branches', 'sub_title' => '', 'summary' => 'October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October 26.', 'content' => '<p style="text-align: justify;">October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October 26. According to a press statement issued by the bank, it started the branches with a view to provide its services conveniently to its customers. With the additions, the bank is providing its services through 57 branches, two extension counters and 77 ATMs outlets across the country.</p> <p> </p> ', 'published' => true, 'created' => '2016-10-27', 'modified' => '2016-10-27', 'keywords' => '', 'description' => '', 'sortorder' => '4486', 'image' => '20161027103109_laxmi bank.jpg', 'article_date' => '2016-10-27 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4655', 'article_category_id' => '1', 'title' => 'Floatation of Arun Kabeli General Shares Begins', 'sub_title' => '', 'summary' => 'October 26: Arun Kabeli has commenced issuance of its 3 million units general shares to public from October 26. The company informed of closing the issuance early on October 28. The company has appointed Siddhartha Capital as issue manager for the share issuance. Moreover, it is setting up 64 collection center across the country for the convenience of applicants and interested investors. ', 'content' => '<p>October 26: Arun Kabeli has commenced issuance of its 3 million units general shares to public from October 26. The company informed of closing the issuance early on October 28. The company has appointed Siddhartha Capital as issue manager for the share issuance. Moreover, it is setting up 64 collection center across the country for the convenience of applicants and interested investors. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4485', 'image' => '20161026034023_20161021010505_arun kabeli.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4654', 'article_category_id' => '1', 'title' => 'Pokhara Finance to Distribute 14.29% Dividend', 'sub_title' => '', 'summary' => 'October 26: The 20th Annual General Meeting (AGM) of Pokhara Finance has endorsed a proposal of distributing 14.21 percent dividend of its total paid-up capital to its shareholders in the fiscal year 2072/73. According to the company, the total paid-up capital of the company will reach around Rs 550 million after distribution of dividend. Speaking in the program, Rajkumar Gurung, CEO of the company said that the meeting has also endorsed a proposal of issuing 15 percent right shares', 'content' => '<p style="text-align: justify;">October 26: The 20th Annual General Meeting (AGM) of Pokhara Finance has endorsed a proposal of distributing 14.21 percent dividend of its total paid-up capital to its shareholders in the fiscal year 2072/73. According to the company, the total paid-up capital of the company will reach around Rs 550 million after distribution of dividend. Speaking in the program, Rajkumar Gurung, CEO of the company said that the meeting has also endorsed a proposal of issuing 15 percent right shares. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4484', 'image' => '20161026032915_pokhara finance.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4653', 'article_category_id' => '1', 'title' => 'NIC Asia Opens Two New Branches in Morang', 'sub_title' => '', 'summary' => 'October 26: NIC Asia Bank has inaugurated two new branch offices at Urlabari and Puspalal Chowk of Morang district. Issuing a press statement, the company informed that Jagadish Prasad Agrawal, Chairman of the bank, inaugurated the branch offices on October 25.', 'content' => '<p>October 26: NIC Asia Bank has inaugurated two new branch offices at Urlabari and Puspalal Chowk of Morang district.</p> <p>Issuing a press statement, the company informed that Jagadish Prasad Agrawal, Chairman of the bank, inaugurated the branch offices on October 25. </p> <p>With the addition of the new branches, the bank is providing its services with a network of 74 branch offices and 69 ATM outlets across the country.</p> <p>According to the statement, NIC Asia Bank posted 66 percent growth in net profit in the first quarter of the current FY compared to the same period of the last FY. </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4483', 'image' => '20161026031729_nic.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4652', 'article_category_id' => '1', 'title' => 'CNI Announces Think Tank', 'sub_title' => '', 'summary' => 'October 26: The Confederation of Nepalese Industries (CNI) has launched CNI Think Tank. Organising an event in the capital on October 25, the private sector body announced the formation of the group comprising of 15 prominent personalities from various walks of life. According to CNI, the newly formed Think Tank will be active in policy advocacy and providing the government and lawmakers with suggestions for formulating and implementing sound policies for the economic betterment of th', 'content' => '<p style="text-align:justify">October 26: The Confederation of Nepalese Industries (CNI) has launched CNI Think Tank. Organising an event in the capital on October 25, the private sector body announced the formation of the group comprising of 15 prominent personalities from various walks of life. According to CNI, the newly formed Think Tank will be active in policy advocacy and providing the government and lawmakers with suggestions for formulating and implementing sound policies for the economic betterment of the country. The group has former Nepali Permanent Representative to the UN Prof Dr Sambhu Ram Simkhada as the Coordinator and Dr Shanker Prasad Sharma, Umakant Jha, Prof Dr Subas KC, Prof Dr Govinda Pokharel, Dr Bindu Lohani, Purushowattam Ojha, Krishna Gyawali, Kishore Thapa, Sureshman Shrestha, Prof Dr Meena Vaidhya Malla, Himalaya Thapa, Govinda Thapa and Dr Biswo Poudel are its members.