March 3: The Nepal Rastra Bank (NRB) has reduced the ceiling on domestic remittances.…

March 3: The Nepal Rastra Bank (NRB) has reduced the ceiling on domestic remittances.…

March 2: The price hike of raw materials worldwide has turned out to be a windfall for Nepal’s oil…

March 2: The Independent Power Producers Association of Nepal (IPPAN) has welcomed the ratification of the US grant project, Millennium Challenge Corporation (MCC) compact, by the…

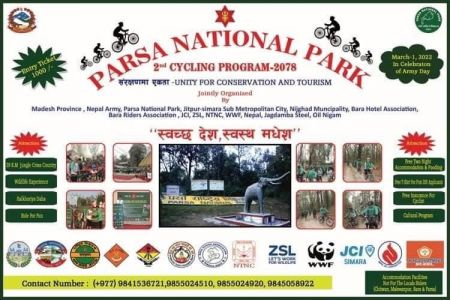

March 2: A cycling competition has been organized in Parsa National Park with the aim of promoting tourism areas located there.…

March 2: Nepal Rastra Bank is making arrangements to avail loans for bank customers from mobile…

March 1: Commercial banks have continued to increase credit flow as compared to deposit…

March 2: Foreign investment commitment in the energy sector, which is believed to be the backbone of economic development, has been steadily declining for some years…

March 2: The BP Koirala Institute of Health Sciences (BPKIHS), a reputed teaching hospital in Dharan, is desperately awaiting for Rs 260 million from the Ministry of Health and Population which the government is liable to pay for insurance…

March 1: Although the MCC agreement has been passed by the parliament, it will take some time for the project to move…

March 1: The rise in price of oil in the international market has also impacted Nepal’s market, according to the state-owned Nepal Oil Corporation…

March 1: Investors investing money in the hydropower sector have lost the most in Monday's trading, despite expectations that the endorsement of the Millennium Challenge Corporation (MCC) deal would have a positive impact on the share prices of hydropower…

March 1: Gautam Buddha International Airport is preparing for test flights after successfully conducting calibration flights.…

March 1: Countries across the world have imposed sanctions on Russia one after another after President Vladimir Putin order invasion of Ukraine last…

March 1: Nepal has reached an understanding with India to import chemical fertilizer from the neighbouring country in a long-term…

