May 6: Bagmati Province is expected to contribute more than one-third of the gross domestic product (GDP) at the national level in the current fiscal…

May 6: Bagmati Province is expected to contribute more than one-third of the gross domestic product (GDP) at the national level in the current fiscal…

May 5: The credit flow of banks have contracted due to the liquidity crisis in the banking system as well as the policy intervention adopted by Nepal Rastra Bank (NRB).…

May 5: The United States of America has agreed to provide US$ 659 million (equivalent to Rs 79.71 billion) to Nepal for supporting its goal of graduating to a middle-income…

May 5: Investors are worried about the margin call as the price of securities is declining in the secondary market.…

May 5: Economist Dr Swarnim Wagle has warned that bad governance in the country coupled with whimsical decision-making trends can push the economy towards…

May 4: The Government of Nepal on Wednesday signed a deal to receive loan worth US$ 150 million to strengthen the financial sector of…

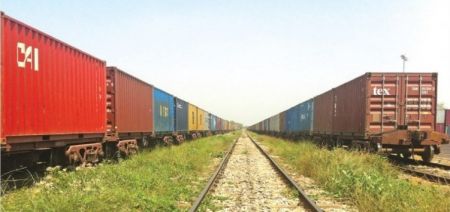

May 4: It has already been four months since the Department of Customs launched online payment system mandatory at the Birgunj Dry Port to make the customs clearance process transparent and…

May 4: The former government led by KP Oli had introduced the Social Security Fund (SSF) claiming it to be the beginning of a new era.…

May 4: Industries reeling under power shortage will have to wait for the snow to melt and rainy season to start for regular supply of…

May 4: Domestic flights were obstructed for one hour this morning (May 4) at Tribhuvan International Airport (TIA) following a hoax that a suspicious object was spotted in the domestic terminal…

May 4: The trend of Nepali nationals providing consultancy and various other services to their compatriots living abroad has been increasing in recent…

May 3: Former Finance Minister Dr Yuba Raj Khatiwada has warned that the country’s economy is still in risk of…

May 3: Shekhar Golchha, president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), has said that it won't be possible to keep the private sector, which contributes 70 per cent to the country's economy, in the…

May 3: Minister for Energy, Water Resources and Irrigation Pampha Bhusal is currently active in discussing the problems in power supply to some big industries with the stakeholders and businessmen.…

