July 26: The Nepal Stock Exchange (NEPSE) increased by 54.31 points on Sunday (July 26) taking the index to 3058.63 points on the first trading day of the week, which is an all-time high record till date.…

July 26: The Nepal Stock Exchange (NEPSE) increased by 54.31 points on Sunday (July 26) taking the index to 3058.63 points on the first trading day of the week, which is an all-time high record till date.…

July 26: The government has not been able to conduct vaccination drive against the coronavirus for all citizens on a regular…

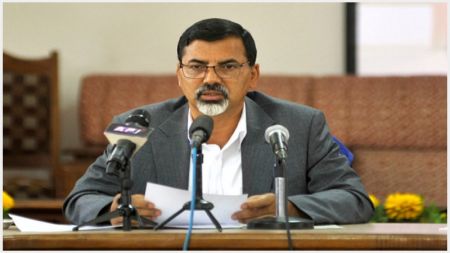

July 26: The industrialists of Sunsari-Morang Industrial Corridor met with Finance Minister Janardan Sharma recently to discuss about the monetary policy.…

July 25: The number of tourists arriving in Chitwan has recorded a fifty per cent decline in the last fiscal…

July 25: Nepal’s foreign trade has crossed the mark of Rs 141 billion for the first time in the fiscal year…

July 25: Despite having some investment-friendly laws and regulations, Nepal still lacks investment-friendly environment, says a report prepared by the US Department of…

July 25: Nepal Rastra Bank (NRB) has directed concerned agencies to release the foreign exchange rate from 10:00 am to 2:00 pm every day for making remittance exchange more…

July 23: Life Insurance companies have collected more insurance premium than the monthly average in the last month of Fiscal Year…

July 23: Fifteen banks including Nepal Rastra Bank have received emails from unidentified persons warning the banks of hacking their banking…

July 23: The Asian Development Bank (ADB) has approved a loan of $165 million for the Government of Nepal to purchase safe and effective vaccines against the coronavirus disease…

July 23: The transport entrepreneurs launched protest in the capital on Thursday (July 22) demanding the adjustment of the transportation fare, according to the state-owned national news agency…

July 22: Vishnu Kumar Agrawal has taken charge as the new president of the Confederation of Nepalese Industries (CNI).…

July 22: The Federation of Contractors' Association of Nepal (FCAN) has demanded extension of the deadline of ongoing projects by one year, considering 'zero-construction holiday' till mid November.…

July 22: Former governors of Nepal Rastra Bank (NRB) have expressed that the central bank should have unveiled the monetary policy with the start of the new fiscal…