March 1: The private sector of Nepal has welcomed the endorsement of US-funded project Millennium Challenge Corporation (MCC) compact by the House of Representatives on February…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '14862', 'article_category_id' => '1', 'title' => 'NRB Reduces Ceiling on Domestic Remittances', 'sub_title' => '', 'summary' => 'March 3: The Nepal Rastra Bank (NRB) has reduced the ceiling on domestic remittances. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">March 3: The Nepal Rastra Bank (NRB) has reduced the ceiling on domestic remittances. The central bank has reduced the daily limit on remittance from Rs 100,000 to Rs 25,000. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Issuing a notice on Wednesday, the central bank said that the licensed agents of remittance companies will have to comply with the new rule effective from March 2.</span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The notice states that the maximum limit of transaction per person per day for internal remittance shall be Rs 25,000.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The central bank however stated that there has been no change in the limit of remittances sent by Nepalis living abroad to their family members or any other beneficiaries in Nepal. </span></span></span><br /> </p> ', 'published' => true, 'created' => '2022-03-03', 'modified' => '2022-03-03', 'keywords' => '', 'description' => '', 'sortorder' => '14604', 'image' => '20220303081648_20220210115450_Remittance.jpg', 'article_date' => '2022-03-03 08:15:44', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '14861', 'article_category_id' => '1', 'title' => 'Price Hike of Raw Materials a Windfall for Nepal’s Oil Industry', 'sub_title' => '', 'summary' => 'March 2: The price hike of raw materials worldwide has turned out to be a windfall for Nepal’s oil industries.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">March 2: The price hike of raw materials worldwide has turned out to be a windfall for Nepal’s oil industries. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The oil producers of Nepal were worried ever since India lowered the tariff on import of edible oil and its raw materials. But the recent hike in prices of unrefined oil has added to the excitement of domestic oil producers of Nepal.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Even in the current situation, refined oil dominates the export trade of Nepal. As Nepal's industries have sufficient reserves, the oil producers of Nepal can benefit from the increase in the price of raw materials in the world market.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Domestic industries had been importing semi-refined oil from Ukraine, Indonesia and Malaysia, processing it and exporting it to India. Industrialists say that it takes three months to get the raw material into the country from the international market. Moreover, it takes additional time to process and export it. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Nikhil Chachan, operator of Narayani Oil Refinery, said that the rise in prices of raw materials has not stopped the export of Nepali products to India.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to Prabhu Dayal Agrawal, operator of Annapurna Vegetable Products, the processing and export of oil has been possible amid current crisis as the importers had purchased the raw materials before the price hike. Unlike Nepal, Indian oil industry often does not stockpile raw materials as it is close to sea ports.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">India levies 5.5 percent customs duty and 5 percent Goods and Services Tax (GST) on imports from other countries. Under the SAFTA facility, customs duty is not levied on exports from Nepal to India. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Agarwal said that the oil produced in Nepal would be cheaper than the oil produced in India due to the import of raw materials into Nepal at a cheaper price. According to the importers, the price of soybean and palm oil in the international market has gone up from USD 1,200 to USD 1,900 per metric ton.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Due to the Russia-Ukraine war, further pressure has been put on the prices of raw materials. The price has gone up by USD 150 per ton in just last one week.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The price of soybean seeds has increased by USD 125 per metric ton in just two days, says Suresh Rungta, operator of OCB Foods.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">“Exports to India are possible because of the stock of raw materials at a time when the price of raw materials is on the rise. Otherwise, we couldn’t have exported oil from Nepal,” said Rungta. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">There are 22 oil producing industries in Nepal. Of them, 14 are in Birgunj alone and others are in Biratnagar and Bhairahawa. Five new industries are preparing to make an entry into this sector. According to Chachan, despite the industry's annual production capacity of 2.5 million metric tons, domestic consumption is only 500,000 metric tons.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Chachan said, “The industrialists claim that the investment of domestic industries will be put to risk if they are not allowed to export to India. However, the benefits of increasing prices of raw material are not long lasting. Export like in the current time is not possible under normal circumstances.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Domestic importers have to pay 10 percent customs duty on raw materials. It is subject to 13 percent value added tax. India charges 5.5 percent customs duty and 5 percent GST.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14603', 'image' => '20220302054345_1501009175_7.jpg', 'article_date' => '2022-03-02 17:43:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '14860', 'article_category_id' => '1', 'title' => 'IPPAN Welcomes Ratification of MCC Compact ', 'sub_title' => '', 'summary' => 'March 2: The Independent Power Producers Association of Nepal (IPPAN) has welcomed the ratification of the US grant project, Millennium Challenge Corporation (MCC) compact, by the parliament. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">March 2: The Independent Power Producers Association of Nepal (IPPAN) has welcomed the ratification of the US grant project, Millennium Challenge Corporation (MCC) compact, by the parliament. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">IPPAN said the ratification of the MCC compact has added a new dimension in the development of Nepal's power sector. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">IPPAN's vice-president Ashish Garg said at a press conference organized in the capital on Wednesday that the endorsement of the MCC compact by Nepal's parliament has elated the independent power producers and promoters who have been facing problem particularly due to the lack of transmission lines. He added that the compact has also opened new door of opportunities for them. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Garg viewed that the MCC compact will support the country's journey towards economic prosperity. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The press conference was organized to give information about the Third Himalayan Hydro Expo. The expo is being organized at Bhrikutimandap from April 1 to 3. The goal of the expo is to promote domestic consumption of electricity and electricity trade. The event is being organized by IPPAN and it will include 100 stalls related to hydroelectricity promoters, producers, equipment suppliers, turbine manufacturers, investors, banks, insurance companies, among others. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The expo will also have stalls related to new technology and construction. It also aims to promote the international market for Nepal's hydroelectricity. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14602', 'image' => '20220302052626_MCC.jpg', 'article_date' => '2022-03-02 17:25:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '14859', 'article_category_id' => '1', 'title' => 'Cycling Competition for Tourism Promotion', 'sub_title' => '', 'summary' => 'March 2: A cycling competition has been organized in Parsa National Park with the aim of promoting tourism areas located there. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">March 2: A cycling competition has been organized in Parsa National Park with the aim of promoting tourism areas located there. The Nepalese Army organized the program on the occasion of Mahashivaratri and the Army Day. The competition was inaugurated by the Mayor Vijay Kumar Sarawagi at Birgunj Metropolitan City.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Major Kaman Singh Gurung of the Nepalese Army informed that the cycling event covered a distance of 39 kilometers and was contested by participants from Bara and Parsa. Inaugurating the competition, Mayor Sarawagi said that the metropolis would continue to support the development of tourism in Parsa National Park.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">He also pointed out the need for cooperation between the local, state and federal governments for the promotion of tourism. He emphasized on the development and promotion of the surrounding tourist areas including Parsa National Park, which is the nearest tourist destination from Birgunj. He also expressed confidence that the Birgunj Metropolitan City, which is the main gateway to Nepal, could benefit from tourism prospects.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">He said that the tourists entering Nepal through Birgunj should be given adequate information about Parsa National Park and if they could be accommodated in hotels in Birgunj for at least two days, it would also contribute significantly to the promotion of hotel business. The metropolitan city had contributed Rs 500,000 for the competition. Members of Parliament of Madhesh Province, Sundar Bishwakarma, Sita Gurung and others were present at the inauguration ceremony.</span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14601', 'image' => '20220302051810_2744718557_n.jpg', 'article_date' => '2022-03-02 17:17:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '14858', 'article_category_id' => '1', 'title' => 'Central Bank Preparing to make Loans Available through Digital Wallets ', 'sub_title' => '', 'summary' => 'March 2: Nepal Rastra Bank is making arrangements to avail loans for bank customers from mobile wallets.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">March 2: Nepal Rastra Bank is making arrangements to avail loans for bank customers from mobile wallets. The central bank decided to provide loan facilities through mobile wallets due to its growing popularity among the people. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The monetary policy of NRB for the current fiscal year mentions that necessary study will be conducted to make arrangement of loan flow from mobile wallets. NRB has stated that it will issue instructions in this regard after the study gets completed. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"As per the announcement made in the monetary policy, we will conduct necessary studies in this regard," said Guru Prasad Poudel, executive director of the payments system department of NRB,adding, "Only then we will issue instructions to provide this feature to the wallet users." </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Until now, facilities such as mobile top-up, and online payment of bills including telephone internet, drinking water, and other utility bills are available from digital wallets. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In mid-February, the central bank had made arrangements for banks and financial institutions to obtain loans up to Rs 500,000 through electronic means. According to the digital lending guidelines 2078, banks and financial institutions can provide loans up to a maximum of Rs 500,000 to the customers with salary or business accounts and up to Rs 200,000 for other account holders. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The banks can also disburse such loans by appointing representatives to the wallet service providers. They will be able to facilitate everything from loan application to recovery. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Poudel said that as the wallet companies have just opened and they do not have adequate infrastructure and capacity, for the time being, only banks and financial institutions will be allowed to give loans digitally. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"At present, wallet companies can act as agents of bank loans," he said. "Once the companies are able, we will authorize them to give small loans." </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to NRB, there are currently 27 payment service providers operating in the country. Wallet companies have 17.71 million users. As of mid-January, transactions worth Rs 16.27 billion have been done through wallets. Currently, there is an arrangement for transactions up to Rs 1 million from wallets on a monthly basis. </span></span></p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14600', 'image' => '20220302025956_20210926011503_20200918073634_digita (1).jpg', 'article_date' => '2022-03-02 14:59:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '14857', 'article_category_id' => '1', 'title' => 'Credit Flow Increases, Deposit Collection Falls', 'sub_title' => '', 'summary' => 'March 1: Commercial banks have continued to increase credit flow as compared to deposit collection.