May 3: Nepal Rastra Bank (NRB) has tightened the rules for using credit cards.…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '15223', 'article_category_id' => '1', 'title' => 'Bagmati Province Expected to make Highest Contribution to GDP', 'sub_title' => 'Study Projects National GDP to be around Rs 4852 Billion', 'summary' => 'May 6: Bagmati Province is expected to contribute more than one-third of the gross domestic product (GDP) at the national level in the current fiscal year. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">May 6: Bagmati Province is expected to contribute more than one-third of the gross domestic product (GDP) at the national level in the current fiscal year. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">According to a study conducted by the Central Bureau of Statistics (CBS) regarding the contribution of the provinces to the GDP in the current fiscal year (FY 2021/22), Bagmati Province is expected to contribute 36.9 percent to the nation’s GDP. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The figure was 36.7 percent during the last fiscal year. As the CBS projection suggests, the national annual GDP in the current fiscal will be around Rs 4,852 billion while that of Bagmati Province is expected to be around Rs 1,791 billion. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Contribution of Karnali Province to the GDP is projected to be the least among all seven provinces. The CBS data shows that Province 1 will contribute 15.7 percent to the GDP followed by Lumbini Province (14.1 percent), Madhes Province (13.2 percent), Gandaki Province (8.9 percent), Sudur Paschim Province (7.0 percent) and Karnali Province (4.1 percent).</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">According to the study, the country's economic growth rate in the current fiscal will be 5.8 percent at the national level. The CBS report says Bagmati Province is projected to record the highest economic growth rate of 6.7 percent while the lowest of 4.8 percent has been projected in the Madhes Province.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Speaking at a press conference organized to unveil the report on Thursday, CBS Director Ganesh Prasad Acharya said that the maximum contribution to the GDP will come from service sector while the industrial sector will contribute the least.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">As per the industry taxonomy, the proportion of contribution of agriculture sector to the GDP in the last fiscal year and the current fiscal year is highest in all the provinces except Bagmati Province. The contribution of wholesale and retail trade sector is found to be more in Bagmati Province. The CBS has stated that the contribution of trade sector is found to be more in Bagmati Province due to the growing urbanization, large population and the national-level trade transactions. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Trade sector occupies second position at the national level in terms of its contribution to the GDP.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The growth projection and other data have been made public on the basis of the information collected up to nine months of the current fiscal year, the CBS stated. Based on the estimated data, the CBS concluded that economic activities are on the way to normalcy in all provinces following a decline in COVID-19 infections. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-06', 'modified' => '2022-05-06', 'keywords' => '', 'description' => '', 'sortorder' => '14965', 'image' => '20220506080122_GDP.jpg', 'article_date' => '2022-05-06 08:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '15222', 'article_category_id' => '1', 'title' => 'BFIs Unlikely to Meet Credit Expansion Target this Year', 'sub_title' => '', 'summary' => 'May 5: The credit flow of banks have contracted due to the liquidity crisis in the banking system as well as the policy intervention adopted by Nepal Rastra Bank (NRB). ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">May 5: The credit flow of banks have contracted due to the liquidity crisis in the banking system as well as the policy intervention adopted by Nepal Rastra Bank (NRB). As a result, the banks are unlikely to meet the target of credit flow fixed by the central bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">NRB had set a target for banks and financial institutions to expand credit flow by 19 percent in the monetary policy for the current fiscal year. As per the target, BFIs have to make loan investment of around Rs 800 billion. However, the credit flow of BFIs in the first nine months of the current fiscal year stands at 12 percent.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">“Banks are unable to expand credit flow due to liquidity crisis,” said Sunil KC, vice president of Nepal Bankers’ Association, adding, “Even 15 percent credit expansion seems difficult this year.”</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Nepal Rastra Bank’s Governor Maha Prasad Adhikari also admitted during a public function organized on Wednesday that the BFIs will not meet the credit expansion target this year.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">BFIs were aggressively involved in credit expansion last year after the impact of Covid-19 subsided. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The central bank had set a target of 20 percent credit expansion in the fiscal year 2020/21. However, credit expansion of BFIs during the review period stood at 28 percent. Despite expanding credit flow, banks failed to collect deposit in the same proportion. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Therefore, banks are unable to extend new credit right now.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">NRB had also fixed 90 percent CCD ratio in the current fiscal year from the earlier CCD ratio of 85 percent. Due to this provision, banks credit flow was affected as they can extend credit flow in proportion to deposit collection. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Economist Dr Bishwas Gauchan says banks were aggressively involved in credit flow to the unproductive sector.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">“There is over financing in our economy. Credit flow has not helped in economic growth. It has only helped increase imports which is unproductive,” said Gauchan.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Central bank officials have also concluded that banks have mostly extended credit to the unproductive sector due to which there has been liquidity crisis. </span></span></p> ', 'published' => true, 'created' => '2022-05-05', 'modified' => '2022-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '14964', 'image' => '20220505071950_Banks - Copy.jpg', 'article_date' => '2022-05-05 19:19:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '15221', 'article_category_id' => '1', 'title' => 'USA to Provide Rs 79.71 Billion Grant to Nepal for its Graduation to Middle-Income Country ', 'sub_title' => '', 'summary' => 'May 5: The United States of America has agreed to provide US$ 659 million (equivalent to Rs 79.71 billion) to Nepal for supporting its goal of graduating to a middle-income country. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 5: The United States of America has agreed to provide US$ 659 million (equivalent to Rs 79.71 billion) to Nepal for supporting its goal of graduating to a middle-income country. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Joint Secretary and Head of the International Economic Cooperation Coordination Division (IECCD) of the Ministry of Finance Ishwori Prasad Aryal and USAID Nepal’s Mission Director Sepideh Keyvanshad signed an agreement to this effect on behalf their respective governments at a programme organized at the ministry on Thursday (May 5). </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Termed as the new Development Objective Agreement, this assistance will span for five years. The US government will partner with the Government of Nepal, civil society, and the private sector to implement projects under the grant assistance.</span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The US assistance is expected to advance Nepal's sustainable development through strengthening democratic governance, enterprise-driven economic growth and increased resilience for communities most at-risk to natural disasters and climate change. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The amount of assistance will be recorded in the GoN Red Book and transparently implemented through both on and off treasury modalities. USAID will develop projects under this assistance in collaboration with line ministries and implement them in accordance with GoN rules and regulations. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Delivering a short remark following the signing ceremony, Aryal expressed, "In 1951, after signing the Point Four Program, the United States became the first bilateral donor to Nepal. This started a 70 plus year relationship of trust, mutual respect, and commitment to the people of Nepal." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He further added that Nepal has greatly benefited from the financial and technical assistance extended by the United States to help drive Nepal's socioeconomic development. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Keyvanshad noted, "Today we add a new chapter to our long-standing partnership with the Government of Nepal and the Nepali people. We look forward to continuing the US government's long-term commitment to support activities that strengthen Nepal's democracy, governance, and economic growth across the country." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">This year, the United States government and the Government of Nepal are celebrating 75 years of bilateral relationship. The Government of Nepal expressed its sincere appreciation to the Government of the United States of America for its invariable support in socioeconomic development and advancements of human resources of Nepal. Both governments acknowledge the partnership has seen many successes and looked forward to continuing in the spirit of strong collaboration, the Ministry of Finance and the USAID said in a joint press release. -- RSS</span></span></span></p> ', 'published' => true, 'created' => '2022-05-05', 'modified' => '2022-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '14963', 'image' => '20220505041459_US flag.jpg', 'article_date' => '2022-05-05 16:14:10', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '15220', 'article_category_id' => '1', 'title' => 'Investors Troubled by Margin Call as Share Market Continues to Decline ', 'sub_title' => '', 'summary' => 'May 5: Investors are worried about the margin call as the price of securities is declining in the secondary market. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">May 5: Investors are worried about the margin call as the price of securities is declining in the secondary market. Investors who have taken loans of a margin nature from banks and financial institutions have started facing margin calls.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Banks and financial institutions, when giving loans of a margin nature, call for an additional amount or share in case the value of the pledged shares falls by 20 per cent. It has raised concerns among the investors who have taken loans of the margin nature.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Secretary of the Share Investors Pressure Group, Nayan Bastola, informed that investors have been suffering due to the recent margin call. Investors who took loans when the market was at a historic high are now facing the risk of margin calls, he said. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to Bastola, there is a lack of investable capital in the financial system, and investors will have difficulty completing the margin call process when the stock price is declining day by day. He is of the view that investors will be relieved from the problem of the margin call if the government pays attention to the need for policy change in the market.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">An experienced investor and secretary of Nepal Investors Forum, Durga Tiwari, also said that investors are falling prey to margin calls. He says margin calls have added tensions as investors are worried about declining market. "Liquidity can ease this problem," said Tiwari.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Tiwari said that the problem of not wanting to sell at a loss when the price of securities is low and also the problem of not getting loans from banks and financial institutions is making the investors panic.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the rate at which the market has declined, investors do not have the problem of margin calls.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to sources, if the market continues to decline, all the borrowers will face the problem of margin calls. Nepse had set a record by crossing 3,200 points on August 20.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">After that, the market dropped to 2,259.51 points on November 12 and climbed to a historic point on January 15. On that day, the Nepse index had risen to 2,956 points. On Wednesday, the last trading day, Nepse stood at 2,275.68 points. Based on the high point of January 19, Nepse has dropped by 23 per cent in the meantime.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Banks and financial institutions can disburse margin loans up to 70 per cent. Investors can get such loans up to Rs 40 million from one institution and up to Rs 120 million from four banks by pledging their shares. </span></span></span></span></p> <p><br /> <br /> </p> ', 'published' => true, 'created' => '2022-05-05', 'modified' => '2022-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '14962', 'image' => '20220505025332_margin call.jpg', 'article_date' => '2022-05-05 14:51:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '15218', 'article_category_id' => '1', 'title' => 'Bad Governance and Whimsical Decisions can Lead to Economic Crisis: Dr Wagle', 'sub_title' => '', 'summary' => 'May 5: Economist Dr Swarnim Wagle has warned that bad governance in the country coupled with whimsical decision-making trends can push the economy towards crisis.