</p> <p style="text-align:justify">“We have talked a lot about politics. Now we need to start discourse on introduction and implementation of proper economic policies,” said CNI President Sharma announcing the formation of the Think Tank. “The group will start discussions on agendas regarding the prosperity of the country and exploration of economic potentials.” He mentioned that the main idea behind establishing the group is to help the government and policymakers to make the country a better place for investment. “The size of our economy has expanded over the years. However, our capacity to add value to the economy has decreased,” he said.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4482', 'image' => '20161026025505_cni.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4651', 'article_category_id' => '1', 'title' => 'Nepal Drops 8 Spots in Ease of Doing Business Ranking', 'sub_title' => '', 'summary' => 'October 26: Nepal's ranking on the World Bank’s Doing Business 2017 report has slipped at 107 compared to 99 last year. According to the World Bank, the main reasons behind the drop are a decline in Nepal’s business regulatory environment and data revisions. However, Nepal ranks second highest in South Asia after Bhutan (73) and ahead of Sri Lanka (110).', 'content' => '<p style="text-align:justify">October 26: Doing business in Nepal has become difficult, according to a new World Bank report. Nepal has slide 8 spots to 107 from last year's 99 in the World Bank's Doing Business 2017 report. The report cites decline in Nepal’s business regulatory environment and data revisions as the main reasons behind the drop. However, Nepal ranks second highest in South Asia after Bhutan (73) and Sri Lanka (110).</p> <p style="text-align:justify">According to the bank, using a comparable methodology, Nepal’s score went down from 59.36 of last year to 58.88 in the latest edition of the report,on the distance to frontier metric. "This indicates a widening gap between Nepal’s regulatory environment and global best practices," states the report. More specifically, the Doing Business report finds Nepal made dealing with construction permits more difficult by increasing the cost of obtaining a building permit in 2015/16. "However, on the positive side, Nepal also made exporting and importing easier by implementing ASYCUDA World, an electronic data interchange system," mentions the bank.</p> <p style="text-align:justify"><br /> As per the report, Nepal has recently made progress in institutional reforms on several fronts that will take some time to be reflected in international rankings, including the Doing Business report. </p> <p style="text-align:justify"><br /> “For example, the government has commissioned a Cloud Infrastructure, introduced Public Key Infrastructure for Digital Signature and is close to launching an online registration and approval system for Foreign Direct Investment,” said Takuya Kamata, the World Bank’s Country Manager for Nepal. “Wider public uptake of these systems can help ensure that these positive developments are captured in future rankings,” he said. </p> <p style="text-align:justify"><br /> "Nepal’s drop in ranking was partially offset by changes in methodology. For the first time, the report includes a gender dimension in three sets of indicators: Starting a Business, Registering Property and Enforcing Contracts. The Paying Taxes indicator set has been expanded to cover post-filing processes, such as tax audits and VAT refund," reads a statement by The World Bank. </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4481', 'image' => '20161026023458_world bank.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4650', 'article_category_id' => '1', 'title' => 'Sangrila's Net Profit Increases 40%', 'sub_title' => '', 'summary' => 'October 26: Sangrila Development Bank has been able to earn Rs 69.7 million operating profit in the first quarter of the current FY. During the period, the bank collected deposit of Rs 10.94 billion and extended loan of Rs 9.80 million. ', 'content' => '<p style="text-align: justify;">October 26: Sangrila Development Bank has been able to earn Rs 69.7 million operating profit in the first quarter of the current FY. During the period, the bank collected deposit of Rs 10.94 billion and extended loan of Rs 9.80 million. </p> <p style="text-align: justify;"><br /> According to Dinesh Thakali, Chief Executive Officer of the bank, the deposit collection has increased by 28.41 percent during the review period compare to the same period of the last FY. Similarly, loan extension and profit has also increased by 48.40 percent and 38.86 percent in the review period compare to the same period of the last FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4480', 'image' => '20161026110710_sangrila.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4649', 'article_category_id' => '1', 'title' => 'Sanima Mai Hydro Appoints NCM Merchant as Issue Manager', 'sub_title' => '', 'summary' => 'October 26: Sanima Mai Hydropower has appointed NCM Merchant Banking as its issue manager for the issuance of right share. The hydropower is issuing 1:1 (100 percent) right shares to its existing shareholders as per the decision of its 5th annual general meeting (AGM). ', 'content' => '<p style="text-align: justify;">October 26: Sanima Mai Hydropower has appointed NCM Merchant Banking as its issue manager for the issuance of right share. The hydropower is issuing 1:1 (100 percent) right shares to its existing shareholders as per the decision of its 5th annual general meeting (AGM). </p> <p style="text-align: justify;"><br /> Subarna Das Shrestha, Chief Executive Officer of Sanima Mai Hydropower and Bijay Lal Shrestha, Managing Director of NCM Merchant Banking signed the agreement on behalf of their respective organisation on October 25. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4479', 'image' => '20161026105518_sanima.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4648', 'article_category_id' => '1', 'title' => 'Revenue Collection Up 38%', 'sub_title' => '', 'summary' => 'October 25: Revenue collection has increased by 38 percent in the first quarter of the fiscal year 2073/74 compared to the corresponding period of the last FY. In the current FY, the government had targeted to collect Rs 40.28 billion revenue by mid-October 2016. According to the latest data of the Inland Revenue Department (IRD), the revenue collection has reached Rs 41.37 billion. As per IRD, the growth of the revenue collection is 103 percent of the targeted amount. ', 'content' => '<p style="text-align: justify;">October 25: Revenue collection has increased by 38 percent in the first quarter of the fiscal year 2073/74 compared to the corresponding period of the last FY. In the current FY, the government had targeted to collect Rs 40.28 billion revenue by mid-October 2016. According to the latest data of the Inland Revenue Department (IRD), the revenue collection has reached Rs 41.37 billion. As per IRD, the growth of the revenue collection is 103 percent of the targeted amount. </p> <p style="text-align: justify;"><br /> The government has collected Rs 17.16 billion in income tax, Rs 14.57 billion in value added tax (VAT) and Rs 9.22 billion as excise duty during the first quarter of current FY. The amount collected under the headings of income tax, VAT and excise duty are respectively 110, 102 and 93 percent more than the targeted amount. </p> <p style="text-align: justify;"><br /> Similarly, the government has collected Rs 17.37 billion under education service tax and Rs 24.16 billion in health service tax. The collected amounts of education and health service tax are 96 and 83 percent of the targeted amount respectively. Compared to the last FY, the growth rate of income tax , VAT, excise duty, education service tax and health service tax are 138 percent, 123 percent, 168 percent, 133 percent and 129 percent respectively. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-27', 'keywords' => '', 'description' => '', 'sortorder' => '4478', 'image' => '20161025052335_revenue.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4647', 'article_category_id' => '1', 'title' => 'Api Granted Solar Power Generating Approval by NEA', 'sub_title' => '', 'summary' => 'October 25: Nepal Electricity Authority (NEA) has granted approval of generating solar power from eight different projects to Api Power Company. Api received the solar power approval based on the government's quest of eliminating present power crisis through the generation of 64 MW solar energy in collaboration with NEA. In the due process, the government had, earlier, called out tender quotation on solar power generation from interest companies. ', 'content' => '<p style="text-align:justify">October 25: Nepal Electricity Authority (NEA) has granted approval of generating solar power from eight different projects to Api Power Company. Api received the solar power approval based on the government's quest of eliminating present power crisis through the generation of 64 MW solar energy in collaboration with NEA. In the due process, the government had, earlier, called out tender quotation on solar power generation from interest companies. </p> <p style="text-align:justify"><br /> Api has been granted approval for generating solar energy from eight different locations. The company has targeted to generate 19.5MW solar energy from the locations including 1MW from Dhalkewar, 1.5MW from Duhabi, 8MW from Parwanipur, 4MW from Chandranigahapur, 1MW from Bardgath, 1.5MW from Chanouta and 1.5MW from Kawasoti. Upon receiving the approval, the company will immediately starts the projects and aims to generate and connect the electricity in the national transmission line within one year, informs the company in a press statement. </p> <p style="text-align:justify"><br /> The company also mentioned that Nepal has enormous solar power potential and one time investment in the sector can provide relief for years. The government, considering the potentiality, had added few points in the concept paper 2072 related to present Elimination of Energy Crisis and Electricity Development Decade on November 24, 2015. According to the Concept paper, the government aims to generate 100MW solar energy i.e. 10 percent of total hydropower within the current FY. Similarly, the government has targeted to generate 200MW solar energy in next FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4477', 'image' => '20161025040746_api.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4646', 'article_category_id' => '1', 'title' => 'National Stunt Battle 2016 to be Held', 'sub_title' => '', 'summary' => 'October 25: Nepal Motorcycle Federation Club (NMFC) in association with Nepal Cultural and Adventure Events (NCA Events) is organising ‘National Stunt Battle 2016’ in national level on mid-week of November.', 'content' => '<p>October 25: Nepal Motorcycle Federation Club (NMFC) in association with Nepal Cultural and Adventure Events (NCA Events) is organising ‘National Stunt Battle 2016’ in national level on mid-week of November.</p> <p>According to the organisers, the event will have separate stunt presentations of 5 groups under group category and 10 individuals under individual category. Moreover, the stunt riders will get platform to showcase their technical skills apart from bike stunts in the event.