July 22: Foreign trade worth Rs 600 billion took place through Birgunj customs in the last fiscal year…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '13726', 'article_category_id' => '1', 'title' => 'NEPSE Index Reaches All-time High Record ', 'sub_title' => '', 'summary' => 'July 26: The Nepal Stock Exchange (NEPSE) increased by 54.31 points on Sunday (July 26) taking the index to 3058.63 points on the first trading day of the week, which is an all-time high record till date. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">July 26: The Nepal Stock Exchange (NEPSE) increased by 54.31 points on Sunday (July 26) taking the index to 3058.63 points on the first trading day of the week, which is an all-time high record till date. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The sensitive index also increased by 11.74 points and reached 574.02 points. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The sole secondary market of the country which had seen slight improvement last week recorded remarkable increase in Sunday's turnover. The turnover was 43,939,212 unit shares of 223 companies which were traded for Rs 14.23 billion. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Among the 13 sub-categories traded, 11 posted increase in the secondary market. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The hotels and tourism sector witnessed a drop by 22.5 points while mutual fund decreased by 0.24 points. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, the banking sector increased by 72.14 points, trade by 2.71 points, development banks by 13 points, microfinance by 71.6 points, non-life insurance companies by 48.42, productive sector by 71.86 points, hydro power sector by 86.23 points, life insurance companies by 30.86 points, investment by 0.04 points and others by 6.6 points. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Nepal Bank Limited (NBL) topped the list in terms of turnover. The NBL recorded turnover of Rs 497,665,182. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to the NEPSE, the shares of Bishal Bazaar Company, Ngadi Group of Power, Support Microfinance, Radhi Hydropower company, Panchakanya Mai Hydropower, Kalika Power Company, Joshi Hydropower Company, Universal Power and Himalayan Energy Development remained locked in the positive circuit limit of 10 per cent each. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Share of Laxmi Unnati Kosh, however, declined by 3.95 per cent, Kumari Equity Fund by 3.70 per cent and Laxmi Bank's bond by 3.30 percent. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Sunday’s market capitalization, after the end of the trading day, reached over Rs 4254 billion, the NEPSE said. -- RSS </span></span></span><br /> </p> ', 'published' => true, 'created' => '2021-07-26', 'modified' => '2021-07-26', 'keywords' => '', 'description' => '', 'sortorder' => '13472', 'image' => '20210726101919_20160613011604_20160613100022_fdsk;slk.jpg', 'article_date' => '2021-07-26 10:18:26', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '13727', 'article_category_id' => '1', 'title' => 'Workers Bound for Foreign Employment Suffer Due to the Lack of Vaccine', 'sub_title' => '', 'summary' => 'July 26: The government has not been able to conduct vaccination drive against the coronavirus for all citizens on a regular basis.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">July 26: The government has not been able to conduct vaccination drive against the coronavirus for all citizens on a regular basis. As a result, the workers going for foreign employment have been left stranded. Various labor destination countries have decided that anyone entering their country must be vaccinated against coronavirus. However, due to the lack of regular vaccination campaign in Nepal, workers going for foreign employment are facing huge problems.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Workers bound for foreign employment had been stopped in Nepal due to the prohibitory order. Now the prohibitory order has been eased and even international flights have come into operation. On the contrary, most of the workers have not been able to go for foreign employment due to the lack of vaccination.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Most of the labor destination countries require people to take the prescribed or specific vaccine. Countries including Saudi Arabia and Qatar have made the US vaccine Johnson & Johnson, Indian vaccine CoviShield and other vaccines mandatory. Similarly, other countries have prescribed vaccines accordingly. On the other hand, the number of prescribed vaccines is not sufficient in Nepal. As a consequence, Nepali migrant workers are unable to go for foreign employment on time.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Vijay Kumar Gahatraj of Jhapa has been working in Saudi Arabia for the past seven years. He had come home in April to celebrate his holiday. Prohibitory order was imposed from April 30. He also took a flight ticket of Qatar Airlines for Saudi Arabia, the labor destination in the last week of May. But due to the implementation of the prohibitory order, he could not reach his destination, Saudi Arabia.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif""> Saudi Arabia has now made vaccines like Johnson mandatory for all visitors. Since Gahatraj has not been able to get vaccinated, he hasn’t been able to go to work yet.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif""> The Johnson vaccination campaign was conducted in various vaccination centers in Kathmandu from July 19 to 21. He arrived in Kathmandu last Friday after learning that the vaccine was not going to be made available in Jhapa. But he is yet to receive the vaccine.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">He is only a representative case. At Shukraraj Tropical and Communicable Diseases Hospital, Teku, there is a huge crowd of workers who have been stranded after not being able to get vaccinated. They have repeatedly demanded that vaccinations be provided to them promptly. However, the concerned body has not been able to take a proper decision in this regard.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">According to the workers, the police and security personnel directed them to come for vaccination only after watching the news. Spokesperson of the Ministry of Health and Population Dr Krishna Prasad Poudel said that the ministry is serious about the matter. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">"We have made a plan on how to resolve this issue," he said, adding, "The ministry will work as soon as possible after the plan has been finalized." </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">The chief of Immunization Division, Department of Health Services, Jhalak Sharma informed that such problems came into existence after the allocated amount of vaccines for Kathmandu valley ran out of stock.