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 5: Economist Dr Swarnim Wagle has warned that bad governance in the country coupled with whimsical decision-making trends can push the economy towards crisis. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Stating that the Sri Lankan crisis occurred mainly due to bad governance, lack of fiscal discipline and inability to repay the loan, Dr Wagle cautioned Nepal to take timely measures to prevent a similar predicament.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The former vice chairperson of the National Planning Commission made such remarks while addressing an interaction organized by the Society of Economic Journalists-Nepal (SEJON) on the ‘Future Direction of Nepal’s Economy’ on Wednesday.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Wagle, who is also the chief economic advisor to the Asia Pacific chapter of UNDP, also warned that the ruling parties are displaying the nature that is likely to destabilize the country’s economy.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Dr Wagle said that although Nepal’s current situation is much better than that of Sri Lanka, the risk of similar crisis cannot be ruled out as the decision makers of Nepal are following a similar footsteps of Sri Lanka. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The danger of economic crisis is looming large mainly due to policy and economic shortcomings, said Wagle adding that administrative and policy reforms are required in order to maintain fiscal discipline.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Stating that Sri Lanka received loan for infrastructure development after the end of the armed struggle, Dr Wagle said that the South Asian country had to face economic crisis as it received foreign loans for investment without proper study. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">He argued that the Sri Lankan crisis occurred due to massive public borrowing and Balance of Payments (BoP) deficit. According to Dr Wagle, Nepal’s status of public borrowing and Balance of Payments (BoP) is not identical to that of Sri Lanka. </span></span></span></p> <p> </p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2022-05-05', 'modified' => '2022-05-05', 'keywords' => '', 'description' => '', 'sortorder' => '14960', 'image' => '20220505121731_maxresdefault.jpg', 'article_date' => '2022-05-05 12:16:46', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '15217', 'article_category_id' => '1', 'title' => 'World Bank to Provide Loan of US$ 150 million to Strengthen Financial Sector of Nepal', 'sub_title' => '', 'summary' => 'May 4: The Government of Nepal on Wednesday signed a deal to receive loan worth US$ 150 million to strengthen the financial sector of Nepal.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 4: The Government of Nepal on Wednesday signed a deal to receive loan worth US$ 150 million to strengthen the financial sector of Nepal. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The World Bank in a statement expressed its belief that the ‘Finance for Growth’ Development Policy Credit (DPC) will help in creating financial sector stability, diversify financial solutions, and increase access to financial services in Nepal.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Finance Secretary Madhu Kumar Marasini, on behalf of the Government of Nepal, and the World Bank’s Country Director for the Maldives, Nepal, and Sri Lanka, Faris Hadad-Zervos signed the agreement amid a function on Wednesday.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">“Our overarching priorities are guided by the objective of achieving sustainable and inclusive growth as also reflected in the 2022-2026 Financial Sector Development Strategy that addresses emerging vulnerabilities from COVID-19 and climate change risks, and focuses on digital payments, and mainstreaming of financial inclusion. The Finance for Growth DPC contributes to these priorities,” the statement quoted Finance Secretary Madhu Kumar Marasini as saying.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">According to the statement, this is the second Finance for Growth operation approved by the World Bank Board of Executive Directors on March 24, 2022. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The operation will support enhanced supervision of the banking sector to address financial stability risks in the context of the COVID-19 pandemic’s impacts, the statement added.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">“It will help open up capital, insurance, and disaster risk financing markets, and foster financial product innovations. It will also support initiatives to increase liquidity and inclusion through access to external commercial borrowing, financial digitalization, and financial literacy for women. This will help improve the functioning of the financial sector to support private sector-led growth.”</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The operation supports Nepal’s green, resilient, and inclusive development, and also initiates a new climate agenda, supporting climate finance resilience policy measures across different sectors, the statement added.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">“Nepal is one of the early movers in endorsing green, resilient, and inclusive development (GRID) as a national strategic development approach,” stated Faris Hadad-Zervos, World Bank’s Country Director for the Maldives, Nepal, and Sri Lanka. “By supporting a set of transformative financial sector reforms, including the introduction of a broad-based climate-resilience agenda across all financial markets, this project will further contribute to the government’s policy priorities of mitigating the pandemic’s adverse impacts while supporting a resilient recovery.”</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14959', 'image' => '20220504083134_279867408_10158164012646467_2605704589217767504_n.jpg', 'article_date' => '2022-05-04 20:30:50', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '15216', 'article_category_id' => '1', 'title' => 'Nepali Importers Troubled by Problematic Online Payment System', 'sub_title' => '', 'summary' => 'May 4: It has already been four months since the Department of Customs launched online payment system mandatory at the Birgunj Dry Port to make the customs clearance process transparent and easy.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">May 4: It has already been four months since the Department of Customs launched online payment system mandatory at the Birgunj Dry Port to make the customs clearance process transparent and easy. However, the cost of imports is increasing as the new system is not up to date.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Last Saturday, 24 containers of Birgunj-based trader Suresh Rungata were stopped at the port customs. The server of the department was not working properly since Thursday. He paid the revenue when the server was running for a short time but the containers were denied customs clearance as the server did not work all day on Saturday.