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">March 1: Commercial banks have continued to increase credit flow as compared to deposit collection. Because of the lack of deposit collection, banks are withdrawing loans from Nepal Rastra Bank via monetary instruments including the Standing Liquidity Facility (SLF) and are mobilizing loans in the market.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to data unveiled by the Nepal Bankers' Association on Monday, commercial banks have been intensifying credit flow since mid-February. The credit flow of banks was Rs 12 billion in between mid-January to mid-February but the credit flow in the last two weeks of February alone is Rs 10 billion. Banks disbursed Rs 4 billion in the third week and Rs 6 billion in the fourth week of February. Meanwhile, deposits have increased by only Rs 2 billion during this period.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Banks and financial institutions had hiked interest rates on deposits by 10 percent in mid-February, citing liquidity crunch. Commercial banks have raised the maximum interest rate on deposits to 11.3 percent. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Even with an increase in interest rates, bank deposits have not increased. So, the banks have been extending loans via monetary instruments such as Standing Liquidity Facility (SLF), repo, and overnight repo and direct purchase method.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The banks have utilized such monetary instruments 2,481 times in the current fiscal year to mobilize Rs 4591 billion with the help of the central bank as of February 27. Out of this amount, Rs 154.66 billion is in banks and financial institutions.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif""> NRB's Executive Director, Prakash Kumar Shrestha said that this is the highest amount of liquidity consumption by the banks till date. “Banks can enjoy liquidity flow facility to manage the liquidity at the time of crises,” he said adding, “But it is not appropriate and shows the weakness of banks to depend completely on NRB.”</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Chairman of Nepal Bankers Association, Anil Kumar Upadhyaya says that the banks have not made any new investments. “Depending on the condition of the debtor, some investments may have been made in the loans already approved. But banks are not in a position to extend new loans.” He claimed that the money received from the facility including SLF was the bank’s own money and they have been using it accordingly.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">As of mid-February this year, bank deposits have increased by Rs 1.1 billion and credit flow has increased to Rs 434 billion. The credit flow is high and most of the credit goes to unproductive sectors including imports causing further lack of liquidity.</span></span></span></p> <p> </p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> <p> </p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14599', 'image' => '20220302014247_1646089650.Clipboard04.jpg', 'article_date' => '2022-03-02 13:42:10', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '14856', 'article_category_id' => '1', 'title' => 'Foreign Investment Commitments in Energy Sector Continue to Decline', 'sub_title' => '', 'summary' => 'March 2: Foreign investment commitment in the energy sector, which is believed to be the backbone of economic development, has been steadily declining for some years now.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">March 2: Foreign investment commitment in the energy sector, which is believed to be the backbone of economic development, has been steadily declining for some years now.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the Department of Industry, foreign investment commitment in energy sector has been declining since FY 2074/75. In FY 2074/75, the energy sector received foreign investment commitment of Rs 36.24 billion.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">In the subsequent fiscal year (FY 2075/76), the sector didn't receive any foreign investment commitment. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Director-General of the Energy Department Ram Chandra Tiwari said that the department is not certain about the reason for the decline in investment commitment.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">"In the case of the energy sector, projects have to be surveyed and selected. It is time consuming. Big projects should come under the Investment Board. These might be the probable reasons why there isn’t much foreign investment commitment in the energy sector since some years,” said Tiwari. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Baburaja Adhikari, information officer at the Ministry of Energy, also said that they are yet to conduct any study to find out the reason behind the decline in investment commitment.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the data provided by the department, the foreign investment commitment in energy sector in FY 2076/77 was Rs 4.97 billion and Rs 1.54 billion in FY 2077/78. The sector has received a commitment of Rs 56.2 million as of February 30 of the current fiscal year.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Within the energy sector, there is even less commitment for hydropower projects. The statistics show that the hydropower projects have not received any foreign investment commitment in the current fiscal year. During this period, only one solar plant has received foreign investment commitment.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Similar is the case with projects under the Department of Industry.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Investments in big projects come through the Investment Board Nepal. The last time Nepal received foreign investment commitment was for the 900 MW Arun III Hydropower Project with the approval of the Investment Board. Similarly, the process has been initiated to bring foreign investment for Upper Karnali, Tamor Storage, Upper Marsyangdi-2 projects through the board.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Energy producers are worried about the lack of foreign investment commitment as per Nepal's expectations.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Krishna Prasad Acharya, chairman of the Independent Power Producers Association of Nepal (IPPAN), said that it was unfortunate that foreign investment commitments in energy sector have been declining. He said if this situation continues, there will be a challenge for the development of the energy sector.