</p> <p>As per the organiser, many youths have desires and dreams to show their bike stunts and technical skills. “These types of contests can be helpful for the participation in the international level of contests," said the organisers.</p> <p>NMFC informed that it will play important role to initiate participation for the winners of the contest in international platforms as well. The event being organised by NMFC, which has already organised successful motorcycle events including Racemandu and Crossmandu, is also supported by National Sports Council and Nepal Automobiles Association (NASA). The winner of the contest will be awarded with shield, medal and cash prize, informs the organiser.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4476', 'image' => '20161025013038_national.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4645', 'article_category_id' => '1', 'title' => 'Remit Agreement between Best Remit and Ramaroshan Microfinance', 'sub_title' => '', 'summary' => 'October 25: Best Remit Nepal and Ramaroshan Microfinance, headquartered at Mangalsen, Acchaam, have entered in an agreement regarding remittance payment. Pradip Shrestha, Marketing and Operation Manager of Best Remit and Bakhat Bahadur Batala, Chief Executive Officer of Microfinance signed the agreement paper on behalf of their respective organisation.', 'content' => '<p style="text-align: justify;">October 25: Best Remit Nepal and Ramaroshan Microfinance, headquartered at Mangalsen, Acchaam, have entered in an agreement regarding remittance payment. Pradip Shrestha, Marketing and Operation Manager of Best Remit and Bakhat Bahadur Batala, Chief Executive Officer of Microfinance signed the agreement paper on behalf of their respective organisation.</p> <p style="text-align: justify;">According to the agreement, customers sending remittances from various countries through Best Remit can receive the payment from branch offices of the microfinance at Acchaam, Dadeldhura, Doti, Bajhang, Bajura, Kailali, Jumla, Kalikot, Surkhet and Dailekh. </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4475', 'image' => '20161025122522_best remit.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4644', 'article_category_id' => '1', 'title' => 'Tinau Devt Bank Concludes 10th AGM', 'sub_title' => '', 'summary' => 'October 25: Tinau Development Bank has concluded its 10th annual general meeting (AGM) at Butwal under the chairmanship of Rajendra Prasad Ojha, Chairman of the bank. ', 'content' => '<p style="text-align: justify;">October 25: Tinau Development Bank has concluded its 10th annual general meeting (AGM) at Butwal under the chairmanship of Rajendra Prasad Ojha, Chairman of the bank. </p> <p style="text-align: justify;"><br /> The bank, issuing a press statement, informed that the AGM was hosted by Pradip Kumar Shrestha, Chief Executive Officer of the bank. In the meeting, Ojha presented the annual report of FY 2072/73. The meeting saw discussion on auditor's report, balance sheet, profit and loss account and cash flow statement of the FY 2072/73. </p> <p style="text-align: justify;"><br /> According to the statement, the AGM approved a proposal of issuing 25 percent bonus share of its total paid-up capital and cash dividend of 1.32 percent for tax purpose. The total paid-up capital of the bank will reach Rs 341.3 million after bonus share distribution. <br /> Moreover, the meeting approved a proposal of issuing 35 percent right shares to its existing shareholders. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4474', 'image' => '20161025120651_tinau.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4643', 'article_category_id' => '1', 'title' => 'TCL Curve TV in the Nepali Market', 'sub_title' => '', 'summary' => 'October 25: Chaudhary Group (CG), the authorized distributor of TCL television for Nepal, has launched a Curve TV in the Nepali market.', 'content' => '<p>October 25: Chaudhary Group (CG), the authorized distributor of TCL television for Nepal, has launched a Curve TV in the Nepali market.</p> <p>Issuing a press statement the company informed that the curve TV has Android 4.4, 2 USB ports, 2 HDMI ports and a HDMI MHL. The special feature of the TV is that it can be viewed from any angle.</p> <p><br /> According to the statement, the Curve TV is available in 48 inches with a price tag of Rs 86,290 in the market. </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4473', 'image' => '20161025113313_tcl.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4642', 'article_category_id' => '1', 'title' => 'NB Bank Approves Bonus and Right Shares', 'sub_title' => '', 'summary' => 'October 25: The 22nd annual general meeting (AGM) of Nepal Bangladesh Bank (NB Bank) has approved 32 percent bonus shares and 1.6 percent cash dividend for the tax purpose.', 'content' => '<p style="text-align:justify">October 25: The 22nd annual general meeting (AGM) of Nepal Bangladesh Bank (NB Bank) has approved 32 percent bonus shares and 1.6 percent cash dividend for the tax purpose.</p> <p style="text-align:justify">Moreover, the AGM also approved a proposal of issuing 10:8 right shares after the bonus shares distribution to meet the minimum paid-up capital of Rs 8 billion as per the Nepal Rastra Bank (NRB) directive.</p> <p style="text-align:justify"><br /> Issuing a press statement, the bank informed that the paid-up capital after distribution bonus share and right shares will reach Rs 7.22 billion.</p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4472', 'image' => '20161025111057_nb bank.