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">“Even the goods whose revenue was paid could not be cleared,” Rungata shared with New Business Age</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Most of the goods arriving via train from India and third countries enter Nepal through this customs point. Madhav Rajpal, vice-president of the Birgunj Chamber of Commerce and Industry, said that the importers are suffering due to the problems in the system as well as bank payment and Nepal Clearing House Limited. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Revenue payments at this port is made completely online. The Department Customs started online payment at the dry port as a trial and implemented it at other customs from January 15. However, in other customs, there are options to pay with cheque.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to the service seekers, there are frequent problems with the server and system of the Department of Customs. Rajpal said that the inspection pass and revenue payment get halted due to system failure.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to Santosh Kumar Neupane, information officer at the dry port, the problem appears due to procedural shortcomings of the dry port customs’ system and other online service providers.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Neupane said, “The server and the system of the department are outdated, so online payments are sometimes blocked. Discussions are being held to set up a proxy server at the customs and update it to the main server of the department.”</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Officials of the dry port customs said that the online payment cannot be done on a timely manner due to procedural hassles of the clearing house and the bank. They say that the arrangement of the clearing house to get step-wise approval for the payment of an amount more than Rs 200,000 has caused the delay.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The importers said that due to the limitations of the service providers’ system, the payment is hampered and the customs clearance is also delayed. They added that even if the customs officials pass the inspection till 6 pm, the online payment made after 5 pm is deposited in the account of the dry port customs the clearing house only in the next working day.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Earlier, customs clearance was possible throughout 365 days in a year till 6 pm. Trader Rungata complained that the cost of import is increasing as service providers do not improve their systems and processes. The vice-president of the association Rajpal said that the system should be improved immediately to ease the customs clearance.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14958', 'image' => '20220504063018_1631664081.Clipboard03.jpg', 'article_date' => '2022-05-04 18:29:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '15215', 'article_category_id' => '1', 'title' => 'SSF Witnesses Rise in Contribution by Rs 10.78 Billion', 'sub_title' => '', 'summary' => 'May 4: The former government led by KP Oli had introduced the Social Security Fund (SSF) claiming it to be the beginning of a new era. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">May 4: The former government led by KP Oli had introduced the Social Security Fund (SSF) claiming it to be the beginning of a new era. Companies have added Rs 10.78 billion in one year to the contribution-based social security fund. The contribution amount which was Rs. 5.45 billion on April 3 last year has reached Rs 16.23 billion by April 30 this year.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">According to the investment procedure of the Social Security Fund, the amount deposited in the fund can be invested in government bonds, shares, debentures, mutual funds and fixed assets. The contributors’ money has already been invested in fixed deposit accounts, debentures, mutual funds, etc, said Vivek Panthi, director of the fund. According to him, the fund is getting interest at the rate of up to 8 percent per annum on the amount deposited in the fixed deposit accounts. According to the director, 130,547 contributors working in 3,267 organization have contributed to the fund during this period.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Although the government has tried to include government employees working in contract basis in public enterprises for two consecutive years in the social security scheme, it has failed to do so. Even though such programme was announced in the budget of the current and previous fiscal years, the officials of the fund say that the process could not move ahead due to the objection by the finance ministry.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">The government had announced in the budget of the current fiscal year that the informal sector workers would be included in the social security programme. So far, no attempt has been made to include them in this scheme.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Although the Social Security Fund has been urging the private sector to get listed, the employees of banks and financial institutions in particular have not agreed to it.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14957', 'image' => '20220504053144_SSF (1).jpg', 'article_date' => '2022-05-04 17:30:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '15214', 'article_category_id' => '1', 'title' => 'Regular Supply of Electricity Expected from Second Week of May', 'sub_title' => '', 'summary' => 'May 4: Industries reeling under power shortage will have to wait for the snow to melt and rainy season to start for regular supply of electricity.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">May 4: Industries reeling under power shortage will have to wait for the snow to melt and rainy season to start for regular supply of electricity.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">State authorities say it is not possible to get the required amount of electricity from India immediately. In this situation, there is no alternative but to wait for the snow to melt and rain to ease the supply of electricity.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">It seems that the power supply will ease only after the second week of May. The snow at the base of the mountain has already started melting since April. But the snow in the upper region starts melting slowly from the second week of May. Then the amount of water in the river increases. As the water level in the river rises, electricity generation automatically increases. On this basis, Nepal Electricity Authority says that power supply will be normal after the second week of May.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">NEA spokesperson Suresh Bhattarai said that the power supply will be smooth from the second week of May. "The snow begins to melt from the second week of May and the water level in the river rises," he said.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">It starts to rain from June and there will be enough water in the rivers. NEA said that surplus electricity can be exported to India during the monsoon.