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">“The problem arose after the Johnson and Johnson vaccine, which was allocated for the Kathmandu Valley, was finished," he said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">“Vaccines have also been sent to other districts as well. Those who are going for foreign employment will be able to get vaccinated from their own district,” he said, adding, “The vaccination campaign will resume again in Kathmandu after the arrival of the next lot of vaccines.”</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Sharma said that preparations are being made to set up a separate vaccination center for those going for foreign employment and those working in essential sectors. He said that even after the vaccination campaign comes to an end, a separate center will be set up targeting the workers going for foreign employment and it will always be open.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">According to a source, the Ministry of Health and Population has already decided to set up a separate vaccination center targeting those going for foreign employment. But for some reason, it has not yet been officially announced to the public. It has been decided to operate vaccination centers at Teku, Civil Hospital, Armed Police Hospital Balambu and Patan Hospital for the workers going for foreign employment. Sources say that it could be implemented this week itself.</span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> </p> ', 'published' => true, 'created' => '2021-07-26', 'modified' => '2021-07-26', 'keywords' => '', 'description' => '', 'sortorder' => '13471', 'image' => '20210726103917_20210403032054_Foreign Employment.jpg', 'article_date' => '2021-07-26 10:38:24', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '13728', 'article_category_id' => '1', 'title' => 'Industrialists Discuss Issues Related to Monetary Policy with Finance Minister', 'sub_title' => '', 'summary' => 'July 26: The industrialists of Sunsari-Morang Industrial Corridor met with Finance Minister Janardan Sharma recently to discuss about the monetary policy. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">July 26: The industrialists of Sunsari-Morang Industrial Corridor met with Finance Minister Janardan Sharma recently to discuss about the monetary policy. The industrialists urged Finance Minister Sharma to introduce the monetary policy focusing on reviving the industries that have been affected by Covid-19. A delegation led by Morang Trade Association’s President Prakash Mundada also handed over a 21-point recommendation to the Finance Minister. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">The industrialists have requested the government to waive interest on loans, extend the loan repayment deadline, maintain the current bank's spread rate at a maximum of 3.5 percent, and limit credit rating of public limited companies to Rs 500 million and Rs 200 million for private companies. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Similarly, they also demanded that the monetary policy should simplify refinancing for industrialists and entrepreneurs. Likewise, domestic industrial establishments that have incurred losses due to lockdown should receive help for the next three years, states one of their demands.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Similarly, they demanded the government to waive the service charges and renewal fees charged by the banks during the lockdown period. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Their demand also includes renewal of loans at low interest rates with special concessions for the tourism, transport, hotel/resort, poultry, and other sectors that have been severely affected by the pandemic.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">The delegation that visited the finance minister included trade union president Mundada, senior vice president Navin Rijal, former presidents Pawan Kumar Sarda and Mahesh Jaju.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Meanwhile, a team of the Morang Trade Association has called on Energy Minister Pampha Bhusal to resolve the issue of the power crisis. The electricity supply in Sunsari-Morang Industrial Corridor has been disturbed recently.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">A team led by President Mundada met Energy Minister Bhusal and Energy Secretary Devendra Karki and drew their attention to the problems faced by the industries in the Morang-Sunsari Industrial Corridor. </span></span></span></p> <p><br /> </p> <p> </p> ', 'published' => true, 'created' => '2021-07-26', 'modified' => '2021-07-26', 'keywords' => '', 'description' => '', 'sortorder' => '13470', 'image' => '20210726105922_1626392414.Clipboard14.jpg', 'article_date' => '2021-07-26 10:58:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '13723', 'article_category_id' => '1', 'title' => ' Tourist Arrival Down in Chitwan ', 'sub_title' => '', 'summary' => 'July 25: The number of tourists arriving in Chitwan has recorded a fifty per cent decline in the last fiscal year. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">July 25: The number of tourists arriving in Chitwan has recorded a fifty per cent decline in the last fiscal year. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Majority of the tourists coming to Chitwan National Park go on a jungle safari, which is the main attraction of the district. Government data show a significant decline in tourist arrival due to the COVID-19 pandemic. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">In the last fiscal year (FY 2020/21), a total of 92,209 tourists went for a jungle safari in the park, which was 182,435 in the previous fiscal year (FY 2019/20), the state-owned national news agency RSS reported. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The number of domestic tourists visiting the park however saw only a minor decline, with 89,441 visiting the park in the last fiscal year. The number was 89,601 in the FY 2019/20. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The record of foreign tourists (excluding SAARC countries) visiting the park was only 1,244 in the review period. From the SAARC member states, 1,364 people arrived at Chitwan National Park in FY 2020/21. The number was 14,239 from SAARC countries and 78,755 from other countries in FY 2019/20. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Coronavirus pandemic was the major reason for the decline in the number of tourist visiting Chitwan, Chief Projection Officer of the CNP Ananath Baral told RSS. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Meanwhile, the park has also suffered a significant loss in annual income due to low tourist arrival. The park collected Rs 25.5 million in tourist fees in FY 2020/21 against Rs 187.3 million in the previous fiscal year. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">President of Regional Hotel Association, Chitwan, Dipak Bhattarai said that the tourism sector of Chitwan continues to be hit by several incidents in the recent past years. After the earthquake, economic blockade by India and obstruction in Narayangadh-Mugling road, COVID-19 has further deteriorated the tourism sector. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">Besides Chitwan, Pokhara, Lumbini, Everest, Mustang and Rara are the other famous tourist destinations of Nepal </span></span></span><br /> </p> ', 'published' => true, 'created' => '2021-07-25', 'modified' => '2021-07-25', 'keywords' => '', 'description' => '', 'sortorder' => '13468', 'image' => '20210725030344_20210202121548_20190415022754_aaa.jpg', 'article_date' => '2021-07-25 15:02:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '13722', 'article_category_id' => '1', 'title' => 'Soybean Oil Accounts for 38 Percent of Total Export', 'sub_title' => '', 'summary' => 'July 25: Nepal’s foreign trade has crossed the mark of Rs 141 billion for the first time in the fiscal year 2020/21.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">July 25: Nepal’s foreign trade has crossed the mark of Rs 141 billion for the first time in the fiscal year 2020/21.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Soybean oil, which is basically not a native product of Nepal, is considered an important contributor to this growth factor. Entrepreneurs have been importing raw soybean from abroad, packing and exporting them to India.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Soybean oil worth Rs 53.65 billion has been exported during the review period, which is 38 percent of the total export. During this period, raw soybean worth Rs 53.39 billion were imported from foreign countries.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Similarly, soybean oil came up as an alternative to palm after India banned import palm into the country.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Earlier, packaging of palm oil used to be done in 18 industries in Birgunj and Biratnagar, and other industries in Nepalgunj, Butwal and Bhairahawa. However, after the ban imposed on palm oil, traders started packing soybean oil in those industries. As India lifted the ban on palm oil in June, palm oil worth Rs 2.2 billion has been exported this year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">While the processed palm worth Rs 2 billion has been exported, raw palm worth Rs 8 billion has been imported into the country. Traders have been importing raw palm oil and soybean oil from Argentina, Bolivia, Indonesia, Bangladesh, Malaysia and other countries.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Although the import is higher than export, traders have claimed that the export of soybean and palm oil have reduced the country’s trade deficit. Pradip Murarka of Murarka Industries says export of soybean and palm oil have significantly contributed to reducing the trade deficit.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">“For the first time, Nepal’s exports have exceeded Rs 100 billion due to the export of soybean oil,” he said, adding, “It will reduce the trade deficit. If the government provides incentives, it will make a significant contribution to the country’s foreign trade.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">On the other hand, economists say that doing business in such a way as to benefit from Indian customs will not contribute to the economy in the long run. Economist Rameshwar Khanal says that the export of vegetable ghee and gold jewelry had earlier reduced the trade deficit, so the current export of palm and soybean oil will be the same. “It cannot be stopped or discouraged, but there is no reason to be happy with the increase in exports and the government to encourage it,” he said. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-07-25', 'modified' => '2021-07-25', 'keywords' => '', 'description' => '', 'sortorder' => '13467', 'image' => '20210725024553_20210201123822_1612135819.Clipboard21.jpg', 'article_date' => '2021-07-25 14:44:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '13721', 'article_category_id' => '1', 'title' => 'US Report Points to GoN as a Barrier to Investment', 'sub_title' => '', 'summary' => 'July 25: Despite having some investment-friendly laws and regulations, Nepal still lacks investment-friendly environment, says a report prepared by the US Department of State.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">July 25: Despite having some investment-friendly laws and regulations, Nepal still lacks investment-friendly environment, says a report prepared by the US Department of State. This finding comes at a time when the Government of Nepal (GoN) has been urging the international community to invest in Nepal as the country has been created conducive environment for foreign investment.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The report titled '2020 Investment Climate Statements: Nepal' says that the country provides huge opportunities in energy, ICT, tourism and agriculture but it still has various obstacles related to inviting foreign investment.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The report states political instability, massive corruption, bureaucratic hassles and poor implementation of law as obstacles in bringing FDI (foreign Direct Investment). The government is willing to bring in FDI but has not been able to work accordingly, the report further says adding that foreign investors face various hurdles in taking back their profit and currency exchange. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The report has pointed out that the government has a monopoly over power transmission lines and petroleum distribution sector. According to the report, the trade unions close to political parties stage protest programs in industries and the previous government was occupied in resolving its intra-party rift rather than on maintaining good governance which has discouraged FDI in the country.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Immigration laws and visa policies for foreign workers are complex, while operation procedures are not efficient and corruption has further exacerbated the problem of foreign workers seeking to work in the country. The report has expressed dissatisfaction over the government for not being able to implement the US-funded Millennium Challenge Corporation (MCC) project. The report states that the country is discouraging FDI by its inability to implement game changer project like MCC.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">In 2017, Nepal signed the MCC project but has not endorsed it through the parliament for its implementation and this does not convey a good message among foreign investors, the report says.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The reports also finds the then government's attempt to prohibit media and non-government organization as inappropriate and considers bringing in secessionist CK Raut and outlawed Netra Bikram Chand into peace process through dialogue as a positive thing. This step will drive to bring in the foreign investment, the report added.