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Acharya claimed that such a situation has arisen due to the government's inability to create an investment-friendly environment.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">"Foreign investors have two things to look at. One is the guarantee of return on investment, and the other is the investment-friendly environment,” he said, adding, “There is a guarantee of return on investment in Nepal. On top of that, there isn’t any investment-friendly environment. That is why foreign investment commitments are declining.”</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">He says that the Covid-19 pandemic has also had an effect on foreign investment commitments. "Recently, foreign investment commitments have declined due to the Covid-19 pandemic. But, it should not be seen as such,” he said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Likewise, he added that an investment-friendly environment has not been created. Acharya further said that the investors were not enthusiastic about investment as there was still a cumbersome process to build the project with the help of many agencies. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">"On top of that, the work of PPA has been stopped for the last two years and the government has failed to bring policy reforms to encourage foreign investment. The government's policy is to control rather than facilitate," he added.</span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14598', 'image' => '20220302115907_hydro.jpg', 'article_date' => '2022-03-02 11:58:24', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '14855', 'article_category_id' => '1', 'title' => 'Government yet to Release Rs 260 Million to BPKIHS for Health Insurance Scheme ', 'sub_title' => '', 'summary' => 'March 2: The BP Koirala Institute of Health Sciences (BPKIHS), a reputed teaching hospital in Dharan, is desperately awaiting for Rs 260 million from the Ministry of Health and Population which the government is liable to pay for insurance coverage.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">March 2: The BP Koirala Institute of Health Sciences (BPKIHS), a reputed teaching hospital in Dharan, is desperately awaiting for Rs 260 million from the Ministry of Health and Population which the government is liable to pay for insurance coverage. The hospital spent the amount on health insurance schemes for patients on its own but has not received the amount from the government. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The BPKIHS administration has said that the lack of fund has hampered the health insurance scheme at the hospital, which is the major destination for locals of Province 1 and Madhesh Province. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">''BPKIHS has made it clear in writing to the Health Ministry that if the fund is not released within March 29, the hospital will cease the health insurance scheme,'' said Professor Doctor Gaurishankar Shah, the hospital's director. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">''BPKIHS is itself in crisis in financial fronts which is added by the pending health insurance dues from the Health Ministry. The ministry owes us Rs 260 million which is not a small amount,'' he added.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Dr Shah said BPKIHS has drawn the attention of the office of the Prime Minister, Chief Minister of Province 1, Health Ministry of Province 1, District Administration Office of Sunsari and Dharan Sub-Metropolitan City but to no avail. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Dr Shah said more than 60 to 70 percent patients at the institution are from government-funded health insurance scheme. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">''BPKIHS is an autonomous institution where more than 2300 staff including doctors, nurses, teachers and other employees are working,'' Dr Shah told a local media outlet of Dharan. 'The government doesn't pay the salary of hospital staff and we are economically stressed to manage on our own due to lack of funds.'' -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2022-03-02', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14597', 'image' => '20220302081338_health-insurence1.jpg', 'article_date' => '2022-03-02 08:10:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '14853', 'article_category_id' => '1', 'title' => 'MCC Agreement to be Implemented within a Year and a Half', 'sub_title' => '', 'summary' => 'March 1: Although the MCC agreement has been passed by the parliament, it will take some time for the project to move ahead.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">March 1: Although the MCC agreement has been passed by the parliament, it will take some time for the project to move ahead.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"The Millennium Challenge Account (MCA) Development Committee will begin construction of the proposed transmission line and strategic roads within a year and a half after completing all the pre-requisites for construction and issuing global tender," said Khadga Bahadur Bista, chief executive officer (CEO) of the MCA.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">He said that the acquisition of land, forest, and environment-related works should be completed first to start the construction. "These works will be completed within a year. After that, the date of commencement of construction will be fixed," said Bista.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">He said that even the global tender for the construction of road and transmission line would take up to a year and a half. He said that the budget of the project was estimated five years ago and it will be reviewed. According to the agreement signed with the US, the entire work of the project has to be completed within five years. If the grant is not spent within five years, the project will be terminated.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">As per the current agreement, the US-backed MCC will invest USD 500 million or about Rs 55 billion from the MCC and the Government of Nepal will invest USD 130 million or about Rs 15 billion in the project. The target of the MCC project is to build a 315 km long transmission line of 400 Kv capacity and 77 km long strategic road.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The transmission line to be constructed with the grant of MCC is expected to strengthen the proposed 7,000 MW capacity hydropower projects financially. The project will ensure security of large investments made by banks and hydropower developers. The private sector expects Nepal to make a drastic leap in power generation as more investment will be made in Nepal's energy sector after the endorsement of MCC grant.