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">The installed capacity of electricity in the national transmission system is more than 2,000 MW. Due to the shortage of water in the river, only 800 MW is being generated at present, while the demand is 1,600 MW.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Most of the hydropower projects in Nepal are based on river flow system. Therefore, when the water level in the river decreases in winter, the power generation automatically decreases. In the rainy season, it is produced at full capacity.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">NEA was meeting the demand by importing electricity from India after the domestic production decreased due to low water level. However, import of electricity from India has halted due to the shortage of coal in India. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14956', 'image' => '20220504040020_electricity.jpg', 'article_date' => '2022-05-04 15:59:24', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '15212', 'article_category_id' => '1', 'title' => 'Domestic Flights Resume at TIA after Bomb Hoax ', 'sub_title' => '', 'summary' => 'May 4: Domestic flights were obstructed for one hour this morning (May 4) at Tribhuvan International Airport (TIA) following a hoax that a suspicious object was spotted in the domestic terminal building. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 4: Domestic flights were obstructed for one hour this morning (May 4) at Tribhuvan International Airport (TIA) following a hoax that a suspicious object was spotted in the domestic terminal building. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">TIA office said that domestic flights have resumed as no such object was found at the building after a search operation carried out by a bomb disposal squad. The airport which was stalled following the bomb hoax has been opened a while ago, TIA General Manager Prem Nath Thakur said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Passengers inside the domestic terminal building were evacuated after the hoax. --RSS </span><br /> </span></span></p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14954', 'image' => '20220504123704_Airport.width-1024.jpg', 'article_date' => '2022-05-04 12:36:06', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '15211', 'article_category_id' => '1', 'title' => '‘Nepali Nationals Working Informally for Foreign Companies Receive Payment Through Illegal Channels’', 'sub_title' => '', 'summary' => 'May 4: The trend of Nepali nationals providing consultancy and various other services to their compatriots living abroad has been increasing in recent years.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Rama Subedi</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">May 4: The trend of Nepali nationals providing consultancy and various other services to their compatriots living abroad has been increasing in recent years. It has been found that the service providers mostly get paid through informal channels such as hundi, which is an illegal business in Nepal.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">People involved in such business number around 10,000, says Anuj Agrawal, vice president of the Confederation of Nepalese Industries (CNI).</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">He says that Nepali citizens providing services like translation, consultation, online teaching and IT service receive payment through informal channels. He made such remark during a recent programme organized by the CNI in the capital. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">“Ten thousand Nepalis are involved in outsourcing work of foreign companies from Nepal. They are paid through informal channels,” said Agrawal, adding, “If such money is brought through formal channels, it would contribute to Nepal’s foreign exchange reserves.”</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">According to Agrawal, the Nepali’s involved in such work get paid between Rs 20,000 to Rs 300,000 per month. They receive Nepali currency in their bank account through informal channels instead of getting paid in foreign currency such as dollars, pound, yen, yuan etc, argued Agrawal.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The reason for people opting to send money through informal channel is because they have to pay high fee in the source country to send remittance. Western Union, a leading remittance company, charges 2.5 percent of the amount sent. Other companies charge as much as 5 percent. Likewise, the recipients also have to let go a certain amount as commission. Therefore, most of the people prefer informal channels to send money.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Stakeholders say that the inflow of remittance will rise if the government reduces the charges incurred in remittance.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Some of the recipients say that even if they are ready to pay a certain amount as commission, the sender might not be willing to do so. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">The government can improve the foreign exchange reserves if it regulates those working in the informal sector. However, the government does not have any date regarding the number of workers involved in the informal sector and how much tax they pay. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Economist Som Luitel says that the transaction of money through illegal channels can be curbed to some extent if the government encourages the tax payers and introduces a provision for self declaration of income. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">“This problem will not exist if the government adopts a policy to encourage tax payers by providing them concessions,” said Luitel.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">Some people are wary about the loss that the state has to incur while receiving money from informal channels. However, such trend continues unabated because there is no compulsion to pay taxes and also due to the mentality that there is problem in opening bank accounts in foreign currency. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">However, bankers say that there is no problem in opening bank accounts in foreign currency. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">“All that is required is a proof that one earns income in dollars,” said a banker.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-04', 'modified' => '2022-05-04', 'keywords' => '', 'description' => '', 'sortorder' => '14953', 'image' => '20220504114652_Remittance.jpg', 'article_date' => '2022-05-04 11:45:46', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '15210', 'article_category_id' => '1', 'title' => '‘Nepal’s Economy Still Faces Risk of Falling in Crisis’', 'sub_title' => '', 'summary' => 'May 3: Former Finance Minister Dr Yuba Raj Khatiwada has warned that the country’s economy is still in risk of crisis.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">May 3: Former Finance Minister Dr Yuba Raj Khatiwada has warned that the country’s economy is still in risk of crisis. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He made such remark during a programme organized in the capital on Tuesday by Youth Chamber, a sister organization of Nepal Chamber of Commerce (NCC).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Other participants of the programme stressed on export promotion while speaking on the topic of the ‘Current Economic Situation of Nepal, its Challenges and Remedy’. Stakeholders said that the government must adopt a long-term policy to promote export.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Former Finance Minister Khatiwada also said that the reason the country’s economy is struggling to return back on track is the unstable policy of the state.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He stressed on the need of effective collaboration between the Ministry of Finance, the Ministry of Industry, Commerce and Supplies and Nepal Rastra Bank in order to discourage imports and to promote exports.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif""> “The economy has structural problems. We have been forced to import goods and services in all sectors ranging from agriculture to road construction as well as hydropower. Trade management is not effective,” said Khatiwada.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He suggested the government to adopt short-term as well as long-term policies to reduce imports and increase exports.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Stating that the country’s economy still faces risk of falling into crisis, he urged the government to adopt cautionary measures.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He maintained that there are rumors in the market about possible price hike due to scarcity of consumable goods. He further said that the private sector, which has a major share in the country’s economy, must also act responsibly.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Khatiwada stressed on the need to bring the real estate business under the purview of tax. He was of the view that the country’s foreign exchange reserves could improve if the government cracks down on the illegal hundi business and stops foreign visits of Nepali citizens and also bars Nepalis from unnecessarily spending on education in foreign countries.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Of late, the economic indicators are showing positive signs, said Khatiwada, adding that the growth projection of 5.8 percent seems to be practical.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">On the occasion, NCC Vice President Deepak Shrestha accused the government of halting imports without any proper planning. He said that the business community has been urging the government for proper management of imports rather than curbing imports.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">“The government should have consulted with the private sector regarding which goods should be banned and which shouldn’t before taking a decision,” said Shrestha. He said that the government must adopt an effective policy to increase domestic production in order to promote exports.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Joint Secretary at the Ministry of Industry, Commerce and Supplies Govinda Bahadur Karki informed that the government decided to control the import of luxurious goods after they started taking toll on the country’s foreign exchange reserves.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He added that the government is not against the private sector and assured that the government’s decision will not have any long-term implications.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Speaking on the occasion, economist Bishwas Gauchan and CEO of NMB Bank Sunil Kumar KC said that although the economy is under pressure, it is of short-term nature.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-05-03', 'modified' => '2022-05-03', 'keywords' => '', 'description' => '', 'sortorder' => '14952', 'image' => '20220503081321_1651583992.IMG_7391 copy.jpg', 'article_date' => '2022-05-03 20:12:37', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '15208', 'article_category_id' => '1', 'title' => 'FNCCI Hands Over Memo to Government for Upcoming Budget', 'sub_title' => '', 'summary' => 'May 3: Shekhar Golchha, president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), has said that it won't be possible to keep the private sector, which contributes 70 per cent to the country's economy, in the dark.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">May 3: Shekhar Golchha, president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), has said that it won't be possible to keep the private sector, which contributes 70 per cent to the country's economy, in the dark.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Stating that the private sector can no longer be discouraged under any pretext, he complained that the government has taken a unilateral decision to increase energy tariff, interest rates and production costs.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The federation handed over suggestions to the government for the coming fiscal year’s budget during a formal programme attended by Finance Minister Janardan Sharma and Finance Secretary Madhu Kumar Marasini on Monday.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Golchha said that the projection of economic growth rate made by the Central Bureau of Statistics was not unnatural. He claimed that if the growing economic activities are maintained in the current fiscal year, the growth would reach up to 8 percent.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"There cannot be any excuse to discourage the private sector," Golchha said. "It is not possible to keep the private sector in the dark." </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">He added that the government has reduced 450 megawatts of electricity to the industrial sector which is against the government’s plan to increase energy consumption.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Power cut in industries since the last 4/5 days is not acceptable to us," Golchha complained. "Why Nepal Electricity Authority has not been able to manage electricity when it has been urging everyone to increase its consumption?"</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Stating that the banks’ interest rate has increased, Golchha said that the business community lost its confidence due to the ban on imports. The federation argued that the decision would reduce production and put the economy at greater risk.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Our economy is not in trouble," Golchha said. However, "If the problems like energy and interest rates are not managed, the risk will prevail."</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">FNCCI Vice President Chandra Prasad Dhakal pointed out the need to hand over public institutions to the private sector. He also urged to give priority to the export of stone and ballast while conserving the Chure region. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Chairman of the Nepal Readymade Garments Association Chandi Prasad Aryal said that an export-oriented policy is needed.