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">According to the report the country can earn a good amount through the development of hydropower secctor. With an estimated capacity of 40,000 MW, it can make hydropower as a major source of income through the export of energy. The report has also predicted, tourism which provides great opportunities for investment, will be affected by COVID-19 pandemic till 2022.</span></span></p> ', 'published' => true, 'created' => '2021-07-25', 'modified' => '2021-07-25', 'keywords' => '', 'description' => '', 'sortorder' => '13466', 'image' => '20210725125312_20210507114916_20200914112314_1600032154.2 (1).jpg', 'article_date' => '2021-07-25 12:51:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '13720', 'article_category_id' => '1', 'title' => 'Central Bank Directs Remittance Companies to Determine Uniform Foreign Exchange Rate', 'sub_title' => '', 'summary' => 'July 25: Nepal Rastra Bank (NRB) has directed concerned agencies to release the foreign exchange rate from 10:00 am to 2:00 pm every day for making remittance exchange more systematic. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">July 25: Nepal Rastra Bank (NRB) has directed concerned agencies to release the foreign exchange rate from 10:00 am to 2:00 pm every day for making remittance exchange more systematic. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Amending the Unified Directives 2076, the central bank has instructed banks and financial institutions and remittance companies to determine a uniform exchange rate through the Foreign Exchange Dealers Association of Nepal (FEDAN). </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The FEDAN should send the exchange rate to the Foreign Exchange Management Department of the NRB every day, NRB said in a notice issued on July 23. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">The central bank has also instructed FEDAN to make the exchange rate available to all the licensed BFIs and remittance companies two times a day. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, the central bank has made it mandatory for companies involved in remittance business to take membership of the FEDAN. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The notice issued by NRB Executive Director Ramu Poudel further states that such a directive was issued to make the remittance transaction more systematic. </span><br /> </span></span></p> ', 'published' => true, 'created' => '2021-07-25', 'modified' => '2021-07-25', 'keywords' => '', 'description' => '', 'sortorder' => '13465', 'image' => '20210725113120_20210713025441_1626132831.Clipboard03.jpg', 'article_date' => '2021-07-25 11:29:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '13719', 'article_category_id' => '1', 'title' => 'Insurance Companies Collect Three Times More Premium in Last Month of FY 2020/21', 'sub_title' => '', 'summary' => 'July 23: Life Insurance companies have collected more insurance premium than the monthly average in the last month of Fiscal Year 2020/21', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">July 23: Life Insurance companies have collected more insurance premium than the monthly average in the last month of Fiscal Year 2020/21, according to the data provided by the Insurance Board. There are 19 life insurance companies operating in Nepal. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">During the review period (mid-June to mid-July), those life insurance companies collected insurance premium of Rs 18.48 billion which is three times more than the average monthly collection. On an average, insurance companies collect Rs 5 to 6 billion insurance premium every month.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">However, collection of insurance premium was more than Rs 18 billion during the last months of FY 2020/21 as the financial activities increase during the last month. Insurance agents are found working hard to meet their target during this period. Most of the insurance policies are also renewed during this period. This is the reason why collection of insurance premium has increased during this period, according to the insurance companies.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The business of life insurance companies were badly affected until mid-June due to the impact of coronavirus. However, data show the insurance business was encouraging between mid-June to mid-July.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Data provided by the Insurance Board show that the average monthly collection of insurance premium was between Rs 5 to 6 billion as of mid-May. Insurance companies had collected insurance premium of Rs 5.2 billion in the month of Baishakh (mid-April to mid-May) which further slumped to Rs 3.31 billion the next month (mid-May to mid-June). However, it picked up pace again in the month of Asar (mid-June to mid-July).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">During the last fiscal year (FY 2020/21), life insurance companies collected insurance premium worth Rs 120.95 billion, which is more than the insurance premium collection of the previous fiscal year by 28.15 percent. In Fiscal Year 2019/20, the 19 life insurance companies had collected insurance premium worth Rs 94.38 billion.</span></span></span></span></p> ', 'published' => true, 'created' => '2021-07-23', 'modified' => '2021-07-23', 'keywords' => '', 'description' => '', 'sortorder' => '13464', 'image' => '20210723111545_1626997044.1.jpg', 'article_date' => '2021-07-23 11:14:47', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '13718', 'article_category_id' => '1', 'title' => 'Hackers Issue Threats to 15 Banks, NRB tells not to Worry ', 'sub_title' => '', 'summary' => 'July 23: Fifteen banks including Nepal Rastra Bank have received emails from unidentified persons warning the banks of hacking their banking system. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">July 23: Fifteen banks including Nepal Rastra Bank have received emails from unidentified persons warning the banks of hacking their banking system. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Spokesperson and the deputy spokesperson of the Nepal Rastra Bank (NRB) and high officials of different banks reportedly received the warning email on Wednesday evening. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">Chief of the Bank and Financial Institutions Regulation Department and Spokesperson of the Nepal Rastra Bank, Dev Kumar Dhakal confirmed that the group claiming itself as 'the group of hackers' sent message of hacking the banking system of 15 commercial banks including NRB. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">Spokesperson Dhakal told the state-owned national news agency (RSS) that they received the email on Wednesday evening (July 21) warning that the systems would be hacked and money withdrawn by the next morning. However, he assured that the systems have not been hacked and further investigations are underway.