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4656', 'article_category_id' => '1', 'title' => 'Laxmi Bank Starts Two New Branches', 'sub_title' => '', 'summary' => 'October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October 26.', 'content' => '<p style="text-align: justify;">October 27: Laxmi Bank has started two new branches in at Rajhar, Nawalparasi and Gaighat, Udayapur. The banks inaugurated both branches on Wednesday, October 26. According to a press statement issued by the bank, it started the branches with a view to provide its services conveniently to its customers. With the additions, the bank is providing its services through 57 branches, two extension counters and 77 ATMs outlets across the country.</p> <p> </p> ', 'published' => true, 'created' => '2016-10-27', 'modified' => '2016-10-27', 'keywords' => '', 'description' => '', 'sortorder' => '4486', 'image' => '20161027103109_laxmi bank.jpg', 'article_date' => '2016-10-27 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4655', 'article_category_id' => '1', 'title' => 'Floatation of Arun Kabeli General Shares Begins', 'sub_title' => '', 'summary' => 'October 26: Arun Kabeli has commenced issuance of its 3 million units general shares to public from October 26. The company informed of closing the issuance early on October 28. The company has appointed Siddhartha Capital as issue manager for the share issuance. Moreover, it is setting up 64 collection center across the country for the convenience of applicants and interested investors. ', 'content' => '<p>October 26: Arun Kabeli has commenced issuance of its 3 million units general shares to public from October 26. The company informed of closing the issuance early on October 28. The company has appointed Siddhartha Capital as issue manager for the share issuance. Moreover, it is setting up 64 collection center across the country for the convenience of applicants and interested investors. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4485', 'image' => '20161026034023_20161021010505_arun kabeli.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4654', 'article_category_id' => '1', 'title' => 'Pokhara Finance to Distribute 14.29% Dividend', 'sub_title' => '', 'summary' => 'October 26: The 20th Annual General Meeting (AGM) of Pokhara Finance has endorsed a proposal of distributing 14.21 percent dividend of its total paid-up capital to its shareholders in the fiscal year 2072/73. According to the company, the total paid-up capital of the company will reach around Rs 550 million after distribution of dividend. Speaking in the program, Rajkumar Gurung, CEO of the company said that the meeting has also endorsed a proposal of issuing 15 percent right shares', 'content' => '<p style="text-align: justify;">October 26: The 20th Annual General Meeting (AGM) of Pokhara Finance has endorsed a proposal of distributing 14.21 percent dividend of its total paid-up capital to its shareholders in the fiscal year 2072/73. According to the company, the total paid-up capital of the company will reach around Rs 550 million after distribution of dividend. Speaking in the program, Rajkumar Gurung, CEO of the company said that the meeting has also endorsed a proposal of issuing 15 percent right shares. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4484', 'image' => '20161026032915_pokhara finance.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4653', 'article_category_id' => '1', 'title' => 'NIC Asia Opens Two New Branches in Morang', 'sub_title' => '', 'summary' => 'October 26: NIC Asia Bank has inaugurated two new branch offices at Urlabari and Puspalal Chowk of Morang district. Issuing a press statement, the company informed that Jagadish Prasad Agrawal, Chairman of the bank, inaugurated the branch offices on October 25.', 'content' => '<p>October 26: NIC Asia Bank has inaugurated two new branch offices at Urlabari and Puspalal Chowk of Morang district.</p> <p>Issuing a press statement, the company informed that Jagadish Prasad Agrawal, Chairman of the bank, inaugurated the branch offices on October 25. </p> <p>With the addition of the new branches, the bank is providing its services with a network of 74 branch offices and 69 ATM outlets across the country.</p> <p>According to the statement, NIC Asia Bank posted 66 percent growth in net profit in the first quarter of the current FY compared to the same period of the last FY. </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4483', 'image' => '20161026031729_nic.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4652', 'article_category_id' => '1', 'title' => 'CNI Announces Think Tank', 'sub_title' => '', 'summary' => 'October 26: The Confederation of Nepalese Industries (CNI) has launched CNI Think Tank. Organising an event in the capital on October 25, the private sector body announced the formation of the group comprising of 15 prominent personalities from various walks of life. According to CNI, the newly formed Think Tank will be active in policy advocacy and providing the government and lawmakers with suggestions for formulating and implementing sound policies for the economic betterment of th', 'content' => '<p style="text-align:justify">October 26: The Confederation of Nepalese Industries (CNI) has launched CNI Think Tank. Organising an event in the capital on October 25, the private sector body announced the formation of the group comprising of 15 prominent personalities from various walks of life. According to CNI, the newly formed Think Tank will be active in policy advocacy and providing the government and lawmakers with suggestions for formulating and implementing sound policies for the economic betterment of the country. The group has former Nepali Permanent Representative to the UN Prof Dr Sambhu Ram Simkhada as the Coordinator and Dr Shanker Prasad Sharma, Umakant Jha, Prof Dr Subas KC, Prof Dr Govinda Pokharel, Dr Bindu Lohani, Purushowattam Ojha, Krishna Gyawali, Kishore Thapa, Sureshman Shrestha, Prof Dr Meena Vaidhya Malla, Himalaya Thapa, Govinda Thapa and Dr Biswo Poudel are its members.