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The United States has responded by saying that the project has now moved towards the implementation phase.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The decision on whether to ratify the MCC agreement has always been in the hands of the Nepalese government as a sovereign democracy, the US Embassy in Kathmandu said in a statement on Monday. According to the embassy, the project will improve the supply of electricity and decrease transportation costs.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The United States noted that this year marks the 75th anniversary of the establishment of diplomatic relations between Nepal and the United States.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The United States has said that MCC compacts have helped alleviate poverty worldwide since its inception about 20 years ago.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The latest US statement comes after the House of Representatives ratified the MCC agreement on Sunday with a 12-point explanatory announcement.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14595', 'image' => '20220301050950_MCC.jpg', 'article_date' => '2022-03-01 17:09:16', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '14852', 'article_category_id' => '1', 'title' => 'NOC under Pressure to Hike Fuel Prices after getting Revised List from IOC', 'sub_title' => '', 'summary' => 'March 1: The rise in price of oil in the international market has also impacted Nepal’s market, according to the state-owned Nepal Oil Corporation (NOC).', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">March 1: The rise in price of oil in the international market has also impacted Nepal’s market, according to the state-owned Nepal Oil Corporation (NOC).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The NOC has received a revised list of petroleum products from the Indian Oil Corporation. As per the new list, the price of diesel has been increased by Rs 3 per litre, petrol by Rs 3.89 per litre, kerosene by Rs 10 per litre, aviation fuel by Rs 3.5 per litre and cooking gas (liquefied petroleum gas) by Rs 100 per cylinder.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">NOC Spokesperson Binit Mani Upadhyay said that they are anticipating a fortnightly loss of Rs 3.9 billion and a monthly loss of Rs 6.19 billion if they did not revise the price according to the new list.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">“We are under pressure to increase the price of petroleum products. Otherwise, we cannot pay the IOC,” said Upadhyay.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">“We have to pay two installments to IOC for the month of March. We will not be able to pay them unless we increase the price or receive financial support from the government,” the official added.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">According to him, NOC has to pay those installments on March 8 and 23.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-02', 'keywords' => '', 'description' => '', 'sortorder' => '14594', 'image' => '20220301042117_20220220082656_petrol.jpg', 'article_date' => '2022-03-01 16:20:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '14851', 'article_category_id' => '1', 'title' => 'Hydropower Investors at Loss as Share market Falls despite Ratification of MCC ', 'sub_title' => '', 'summary' => 'March 1: Investors investing money in the hydropower sector have lost the most in Monday's trading, despite expectations that the endorsement of the Millennium Challenge Corporation (MCC) deal would have a positive impact on the share prices of hydropower sector. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">March 1: Investors investing money in the hydropower sector have lost the most in Monday's trading, despite expectations that the endorsement of the Millennium Challenge Corporation (MCC) deal would have a positive impact on the share prices of hydropower sector. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Among the indices of 13 groups, the hydropower group declined the most at 3.9 percent. Of the 10 companies whose prices dropped the most, nine belonged to the hydropower sector. Shares of Tehrathum Power Company Limited and Samling Power Company dropped by 10 percent. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Companies under the hydropower group were also among the groups with the highest turnover. Api Power had the highest turnover, followed by Arun Valley Hydropower. Shares of Api Power worth Rs 169.99 million were traded. Shares of Arun Valley Hydro worth Rs 149.42 million were also traded the same day. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">A total of 3.4 million shares worth Rs 1.62 billion of 45 listed companies under the Hydropower Group were traded during the period. The hydropower group had a share of 44.29 percent in the total turnover. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The US-funded MCC which was approved by the House of Representatives on February 27 has provisions to build power transmission lines and roads within the next five years. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the Millennium Challenge Account (MCA) Nepal, about Rs 45 billion of the grant received by Nepal through MCC will be spent on the construction of transmission lines. Investors had speculated that most of the grants under the MCC agreement would be invested in the power sector, which would have a positive impact on the share market of hydropower companies. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Likewise, analysts had also speculated that the ratification of MCC would lift the overall share market. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Chhotelal Rauniyar, a stock investor and former chairman of the Nepal Investors Forum, said that even after the MCC was passed, investors were not enthusiastic due to the previous policy change. He said that the market has not turned positive as most investors are confused about MCC and its impact on the market. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to Rauniyar, investors who were disappointed by the monetary policy review, lack of investable capital in banks and financial institutions and rising interest rates, could not be enthusiastic even after the MCC was passed. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Another stock investor, Keshav Koirala, said that the MCC agreement should not be linked to the share trading of the hydropower company. He also accused the government of increasing the share price of the hydropower companies by linking it to the MCC agreement. </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14593', 'image' => '20220301035018_1646089597.3.jpg', 'article_date' => '2022-03-01 15:49:39', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '14850', 'article_category_id' => '1', 'title' => 'Test Flights at Gautam Buddha Airport from April 14', 'sub_title' => '', 'summary' => 'March 1: Gautam Buddha International Airport is preparing for test flights after successfully conducting calibration flights. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">March 1: Gautam Buddha International Airport is preparing for test flights after successfully conducting calibration flights. The airport is preparing to conduct test flights on April 14. The airport officials have already received a preliminary report of the 10-day calibration flights by Thailand’s Aero Thai.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The airlines briefed the Civil Aviation Authority of Nepal and the heads of Gautam Buddha Airport Project about the calibration flight on Monday, February 28. General Manager of the airport Govinda Prasad Dahal informed that Aero Thai will submit the final report within a week after submitting the preliminary report.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Dahal said the airport would have customs and immigration offices as well as a structure for ground handling and cargo management as soon as Aero Thai submits its final report. He also informed that after Aero Thai submits the final report, the project will start homework for necessary preparations for test flights and commercial flights. Aero Thai had conducted calibration flights at the airport from February 18 to 28.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to Dahal, they have started preparations for test flights and commercial flights after the preliminary report of the calibration flights gave the green signal. Therefore, the project has scheduled test flights as there were no problems during the calibration flights.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Dahal further said that commercial flights will be conducted from May 16 after the test flights. As soon as the test flight is successful, CAAN will invite international airlines to apply for international flights.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">It took almost seven years for the completion of the Gautam Buddha International Airport. An additional 500 bighas of land was acquired to upgrade the airport to the international standard.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14592', 'image' => '20220301030704__RM_0142.jpg', 'article_date' => '2022-03-01 15:06:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '14849', 'article_category_id' => '1', 'title' => 'Russia-Ukraine War Fuels Fears of Global Food Crisis', 'sub_title' => '', 'summary' => 'March 1: Countries across the world have imposed sanctions on Russia one after another after President Vladimir Putin order invasion of Ukraine last week.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Rama Subedi</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">March 1: Countries across the world have imposed sanctions on Russia one after another after President Vladimir Putin order invasion of Ukraine last week.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The situation has caused fluctuation in the price of oil globally. Commodity prices have also increased. Russia and Ukraine are the chief producers of oil, natural gas and metals.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Both the countries also play a vital role in supply of food grains across the globe. Wheat produced in Ukraine and Russia constitute 29 percent of the wheat traded across the world. These two countries also supply 19 percent of maize to the world.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Russia and Ukraine also supply 80 percent of sunflower oil to the world. The war between Russia and Ukraine has raised prospect of food crisis across the world. Importers of maize, wheat and sunflower are looking for alternative supply after the outbreak of war, according to analysts.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The price of wheat has increased by US$ 150 per 100 bushels. Egypt and Turkey are the major importers of wheat produced by Russia. However, the delay in supply of wheat will not only affect these two countries but will have a wider impact. Countries across the world will be impacted and the prices are expected to soar.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The price of wheat futures per 100 bushels (approx. 2,721 kg) rose to US$ 950, an increase by 1.63 percent from a day before. The price of wheat has skyrocketed since February 16. Likewise, the prices of maize and soybean have also increased. Maize futures rose from US$ 638 to US$ 695 per 100 bushels last Thursday.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Soybean futures also increased by US$ 125 per 100 bushels during this period. The prices of all three products have increased by 50 percent in February.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The prices have soared basically due to the decline in production and high demand for these food grains. Citing an agribusiness economist of National Australia Bank, Reuters said that the supply of food grains will be affected across the world if the supply is halted at the Black Sea due to the war.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">A total of 70 percent of wheat exported by Russia were consumed in the middle east and Africa.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The Food and Agriculture Organisation (FAO) of the United Nations had said that the food prices were recorded at a ten-year high last year due to the Covid-19 pandemic. A report published by FAO this month shows that the food prices also increased this year mainly due to the increase in price of vegetable oils. Russia and Ukraine both are major exporters of vegetable oil products, especially sunflower oil.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The Ukraine-Russia war has resulted in an increase in demand for palm oil and soybean oil. Analysts say that the prices of all kinds of cooking oil are expected to rise in the near future.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The price of palm oil had already increased by 44 percent during the start of this year. Food prices are at all-time high after 2014 due to the Covid-19 crisis. The Russia-Ukraine war is further likely to worsen the condition. Analysts say that the war will increase transportation charge which in turn will increase food prices.