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">"I had received such type of message in Viber and Messenger. We checked banking system of NRB and other banks. Our system has not been hacked and it is safe. So there is no situation to be worried," RSS quoted Dhakal as saying. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Dhakal said it is still unknown who sent such type of messages. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to RSS, the hackers in the message warned of withdrawing money from Nepal Rastra Bank, Kumari Bank, Nepal Bank Limited, Nabil Bank, Rastriya Banijya Bank, Machhapuchchhre Bank, NMB Bank, NIC Asia Bank, Bank of Kathmandu, Citizens Bank International, Sanima Bank, Nepal SBI Bank, Everest Bank, Nepal Investment Bank and Himalayan Bank. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The hackers also warned not to take their message lightly. </span></span></span><br /> </p> ', 'published' => true, 'created' => '2021-07-23', 'modified' => '2021-07-23', 'keywords' => '', 'description' => '', 'sortorder' => '13463', 'image' => '20210723090033_20210713025441_1626132831.Clipboard03.jpg', 'article_date' => '2021-07-23 08:59:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '13717', 'article_category_id' => '1', 'title' => 'ADB Approves $165 Million Loan for COVID-19 Vaccines in Nepal', 'sub_title' => '', 'summary' => 'July 23: The Asian Development Bank (ADB) has approved a loan of $165 million for the Government of Nepal to purchase safe and effective vaccines against the coronavirus disease (COVID-19).', 'content' => '<h1><em><span style="font-size:16px">Elderly women of Nepal pose for photo after receiving vaccine against Covid-19 in this photo posted by ADB. Photo Courtesy: ADB</span></em></h1> <h1><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">July 23: </span></span><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">The Asian Development Bank (ADB) has approved a loan of $165 million for the Government of Nepal to purchase safe and effective vaccines against the coronavirus disease (COVID-19).</span></span></span></span></h1> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">The project will support the National Deployment and Vaccination Plan in Nepal by procuring an estimated 15.9 million doses of COVID-19 vaccines, which will benefit about 6.8 million Nepalese, according to a press statement issued by the Manila-based ADB Headquarters on July 22. <br /> “ADB’s support will help the Government of Nepal procure much-needed COVID-19 vaccines to protect its citizens from the further spread of this disease,” the statement quoted ADB President Masatsugu Asakawa as saying. “It is essential that COVID-19 vaccines are quickly purchased and administered to help get the economy back on track by enabling the restoration of livelihoods and economic activities, as well as the resumption of educational and human development pursuits.”</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">According to the press statement, the project is financed by ADB’s $9 billion Asia Pacific Vaccine Access launched in December 2020 to offer rapid and equitable vaccine-related support to ADB developing member countries. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">Vaccines eligible for financing must meet at least one of the APVAX eligibility criteria: the vaccine has been selected for procurement through the COVID-19 Vaccines Global Access (COVAX) mechanism; the vaccine has been prequalified by the World Health Organization (WHO) or WHO emergency use listing; or the vaccine has received regular or emergency licensure or authorization by a Stringent Regulatory Authority.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">In addition to this project, ADB’s ongoing technical assistance grants will support the strengthening of the vaccine delivery system, communication, and community engagement to raise awareness on the risks of COVID-19 and the benefits of vaccination, the statement added. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">The government is mobilizing female community health volunteers to disseminate information among marginalized communities to raise awareness. At least one female health worker or volunteer will support the effort in every vaccination site or outreach center, ADB said.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">ADB said it closely collaborates with other partners, like the World Bank, COVAX, WHO, and the United Nations Children’s Fund (UNICEF), in supporting the Government of Nepal in its efforts to vaccinate its people as soon as possible.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">The project will complement the government’s broader response through its $1.2 billion National Relief Program, which consists of social protection, health care, and economic relief measures. In May 2020, ADB provided support to the program through a $ 259 million concessional loan.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-07-23', 'modified' => '2021-07-23', 'keywords' => '', 'description' => '', 'sortorder' => '13462', 'image' => '20210723082704_133776-un0431162-2.jpeg', 'article_date' => '2021-07-23 08:24:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '13716', 'article_category_id' => '1', 'title' => 'Transport Entrepreneurs Stage Protest in the Capital Demanding Hike in Transportation Fare', 'sub_title' => '', 'summary' => 'July 23: The transport entrepreneurs launched protest in the capital on Thursday (July 22) demanding the adjustment of the transportation fare, according to the state-owned national news agency (RSS).', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">July 23: The transport entrepreneurs launched protest in the capital on Thursday (July 22) demanding the adjustment of the transportation fare, according to the state-owned national news agency (RSS).</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">The transport entrepreneurs staged protest in different parts along the Ring Road in Kathmandu valley as part of their protest. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">They have further demanded the government to manage anti COVID-19 vaccines for drivers and helpers of long and short-route vehicles as well. They appealed to the federal government to address their genuine demands. According to the transport entrepreneurs,, they have been hard hit by the pandemic and therefore struggling to pay the bank loans of their vehicles.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Arial Unicode MS","sans-serif"">Recently, the Department of Transport Management has allowed transport entrepreneurs to hike bus fare on inter-provincial routes by 28 per cent. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, cargo carriers serving in the Terai and hills were permitted to hike transport fares by 26 and 20 per cent, respectively. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The protesters have demanded adjustment of transportation fare due to inflation and price hike of petroleum products and vehicle spare parts. They said that the fare was adjusted nine years ago.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-07-23', 'modified' => '2021-07-23', 'keywords' => '', 'description' => '', 'sortorder' => '13461', 'image' => '20210723075242_195145109_4342684782456148_468800994003319459_n.jpg', 'article_date' => '2021-07-23 07:51:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '13714', 'article_category_id' => '1', 'title' => 'Vishnu Kumar Agrawal Takes Charge as New President of CNI', 'sub_title' => '', 'summary' => 'July 22: Vishnu Kumar Agrawal has taken charge as the new president of the Confederation of Nepalese Industries (CNI). ', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">July 22: Vishnu Kumar Agrawal has taken charge as the new president of the Confederation of Nepalese Industries (CNI). The 18th Annual General Meeting (AGM) of the CNI held on Wednesday (July 21) selected Agrawal as the new president of the organization. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Earlier, Agrawal was serving as senior vice president of the CNI. </span></span><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">He has previously led the Young Entrepreneurs’ Forum at the CNI and has also served as the chairman of the infrastructure development committee of CNI.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Agarwal is a former football player and is currently promoting the Kathmandu Razors Football Club, winner of the Nepal Super League 2021.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Agrawal, the Managing Director of MAW Group of Companies, is also the Honorary Consul General of the Czech Republic to Nepal.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Similarly, the general assembly of the confederation has elected 37 members for its National Council. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Amit More, Ratanlal Kedia, Rahul Kumar Agrawal, Sandeep Kumar Sharda, Varun Kumar Todi, Shulabh Agrawal, Amit Begani, Vikas Dugad, Rajesh Kumar Agrawal, Chandra Tandon, Anuj Agrawal and Arpit Agrawal are the new members of the council. Similarly, other newly elected members include Deepak Agrawal, Suraj Bhakta Poudel, Nirvana Chaudhary, Bikram Singhania, Dilip Agrawal, Sharad Tibdewala, Rohit Gupta, and Aditya Shanghai from the founding group.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Hemraj Dhakal, Nicholas Pandey, Virendra Raj Pandey, Varsha Shrestha, Laxmi Prasad Subedi, Guru Prasad Neupane, Rajiv Kumar Gupta, Raj Bahadur Shah, Pampha Dhamala, Ashish Garg, Dwiraj Sharma (Siwakoti), Ashok Sherchan, Tara Prasad Poudyal, and Hitesh Golchha, are the other new members of the council. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Likewise, Gokul Bhandari, Krishna Prasad Adhikari, and Basanta Bahadur Chand have been unanimously elected as members of the National Council from the institutional member group.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">The AGM was inaugurated by Prime Minister Sher Bahadur Deuba. Speaking at the inaugural ceremony, Prime Minister Deuba said that the Make in Nepal campaign would help in accelerating industrialization in Nepal, and also increase the production and consumption of Nepali goods. He also vowed to take the private sector into confidence to revive the economy hit by the pandemic.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman",serif">Similarly, Finance Minister Janardan Sharma said that the pandemic has made the government realize the need for a self-reliant economy. He said that the Make in Nepal-Swadeshi campaign launched by the confederation would lay the foundation for a self-reliant economy.</span></span></p> <p> </p> <p><img alt="" src="/app/webroot/userfiles/images/9D3A8810.JPG" style="height:533px; width:800px" /></p> ', 'published' => true, 'created' => '2021-07-22', 'modified' => '2021-07-22', 'keywords' => '', 'description' => '', 'sortorder' => '13460', 'image' => '20210722052104_9D3A8796.JPG', 'article_date' => '2021-07-22 17:19:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '13715', 'article_category_id' => '1', 'title' => 'Contractors Seek Deadline Extension of Projects by a Year', 'sub_title' => '', 'summary' => 'July 22: The Federation of Contractors' Association of Nepal (FCAN) has demanded extension of the deadline of ongoing projects by one year, considering 'zero-construction holiday' till mid November. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">July 22: The Federation of Contractors' Association of Nepal (FCAN) has demanded extension of the deadline of ongoing projects by one year, considering 'zero-construction holiday' till mid November. The budget for the current fiscal year has called for deadline extension by six months, but it has not been implemented. Therefore, the federation members met with Prime Minister Sher Bahadur Deuba and requested for a one year deadline extension.</span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">A delegation of FCAN including its President Ravi Singh met the PM on July 21 and presented their demands. Singh informed that the PM has expressed commitment to fulfill their demands after going through it. He said that the federation has sought for extension of all contracts by one year. </span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">The budget statement of the current Fiscal Year 2021/22 has provisioned to extend the construction projects by six months. Due to the second wave of Covid-19, monsoon season, seasonal work and subsequent holidays, the period till mid Nov should be considered as a construction holiday and the deadline should be extended, said Singh. </span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">The federation has also drawn the attention to the issue of payment and return of bail amount. It has urged the government to implement the provisions introduced by the previous government and has requested to address the demands of contractors if the government brings in a supplementary budget.</span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">The sixth amendment to the Public Procurement states that deadline cannot be extended. According to this provision, once the term has been decided, the term will not be extended again.</span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">Stating that this provision has created serious complications for the extension of deadlines of many projects, the federation has also suggested scrapping such impractical provisions. </span></span></p> <p><span style="font-size:16px"><span style="font-family:"Times New Roman",serif">As mentioned in the budget statement, the federation has also demanded 100 percent return instead of 50 percent of the bail amount. Singh urged Prime Minister Deuba to form an expert team involving stakeholders to make the second amendment to the Public Procurement Act business-friendly. They have also requested to make immediate payment as large payments have been stopped at present.