</p> <p style="text-align:justify">“We have talked a lot about politics. Now we need to start discourse on introduction and implementation of proper economic policies,” said CNI President Sharma announcing the formation of the Think Tank. “The group will start discussions on agendas regarding the prosperity of the country and exploration of economic potentials.” He mentioned that the main idea behind establishing the group is to help the government and policymakers to make the country a better place for investment. “The size of our economy has expanded over the years. However, our capacity to add value to the economy has decreased,” he said.</p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4482', 'image' => '20161026025505_cni.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4651', 'article_category_id' => '1', 'title' => 'Nepal Drops 8 Spots in Ease of Doing Business Ranking', 'sub_title' => '', 'summary' => 'October 26: Nepal's ranking on the World Bank’s Doing Business 2017 report has slipped at 107 compared to 99 last year. According to the World Bank, the main reasons behind the drop are a decline in Nepal’s business regulatory environment and data revisions. However, Nepal ranks second highest in South Asia after Bhutan (73) and ahead of Sri Lanka (110).', 'content' => '<p style="text-align:justify">October 26: Doing business in Nepal has become difficult, according to a new World Bank report. Nepal has slide 8 spots to 107 from last year's 99 in the World Bank's Doing Business 2017 report. The report cites decline in Nepal’s business regulatory environment and data revisions as the main reasons behind the drop. However, Nepal ranks second highest in South Asia after Bhutan (73) and Sri Lanka (110).</p> <p style="text-align:justify">According to the bank, using a comparable methodology, Nepal’s score went down from 59.36 of last year to 58.88 in the latest edition of the report,on the distance to frontier metric. "This indicates a widening gap between Nepal’s regulatory environment and global best practices," states the report. More specifically, the Doing Business report finds Nepal made dealing with construction permits more difficult by increasing the cost of obtaining a building permit in 2015/16. "However, on the positive side, Nepal also made exporting and importing easier by implementing ASYCUDA World, an electronic data interchange system," mentions the bank.</p> <p style="text-align:justify"><br /> As per the report, Nepal has recently made progress in institutional reforms on several fronts that will take some time to be reflected in international rankings, including the Doing Business report. </p> <p style="text-align:justify"><br /> “For example, the government has commissioned a Cloud Infrastructure, introduced Public Key Infrastructure for Digital Signature and is close to launching an online registration and approval system for Foreign Direct Investment,” said Takuya Kamata, the World Bank’s Country Manager for Nepal. “Wider public uptake of these systems can help ensure that these positive developments are captured in future rankings,” he said. </p> <p style="text-align:justify"><br /> "Nepal’s drop in ranking was partially offset by changes in methodology. For the first time, the report includes a gender dimension in three sets of indicators: Starting a Business, Registering Property and Enforcing Contracts. The Paying Taxes indicator set has been expanded to cover post-filing processes, such as tax audits and VAT refund," reads a statement by The World Bank. </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4481', 'image' => '20161026023458_world bank.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4650', 'article_category_id' => '1', 'title' => 'Sangrila's Net Profit Increases 40%', 'sub_title' => '', 'summary' => 'October 26: Sangrila Development Bank has been able to earn Rs 69.7 million operating profit in the first quarter of the current FY. During the period, the bank collected deposit of Rs 10.94 billion and extended loan of Rs 9.80 million. ', 'content' => '<p style="text-align: justify;">October 26: Sangrila Development Bank has been able to earn Rs 69.7 million operating profit in the first quarter of the current FY. During the period, the bank collected deposit of Rs 10.94 billion and extended loan of Rs 9.80 million. </p> <p style="text-align: justify;"><br /> According to Dinesh Thakali, Chief Executive Officer of the bank, the deposit collection has increased by 28.41 percent during the review period compare to the same period of the last FY. Similarly, loan extension and profit has also increased by 48.40 percent and 38.86 percent in the review period compare to the same period of the last FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4480', 'image' => '20161026110710_sangrila.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4649', 'article_category_id' => '1', 'title' => 'Sanima Mai Hydro Appoints NCM Merchant as Issue Manager', 'sub_title' => '', 'summary' => 'October 26: Sanima Mai Hydropower has appointed NCM Merchant Banking as its issue manager for the issuance of right share. The hydropower is issuing 1:1 (100 percent) right shares to its existing shareholders as per the decision of its 5th annual general meeting (AGM). ', 'content' => '<p style="text-align: justify;">October 26: Sanima Mai Hydropower has appointed NCM Merchant Banking as its issue manager for the issuance of right share. The hydropower is issuing 1:1 (100 percent) right shares to its existing shareholders as per the decision of its 5th annual general meeting (AGM). </p> <p style="text-align: justify;"><br /> Subarna Das Shrestha, Chief Executive Officer of Sanima Mai Hydropower and Bijay Lal Shrestha, Managing Director of NCM Merchant Banking signed the agreement on behalf of their respective organisation on October 25. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-26', 'modified' => '2016-10-26', 'keywords' => '', 'description' => '', 'sortorder' => '4479', 'image' => '20161026105518_sanima.jpg', 'article_date' => '2016-10-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4648', 'article_category_id' => '1', 'title' => 'Revenue Collection Up 38%', 'sub_title' => '', 'summary' => 'October 25: Revenue collection has increased by 38 percent in the first quarter of the fiscal year 2073/74 compared to the corresponding period of the last FY. In the current FY, the government had targeted to collect Rs 40.28 billion revenue by mid-October 2016. According to the latest data of the Inland Revenue Department (IRD), the revenue collection has reached Rs 41.37 billion. As per IRD, the growth of the revenue collection is 103 percent of the targeted amount. ', 'content' => '<p style="text-align: justify;">October 25: Revenue collection has increased by 38 percent in the first quarter of the fiscal year 2073/74 compared to the corresponding period of the last FY. In the current FY, the government had targeted to collect Rs 40.28 billion revenue by mid-October 2016. According to the latest data of the Inland Revenue Department (IRD), the revenue collection has reached Rs 41.37 billion. As per IRD, the growth of the revenue collection is 103 percent of the targeted amount. </p> <p style="text-align: justify;"><br /> The government has collected Rs 17.16 billion in income tax, Rs 14.57 billion in value added tax (VAT) and Rs 9.22 billion as excise duty during the first quarter of current FY. The amount collected under the headings of income tax, VAT and excise duty are respectively 110, 102 and 93 percent more than the targeted amount. </p> <p style="text-align: justify;"><br /> Similarly, the government has collected Rs 17.37 billion under education service tax and Rs 24.16 billion in health service tax. The collected amounts of education and health service tax are 96 and 83 percent of the targeted amount respectively. Compared to the last FY, the growth rate of income tax , VAT, excise duty, education service tax and health service tax are 138 percent, 123 percent, 168 percent, 133 percent and 129 percent respectively. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-27', 'keywords' => '', 'description' => '', 'sortorder' => '4478', 'image' => '20161025052335_revenue.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4647', 'article_category_id' => '1', 'title' => 'Api Granted Solar Power Generating Approval by NEA', 'sub_title' => '', 'summary' => 'October 25: Nepal Electricity Authority (NEA) has granted approval of generating solar power from eight different projects to Api Power Company. Api received the solar power approval based on the government's quest of eliminating present power crisis through the generation of 64 MW solar energy in collaboration with NEA. In the due process, the government had, earlier, called out tender quotation on solar power generation from interest companies. ', 'content' => '<p style="text-align:justify">October 25: Nepal Electricity Authority (NEA) has granted approval of generating solar power from eight different projects to Api Power Company. Api received the solar power approval based on the government's quest of eliminating present power crisis through the generation of 64 MW solar energy in collaboration with NEA. In the due process, the government had, earlier, called out tender quotation on solar power generation from interest companies. </p> <p style="text-align:justify"><br /> Api has been granted approval for generating solar energy from eight different locations. The company has targeted to generate 19.5MW solar energy from the locations including 1MW from Dhalkewar, 1.5MW from Duhabi, 8MW from Parwanipur, 4MW from Chandranigahapur, 1MW from Bardgath, 1.5MW from Chanouta and 1.5MW from Kawasoti. Upon receiving the approval, the company will immediately starts the projects and aims to generate and connect the electricity in the national transmission line within one year, informs the company in a press statement. </p> <p style="text-align:justify"><br /> The company also mentioned that Nepal has enormous solar power potential and one time investment in the sector can provide relief for years. The government, considering the potentiality, had added few points in the concept paper 2072 related to present Elimination of Energy Crisis and Electricity Development Decade on November 24, 2015. According to the Concept paper, the government aims to generate 100MW solar energy i.e. 10 percent of total hydropower within the current FY. Similarly, the government has targeted to generate 200MW solar energy in next FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4477', 'image' => '20161025040746_api.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4646', 'article_category_id' => '1', 'title' => 'National Stunt Battle 2016 to be Held', 'sub_title' => '', 'summary' => 'October 25: Nepal Motorcycle Federation Club (NMFC) in association with Nepal Cultural and Adventure Events (NCA Events) is organising ‘National Stunt Battle 2016’ in national level on mid-week of November.', 'content' => '<p>October 25: Nepal Motorcycle Federation Club (NMFC) in association with Nepal Cultural and Adventure Events (NCA Events) is organising ‘National Stunt Battle 2016’ in national level on mid-week of November.</p> <p>According to the organisers, the event will have separate stunt presentations of 5 groups under group category and 10 individuals under individual category. Moreover, the stunt riders will get platform to showcase their technical skills apart from bike stunts in the event.