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The price of crude oil has reached above US$ 105 per barrel for the first time since 2014<em>. (With inputs from news published by various agencies)</em></span></span></span></span></p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14591', 'image' => '20220301125313_food.jpg', 'article_date' => '2022-03-01 12:52:26', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '14848', 'article_category_id' => '1', 'title' => 'Nepal to Purchase Chemical Fertilizer from India', 'sub_title' => '', 'summary' => 'March 1: Nepal has reached an understanding with India to import chemical fertilizer from the neighbouring country in a long-term basis.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">March 1: Nepal has reached an understanding with India to import chemical fertilizer from the neighbouring country in a long-term basis.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The Government of Nepal signed a Memorandum of Understanding (MoU) with India on Monday (February 28) for the supply of urea and Diammonium Phosphate (DAP) from India through G2G process. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The MoU was signed by Secretary at Ministry of Agriculture and Livestock Development Dr Govinda Prasad Sharma on behalf of Nepal and by Rajesh Kumar Chaturvedi, secretary at the Ministry of Chemicals and Fertilizers of the Government of India, according to the Kathmandu-based Indian Embassy. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to a statement issued by the India Embassy, the MoU was signed between the two sides in a virtual ceremony held on Monday in the presence of Minister for Agriculture and Livestock Development Mahindra Raya Yadav and Indian Ambassador to Nepal Vinay Mohan Kwatra. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The understanding between the two sides is expected to address the recurring problem of fertilizer shortage in Nepal. The MoU is another milestone in bilateral economic cooperation between India and Nepal and reflects India's priorities for Nepal, the embassy added. -- RSS</span></span></p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14590', 'image' => '20220301113852_Fertilizer.jpg', 'article_date' => '2022-03-01 11:38:05', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '14847', 'article_category_id' => '1', 'title' => 'Private Sector Welcomes Endorsement of MCC ', 'sub_title' => '', 'summary' => 'March 1: The private sector of Nepal has welcomed the endorsement of US-funded project Millennium Challenge Corporation (MCC) compact by the House of Representatives on February 27. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">March 1: The private sector of Nepal has welcomed the endorsement of US-funded project Millennium Challenge Corporation (MCC) compact by the House of Representatives on February 27. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The private sector is also confident that the 11-point descriptive note announced prior to the endorsement of the USD 500 million grant assistance would help dispel the misconceptions regarding the MCC. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Stating that endorsement of MCC was an important landmark for the economic development and prosperity of the country, the Federation of Nepalese Chambers of Commerce and Industries (FNCCI), the umbrella organization of business houses in Nepal, has expressed confidence that the MCC compact would now go into full implementation phase as per the agreement reached between the Government of Nepal and the MCC on September 14, 2017. The grant assistance would be utilized to construct and expand transmission lines and build and expand road networks in the country. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The FNCCI said in a statement that the private sector is confident that the timely completion of these projects of strategic importance would aid in economic growth of the country. The implementation of the MCC Compact would also help in revitalization of the post-COVID-19 economy and would open the door to export electricity in the long run. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Stating that various projects were accomplished under MCC in over three dozen countries across the world, the Federation was hopeful that the implementation of the MCC Compact would be helpful in Nepal. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The endorsement of MCC Compact would also send message across the world that Nepal had conducive environment for investment and more investment could be attracted to Nepal in the future. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Similarly, the Confederation of the Nepalese Industries (CNI) has expressed happiness over the endorsement of the MCC compact after long deliberations and debates. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The confederation is confident that the projects proposed to be built under the MCC Compact would be implemented within the stipulated timeline thereby playing an important role in the development of infrastructures. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Also, the endorsement of the MCC Compact would help in taking the bilateral ties between Nepal and the USA to new heights and help increase mutual trust, CNI added. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">If the projects under the MCC Compact would be built within five years as mentioned in the agreement, it would be a model for Nepal in development management, the confederation further said. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The 400-kv transmission line from Lapsiphedi-Ratamate, Ratamate-Hetauda, Ratamate-Damauli-Butwal and sub-stations to be built and expanded under the project would be important for improvement of the Nepal's internal power transmission system and inter-country trade of electricity. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Furthermore, upgrading of Kapilvastu-Dang road section along the East West Highway would also be effective for economic development of those areas and is expected to uplift the lives of the people. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The confederation has appealed to the Government of Nepal, concerned provincial governments and local levels as well as the MCA Nepal to move forward the project by taking the affected locals in confidence. -- RSS </span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-03-01', 'modified' => '2022-03-01', 'keywords' => '', 'description' => '', 'sortorder' => '14589', 'image' => '20220301080839_20220227035518_MCC.jpg', 'article_date' => '2022-03-01 08:08:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117