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-07-22', 'modified' => '2021-07-22', 'keywords' => '', 'description' => '', 'sortorder' => '13459', 'image' => '20210722053554_20160715032741_cni.jpg', 'article_date' => '2021-07-22 17:34:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '13713', 'article_category_id' => '1', 'title' => 'NRB Collects Suggestions from Former Governors for Monetary Policy', 'sub_title' => '', 'summary' => 'July 22: Former governors of Nepal Rastra Bank (NRB) have expressed that the central bank should have unveiled the monetary policy with the start of the new fiscal year. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">July 22: Former governors of Nepal Rastra Bank (NRB) have expressed that the central bank should have unveiled the monetary policy with the start of the new fiscal year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Stating that the monetary policy should be in line with the amended budget brought after the change of the finance minister, the former governors suggested the NRB to introduce the new monetary policy as soon as possible without deviating from its duties. They also stressed the need for the NRB to formulate a policy without losing its autonomy.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The former governors made such suggestions during a virtual discussion organized on Wednesday regarding the central bank’s preparations for unveiling the monetary policy for the current fiscal year. NRB Spokesperson Dev Kumar Dhakal said that the central bank has collected suggestions from former governors on the current economic situation and policies needed to be addressed by the monetary policy.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif""> "They have adequate experience of preparing monetary policy. The virtual discussion was held to collect their suggestions on what kind of policy would be appropriate. We have done the work of collecting the feedback. We will bring the monetary policy as soon as possible by coordinating with the Ministry of Finance. "</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The monetary policy was supposed to be made public in the third week of July, but it was delayed due to the change of the finance minister. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Economists have been advising NRB Governor Maha Prasad Adhikari not to bring monetary policy immediately due to the change of government. But the NRB denied that the finance minister's directive delayed the monetary policy. Spokesperson Dhakal said that it was not true and that they were working on monetary policy internally and were in the final stages of preparation.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The former governor drew the attention of NRB to remain alert as the government was likely to bring a populist budget. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The former governors also pointed out that it is important to see where the investment money is coming from as the capital market will be bullish in the days to come. The daily turnover of the stock market exceeded Rs 21 billion.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In addition, they also suggested that commercial banks should be required to issue at least 25 percent of their paid-up capital as debentures.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Former Governors Himalaya Shamsher J.B Rana, Ganesh Bahadur Thapa, Bhesh Bahadur Thapa, Dipendra Bahadur Chhetri, Dipendra Purush Dhakal, and Tilak Rawal were present at the discussion organized by the central bank to seek suggestions on monetary policy.</span></span></span></span></p> <p><br /> </p> <p> </p> ', 'published' => true, 'created' => '2021-07-22', 'modified' => '2021-07-22', 'keywords' => '', 'description' => '', 'sortorder' => '13458', 'image' => '20210722021607_20160909042218_nrb.jpg', 'article_date' => '2021-07-22 14:15:22', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '13712', 'article_category_id' => '1', 'title' => 'Foreign Trade from Birgunj Customs Hits Rs 600 Billion Mark', 'sub_title' => '', 'summary' => 'July 22: Foreign trade worth Rs 600 billion took place through Birgunj customs in the last fiscal year 2077/78.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">July 22: Foreign trade worth Rs 600 billion took place through Birgunj customs in the last fiscal year 2077/78. Birgunj Integrated Check Post (ICP) and dry port customs accounted for Rs 593 billion in foreign trade last year.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the data of ICP customs, goods worth Rs 513 billion were imported and goods worth Rs 53 billion were exported during the review period. Similarly, the goods worth Rs 26.16 billion were imported from the dry port customs last fiscal year. As per the custom office, goods amounting Rs 380 million were exported through this custom.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The total trade from Birgunj customs has increased by 27 percent last year as compared to the previous fiscal year 2076/77. The customs data shows that while the size of imports increased by 24 percent, export has also increased by 66 percent.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Harihar Poudel, chief customs officer of Birgunj Customs, said that soybean and sunflower oil were the main contributors to the export trade.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">“Last year, imports of fuel and vehicles did not decline, but imports of other commodities declined sharply due to the impact of Covid-19,” said Poudel.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Customs officials say that the ban imposed to control the pandemic has affected the foreign trade and the import of fuel has increased as vehicles started running towards the end of the year.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the customs data, new vehicle inspection passes have increased in the recent months. Poudel said that the import of shoes, slippers, hardware, equipment and vehicle parts has declined.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Chudamani Sharma Kattel, information officer at the customs office said that the importers imported raw materials for iron industry, peas, alcoholic beverage, mustard, pepper, and semi-processed sunflower oil from the dry port last year. Likewise, he said goods like noodles, pickles, flour, tyres, leather, herbs and other items were exported. </span></span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> ', 'published' => true, 'created' => '2021-07-22', 'modified' => '2021-07-22', 'keywords' => '', 'description' => '', 'sortorder' => '13457', 'image' => '20210722015910_20190410102147_ICP-Birgunj-2.jpg', 'article_date' => '2021-07-22 13:58:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117