</p> <p>As per the organiser, many youths have desires and dreams to show their bike stunts and technical skills. “These types of contests can be helpful for the participation in the international level of contests," said the organisers.</p> <p>NMFC informed that it will play important role to initiate participation for the winners of the contest in international platforms as well. The event being organised by NMFC, which has already organised successful motorcycle events including Racemandu and Crossmandu, is also supported by National Sports Council and Nepal Automobiles Association (NASA). The winner of the contest will be awarded with shield, medal and cash prize, informs the organiser.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4476', 'image' => '20161025013038_national.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4645', 'article_category_id' => '1', 'title' => 'Remit Agreement between Best Remit and Ramaroshan Microfinance', 'sub_title' => '', 'summary' => 'October 25: Best Remit Nepal and Ramaroshan Microfinance, headquartered at Mangalsen, Acchaam, have entered in an agreement regarding remittance payment. Pradip Shrestha, Marketing and Operation Manager of Best Remit and Bakhat Bahadur Batala, Chief Executive Officer of Microfinance signed the agreement paper on behalf of their respective organisation.', 'content' => '<p style="text-align: justify;">October 25: Best Remit Nepal and Ramaroshan Microfinance, headquartered at Mangalsen, Acchaam, have entered in an agreement regarding remittance payment. Pradip Shrestha, Marketing and Operation Manager of Best Remit and Bakhat Bahadur Batala, Chief Executive Officer of Microfinance signed the agreement paper on behalf of their respective organisation.</p> <p style="text-align: justify;">According to the agreement, customers sending remittances from various countries through Best Remit can receive the payment from branch offices of the microfinance at Acchaam, Dadeldhura, Doti, Bajhang, Bajura, Kailali, Jumla, Kalikot, Surkhet and Dailekh. </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4475', 'image' => '20161025122522_best remit.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4644', 'article_category_id' => '1', 'title' => 'Tinau Devt Bank Concludes 10th AGM', 'sub_title' => '', 'summary' => 'October 25: Tinau Development Bank has concluded its 10th annual general meeting (AGM) at Butwal under the chairmanship of Rajendra Prasad Ojha, Chairman of the bank. ', 'content' => '<p style="text-align: justify;">October 25: Tinau Development Bank has concluded its 10th annual general meeting (AGM) at Butwal under the chairmanship of Rajendra Prasad Ojha, Chairman of the bank. </p> <p style="text-align: justify;"><br /> The bank, issuing a press statement, informed that the AGM was hosted by Pradip Kumar Shrestha, Chief Executive Officer of the bank. In the meeting, Ojha presented the annual report of FY 2072/73. The meeting saw discussion on auditor's report, balance sheet, profit and loss account and cash flow statement of the FY 2072/73. </p> <p style="text-align: justify;"><br /> According to the statement, the AGM approved a proposal of issuing 25 percent bonus share of its total paid-up capital and cash dividend of 1.32 percent for tax purpose. The total paid-up capital of the bank will reach Rs 341.3 million after bonus share distribution. <br /> Moreover, the meeting approved a proposal of issuing 35 percent right shares to its existing shareholders. </p> <p> </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4474', 'image' => '20161025120651_tinau.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4643', 'article_category_id' => '1', 'title' => 'TCL Curve TV in the Nepali Market', 'sub_title' => '', 'summary' => 'October 25: Chaudhary Group (CG), the authorized distributor of TCL television for Nepal, has launched a Curve TV in the Nepali market.', 'content' => '<p>October 25: Chaudhary Group (CG), the authorized distributor of TCL television for Nepal, has launched a Curve TV in the Nepali market.</p> <p>Issuing a press statement the company informed that the curve TV has Android 4.4, 2 USB ports, 2 HDMI ports and a HDMI MHL. The special feature of the TV is that it can be viewed from any angle.</p> <p><br /> According to the statement, the Curve TV is available in 48 inches with a price tag of Rs 86,290 in the market. </p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4473', 'image' => '20161025113313_tcl.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4642', 'article_category_id' => '1', 'title' => 'NB Bank Approves Bonus and Right Shares', 'sub_title' => '', 'summary' => 'October 25: The 22nd annual general meeting (AGM) of Nepal Bangladesh Bank (NB Bank) has approved 32 percent bonus shares and 1.6 percent cash dividend for the tax purpose.', 'content' => '<p style="text-align:justify">October 25: The 22nd annual general meeting (AGM) of Nepal Bangladesh Bank (NB Bank) has approved 32 percent bonus shares and 1.6 percent cash dividend for the tax purpose.</p> <p style="text-align:justify">Moreover, the AGM also approved a proposal of issuing 10:8 right shares after the bonus shares distribution to meet the minimum paid-up capital of Rs 8 billion as per the Nepal Rastra Bank (NRB) directive.</p> <p style="text-align:justify"><br /> Issuing a press statement, the bank informed that the paid-up capital after distribution bonus share and right shares will reach Rs 7.22 billion.</p> ', 'published' => true, 'created' => '2016-10-25', 'modified' => '2016-10-25', 'keywords' => '', 'description' => '', 'sortorder' => '4472', 'image' => '20161025111057_nb bank.jpg', 'article_date' => '2016-10-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117