</span></span><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif""> He said that the garment sector had incurred a loss of Rs 1.25 billion due to the Covid-19 pandemic. He also suggested to make arrangements for giving cash subsidy on the basis of manufactured goods.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Chairman of the Nepal Cement Producers' Association, Dhruva Thapa, said that the domestic cement industry was ready to export cement worth Rs 150 billion if the government facilitated in export. Similarly, officials of various unions expressed their views in the programme.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-05-03', 'modified' => '2022-05-03', 'keywords' => '', 'description' => '', 'sortorder' => '14950', 'image' => '20220503030605_1651550802.निजीक्षेत्रलाई अँध्यारोमा राखेर उज्यालो असम्भव.jpg', 'article_date' => '2022-05-03 15:05:23', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '15207', 'article_category_id' => '1', 'title' => 'Electricity Short Supply is a Temporary Problem: Energy Minister', 'sub_title' => '', 'summary' => 'May 3: Minister for Energy, Water Resources and Irrigation Pampha Bhusal is currently active in discussing the problems in power supply to some big industries with the stakeholders and businessmen. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">May 3: Minister for Energy, Water Resources and Irrigation Pampha Bhusal is currently active in discussing the problems in power supply to some big industries with the stakeholders and businessmen. On Monday, she held a meeting with the officials of Nepal Electricity Authority (NEA) and the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) to discuss the reasons for power outages in some industries.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In the meeting, Minister Bhusal said that the problem in power supply is temporary and assured that the supply is going to be smooth from Tuesday itself. She said, “The problem with electricity supply is not our fault, it's a global problem. In the case of Nepal, the government is committed to solve this problem, and will find a solution soon.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Minister Bhusal said that problems may surface during the dry season as large reservoir projects were not constructed for energy security in the past. She even requested not to politicize the issue. She said, “In the past, we did not pay attention to energy security and it is causing short-term problems now. In the upcoming days, these problems will be solved gradually.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Similarly, Secretary at the Energy Ministry Devendra Karki said that there is no need to panic saying that the momentary problem in the energy system of the country will be solved in a few days. “This problem is temporary, the state is going to address it.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Similarly, Executive Director of Nepal Electricity Authority, Kulman Ghising, requested the industrialists not to panic saying that the recent problem seen in power supply is normal problem and not a major crisis. He said, “The current problem is only for a few days. Don't panic, it will be resolved soon.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">During the discussion, President of FNCCI, Shekhar Golchha informed about the problems in power supply. Similarly, Senior Vice President of FNCCI, Chandra Dhakal emphasized on the need for the government and the private sector to work in coordination with each other to ease the power supply. He also expressed confidence that the quality of electricity will improve in the coming days.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-05-03', 'modified' => '2022-05-03', 'keywords' => '', 'description' => '', 'sortorder' => '14949', 'image' => '20220503020622_1651533019.Clipboard02.jpg', 'article_date' => '2022-05-03 14:05:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '15206', 'article_category_id' => '1', 'title' => 'NRB Tightens the Use of Credit Cards ', 'sub_title' => '', 'summary' => 'May 3: Nepal Rastra Bank (NRB) has tightened the rules for using credit cards. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">May 3: Nepal Rastra Bank (NRB) has tightened the rules for using credit cards. By amending the Unified Directive 2078 for payment system on Monday, the central bank has made an arrangement that bars users from loading money from credit card to their mobile wallet and to the bank account. As per the new provision, credit card users cannot withdraw cash as well. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Although cash transaction not allowed with a credit card, there is a facility for cash transaction up to 10 percent within the approved limit of the card in case of emergency. The NRB made such arrangement due to a rise in practice of loading money from credit cards into mobile wallets and bank accounts. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Commercial banks have issued 219,946 credit cards as of March 2022. Transactions using credit cards between mid-February to mid-March stands at Rs 1.14 billion. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Payments through credit card can be made while purchasing goods and services. NRB has stated that the money loaded in the wallet from the credit card should be used only for electronic payment of goods and services. NRB has instructed the payment service providers to make arrangements that the amount loaded from the credit card cannot be transferred to the bank account to withdraw cash. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Banks have been issuing credit cards to government and private sector employees as well as regular income earners. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Similarly, NRB has also given special attention on the identification of wallet customers. The central bank has directed the customers to self-declare that the details submitted are true and if not, they are ready to accept the action as per the law. Similarly, the central bank has directed to make it mandatory to disclose the purpose while transferring money from one wallet to another and other electronic payment transactions. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">As of February 2022, there are 113.57 million wallet users. A total of Rs 16.59 billion has been transacted through wallets in February/March alone. Lately, the use of wallets to pay for utility bills has been increasing. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Similarly, NRB has amended the ‘Moneychanger License and Inspection Regulations-2077’ and directed the money exchange companies to submit their monthly transaction details within 15 days of the end of each month. Earlier, there was a provision to submit the details within a month. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-05-03', 'modified' => '2022-05-03', 'keywords' => '', 'description' => '', 'sortorder' => '14948', 'image' => '20220503011011_Credit Card.jpg', 'article_date' => '2022-05-03 13:09:17', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117